Starting an artisanal business is a journey filled with passion and creativity, but it often requires financial support to turn dreams into reality. Whether you're crafting handmade jewelry, brewing small-batch coffee, or designing unique home goods, securing the right loan can make all the difference in scaling your operations. In this article, we'll explore how to articulate your vision and financial needs effectively in a letter to potential lenders, ensuring you stand out in a crowded marketplace. Ready to dive deeper into crafting the perfect loan request letter? Let's get started!

Business Overview

An artisanal business focuses on handcrafted products that emphasize quality, creativity, and unique techniques. This type of enterprise often draws inspiration from traditional craftsmanship, involving specialized skills in areas such as woodworking, pottery, textiles, or metalworking. For instance, a small workshop in Asheville, North Carolina, creates custom furniture using sustainable materials, showcasing local artisans' talents while promoting environmental responsibility. These businesses typically cater to niche markets, often participating in regional craft fairs and online platforms like Etsy, connecting with customers who value authenticity and craftsmanship. Increased access to loan support can enable these artisans to expand their production capabilities, invest in high-quality raw materials, and enhance their marketing efforts, ultimately solidifying their position in a competitive market.

Financial Projections

Artisanal businesses often require precise financial projections to secure loan support. An accurate financial projection typically includes estimations of revenues, costs, and profits over a defined period, usually three to five years. For example, an artisanal bakery may forecast annual revenues of $250,000, derived from selling handmade pastries and bread at local farmers markets and online platforms. Direct costs, like high-quality organic ingredients and production materials, may amount to approximately $100,000, resulting in a gross profit of $150,000. Operating expenses, such as rent (for a small commercial kitchen in Asheville, North Carolina) and utilities, could be estimated at $50,000, leading to a net profit projection of $100,000. Additionally, cash flow statements provide insights into liquidity, essential for covering operating expenses and potential equipment upgrades, like an artisanal mixer, which could cost around $3,000. Accurate and detailed financial projections enhance the credibility of loan applications, illustrating the business's viability and growth potential within the artisanal sector.

Purpose of Loan

Artisanal businesses, such as handcrafted jewelry makers and organic soap producers, often seek financial support to enhance production capabilities and expand market reach. The primary purpose of the loan could include purchasing high-quality raw materials like sustainably sourced metals or essential oils, which are essential for creating unique products. Additionally, the funds may be allocated to upgrading equipment, such as specialized tools for precision crafting, which can improve efficiency and product consistency. Marketing efforts to increase brand visibility, such as participating in local craft fairs or boosting online presence, can also benefit from the loan. Furthermore, creating a dedicated workspace in community-based locations, particularly in cultural hubs, can aid in fostering collaboration and attracting a loyal customer base, fundamentally strengthening the artisanal community.

Repayment Plan

Artisanal businesses, such as handcrafted jewelry or locally sourced food products, often require financial assistance to scale operations. A repayment plan for a loan may involve structured payments over a fixed period, typically ranging from 12 to 60 months, depending on the loan amount. Monthly payments can vary based on factors like interest rates (often between 5% to 10% for such businesses) and loan terms. Seasonal fluctuations in sales, particularly in artisan markets held in cities like Asheville or Santa Fe, should be accounted for, potentially resulting in adjusted payment schedules during slower months. Additionally, a well-defined repayment strategy can include milestones such as increased revenue targets, which reflect growth from expanding customer bases through online platforms or local crafts fairs. Developing a clear and feasible plan not only enhances credibility but also supports sustainable business practices in the artisanal sector.

Unique Selling Proposition (USP)

Artisanal businesses boast a unique selling proposition (USP) that emphasizes handmade, high-quality products crafted with traditional techniques. These businesses typically source local materials, enhancing sustainability and contributing to local economies. For instance, an artisanal bakery may use organic flour from nearby farms, while a handcrafted furniture maker might utilize reclaimed wood, reflecting a commitment to environmental responsibility. Unique design elements and personalization options differentiate these products from mass-produced alternatives, attracting consumers seeking authenticity and individuality. Engaging storytelling about the artisans behind the products fosters a deeper connection with customers, leading to brand loyalty and a premium pricing strategy. Overall, the USP of artisanal businesses lies in their ability to blend craftsmanship, quality, and community impact, appealing to conscious consumers in today's market.

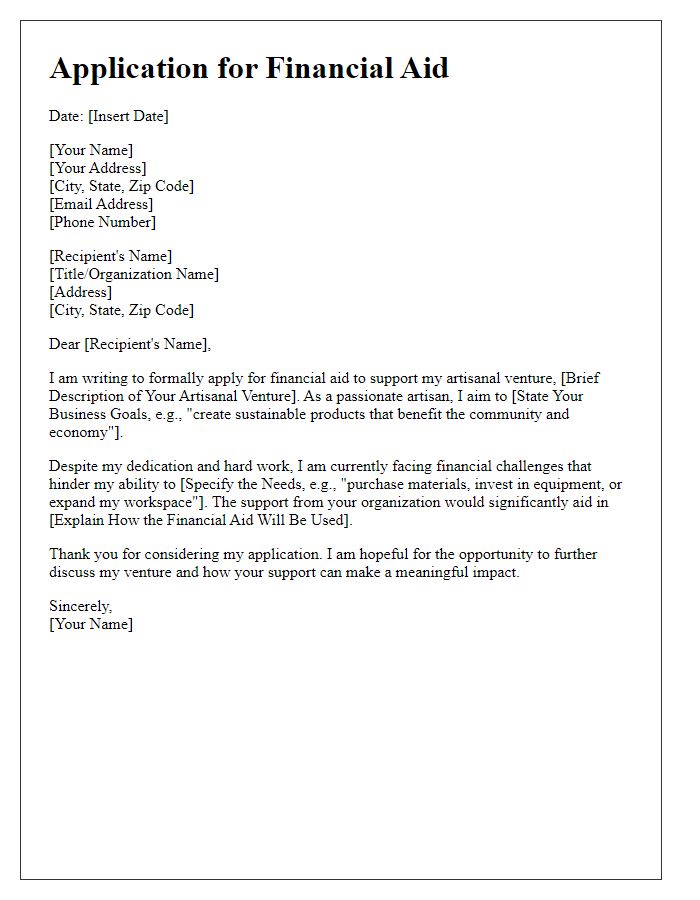

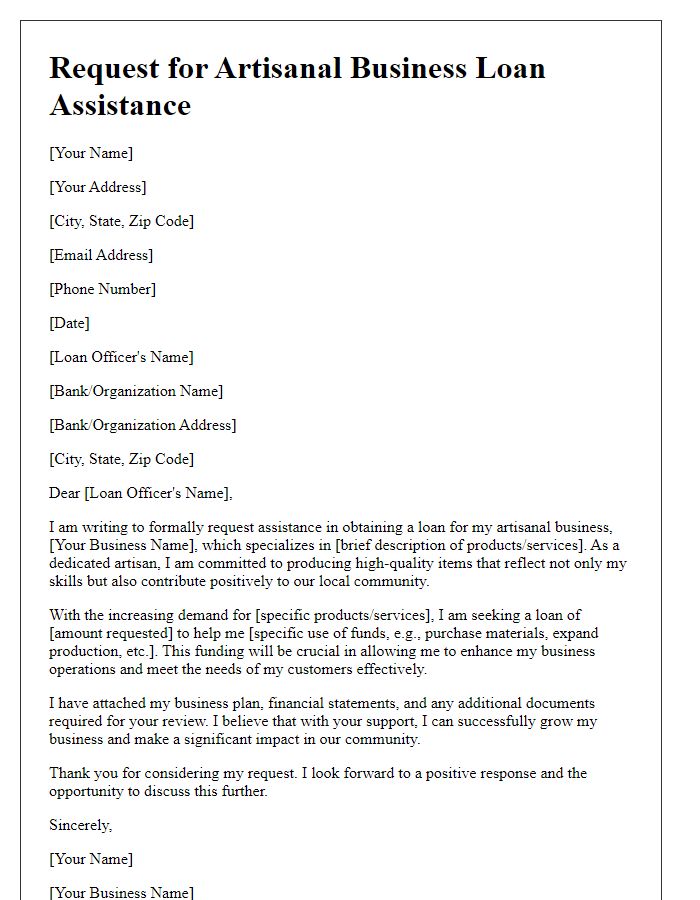

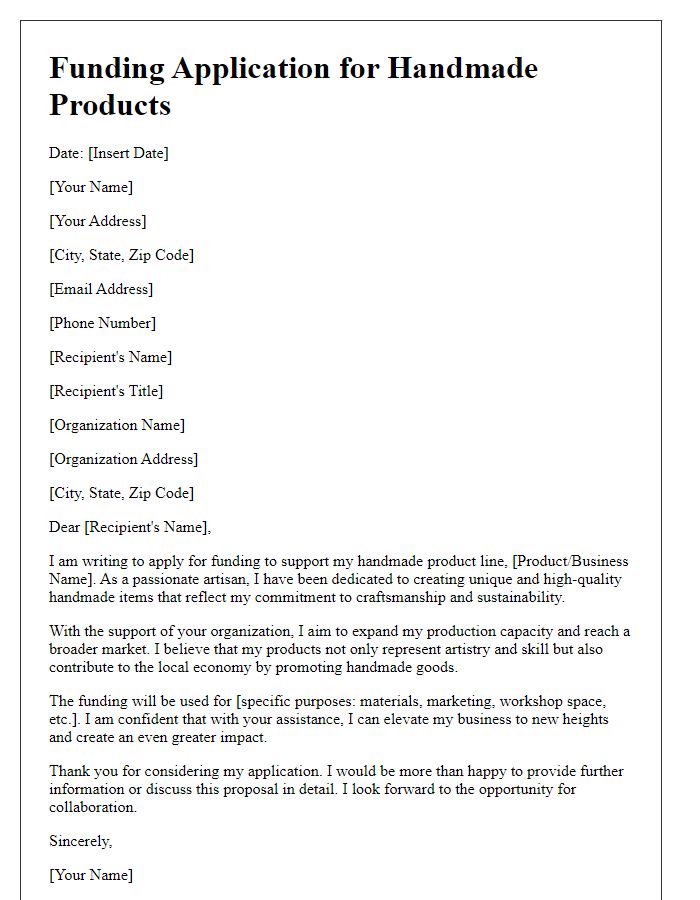

Letter Template For Artisanal Business Loan Support Samples

Letter template of application for financial aid for artisanal ventures.

Comments