When it comes to securing a loan agreement, crafting the right letter is crucial to ensure all parties are on the same page. A well-structured letter sets the tone for a transparent relationship and outlines key details regarding terms, interest rates, and repayment plans. Whether you're a borrower or a lender, understanding the specifics can make the entire process smoother and more efficient. So, let's dive into how to create an effective letter for your secured loan agreement!

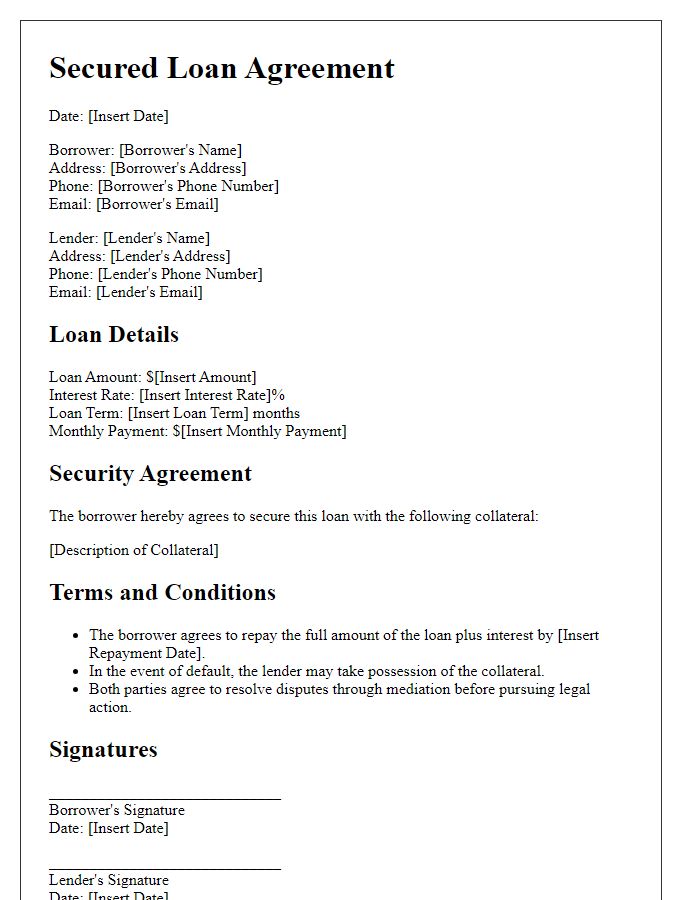

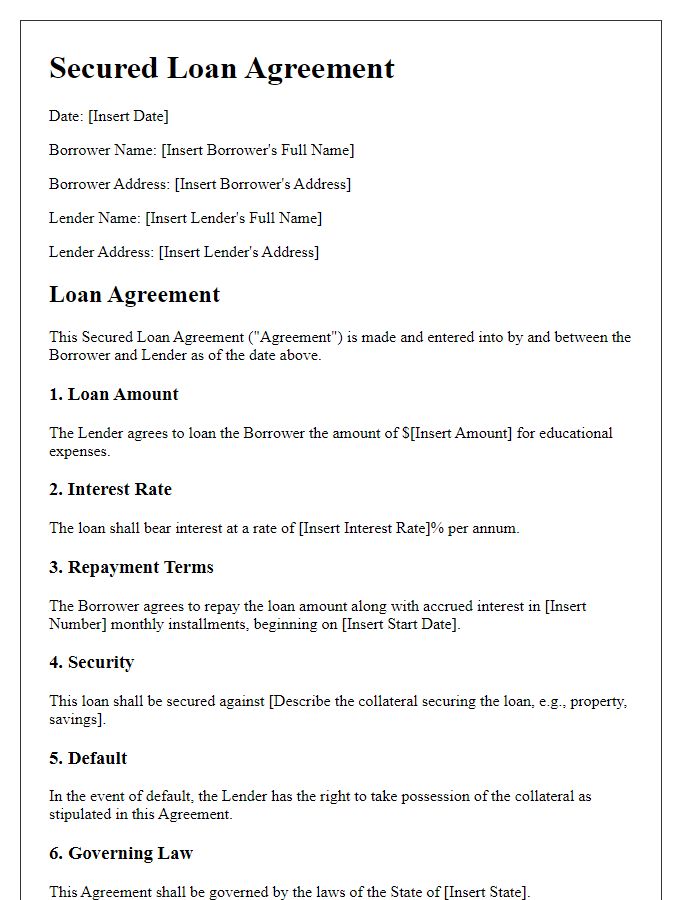

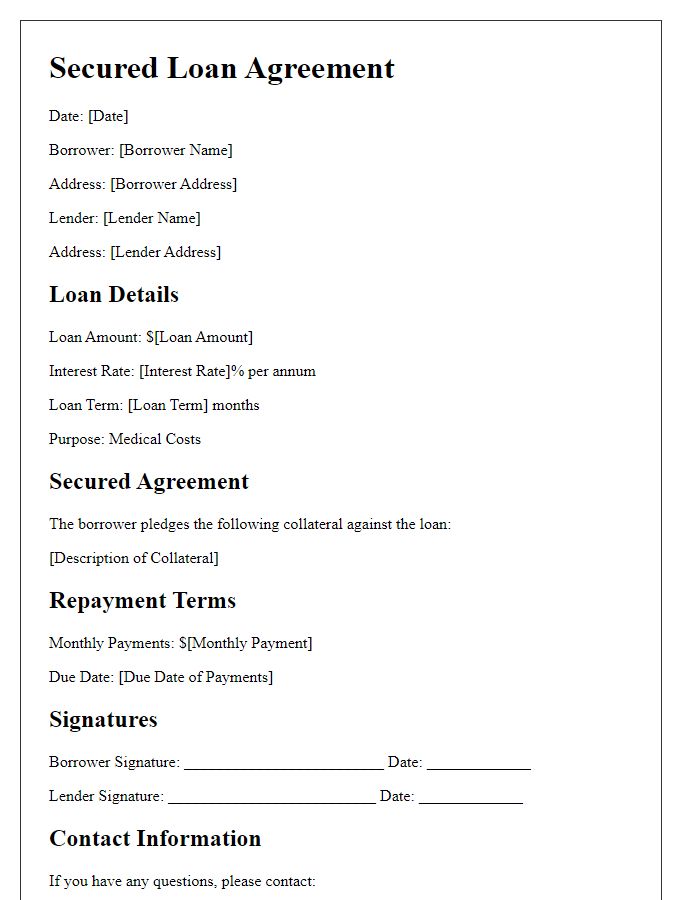

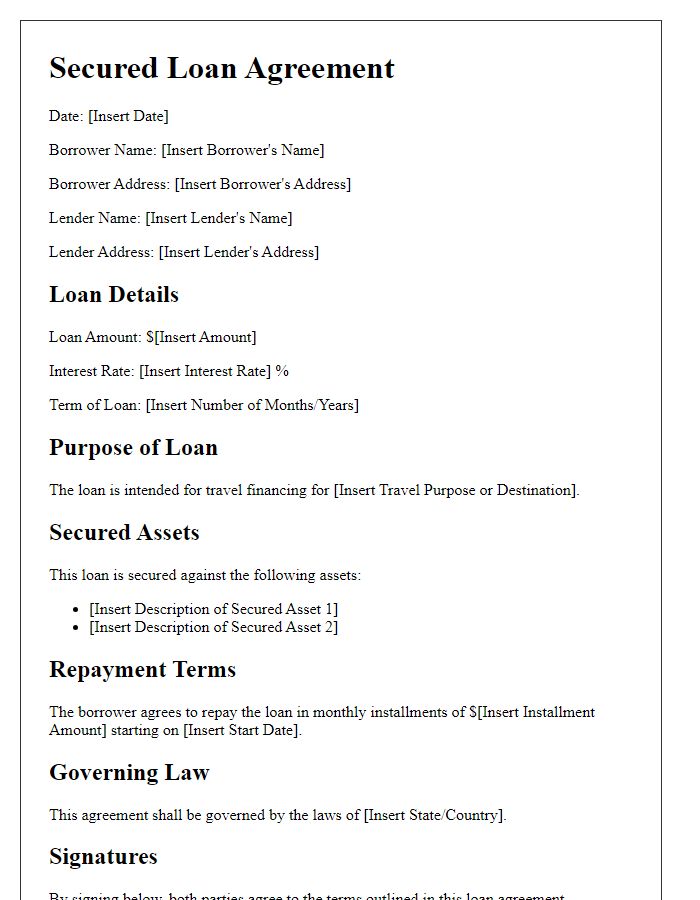

Loan Amount and Interest Rate

Secured loans, such as those backed by a mortgage or collateral, typically involve a principal amount, which represents the total sum borrowed, and an interest rate that indicates the cost of borrowing expressed as a percentage. The loan amount can range significantly, often varying from thousands to millions of dollars, depending on factors like the borrower's creditworthiness and the value of the collateral. Interest rates can fluctuate based on market conditions and individual borrower risk profiles, with rates possibly spanning from 3% to 10% annually. The secured nature of the loan provides lenders with a safety net, reducing their financial risk in case of default, and influencing the terms of the agreement. Additionally, the specifics of repayment schedules, amortization periods, and penalties for late payments are also vital components of secured loan agreements.

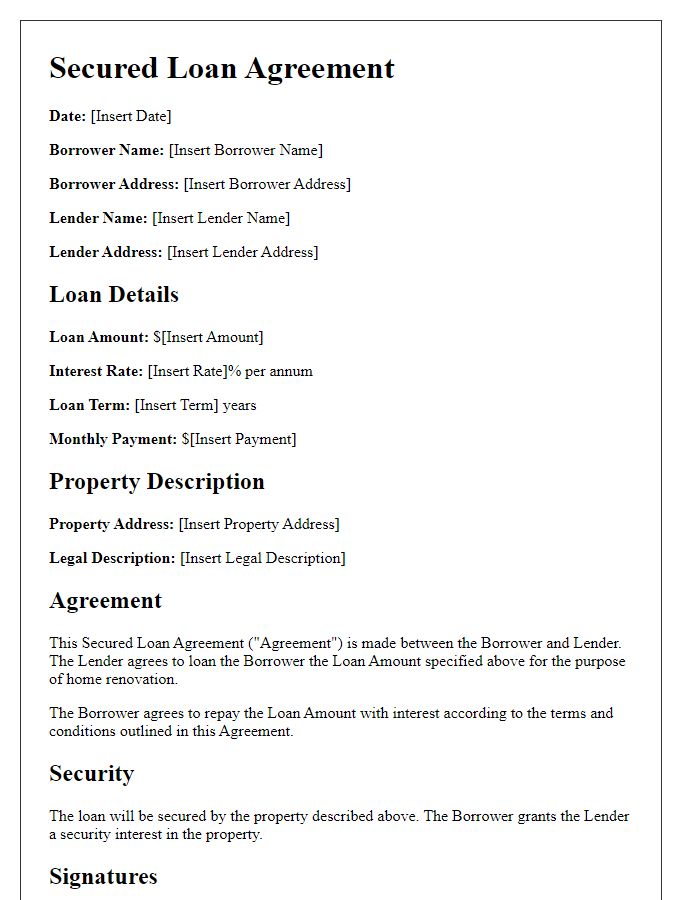

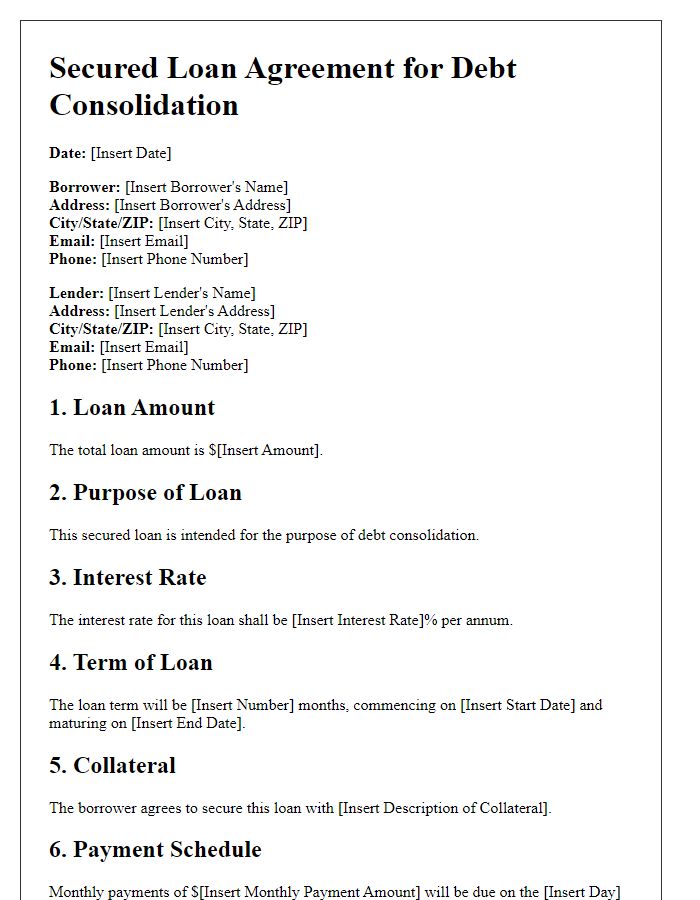

Repayment Terms and Schedule

The repayment terms and schedule for a secured loan agreement define the borrower's obligations for repaying borrowed funds, typically secured against an asset such as real estate or personal property. The total loan amount may range from $10,000 to $500,000, depending on the lender's policies and the borrower's creditworthiness. The interest rate, set between 3% to 10%, significantly influences the monthly payments. Repayment periods often extend from five to twenty years, with a fixed monthly payment schedule that clearly outlines due dates. Additionally, specific terms related to late payments, such as penalties or adjustments to the interest rate, play a crucial role in safeguarding the lender's investment. Borrowers should also be aware of any prepayment penalties if they wish to pay off the loan early or any conditions related to refinancing, which may impact their financial planning.

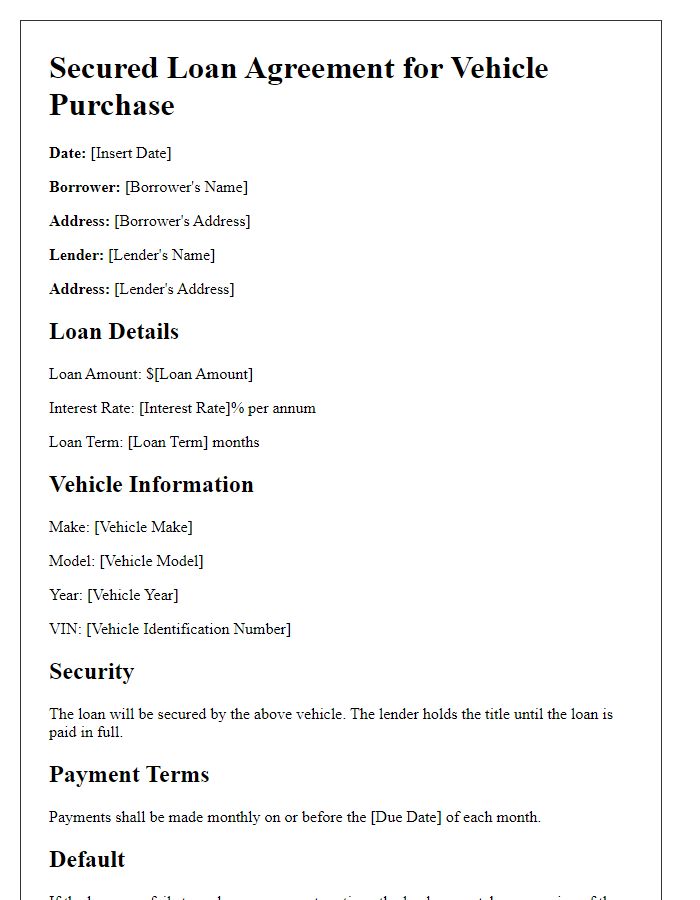

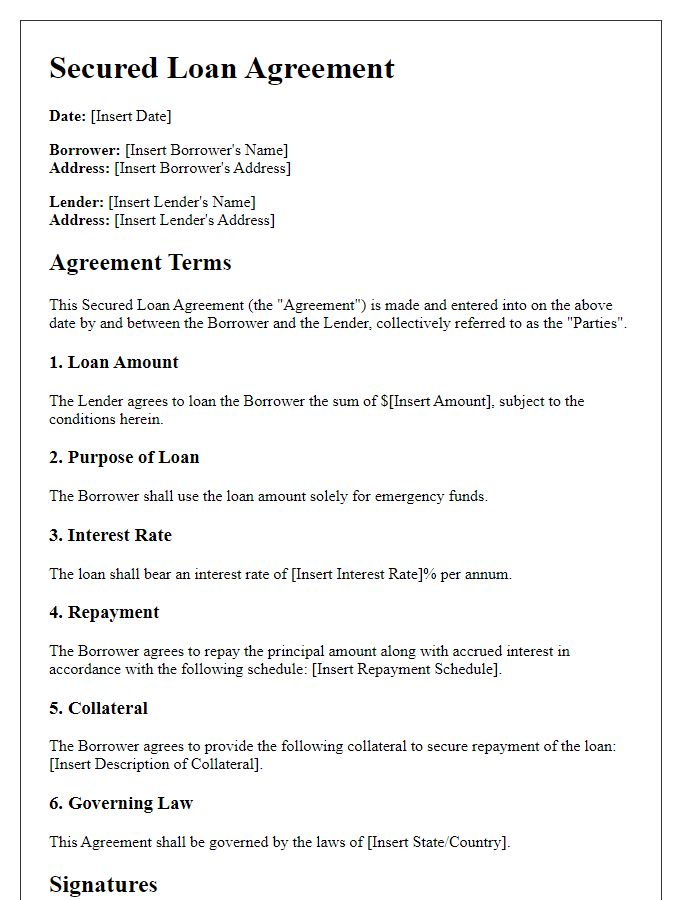

Collateral Description and Valuation

The collateral description and valuation section of a secured loan agreement includes detailed information about the asset pledged as collateral to secure the loan. Specific assets like real estate properties (such as a residential home or commercial building), vehicles (including makes, models, years, and identification numbers), or financial assets (like stocks and bonds) must be clearly identified. Valuation methods may involve professional appraisals determining market value based on recent sales of similar items or formal assessments by licensed appraisers. For real estate, factors such as location (like city, neighborhood specifics), size (square footage), and condition must be noted. High-value vehicles require documentation reflecting current market prices through references such as Kelley Blue Book or NADA Guides. Financial assets should be documented with current market valuations and recent statements indicating ownership and balance. Accurate valuations protect both the lender's investment and the borrower's interests.

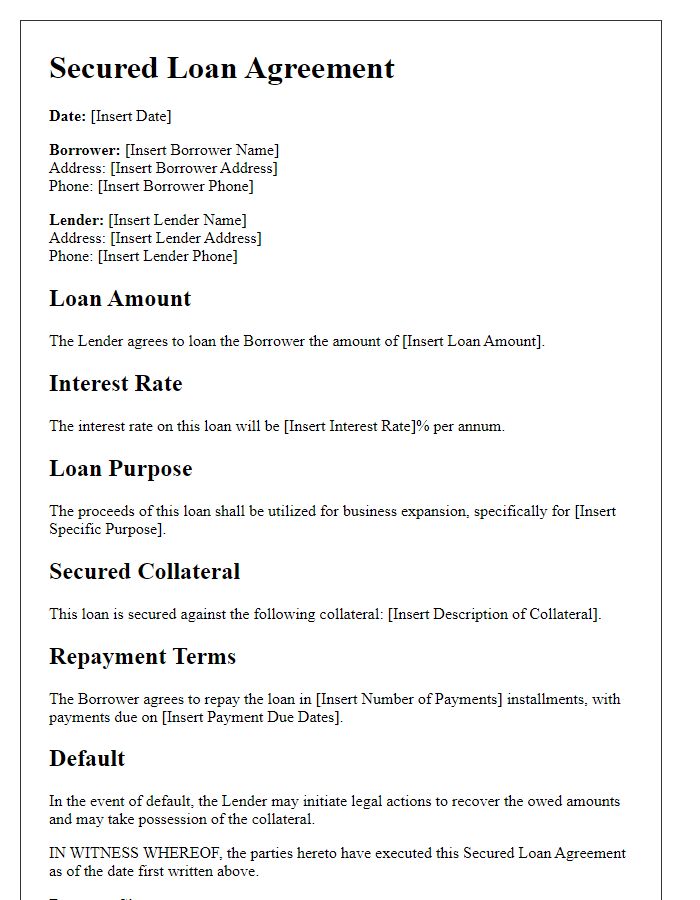

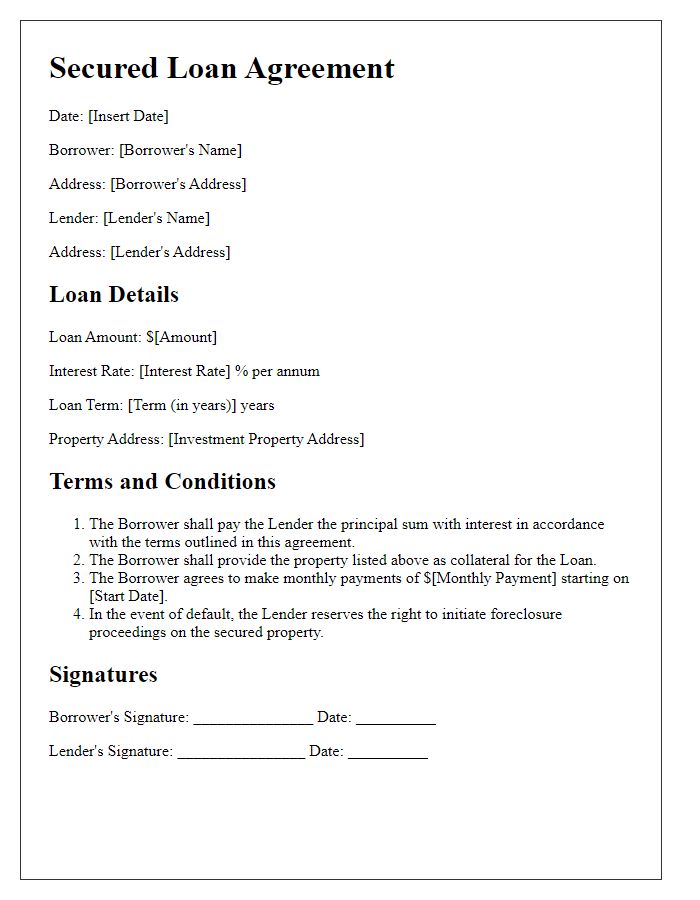

Default and Remedies Clause

A default and remedies clause in a secured loan agreement outlines the consequences of a borrower failing to adhere to the terms of the loan, providing lenders protection and options for recourse. The clause specifies actions that constitute a default, such as missed payments beyond a specified number of days (typically 30 or 60 days), bankruptcy filings, or the deterioration of the value of the collateral. It also details the remedies available to the lender in the event of default, including the right to accelerate the loan, demand immediate payment of the outstanding balance, and initiate foreclosure proceedings on the collateral, which can be real estate or personal property, subject to state laws and regulations. This clause ensures clarity for both parties regarding the potential outcomes of non-compliance and establishes a framework for resolving disputes, thereby facilitating a smoother recovery process for the lender in case of borrower default.

Governing Law and Jurisdiction

The governing law for this secured loan agreement (hereinafter referred to as "the Agreement") shall be the laws of the state of California, United States, specifically under the California Civil Code, which delineates laws pertaining to contracts and secure transactions. Any disputes arising from this Agreement will fall under the jurisdiction of the Superior Court of Los Angeles County, a court known for managing civil and financial cases. This jurisdiction emphasizes the importance of legal proceedings being held in a location that is geographically aligned with the primary parties involved in the financial arrangement, ensuring convenience and accessibility for all parties. The Agreement reflects the intention of the parties to submit to the authority of the designated laws and court, thereby establishing a clear legal framework for any potential disputes or interpretations of the terms set forth herein.

Comments