Are you in need of a little financial help before payday? Requesting a salary advance loan can be a straightforward process if you know how to write your request effectively. In this article, we'll walk you through a simple letter template that will help you clearly communicate your needs to your employer. So, if you're ready to ease your financial stress, read on to discover how to craft the perfect salary advance loan request!

Subject Line

Subject: Request for Salary Advance Loan Approval

Applicant Information

An applicant seeking a salary advance loan typically provides critical information to support their request. This information includes full name, contact number for communication, and email address for formal correspondence. Employment details are essential, particularly the name of the employer, job title (position held within the organization), and length of employment, which indicates job stability. Monthly salary (specific amount) usually accompanies details about additional income sources, if any, to demonstrate repayment capability. Furthermore, the applicant may include identification information, such as a social security number or employee ID, ensuring proper verification. Address details enhance the profile, specifying both residential and permanent addresses, establishing a clear connection to the applicant. It is crucial for the applicant to demonstrate financial responsibility, possibly through a credit score range or past borrowing history to increase the likelihood of approval.

Purpose of Request

Many employees seek financial assistance through salary advance loans to address unforeseen expenses or emergencies. This financial product is typically offered by employers, allowing staff members to receive a portion of their upcoming paycheck before the scheduled payday. Common situations prompting such requests include medical emergencies, car repairs, or urgent home maintenance, which can create significant financial strain. For example, unexpected medical bills may amount to several thousand dollars, necessitating immediate funds. Salary advance loans can vary in terms of eligibility criteria and repayment options, often requiring a formal request process including justification of the need and a proposed repayment plan.

Loan Amount

A salary advance loan request typically involves an amount that a borrower seeks to obtain from their employer, intending to receive an early disbursement of their salary to address immediate financial needs. The loan amount generally varies depending on the employee's monthly salary and personal financial situation. For instance, an employee earning $3,000 monthly may request an advance of up to 50%, which equates to $1,500. Such loans are often designed to be repaid through deductions from future paychecks, typically within one or two pay periods. Lenders may assess factors such as job tenure and departmental budget implications prior to approval.

Repayment Terms

When considering a salary advance loan request, clarity on repayment terms is crucial for both the employee and the employer. Common repayment terms typically involve a fixed percentage (often 10-20%) of the employee's monthly salary being deducted directly from payroll. The duration for repayment may range from three to six months, depending on the total amount advanced. The agreement should outline interest rates, if applicable, which might be set at a modest percentage (e.g., 2-5% per month) to offset the administrative costs involved. Additionally, the terms should specify conditions applicable in cases of employment termination, outlining how the outstanding balance will be settled. This level of detail ensures transparency and minimizes potential misunderstandings between both parties.

Letter Template For Salary Advance Loan Request Samples

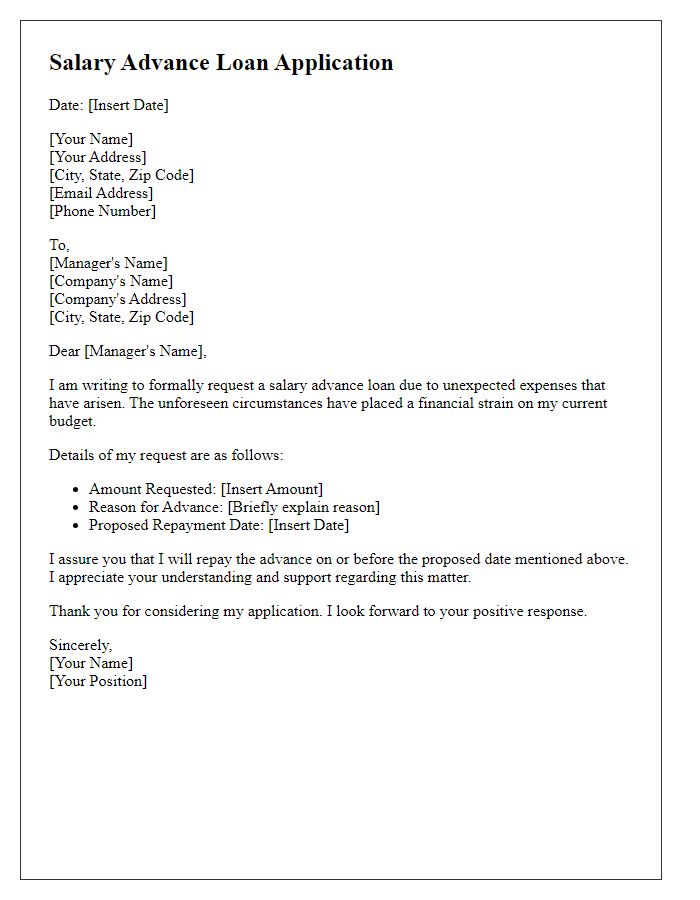

Letter template of salary advance loan application for unexpected expenses.

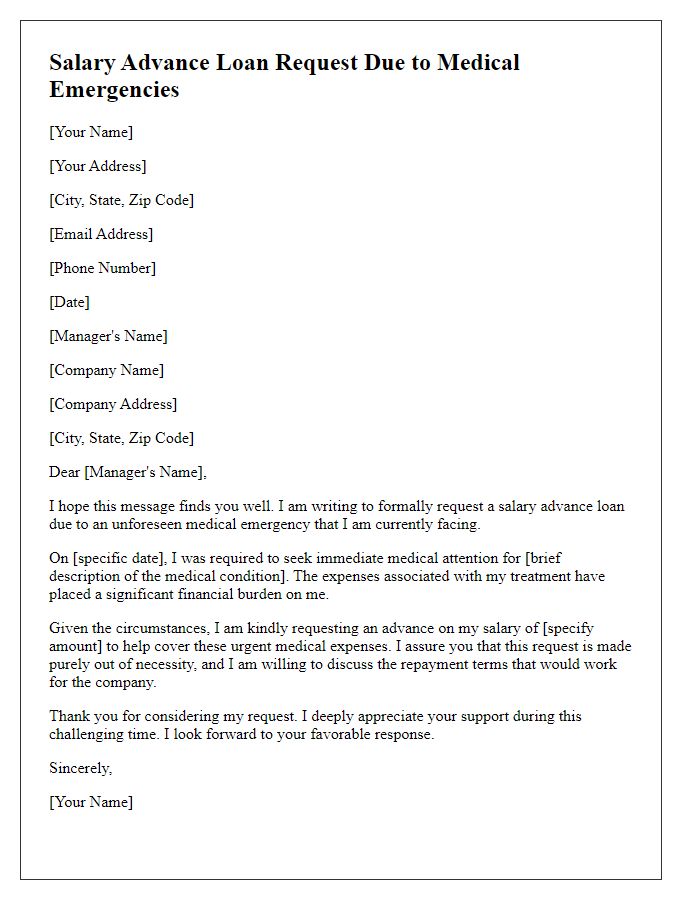

Letter template of salary advance loan request due to medical emergencies.

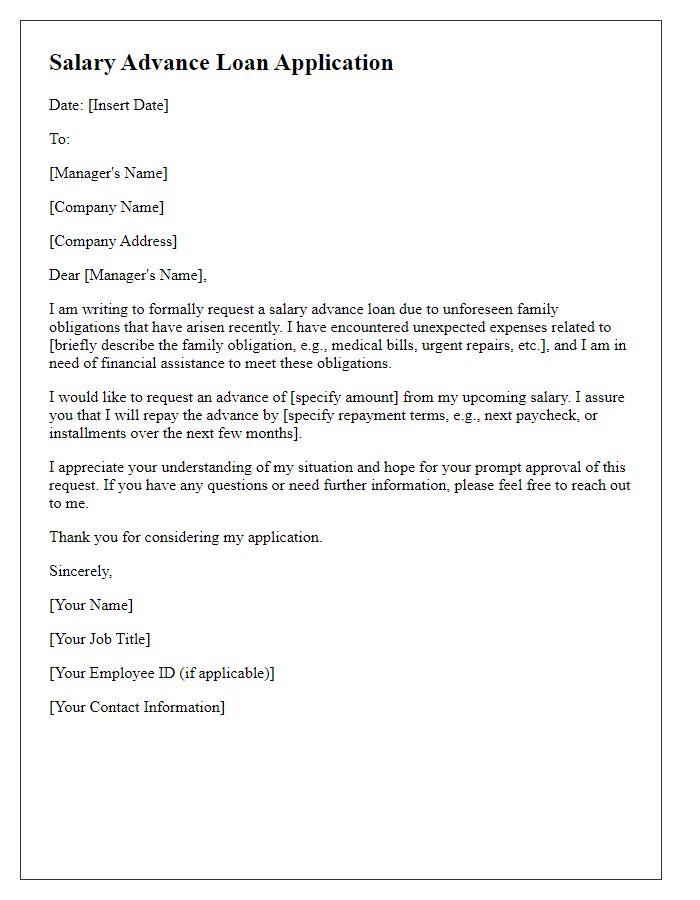

Letter template of salary advance loan application due to family obligations.

Comments