If you've ever found yourself needing to communicate an adverse action determination, whether it's regarding credit, employment, or another sensitive matter, crafting the right letter is crucial. This is not just about sharing the decision; it's about ensuring clarity and compassion in your communication. Understanding the rationale behind the action and the steps that follow can make a world of difference for the recipient. Let's dive into the essential elements of drafting an effective adverse action letter!

Personal Identification and Reference Information

An adverse action determination often involves a thorough analysis of personal identification details and relevant reference information. This process typically includes examining the individual's credit report from agencies like Experian, TransUnion, or Equifax, which may contain data on credit scores, repayment history, and outstanding debts. Additionally, the assessment may incorporate personal identifiers such as social security numbers or driver's license numbers to confirm identity. Relevant reference information can encompass employment history, income verification, and any previous applications for loans or credit. Accurate documentation is crucial in determining eligibility and ensuring compliance with regulations established by the Fair Credit Reporting Act (FCRA), which governs the disclosure and use of individuals' credit information.

Detailed Explanation of Adverse Action Reasons

An adverse action determination in the context of credit or employment typically refers to a negative decision made based on an individual's credit report or background check. Credit reporting agencies, like Experian or Equifax, compile consumer data, which lenders or employers assess when making decisions. Common reasons for adverse actions might include poor credit scores (below 600), past bankruptcies (up to 10 years old), missed payments (30 days late or more), or criminal records (especially felonies). These factors can significantly affect one's ability to secure loans or job opportunities. Regulatory compliance requires informing individuals of these decisions and allowing them the chance to address inaccuracies or provide clarifying information.

Legal and Compliance Disclosures

Adverse action determinations in legal and compliance contexts involve critical evaluations of decisions impacting individuals or entities based on specific criteria. These determinations often reference regulations set forth by the Fair Credit Reporting Act (FCRA) and other governing laws, which require transparency in the process. For example, if a financial institution like Wells Fargo denies a loan application, it must provide a detailed notice outlining the reason, such as credit score limitations (often below 620), alongside providing access to the consumer report that influenced the decision. The notice should also inform the individual of their right to dispute inaccuracies in the report, emphasizing the importance of compliance with legal standards to ensure fair treatment.

Contact Information for Further Inquiries

In adverse action determination notices, providing clear contact information is essential for transparency and effective communication. Key details include the name of the company (e.g., Acme Financial Services) responsible for the notice, the specific department handling inquiries (e.g., Customer Relations Department), and the direct phone number (e.g., +1-800-555-0199) associated with that department. Additionally, the email address (e.g., support@acmefinancial.com) allows individuals to submit inquiries electronically. A physical mailing address, such as 123 Business Rd, Suite 400, Springfield, IL 62701, enables the option for traditional correspondence. Clear instructions on available office hours (e.g., Monday to Friday, 9 AM to 5 PM CST) help set expectations for response times.

Instructions on Rights and Recourse Options

Adverse action determination letters outline the reasons for unfavorable decision-making processes related to credit applications, employment considerations, or rental agreements. These letters must include details such as the specific adverse action taken, the date of the decision, and identification of the recipient. Important references to the Fair Credit Reporting Act (FCRA) guide recipients on their rights to dispute information and seek clarification. Recipients should be informed about their right to request a free copy of the consumer report which led to the adverse decision, typically available within 60 days. Contact information for the consumer reporting agency should accompany this, as well as the right to file a complaint with the Consumer Financial Protection Bureau (CFPB) if they believe their rights have been violated. It's crucial to emphasize that these rights allow individuals to challenge inaccuracies and seek remedies for any unjust actions taken against them.

Letter Template For Adverse Action Determination Samples

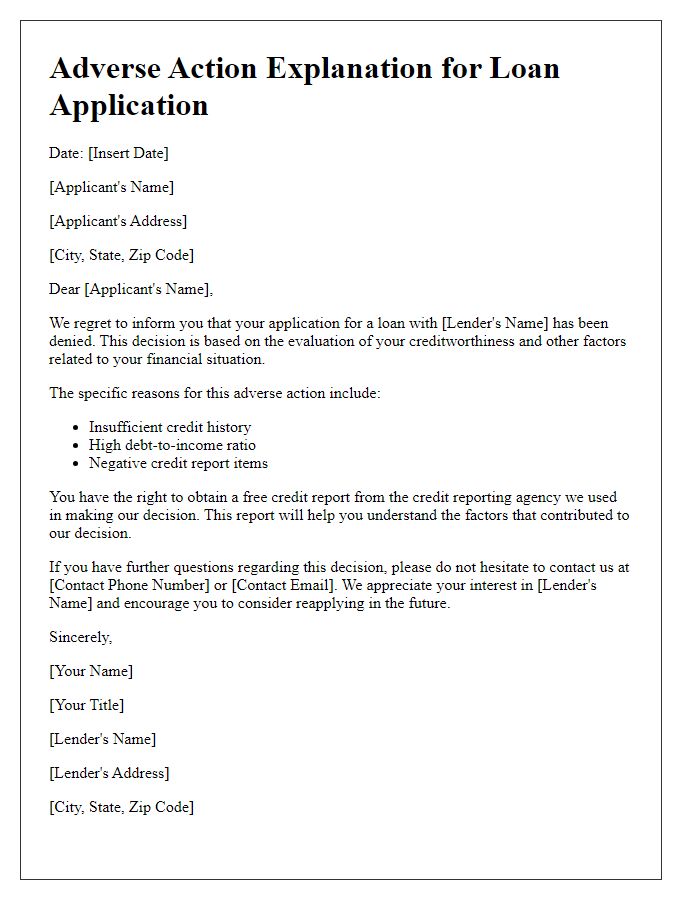

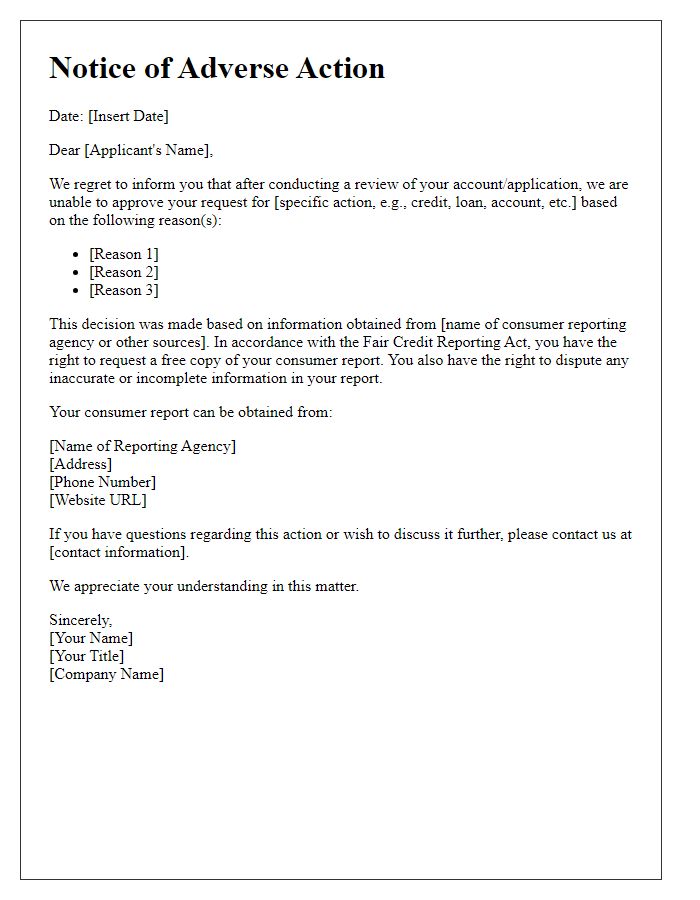

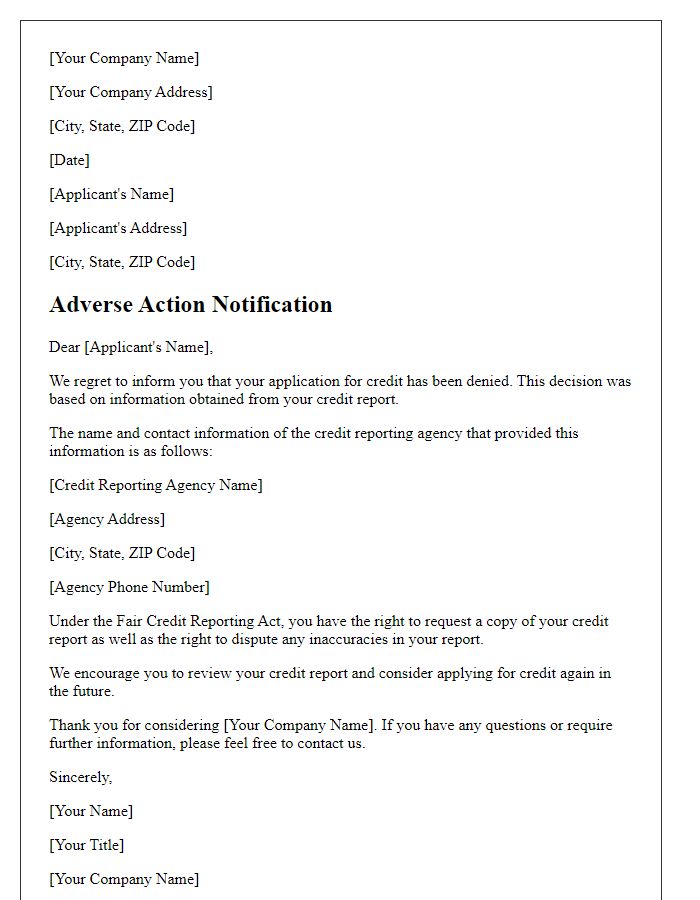

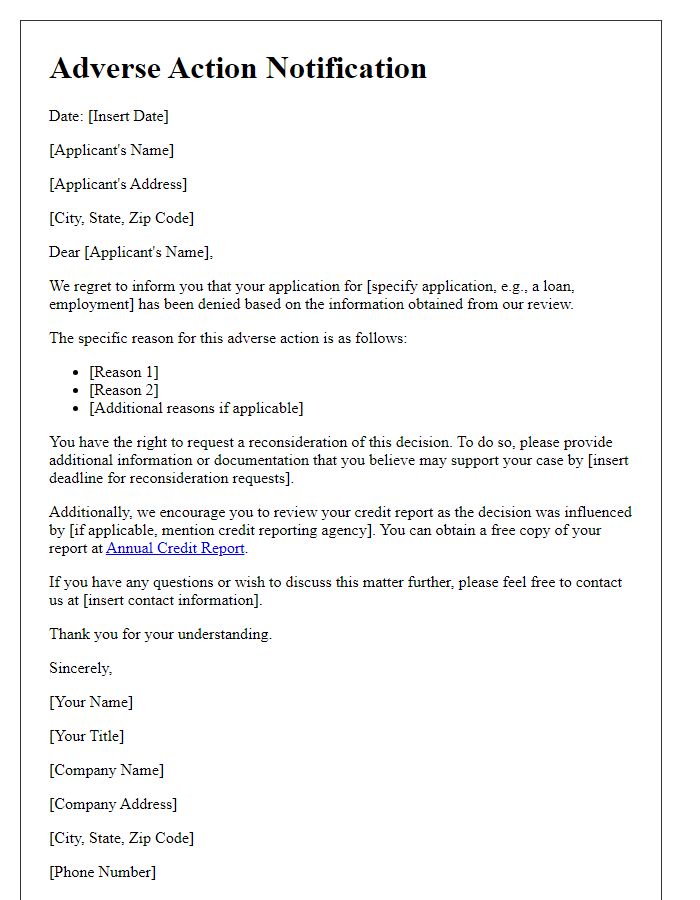

Letter template of adverse action explanation for loan application rejection

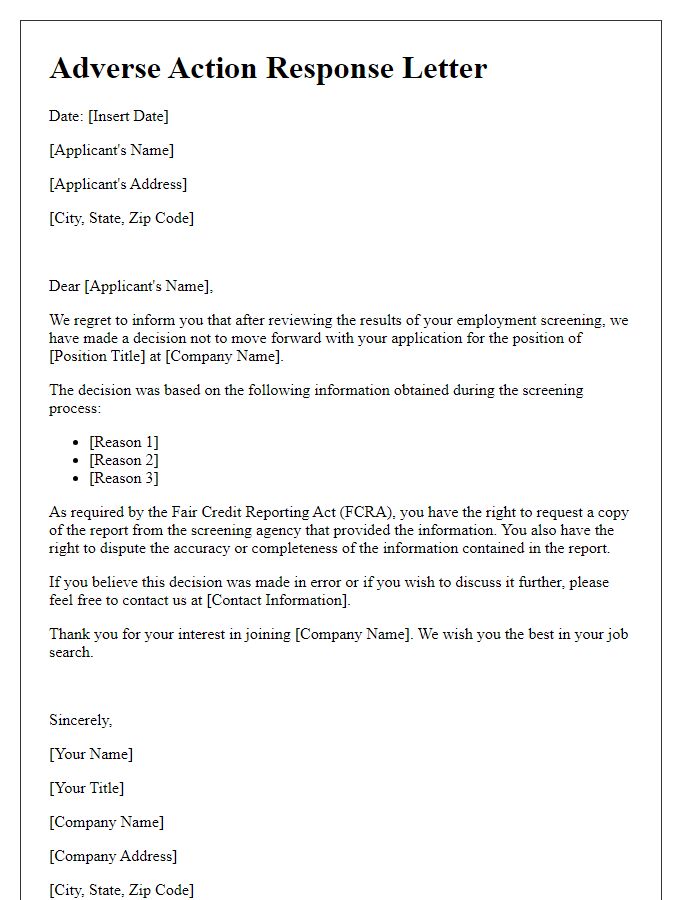

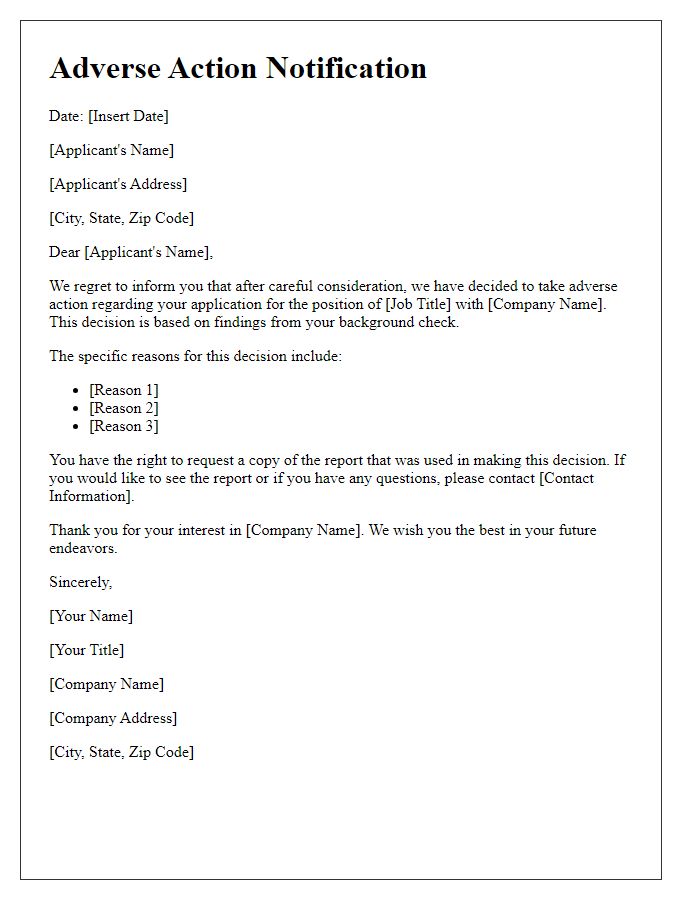

Letter template of adverse action response for employment screening results

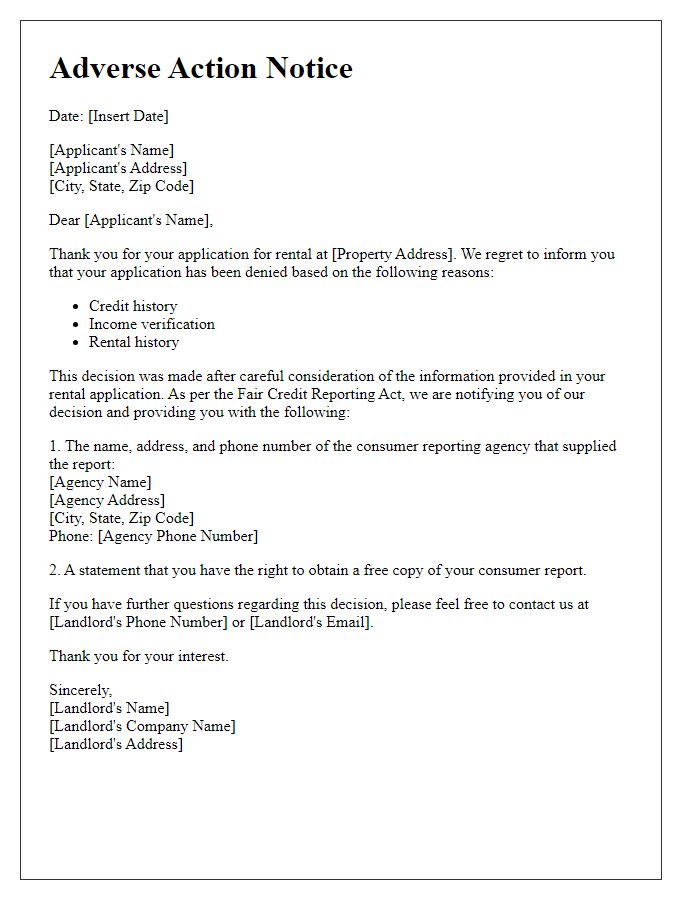

Letter template of adverse action consequence for rental application refusal

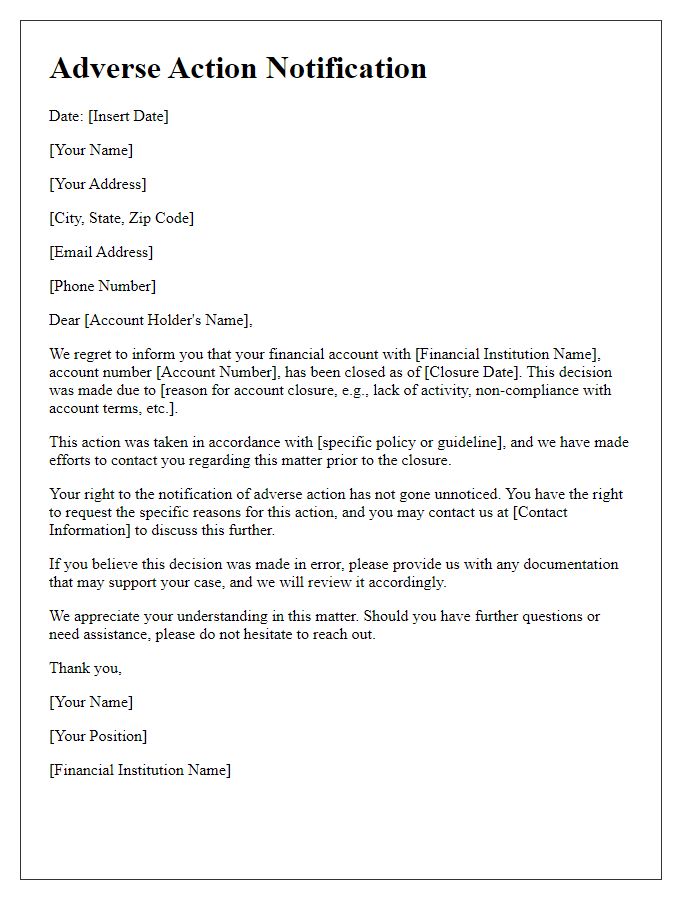

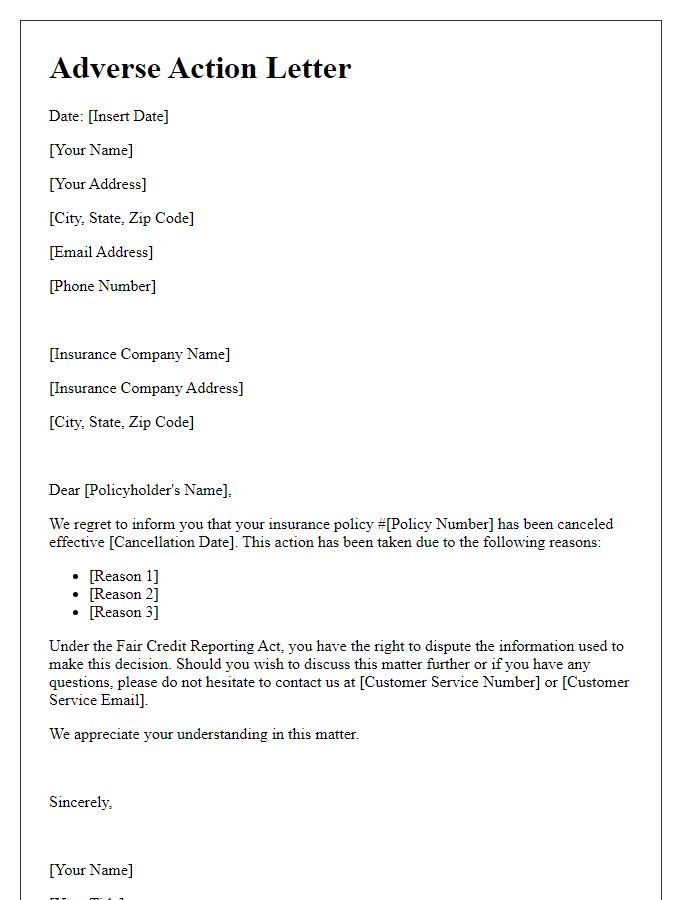

Letter template of adverse action notification for financial account closure

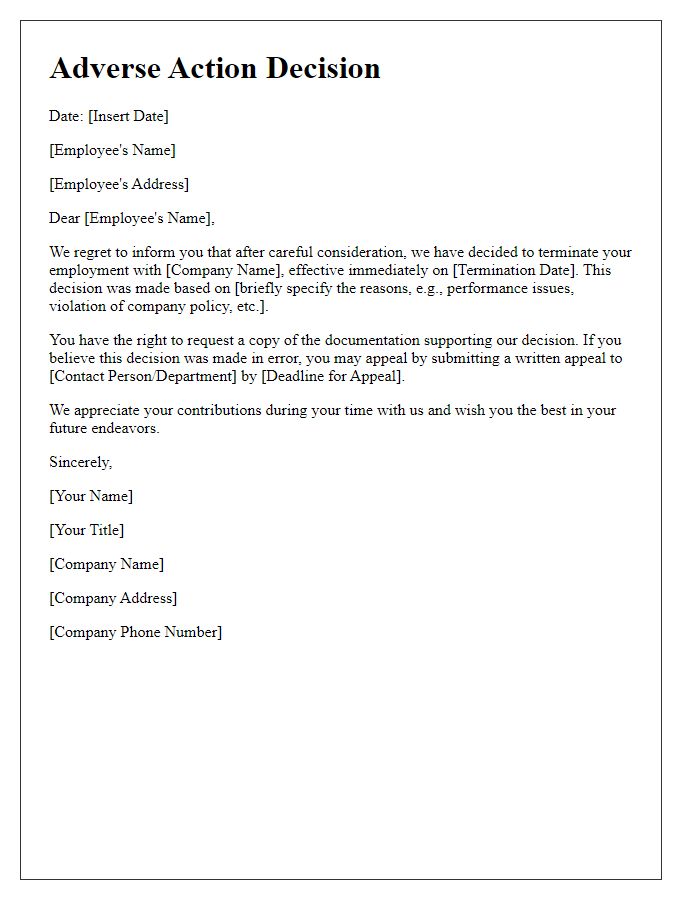

Letter template of adverse action decision regarding service termination

Letter template of adverse action communication for account review outcome

Comments