Are you a seasonal business owner looking for financial support to boost your operations during peak times? Navigating the world of loans can be overwhelming, but understanding your options can lead you to the perfect solution for your needs. Whether it's inventory purchases, marketing efforts, or operational costs, a well-structured loan can provide the boost you need to thrive. Join us as we explore the ins and outs of seasonal business loans and how they can help you succeed!

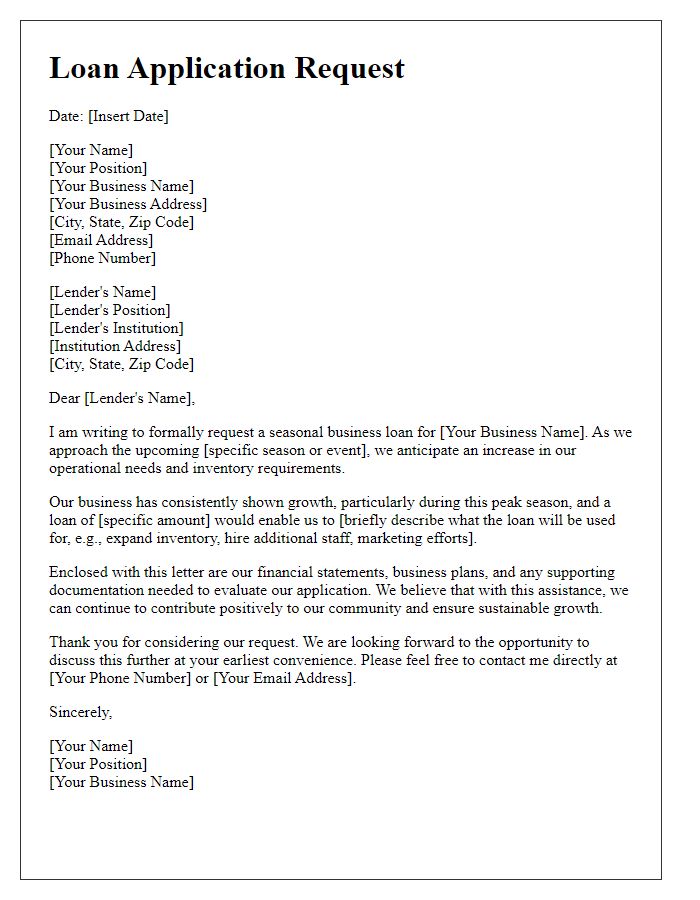

Business Purpose and Loan Amount

A seasonal business loan inquiry typically revolves around short-term financing needs, specifically tailored for companies experiencing fluctuating revenue during particular times of the year. Many retail establishments, such as those located in areas with tourist attractions, often seek loans ranging from $10,000 to $100,000 to cover operational costs during off-peak seasons. Funds may be allocated for inventory purchases, marketing campaigns to boost sales, or supplementing payroll to retain staff through slower months. Having a solid plan detailing projected revenue increases during peak months, such as the holiday season in December or summer sales, can greatly strengthen the loan application, showcasing potential for timely repayment. Financial institutions may require documentation such as tax returns, cash flow statements, and business plans to assess creditworthiness and determine suitable lending options.

Seasonal Revenue Projections

Seasonal businesses often experience fluctuating revenue patterns, significantly impacting cash flow and operational stability. For instance, a winter sports rental company may project a 200% revenue increase during December through February due to holiday tourism at locations like Aspen, Colorado. Conversely, summer months may show a drastic decline, with profits potentially dropping by 70%. Understanding these seasonal cycles is crucial for financial planning and determining funding needs. Accurate revenue projections should incorporate data from past years, accounting for local factors such as tourism trends, holiday sales spikes, and regional economic conditions that may influence buying patterns. Properly forecasting these patterns can facilitate better loan requests, ensuring that businesses can maintain operations and meet expenses during lean months.

Repayment Plan and Schedule

Seasonal businesses often rely on short-term financing to manage cash flow fluctuations during peak and off-peak seasons. A well-structured repayment plan is crucial for maintaining financial health. The repayment schedule typically spans 6 to 12 months, with possible monthly or bi-weekly installments. For instance, a $50,000 seasonal business loan with a 10% annual interest rate might entail payments of approximately $5,500 each month. Interest accrues monthly, impacting overall loan cost. Clear communication with financial institutions regarding profit margins during peak months, like December for retail, can lead to favorable terms. Additionally, aligning repayment with seasonal revenue peaks ensures manageable cash flow dynamics, crucial for sustaining operations.

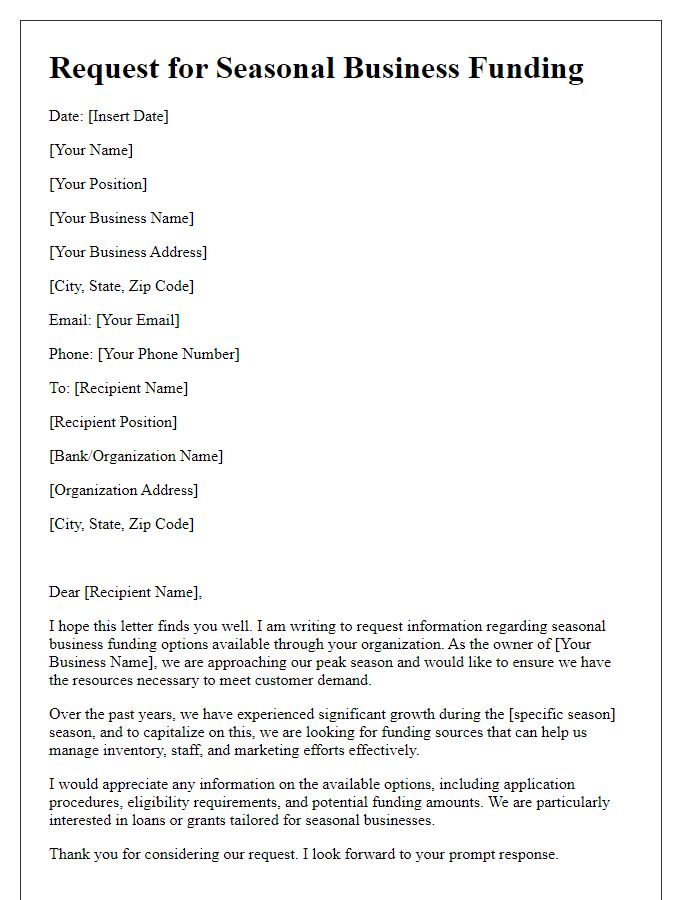

Business Financial Overview

A seasonal business loan inquiry often requires a detailed financial overview to showcase the business's performance and needs. Key metrics like annual revenue (for example, $500,000), monthly operating expenses (around $30,000), and seasonal income fluctuations (peak season generating up to 70% of annual revenue) should be highlighted. Understanding the business's cash flow cycle, particularly in relation to peak seasons (for instance, summer months for a tourism-based business), helps lenders assess risk. Additionally, documents such as profit and loss statements, tax returns from the past three years, and existing debt obligations (totaling $100,000) will provide a comprehensive financial picture. It's crucial to outline planned use of the loan, emphasizing areas like inventory purchase (approximately $50,000) and marketing efforts to boost off-season sales.

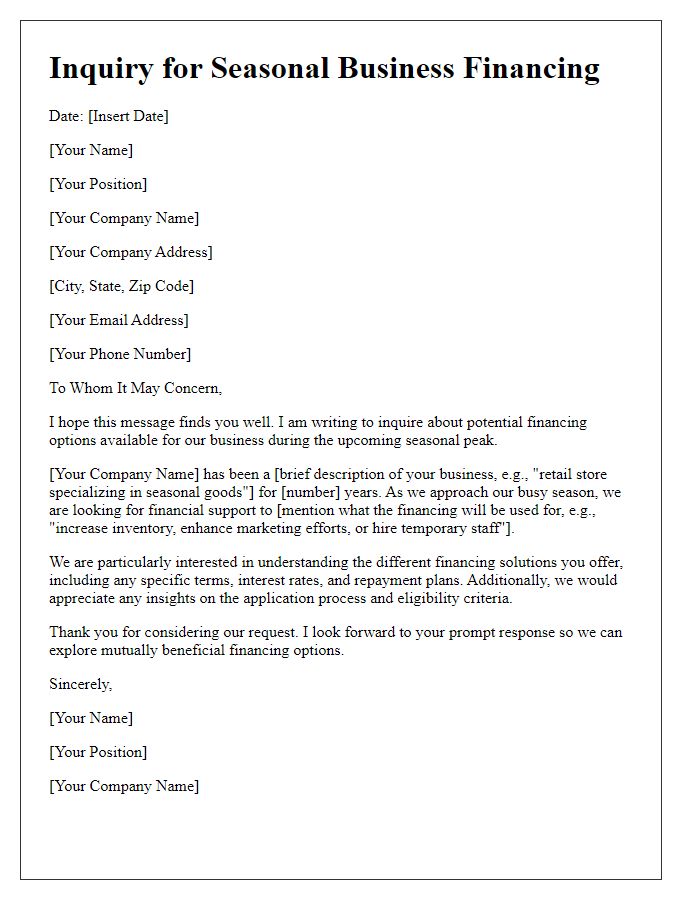

Contact Information and Business Background

Seasonal business loans provide essential financial support to companies that experience fluctuations in revenue throughout the year. For industries like tourism, agriculture, and retail, cash flow variability can create challenges. Establishing contact information, such as a phone number or email, alongside business background, including establishment year and services offered, helps lenders assess eligibility. Specific details, like annual revenue figures and average seasonal expenses, enrich the inquiry and streamline the loan process. Thorough documentation and clear communication can facilitate approval and support business continuity during peak and off-peak seasons.

Comments