Are you feeling the weight of financial burdens and wondering how to navigate the complex world of loan settlements? It can often be daunting to tackle these issues alone, but understanding the process can make all the difference. In this article, we'll explore the essential elements of confirming a loan settlement and provide you with a helpful template to ease your journey. So, let's dive in and simplify this process togetherâread on to find out more!

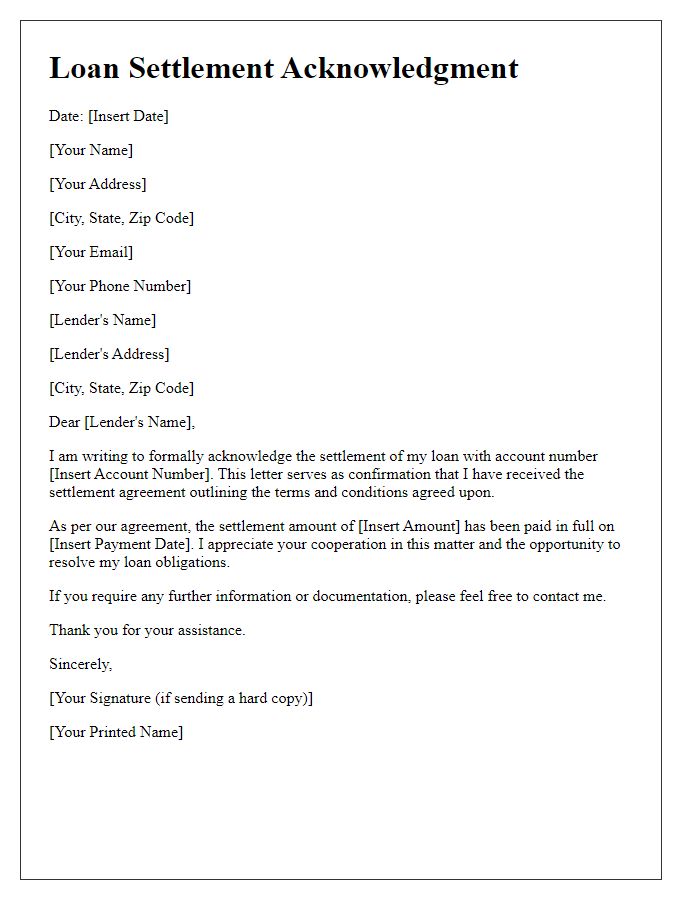

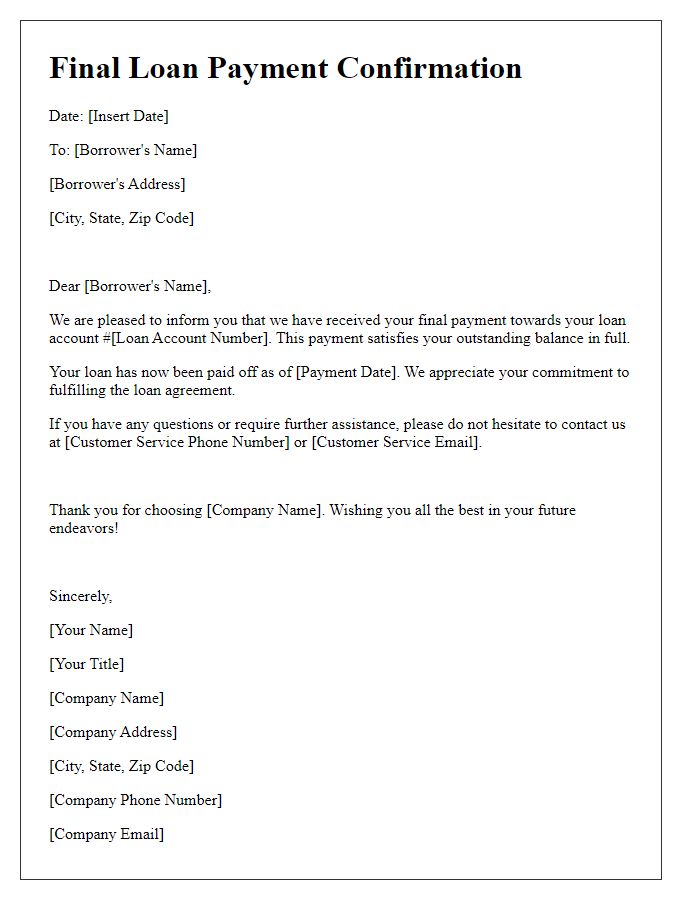

Borrower and Lender Information

Loan settlement confirmation involves the documentation of an agreement between borrowers and lenders regarding the repayment terms of a loan. The borrower, an individual or entity, is the person who has received funds from a lender, typically a financial institution such as a bank or credit union. The lender, on the other hand, is responsible for providing these funds, often with interest rates determined by prevailing market conditions and the borrower's creditworthiness. This document should include critical details such as the loan amount, repayment period, settlement date, and any applicable fees or penalties. Proper identification is crucial; therefore, personal details like addresses, contact numbers, and social security or tax identification numbers of both parties must be clearly stated. This ensures accurate record-keeping and helps avoid future disputes regarding the terms of the settlement.

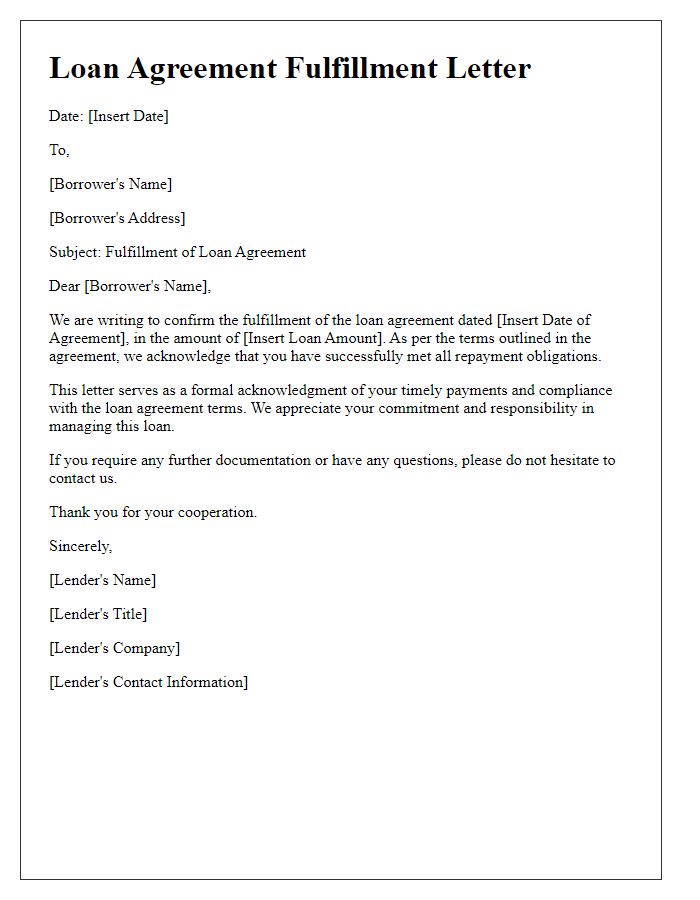

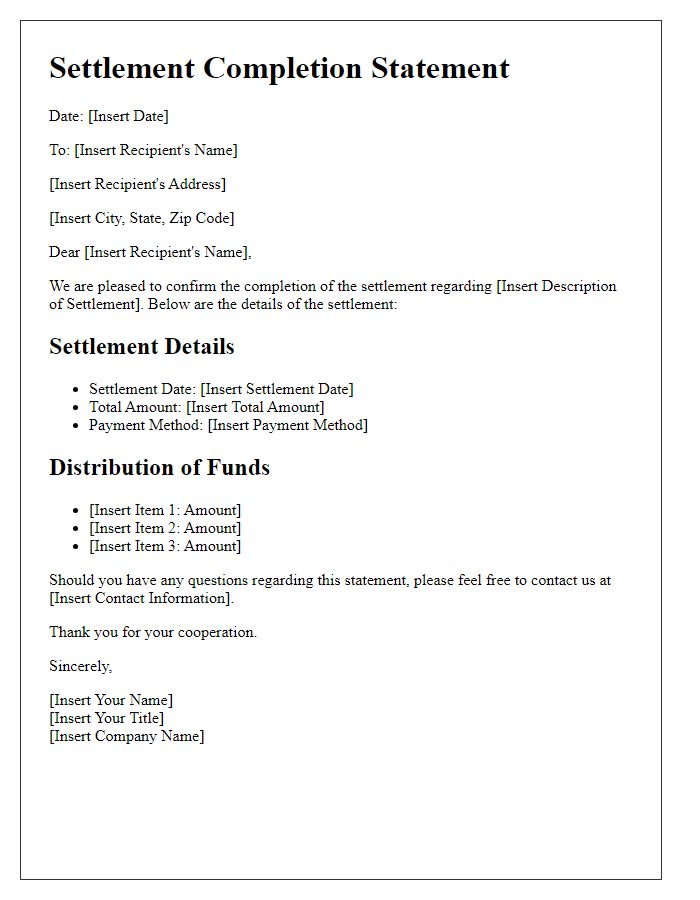

Loan Account Details

A loan settlement confirmation document should include essential loan account details. Key information includes the loan account number (a unique identifier for tracking purposes), the outstanding balance (the remaining amount owed by the borrower), and the settlement amount (the agreed sum that resolves the debt). Additionally, the settlement date (the specific day the agreement becomes effective) and the lender's name (the financial institution facilitating the loan) should be clearly stated. The document should also mention the borrower's name (the individual or entity taking the loan) and relevant contact details (such as phone number or email for any follow-up communication). Providing a clear breakdown of the settlement terms ensures transparency and helps avoid any future disputes related to payments.

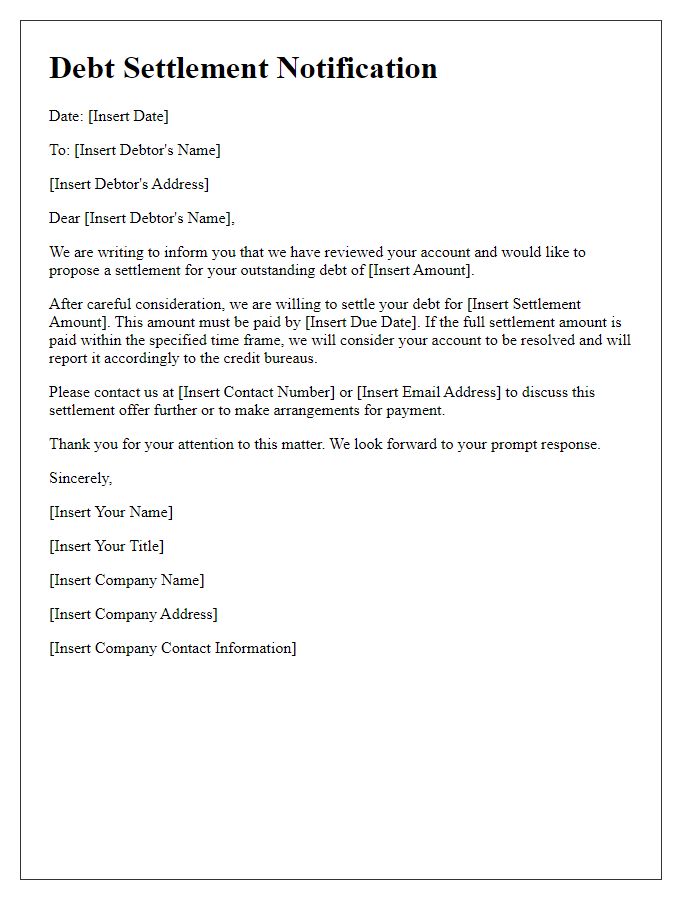

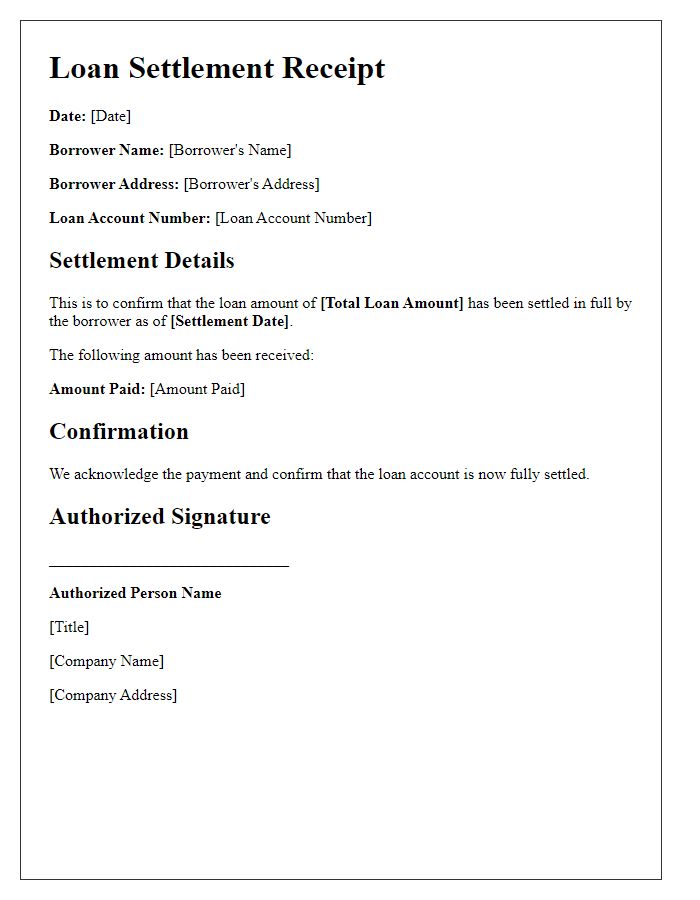

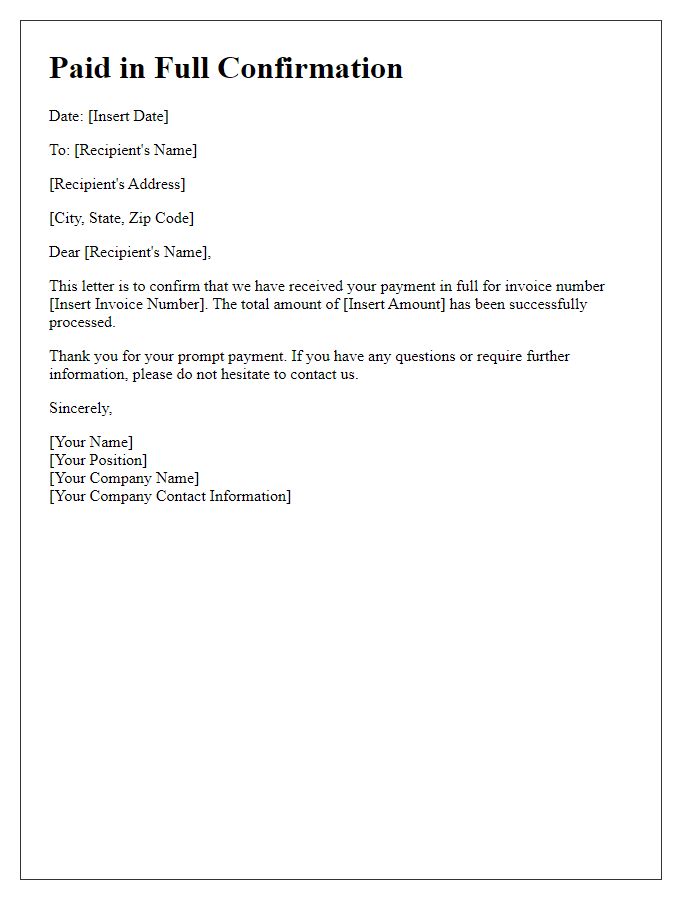

Settlement Amount Confirmation

Loan settlement confirmation provides crucial details regarding financial agreements. The settlement amount, often expressed in specific figures (e.g., $10,000), represents the total due to the lender, typically reduced from the original loan balance. Documentation from financial institutions, such as banks or credit unions, outlines the terms agreed upon during negotiations. For effective communication, clarity about the settlement date and the impact on credit scores is essential. Additionally, keeping records of correspondence, including emails and official letters, ensures transparency in the transaction history. Accurate verification of details prevents future disputes and fosters a solid understanding between borrower and lender.

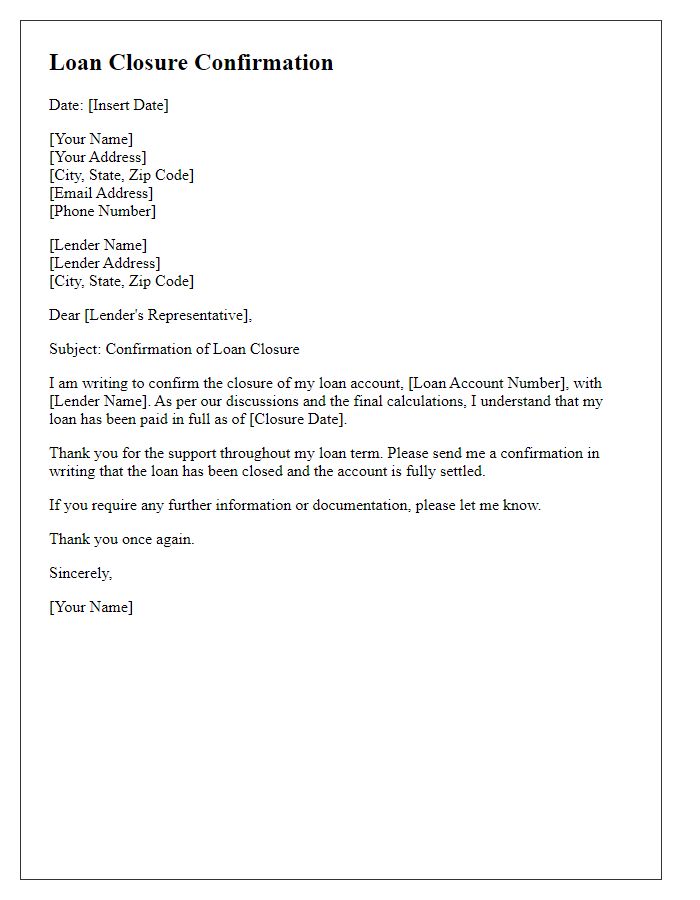

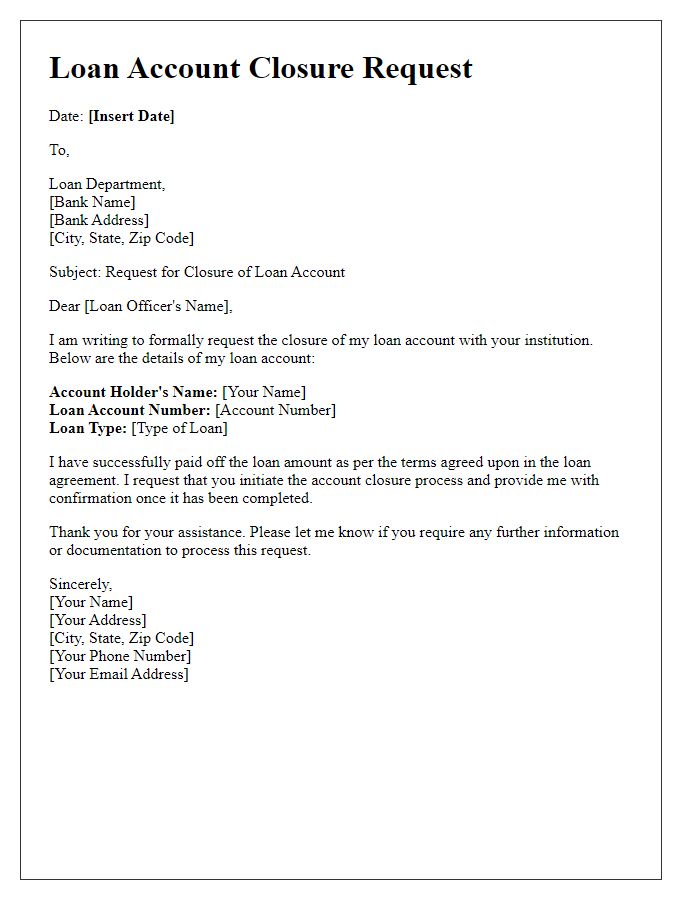

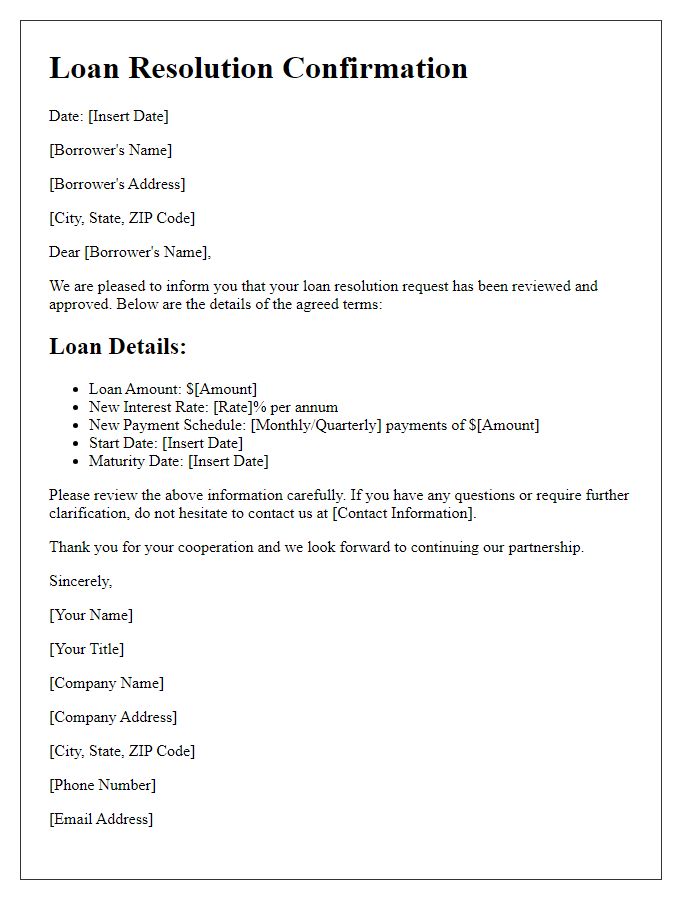

Settlement Date

Loan settlement confirmation marks the final agreement between the borrower and lender, crucial for maintaining transparent financial relationships. The settlement date, a specific calendar date, indicates when the loan payoff occurs, finalizing outstanding balances and terminating the loan agreement. Documentation detailing the terms of settlement, including payment amounts and any agreed-upon concessions or discounts, ensures both parties understand their obligations. Clear communication regarding this settlement process enhances trust and accountability, reflecting the lender's commitment to ethical practices and the borrower's responsibility in resolving financial obligations. Timely confirmation of such settlements can prevent future legal disputes or additional financial penalties.

Contact Information for Further Queries

For further inquiries regarding loan settlement confirmation, please reach out directly through the provided contact methods. Our dedicated customer service team is available to assist you during business hours, which are Monday through Friday, from 9 AM to 5 PM Eastern Standard Time (EST). You can contact us via phone at (555) 123-4567 or send an email to support@loansettlement.com. Additionally, our office is located at 123 Financial Way, Suite 500, New York, NY 10001, where you can schedule appointments for in-person consultations if needed.

Comments