Are you a digital entrepreneur looking to take your business to the next level? Navigating the world of loans can feel overwhelming, but with the right guidance, you can secure the funding you need to thrive. In this article, we'll break down the essential elements you should consider when applying for a loan tailored specifically for digital businesses. So, grab a cup of coffee and dive in to discover the key insights that could make all the difference for your entrepreneurial journey!

Business Plan

A comprehensive business plan serves as a foundational document for digital entrepreneurs seeking loans. This strategic outline typically includes an executive summary, detailing the core concept and objectives of the business venture, along with market analysis that highlights industry trends, target demographics, and competitive landscape within the digital realm. Financial projections, often spanning three to five years, should incorporate forecasts on revenue, expenses, and profit margins, demonstrating robust understanding and planning of potential cash flow scenarios. Additionally, the operational plan needs to delineate the business model (such as e-commerce, SaaS, or digital marketing), outlining essential workflows and resource allocation. Management structure should include qualifications of key team members, showcasing expertise that ensures effective execution of the business model. Appendices may feature supporting documents, such as resumes, legal agreements, or product samples that validate the entrepreneur's readiness and capability to successfully launch and sustain the digital business.

Financial Projections

Financial projections are crucial for digital entrepreneurs seeking loans, providing an insightful roadmap for expected revenue, expenses, and cash flow. A detailed forecast typically spans three to five years, illustrating growth patterns and highlighting key performance indicators (KPIs) such as monthly recurring revenue (MRR) or customer acquisition cost (CAC). Incorporating market research data from industry reports, such as those from Statista or IBISWorld, bolsters credibility in revenue assumptions. In addition, outlining fixed costs, variable costs, and projected profits is essential for demonstrating a viable business model. Clear graphical representations of projections, like charts and tables, allow lenders to easily grasp financial forecasts. Ultimately, robust financial projections not only showcase an entrepreneur's understanding of their business landscape but also instill confidence in lenders regarding repayment capabilities.

Market Analysis

Market analysis is crucial for understanding the competitive landscape in the digital entrepreneurship sector, particularly in e-commerce, mobile applications, and online services. According to Statista, the global e-commerce market is projected to reach approximately $6.3 trillion by 2024, highlighting significant consumer demand and opportunities for growth. Research indicates that 79% of consumers prefer to shop online, driven by convenience and time efficiency. Key players include Amazon, Alibaba, and Shopify, each commanding substantial market share and influencing industry trends. Target demographic analysis reveals that millennials and Gen Z are the primary drivers of online commerce, seeking personalized and seamless shopping experiences. Furthermore, emerging trends like dropshipping and subscription models present new avenues for digital entrepreneurs to explore in 2023. Collectively, this data provides a comprehensive overview of the market landscape, essential for formulating strategies to secure funding and guide business development.

Personal and Business Credit History

Personal and business credit history play a crucial role in securing a digital entrepreneur loan, influencing factors such as interest rates and loan amounts. Personal credit history (including credit scores typically ranging from 300 to 850) reflects an individual's creditworthiness based on past borrowing and repayment behavior. Lenders evaluate this history to assess risk. Business credit history (demonstrated through reports from agencies like Dun & Bradstreet) is equally important, showcasing the financial health and reliability of a business entity over time. Key financial metrics such as debt-to-income ratio and payment history can significantly impact loan approval decisions. Furthermore, a well-established credit history can enhance a business's credibility, potentially leading to better financing options and terms in competitive markets.

Collateral Options

Digital entrepreneurs seeking loans can consider various collateral options to secure financing. Common collateral types include real estate properties (e.g., office buildings, commercial spaces located in tech hubs like Silicon Valley), inventory (e.g., goods stored in warehouses), or equipment (e.g., computers, servers essential for online business operations). Personal assets such as vehicles (e.g., cars, vans for deliveries) or savings accounts can also be leveraged as collateral. Additionally, businesses may utilize accounts receivable (e.g., unpaid invoices) or intellectual property (e.g., patents, trademarks) to enhance their collateral profile. Evaluating these options enables digital entrepreneurs to strengthen their loan applications and potentially achieve favorable loan terms.

Letter Template For Digital Entrepreneur Loan Essentials Samples

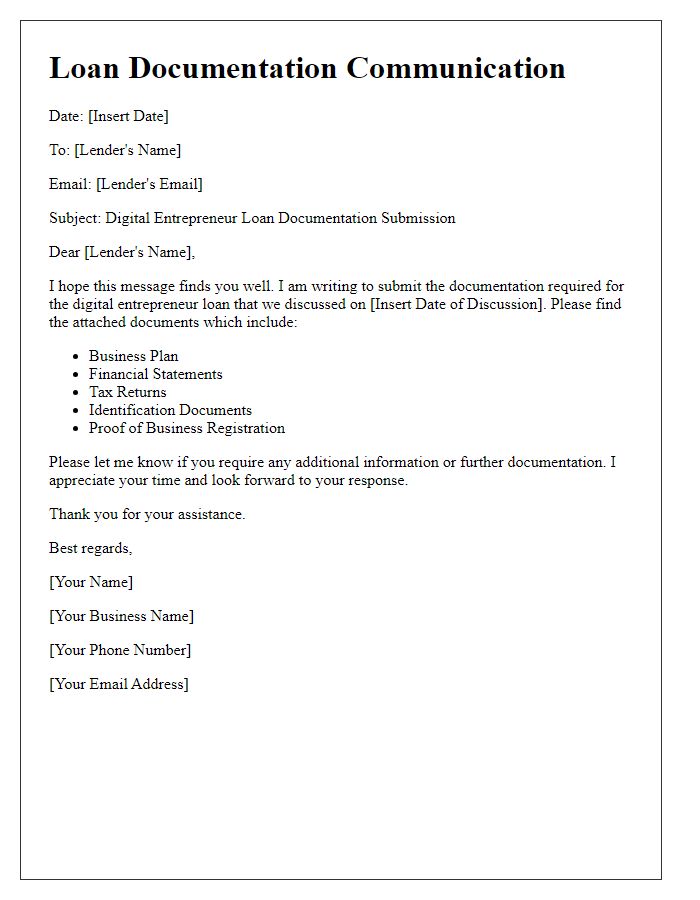

Letter template of communication for digital entrepreneur loan documentation.

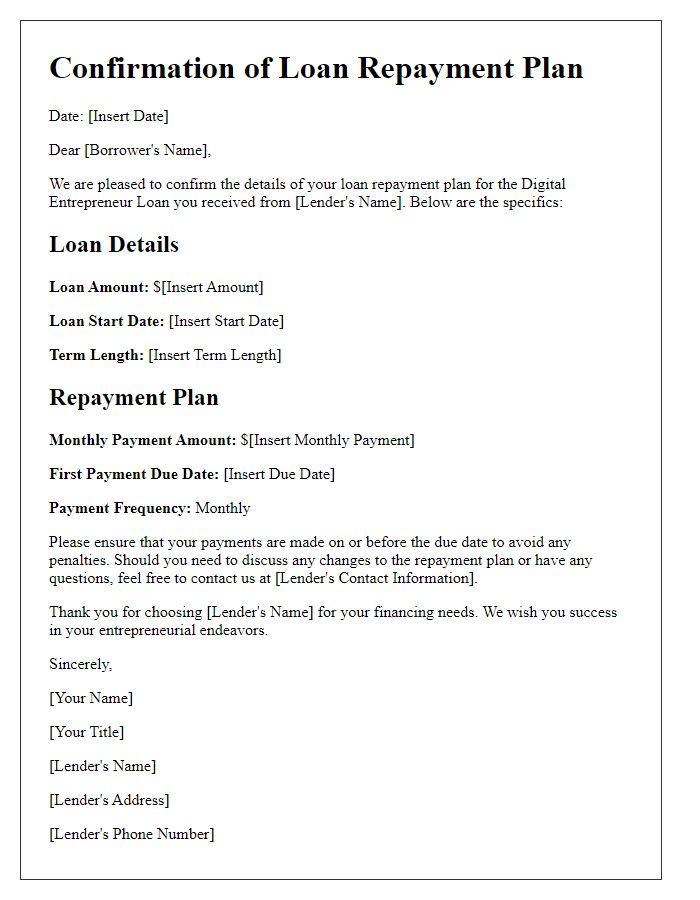

Letter template of confirmation for digital entrepreneur loan repayment plan.

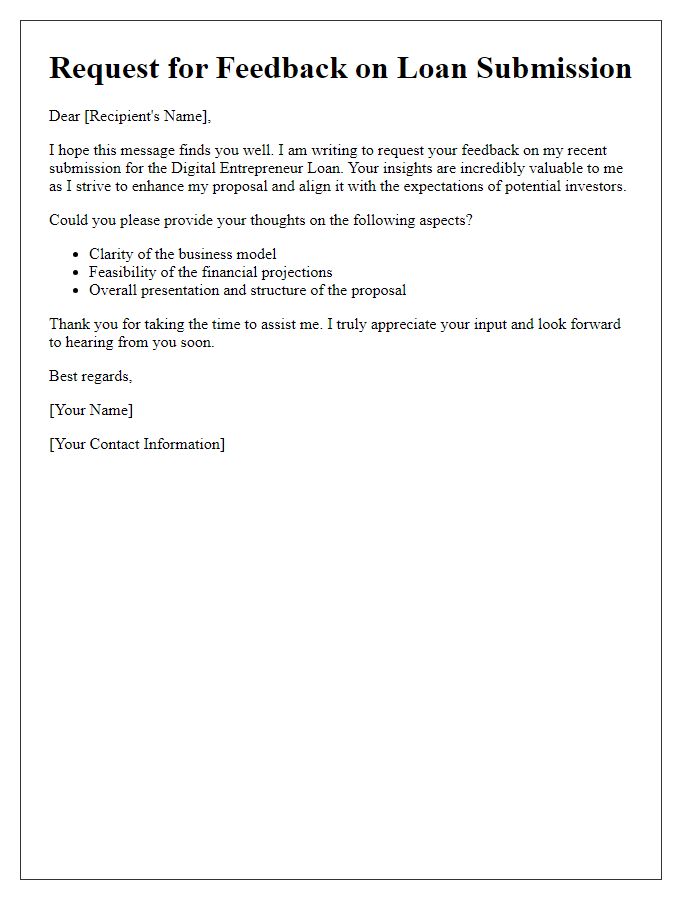

Letter template of feedback request on digital entrepreneur loan submission.

Comments