Are you a healthcare professional navigating the complex world of loan options? The journey to finding the right financial support can be overwhelming, but it doesn't have to be! In this article, we'll explore the key factors to consider when seeking feedback on your healthcare professional loan experience. Stick around for valuable insights that could help streamline your process and empower your financial decisions!

Clear and concise communication

Healthcare professionals experience unique challenges with loan management, especially in high-cost regions like urban hospitals facing staff shortages. Timely repayment structures can assist in alleviating financial burdens, with some institutions offering loan forgiveness programs after specific service periods, typically five years. Feedback mechanisms, such as questionnaires or online platforms, can enhance communication efficiency, ensuring that healthcare workers can express concerns regarding loan terms and access resources. Regular updates on changes in interest rates or policies (as seen with federal student loans transitioning in 2023) play a crucial role in helping professionals stay informed and adequately plan their finances.

Personalized and relevant details

Healthcare professionals seeking financial assistance often utilize specialized loan programs designed to support their educational and career development. Common programs include the Federal Stafford Loan and the Health Resources and Services Administration (HRSA) loan repayment. These loans typically offer lower interest rates compared to standard private loans, with repayment options based on income. For instance, the Income-Driven Repayment Plan (IDR) allows monthly payments to adjust with the borrower's financial circumstances. Additionally, practicing in underserved areas may qualify healthcare providers for loan forgiveness under the National Health Service Corps (NHSC) program. Personalized feedback regarding these options is critical for professionals to make informed financial decisions tailored to their unique circumstances.

Professional tone and language

Providing feedback on healthcare professional loan applications requires a structured approach to ensure clarity and professionalism. The review process for the healthcare professional loan program takes into consideration several key factors including applicant qualifications, financial stability, and practice viability. Understanding the impact of repayment terms is essential in determining the long-term benefits of the loan. The applicant's education credentials (e.g., MD, DO, NP) play a critical role in assessing their potential contribution to patient care within underserved areas. Evaluating the targeted practice location (e.g., rural communities, low-income urban areas) gives insight into the applicant's commitment to addressing healthcare disparities. Additionally, financial performance metrics such as debt-to-income ratios and income projections are vital in determining the feasibility of loan repayment. Thorough assessments and clear communication enhance the understanding of loan impacts on public health initiatives and improve the collaboration between financial institutions and healthcare providers. An emphasis on proactive support through financial literacy programs can lead to better outcomes for both healthcare professionals and the communities they serve.

Specific feedback and suggestions

Feedback from healthcare professionals regarding loan services often highlights the importance of clear communication and user-friendly terms. Many report confusion regarding repayment options, urging improved transparency about interest rates and repayment schedules. Suggestions include incorporating an online platform for better tracking of loan status and making educational resources available for understanding loan implications. Additionally, professionals express a desire for flexible payment plans that accommodate fluctuating incomes common in healthcare careers. Lastly, customer service experiences need enhancement, with healthcare professionals advocating for more accessible support channels.

Call to action or next steps

Healthcare professionals seeking loan feedback can benefit from understanding the specifics of their loan application. Loan types, such as federal Stafford loans or private lenders like SoFi, come with varying interest rates, ranging from 2.75% to 12%, affecting repayment timelines. Analyzing the loan terms in relation to future earnings potential in fields such as nursing or pharmacy can provide insights into manageable repayment strategies. Engaging with financial counselors experienced in the healthcare sector can clarify options for refinancing or loan forgiveness programs available for professionals serving in underserved areas, such as the National Health Service Corps. Following up with lenders about the status of applications or missing documentation within a predetermined timeframe will ensure timely processing.

Letter Template For Healthcare Professional Loan Feedback Samples

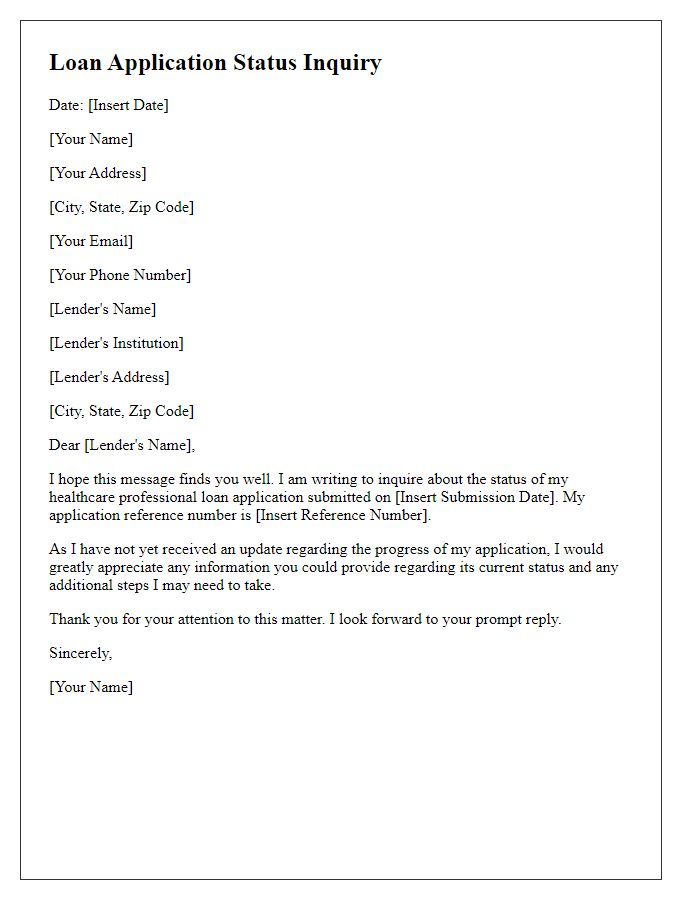

Letter template of healthcare professional loan application status inquiry

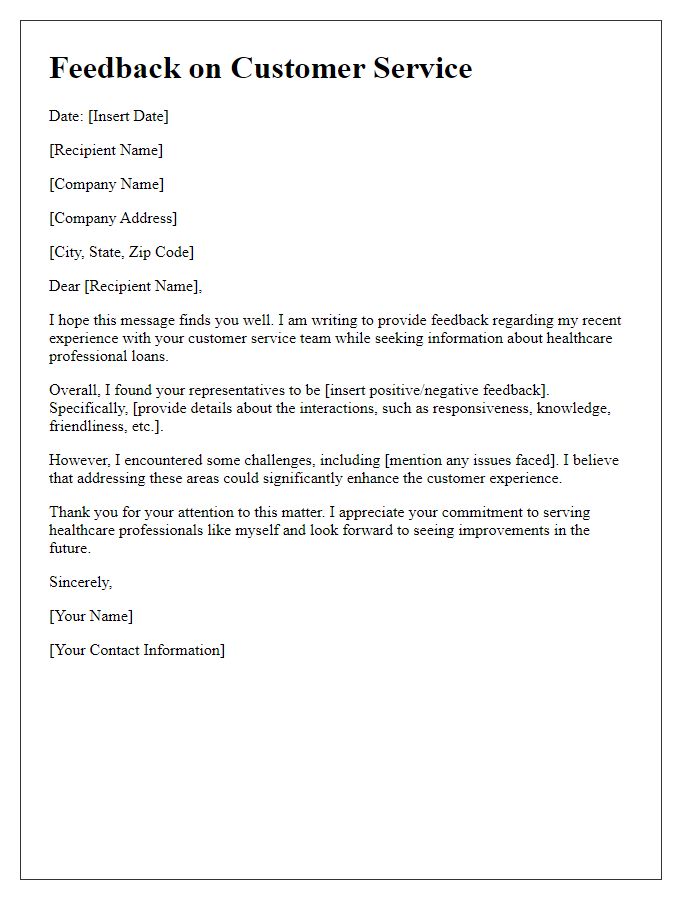

Letter template of healthcare professional loan feedback on customer service

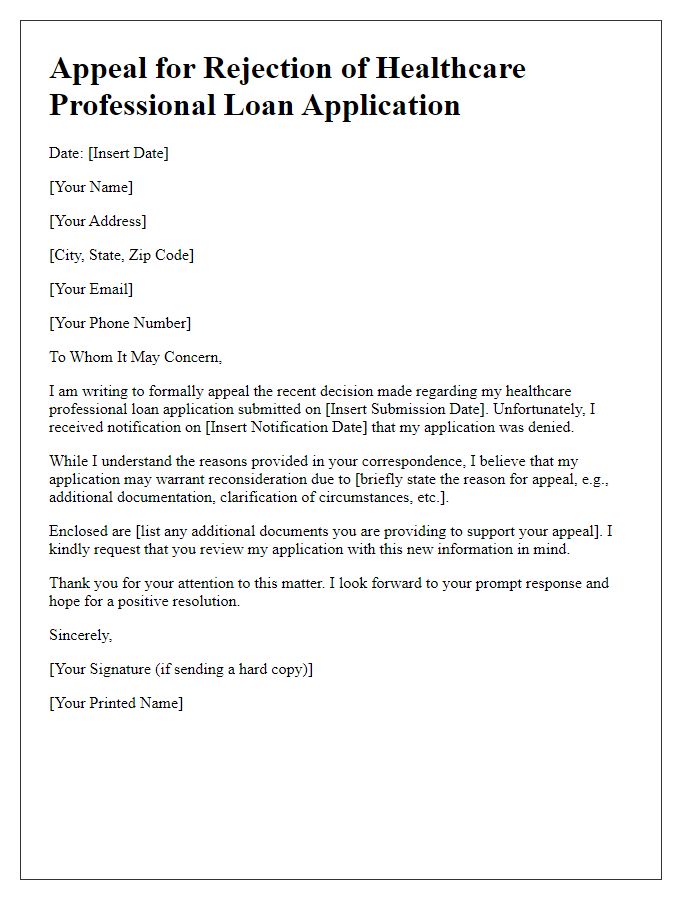

Letter template of healthcare professional loan application rejection appeal

Letter template of healthcare professional loan interest rate negotiation

Comments