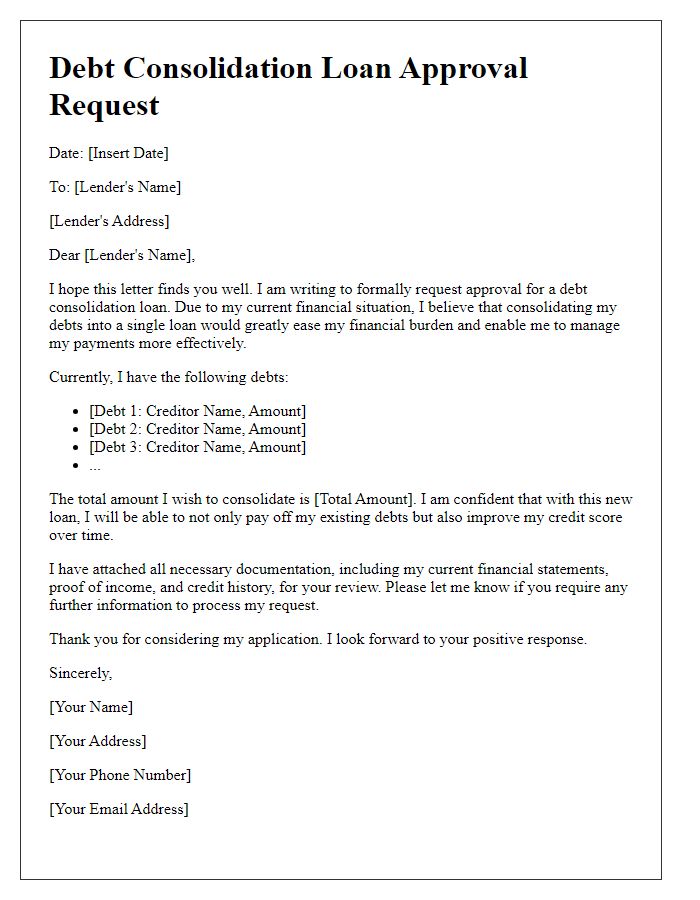

Are you feeling overwhelmed by multiple debts and looking for a way to regain control? A debt consolidation loan might be the perfect solution to simplify your financial life. With just one monthly payment, you can potentially lower your interest rates and reduce stress. If you're curious about how a debt consolidation loan can transform your financial situation, read on to discover the ins and outs of the approval process!

Personal and Financial Information

Debt consolidation loans can streamline multiple debts into a single monthly payment, assisting individuals in managing financial burdens more effectively. These loans typically require personal details, including identification numbers and addresses, alongside financial information such as total income from various sources, outstanding debt amounts, and credit scores. Lenders evaluate this data to assess the applicant's creditworthiness and ability to repay the loan. A favorable credit score, often above 650, can significantly enhance approval chances, with interest rates ranging from 5% to 36% based on credit profile and market conditions. Note: Personal information refers to data such as Social Security numbers and contact information, while financial information encompasses debts, income levels, and credit histories essential for loan assessment.

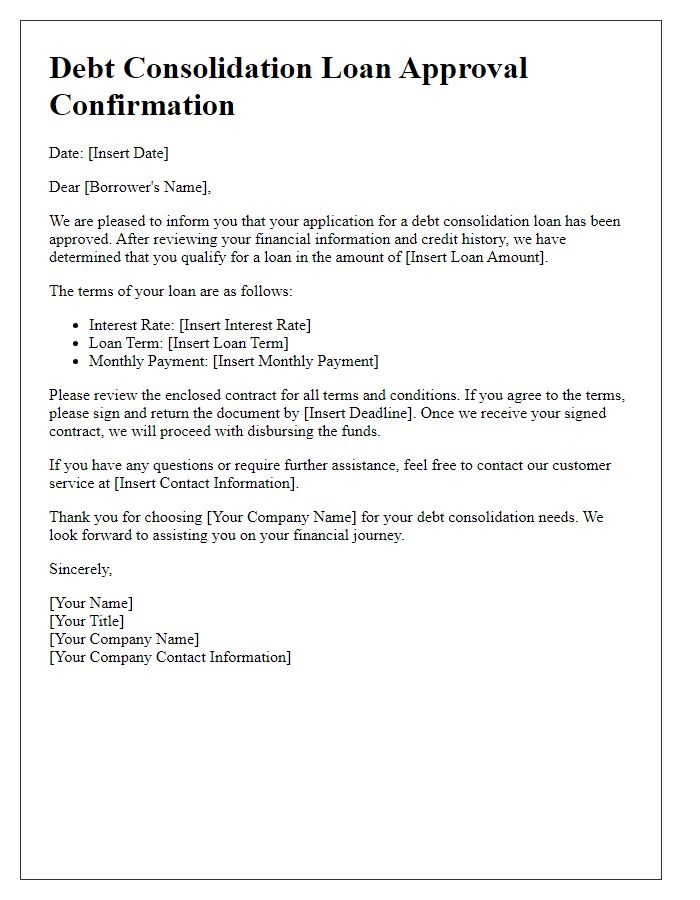

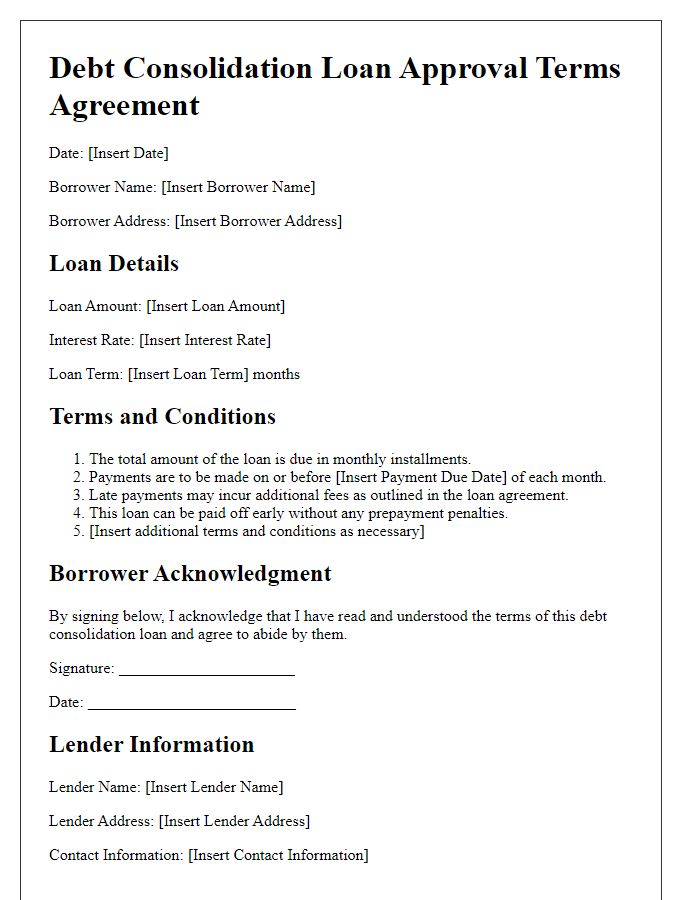

Loan Terms and Conditions

Debt consolidation loans can simplify financial management by merging multiple debts into a single payment. Key terms include interest rates, varying between 5% to 36% based on credit history, payment schedules typically span 3 to 5 years, and loan amounts ranging from $1,000 to $50,000. Lenders may charge origination fees, commonly 1% to 5%, impacting the total loan amount. Additionally, prepayment penalties may apply if the loan is paid off early, sometimes up to 2% of the principal. Understanding the implications of a credit check, which can impact credit scores temporarily, is crucial before proceeding. Each lending institution will provide a detailed summary of these terms, ensuring borrowers are informed of their obligations.

Repayment Schedule and Methods

Debt consolidation loans are designed to simplify the repayment process for individuals managing multiple debts. With a typical loan amount ranging from $5,000 to $50,000, borrowers can combine various high-interest debts into a single loan with a lower interest rate, which can significantly reduce monthly payments. Repayment schedules can span from three to five years, allowing for manageable installments that fit the borrower's financial situation. Various methods are available for repayment, including automatic bank drafts, online payments through financial institutions, and traditional checks, ensuring flexibility and convenience. Additionally, lenders may offer options for bi-weekly or monthly payments, catering to different income cycles and helping borrowers stay on track. It's essential to analyze the terms of the loan, including annual percentage rates (APRs) that can range from 5% to 36%, to determine the overall cost of borrowing and the potential savings compared to existing debts.

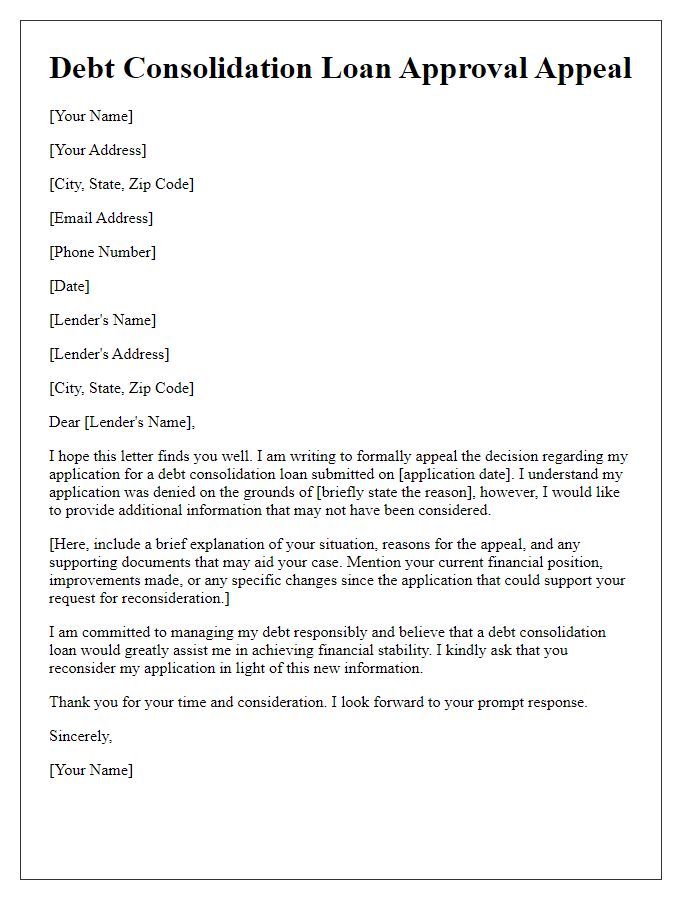

Fees and Associated Costs

Debt consolidation loans often involve various fees and associated costs that borrowers should carefully consider. Origination fees, typically ranging from 1% to 5% of the loan amount, may be charged for processing the loan application. Borrowers should also be aware of potential prepayment penalties, which can apply if the loan is paid off early, affecting long-term savings. Closing costs, including title search and appraisal fees, can add another layer of expense, sometimes totaling hundreds of dollars. Interest rates vary significantly based on credit score, often between 5% and 30%, impacting the overall repayment amount. Understanding these fees is crucial for making informed financial decisions and ensuring the debt consolidation loan is a beneficial solution.

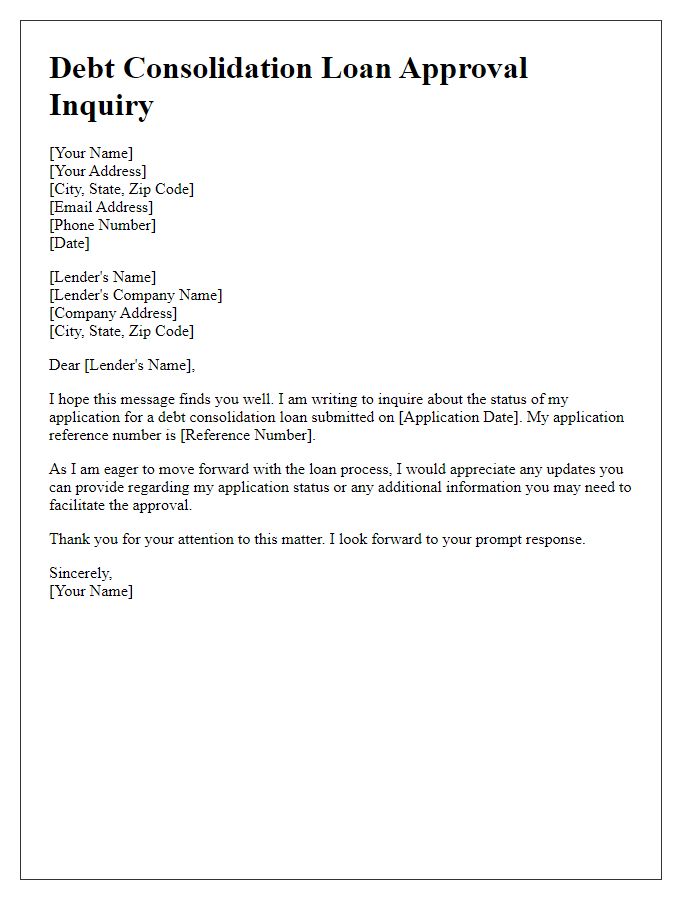

Contact Information for Queries

Debt consolidation loans provide an effective solution for managing multiple debts by combining them into a single loan. Borrowers seeking clarity regarding their application process or seeking assistance can reach out to designated customer service representatives. These representatives are typically available via phone, email, or live chat, ensuring prompt responses to inquiries. Contacting the support team can expedite loan approval timelines, which generally range from a few days to several weeks, depending on the lender's criteria. Factors influencing approval include credit score assessments, income verification, and existing debt levels, all critical elements in determining eligibility for the loan.

Comments