Are you feeling a bit confused about balloon payments and their implications? You're not alone! A balloon payment is essentially a large final payment due at the end of a loan term, which can catch many borrowers off guard. If you're curious to learn more about managing your balloon payments and what steps you can take to prepare, keep reading for valuable insights!

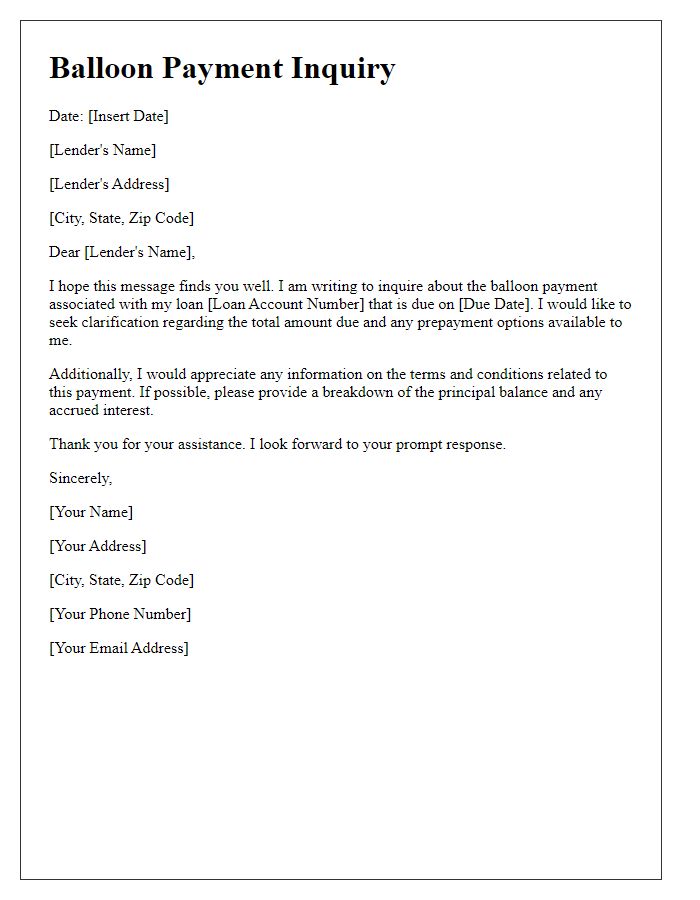

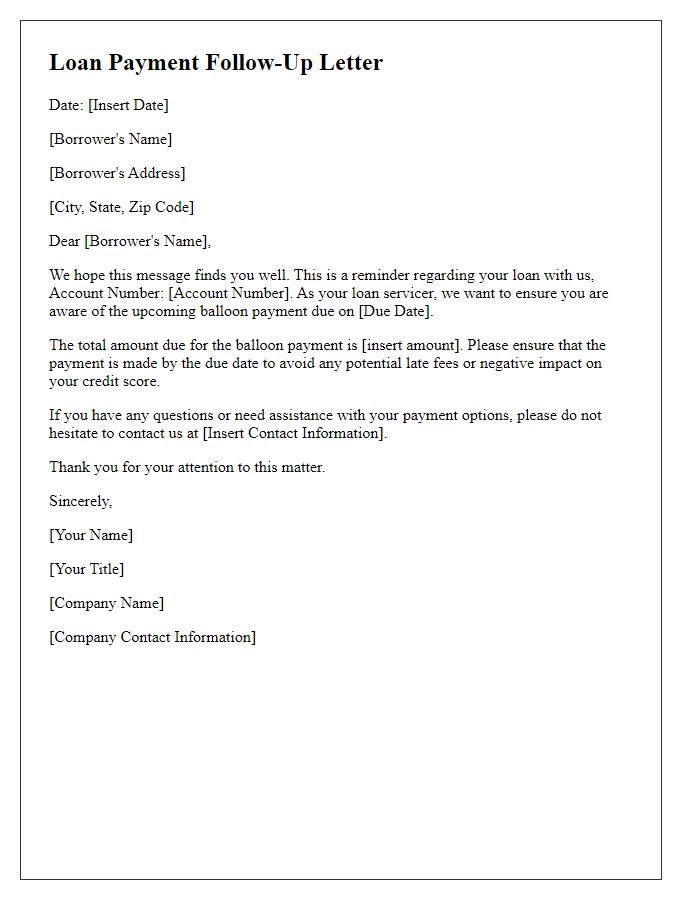

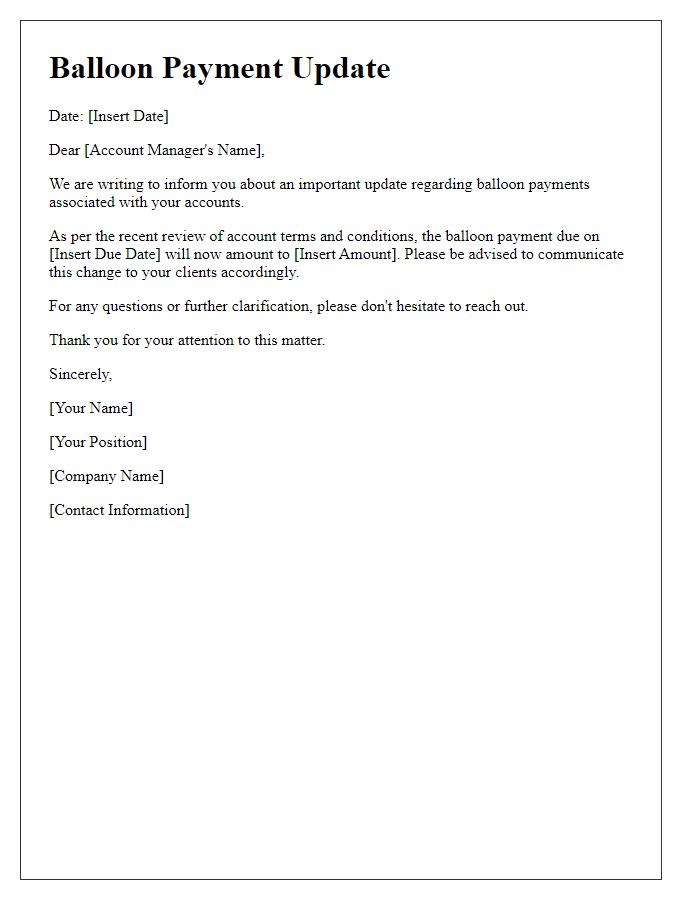

Clear subject line

A balloon payment due (a lump-sum payment at the end of a loan) may catch borrowers off-guard due to its significant impact on finances. This type of payment often occurs after a series of lower regular payments (possibly interest-only) within loans like auto loans or mortgages (fixed-rate and adjustable-rate varieties). For example, in a typical 5/25 mortgage (5 years of lower payments followed by a large final payment), borrowers may need to prepare to pay thousands in one moment. Awareness of the balloon payment date is crucial for budgeting to avoid potential penalties or default.

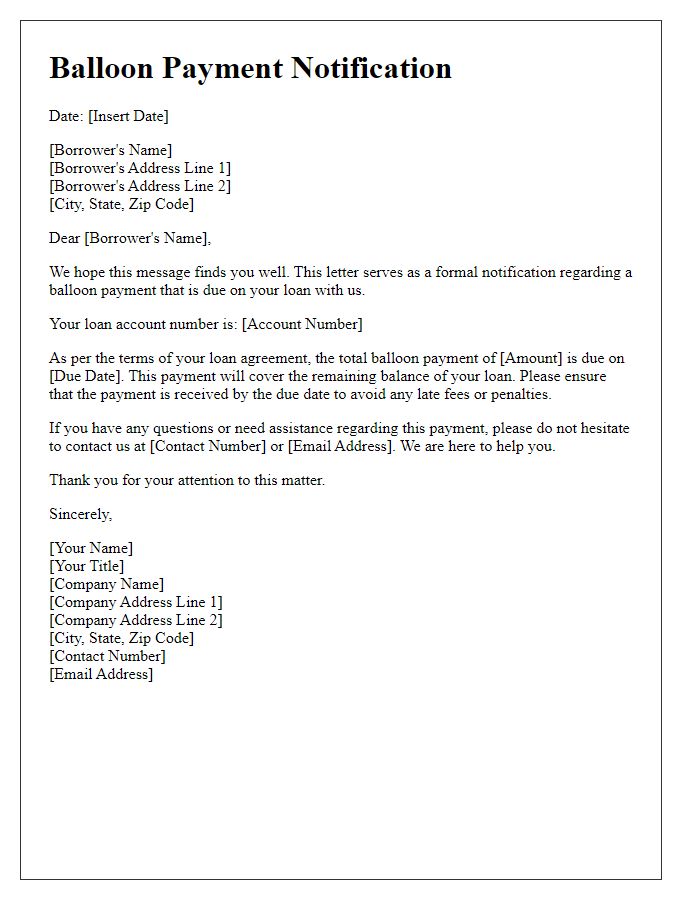

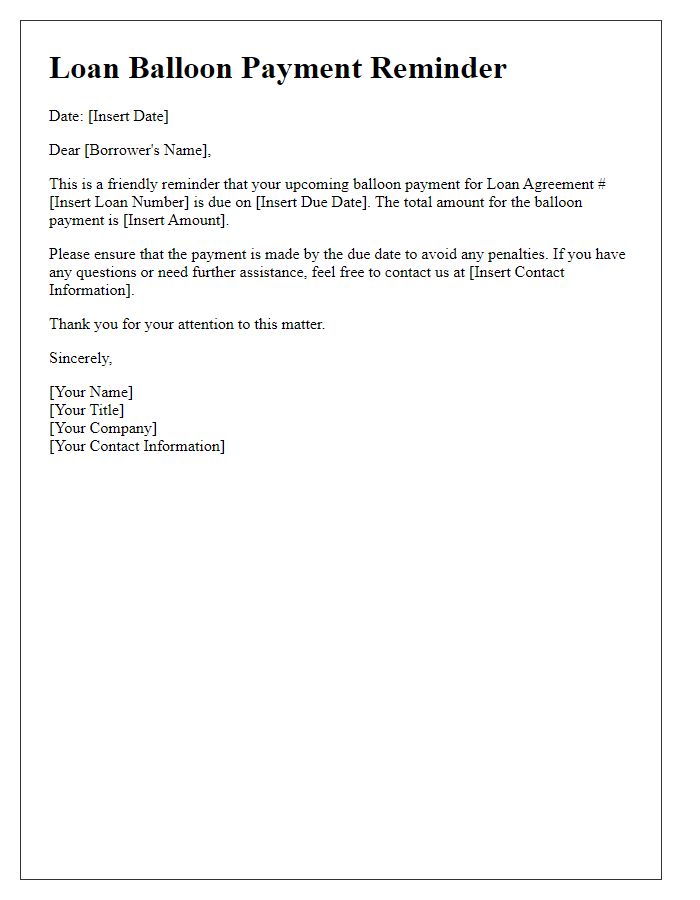

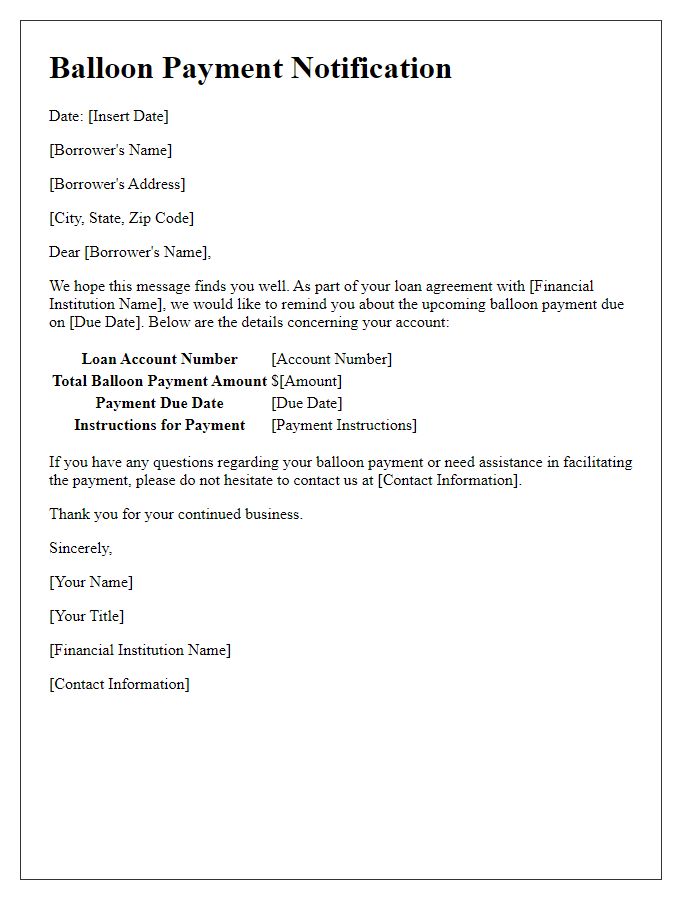

Borrower details

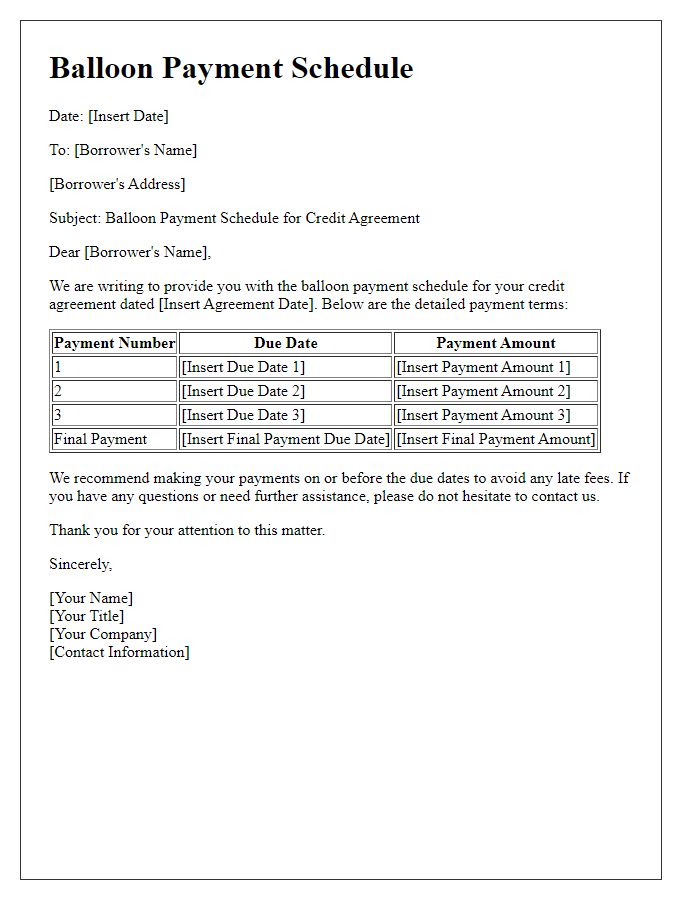

In a balloon payment scenario, borrowers face a significant final payment due at loan maturity. Balloon loans often feature lower monthly payment amounts initially. Borrowers receive periodic payment notifications illustrating amortization schedules. For example, a borrower may have a $50,000 balloon loan taken out through a local credit union, set to mature in five years. Loan documentation highlights a large final payment totaling $40,000. Understanding when to prepare for this substantial financial obligation is crucial. Prompt communication about balloon payment due dates aids in budget management, potentially mitigating late fees and credit score impacts.

Payment due date

A balloon payment typically represents the final large payment due at the end of a loan term, such as a mortgage or auto loan. For borrowers who face a balloon payment due date, being informed well in advance is crucial. For example, if a mortgage has a duration of five years with a due balloon payment of $50,000, borrowers should receive reminders highlighting the due date, which may be specified as December 1, 2023. This alert can also provide insights into payment options such as refinancing, which many lenders offer to assist clients in managing this substantial financial obligation. Borrowers should be prepared to take action well before the due date ensuring a smooth transition in their financing responsibilities.

Amount owed

A balloon payment represents a large final payment due at the end of a loan term. This final payment often constitutes a substantial portion of the total loan amount, typically seen in mortgage loans or auto loans, potentially reaching thousands of dollars in some cases. Borrowers should be aware of the total amount owed when this payment is due--often specified in the loan agreement. Failure to manage this payment responsibly may result in financial difficulties, impact credit scores, and possibly lead to foreclosure or repossession of collateral assets. It's crucial to prepare ahead of time for this financial obligation, whether through savings or refinancing options.

Contact information

A balloon payment alert serves to inform individuals of an impending large final payment due on a loan, often structured in fixed installments with a significant payoff at the end. Such alerts are crucial in mortgage agreements, auto loans, and business financing scenarios, highlighting the necessity for borrowers to prepare financially. The alert typically includes the due date of the balloon payment, the exact amount required, and any specific terms outlined in the original loan agreement. The contact information section is vital, providing lenders' details for clarity and assistance, ensuring that borrowers can quickly reach out for questions regarding the payment, potential refinancing options, or further financial guidance.

Comments