Are you ready to unlock the secrets of successful investing? Crafting a winning loan package is essential for savvy investors looking to secure funding for their next venture. In this article, we'll explore the key elements that make up an effective letter template, guiding you through the process step-by-step. Stick around to discover how you can enhance your investment strategy today!

Personal financial statement

A personal financial statement serves as a comprehensive snapshot of an individual's financial standing, detailing assets, liabilities, income, and expenses. The statement typically includes liquid assets such as bank account balances (checking, savings) amounting to $30,000, investments (stocks, bonds) valued at $150,000, and real estate holdings (property in New York City valued at $750,000) alongside outstanding debts including a mortgage of $500,000 and credit card liabilities totaling $15,000. Additional income sources may encompass annual salary of $90,000, rental income of $24,000 from a second property, and dividends of $5,000 from investments. Preparing a personal financial statement accurately reflects financial health, crucial for savvy investors considering potential loan packages.

Investment portfolio summary

Investment portfolio summaries provide a comprehensive overview of an individual's or entity's financial investments, detailing various asset classes, performance metrics, and risk assessments. A well-structured summary typically includes stocks from reputable companies such as Microsoft and Apple, bonds from reliable issuers like U.S. Treasury bonds, and real estate investments, including specific properties in prime locations like Manhattan or San Francisco. Performance metrics may showcase annual returns, such as a 12% return on equities over the last fiscal year, while risk assessments highlight diversification strategies including a mix of growth and value stocks. This summary aims to provide savvy investors with clear insights into their financial standings, ultimately guiding investment decisions for future opportunities.

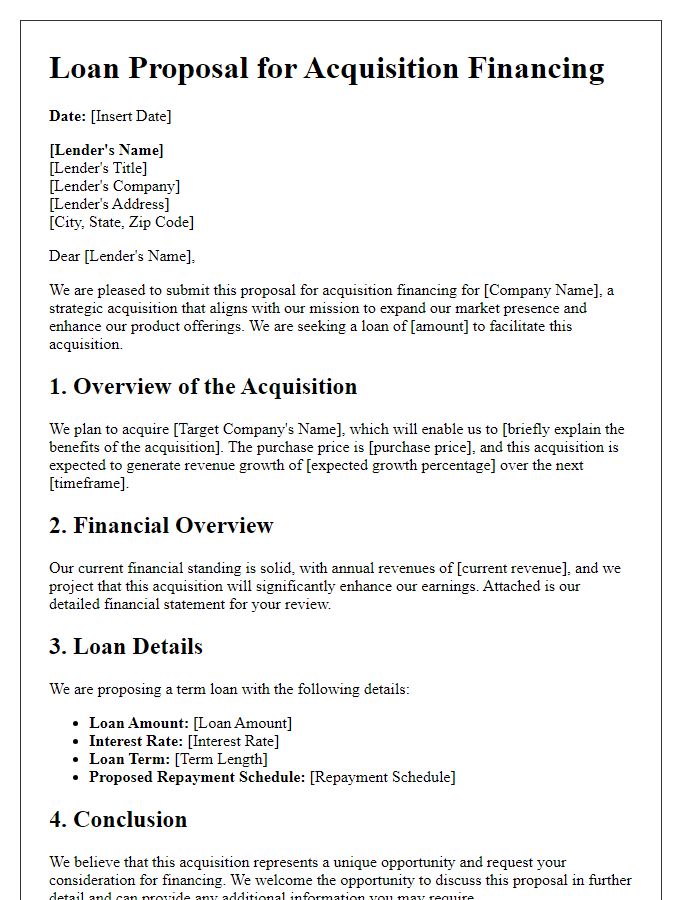

Loan purpose and business plan

When presenting a loan package, clarity and specificity are crucial for showcasing the purpose and strategy effectively. A well-defined loan purpose, such as funding for a startup based in Silicon Valley, can clearly outline goals to expand into the tech market, aiming for a $1 million revenue target within the first year. The accompanying business plan should detail market research, analyzing trends in the technology sector with projected growth rates of 15% annually. Competitive analysis must highlight key competitors, like Google and Apple, with strategies to differentiate through unique offerings. Financial projections, including a break-even analysis within 18 months and targeted profit margins of 20%, should be included alongside a marketing strategy that leverages social media and digital advertising. Clear articulation of loan terms and repayment plans, including proposed interest rates of 6% over five years, is essential to instill confidence in potential investors.

Collateral details

Savvy investors seeking loan packages often utilize various forms of collateral to secure financing. Real estate properties located in high-demand markets, like urban areas with rising property values, serve as primary collateral types; for instance, a rental property in Manhattan, New York, valued at $1.5 million can significantly enhance the attractiveness of the loan application. Vehicles such as luxury cars, often appreciated within collector markets, can also act as collateral; for example, a 2020 Tesla Model S could be valued at around $80,000. Additionally, investment portfolios, including stocks and bonds, contribute positively to collateral worth; portfolios holding blue-chip stocks from companies like Apple Inc. or Microsoft Corporation can provide substantial backing, reflecting both current market conditions and stability. Ensuring that the aggregate value of these collateral assets exceeds the loan amount requested establishes a solid foundation for negotiations.

Terms and conditions

Savvy investors often seek loan packages that provide competitive terms and conditions to maximize their opportunities in real estate markets. Essential components of these loan packages include interest rates ranging from 3% to 6%, typically influenced by current market conditions and the investor's credit score. Loan durations usually span from 15 to 30 years, offering flexibility in repayment options. Additionally, down payment requirements may vary, often set at 20% for investment properties to mitigate lender risk. Closing costs, generally comprising 2% to 5% of the loan amount, should be accounted for within the overall financial projection. Prepayment penalties, if applicable, can pose limitations on early repayment, and it's crucial for savvy investors to assess their potential impact. Loan-to-value ratio thresholds often capped at 75% help ensure that property equity remains intact, protecting both lenders and investors. Understanding these parameters is vital for making informed financing decisions that align with investment goals.

Letter Template For Savvy Investor Loan Package Samples

Letter template of financial support application for startup initiatives

Comments