Are you considering taking the next step in your financial journey with a personal loan? Pre-approval can make the process smoother and offer peace of mind, allowing you to focus on what truly matters. Whether you're planning a big purchase or consolidating debt, understanding the pre-approval process is essential. Join us as we break down the key steps and benefits of securing your personal loan pre-approval!

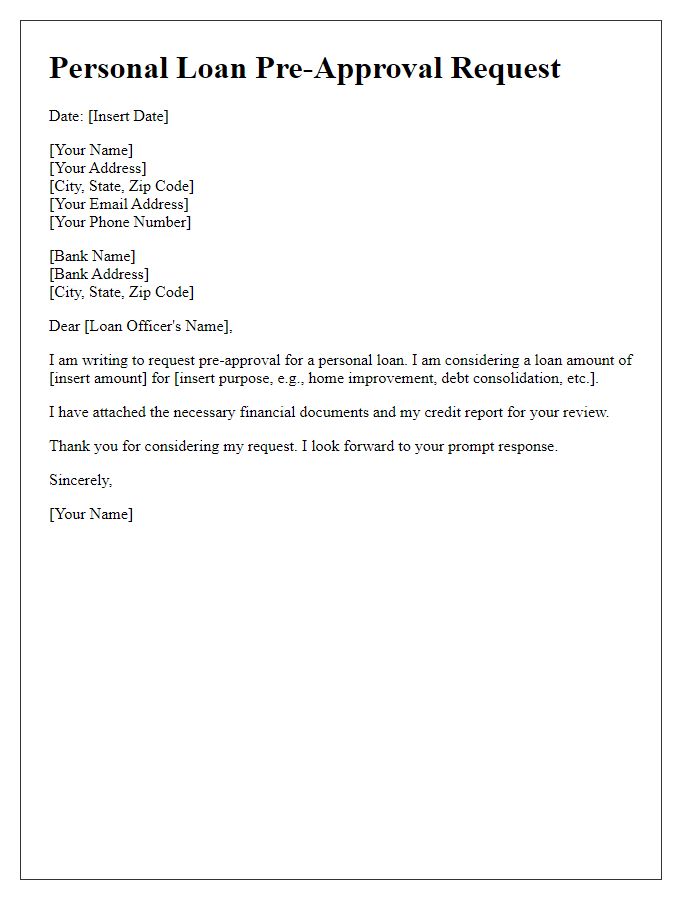

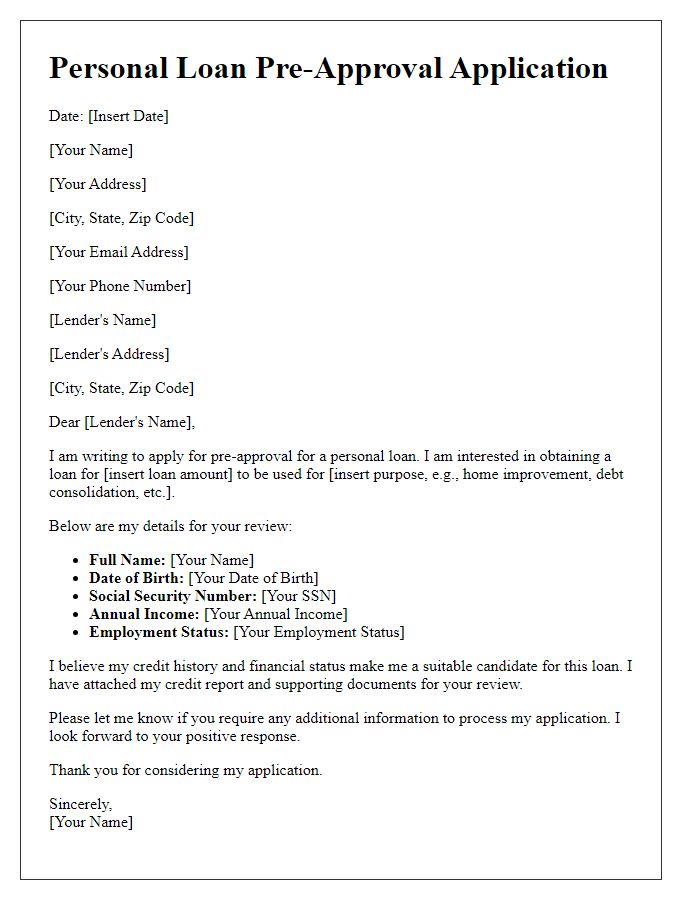

Borrower's Personal Information

A personal loan pre-approval process involves essential borrower details such as name, address, date of birth, social security number, employment status, and annual income. These critical elements help lenders assess creditworthiness and repayment capacity. Providing accurate information is necessary to facilitate a timely review of financial standing, which typically takes one to three business days after submission. Lenders often verify details through credit reports, emphasizing the importance of a good credit score (generally above 600) to secure favorable loan terms. Additionally, understanding the total loan amount requested and the intended purpose, like debt consolidation or home improvement, can significantly influence the approval outcome.

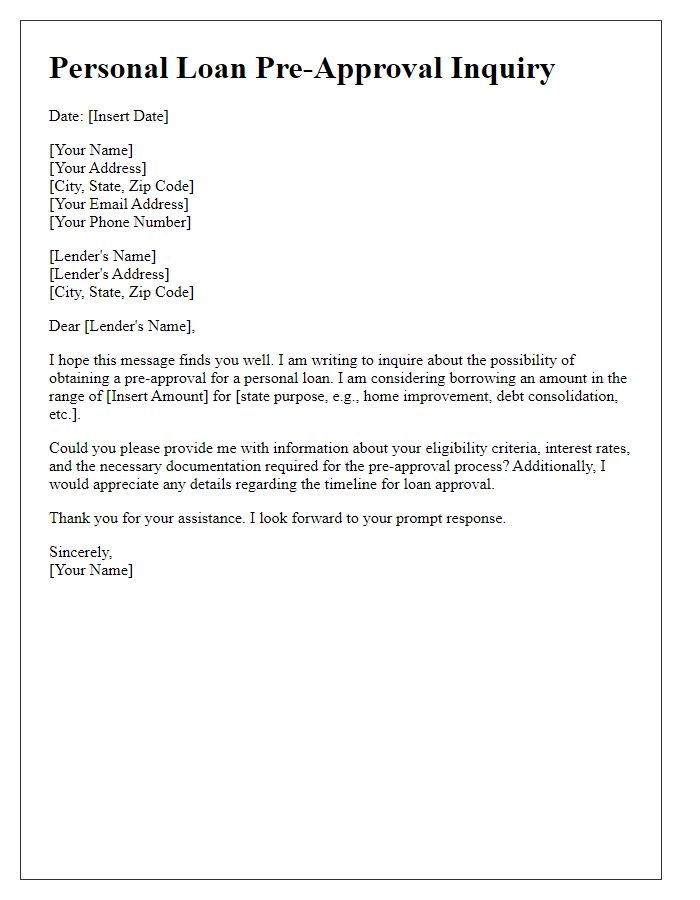

Loan Amount and Terms

Individuals seeking personal loans should consider various factors influencing loan amount and terms. The typical loan amount ranges from $1,000 to $50,000, depending on factors such as credit score, income level, and repayment capacity. Interest rates may vary significantly, often between 5% to 36%, influenced by the lender type, such as traditional banks or online lenders. Loan terms usually span from 1 to 7 years, with shorter terms generally yielding lower interest costs. Key components like origination fees--typically 1% to 6% of the loan amount--can also impact the total repayment amount. Understanding these elements is crucial for making informed financial decisions when applying for personal loans.

Interest Rate and Fees

Personal loans often come with varying interest rates and fees that are crucial for borrowers to understand. Interest rates, typically ranging from 5% to 36% annually, can significantly impact the total repayment amount over the life of the loan. Fees such as origination fees, which may be around 1% to 8% of the loan amount, can also add to the overall cost. Additional charges might include late payment fees, ranging from $15 to $40, and prepayment penalties if the borrower pays off the loan early. Understanding these financial aspects is essential for making informed borrowing decisions and ensuring that the chosen loan fits within one's budgetary constraints.

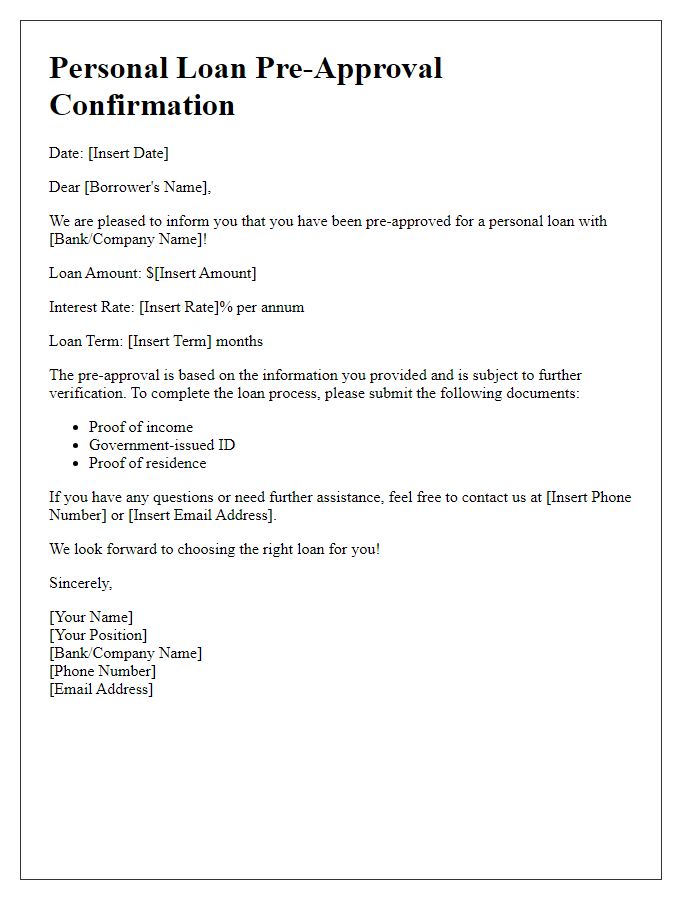

Repayment Schedule

A personal loan pre-approval typically outlines the key aspects of a potential borrowing scenario, including the repayment schedule that specifies the frequency and amount of payments required to repay the loan. The repayment schedule may detail monthly payments -- for instance, if borrowing an amount of $10,000 over a period of 5 years at an interest rate of 6%, an individual would face a monthly payment of approximately $193.33. This schedule clarifies the total interest paid over the life of the loan, which in this example would approximate $1,599.80, demonstrating total repayment of $11,599.80. Additionally, borrowers should be aware of any potential fees, such as origination fees that may affect the total cost of the loan. Understanding the repayment schedule helps individuals budget accordingly and assess their financial capability in meeting loan obligations.

Conditions and Disclaimers

A personal loan pre-approval typically comes with specific conditions and disclaimers that borrowers should thoroughly understand. For instance, income verification (often requiring two recent pay stubs or tax returns), credit score assessment (usually a minimum of 600 for favorable terms), and debt-to-income ratio evaluation (preferably below 40%) are critical factors influencing approval. In addition, lenders may specify a pre-approval validity period, often lasting 30 to 90 days, during which the terms can change based on market conditions. It's essential to note that pre-approval does not guarantee final loan approval; further documentation review and underwriting processes are needed. Borrowers should also be aware of possible fees, such as origination fees (typically ranging from 1% to 5% of the loan amount) and prepayment penalties, which could be imposed if the loan is paid off early. Understanding these conditions allows borrowers to make informed decisions when seeking personal loans.

Comments