Are you a freelancer seeking a loan to boost your business? Navigating the world of loans can be overwhelming, especially when it comes to crafting the perfect request letter. In this article, we'll break down the essential components of a compelling freelance loan request, ensuring you articulate your needs effectively and professionally. Stick around to discover tips and examples that could elevate your loan application process!

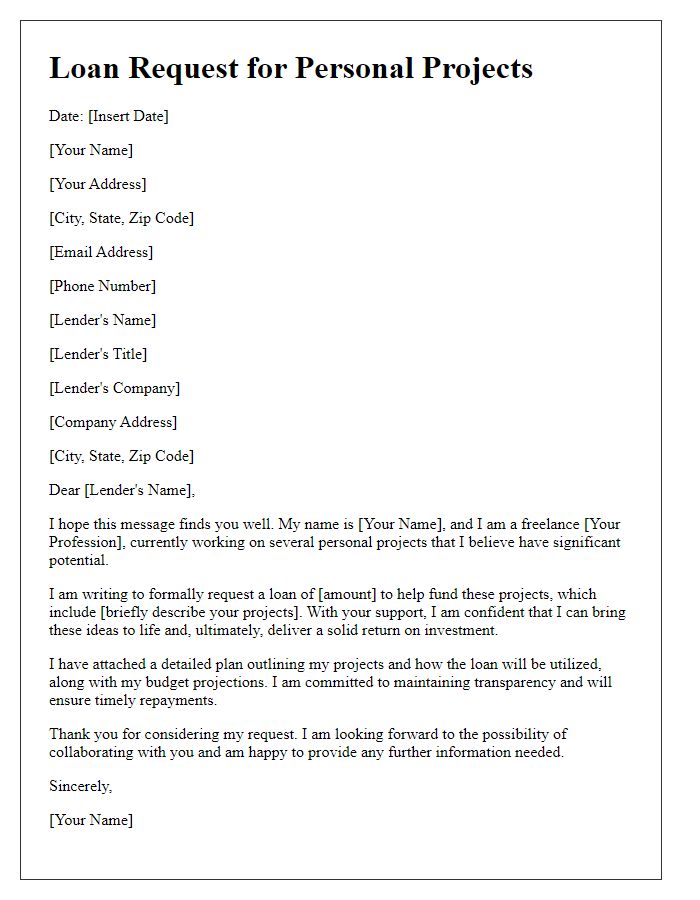

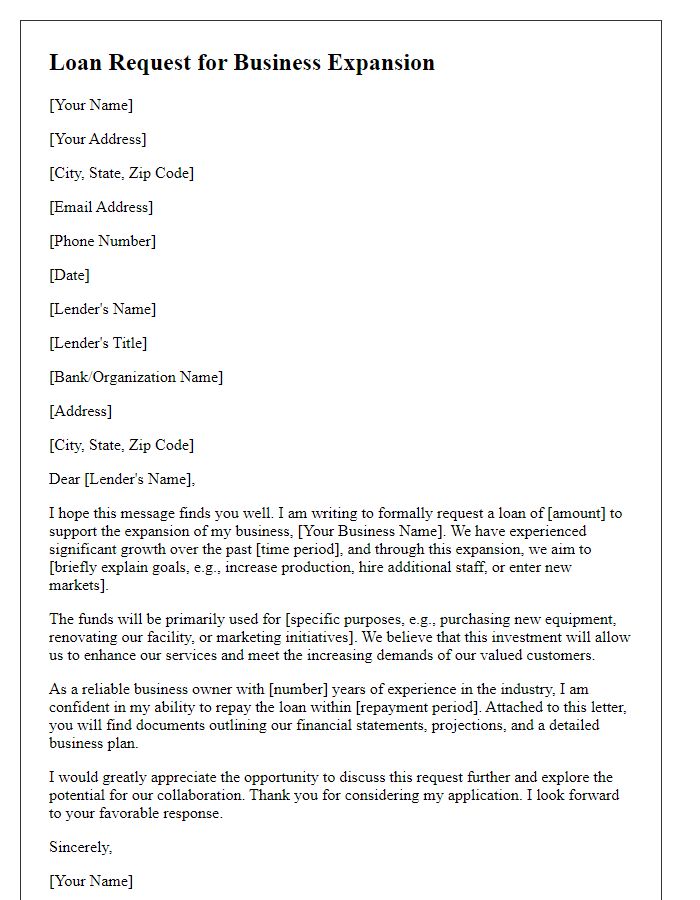

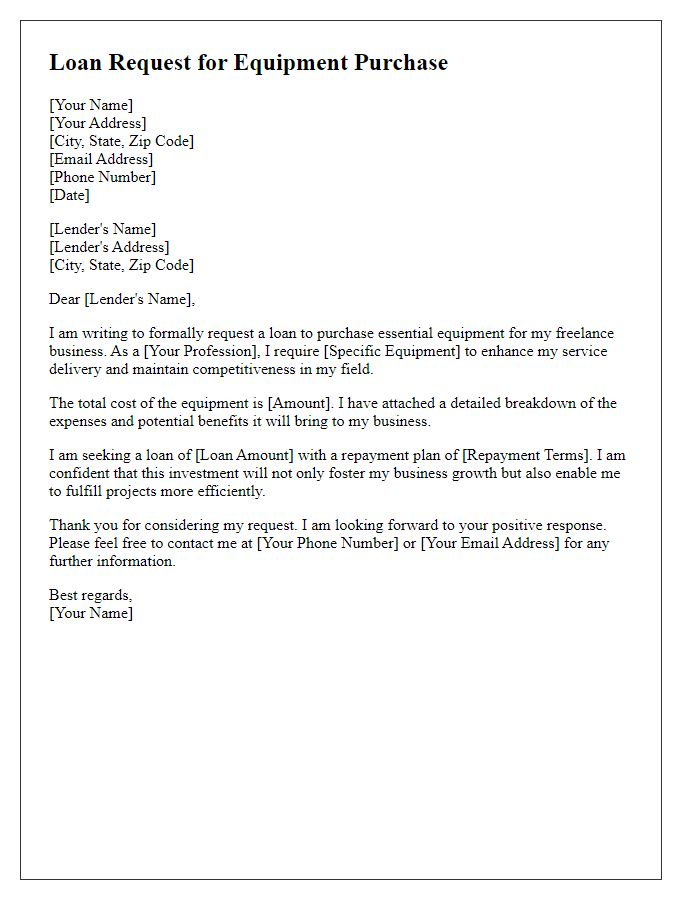

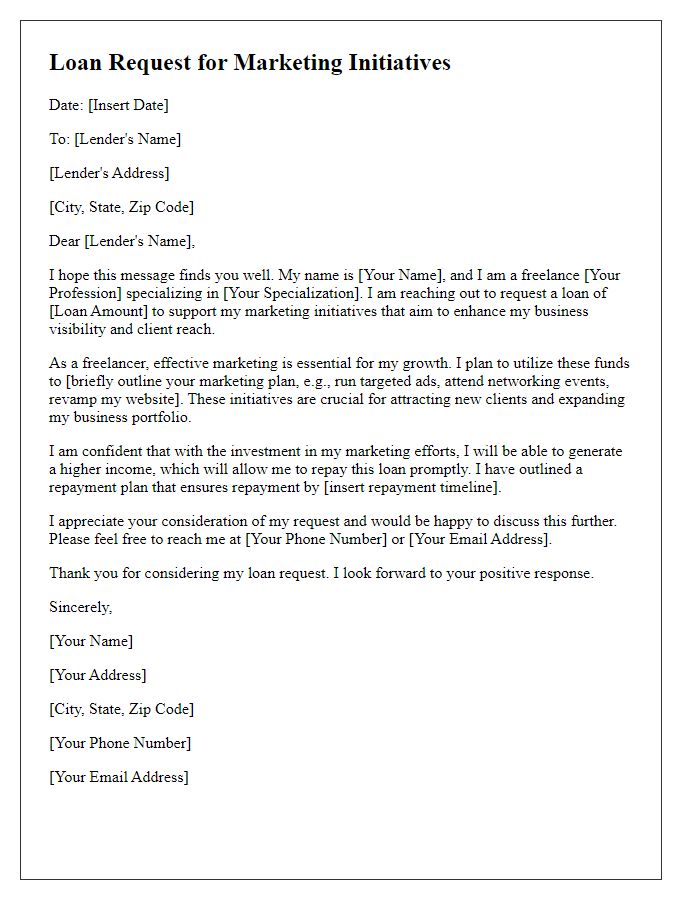

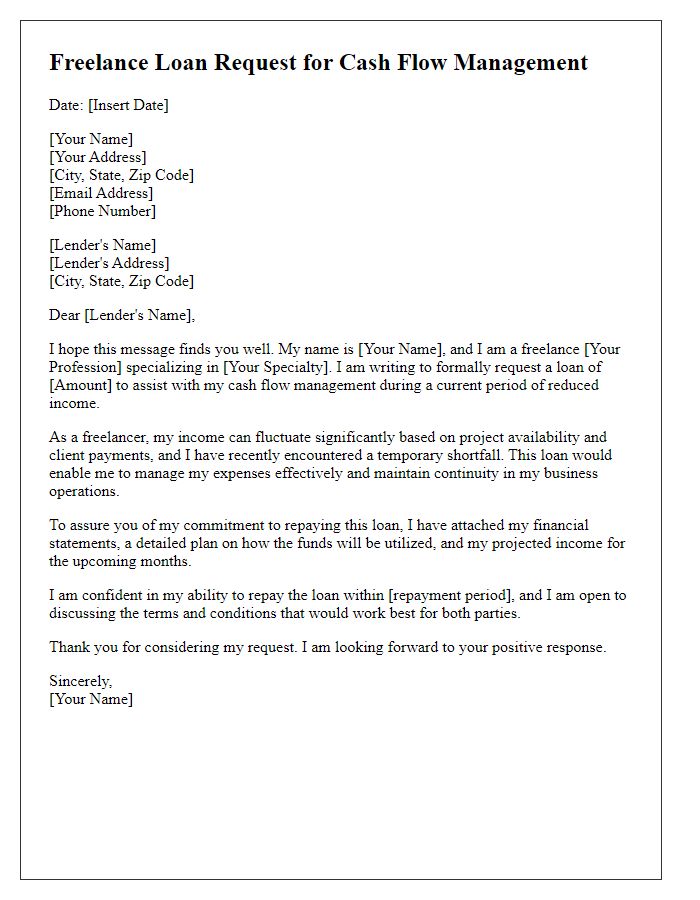

Clarity in Purpose and Amount

Freelancers seeking financial assistance must clearly articulate the purpose of the loan, focusing on specific needs such as equipment acquisition, project funding, or business expansion. Detailed descriptions of the desired loan amount, anchored by precise figures, enhance the request's clarity, enabling lenders to assess financial viability. Including relevant financial data, such as current revenue and projected earnings, strengthens the rationale for the requested figure. Additionally, providing a timeline for repayment and outlining how the loan will contribute to professional growth showcases responsible planning, reflecting commitment and foresight in managing financial obligations.

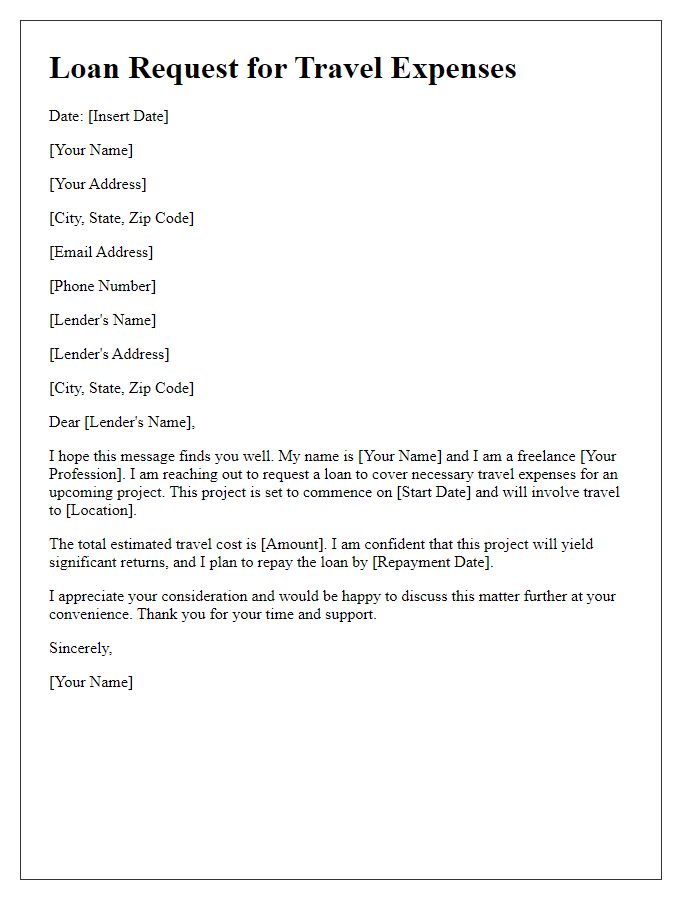

Detailed Project Description

A comprehensive project description outlines the objectives, deliverables, timeline, and budget for a proposed freelance project. The project aims to develop a user-friendly mobile application designed for small businesses in New York City, incorporating features such as inventory management (real-time updates), sales tracking (comprehensive reports), and customer relationship management (CRM). The timeline spans four months, with milestones including initial design mockups (due in month one), development of a prototype (month two), and user testing (month three). The estimated budget totals $25,000, covering design, development, and marketing expenses. This project's outcome intends to enhance operational efficiency, increase sales opportunities, and improve customer interactions for local entrepreneurs.

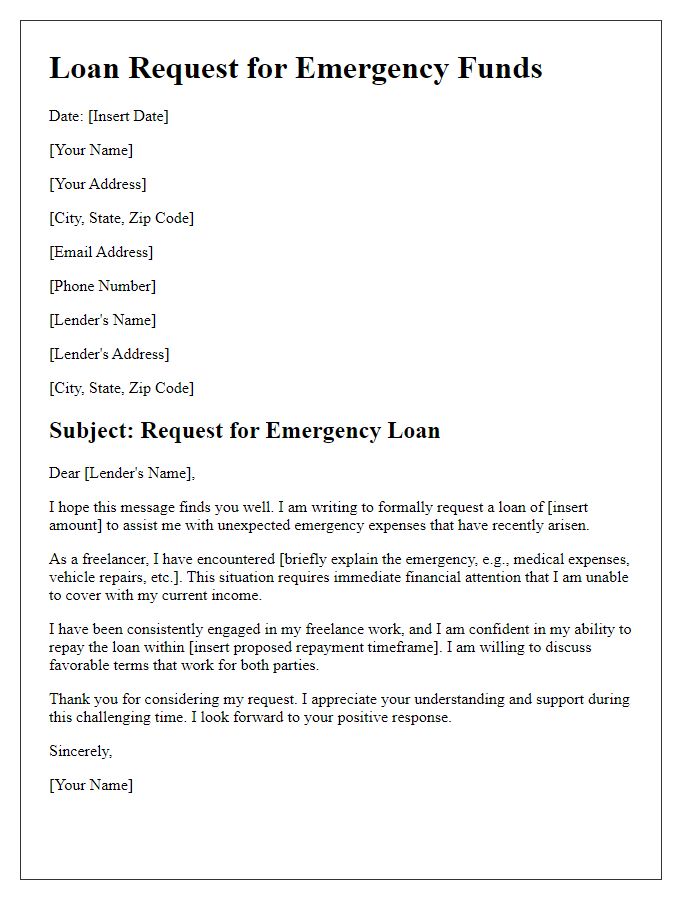

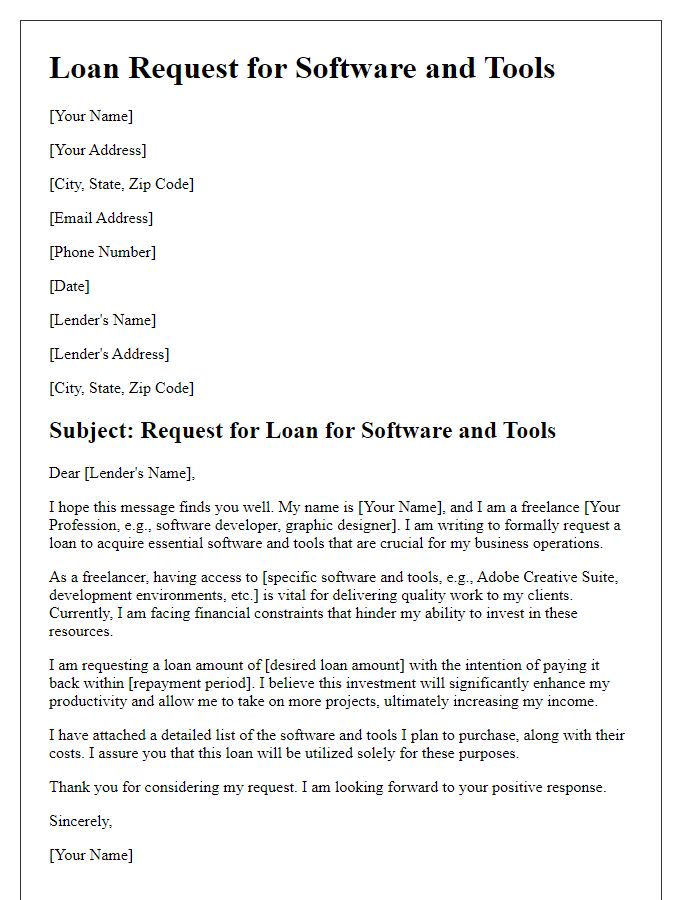

Financial Projections and Justification

Freelance loan requests require clear financial projections and justifications to demonstrate viability. Detailed financial projections should include estimated income, anticipated expenses, and profit margins for upcoming projects, ideally covering at least the next 12 months. Different income streams (e.g., services offered, hourly rates, project-based payments) should be highlighted, alongside expected client acquisition based on market research and past performance. Justifications must address how the loan will enhance freelance operations, improving capabilities or expanding service offerings. Relevant details such as target industries (e.g., technology, design), marketing strategies, and potential client demographics must be included to provide a comprehensive overview. Emphasizing the potential return on investment (ROI) showcases the likelihood of sustaining loan repayment while facilitating growth.

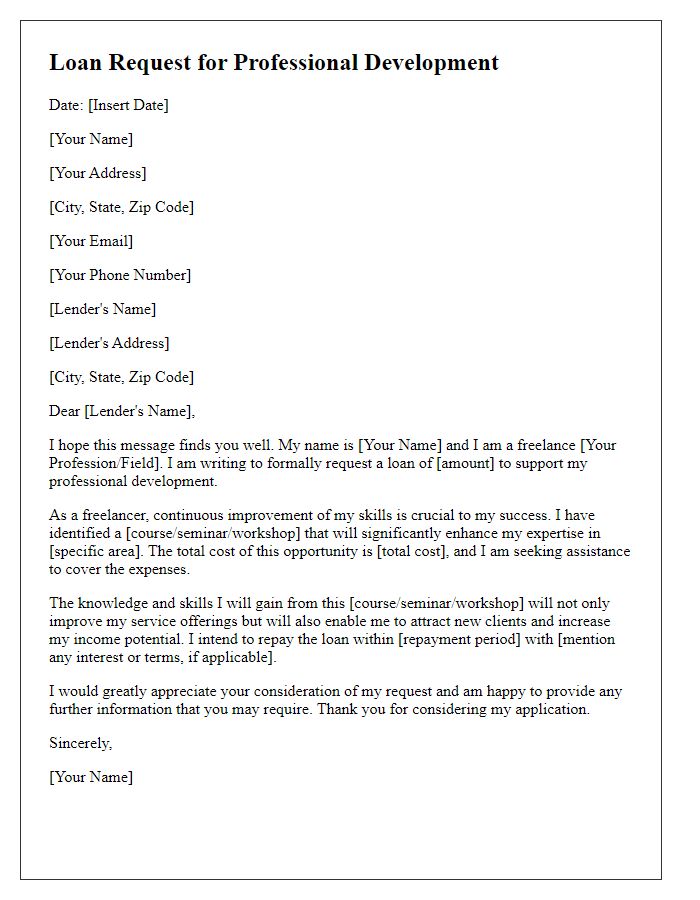

Personal and Professional Credentials

Freelancers seeking financing may emphasize their diverse personal and professional credentials to strengthen loan requests. Highlighting relevant experience such as years dedicated to specific industries (for instance, five years in graphic design or three years in digital marketing), showcasing successful projects with recognizable clients like Fortune 500 companies or local enterprises, can enhance credibility. Mentioning qualifications such as a Bachelor's degree in Business Administration or certifications in project management from recognized institutions like the Project Management Institute adds further weight. Additionally, providing financial statements that demonstrate steady income or growth over previous years, alongside testimonials from satisfied clients, can effectively convey reliability and professionalism to potential lenders.

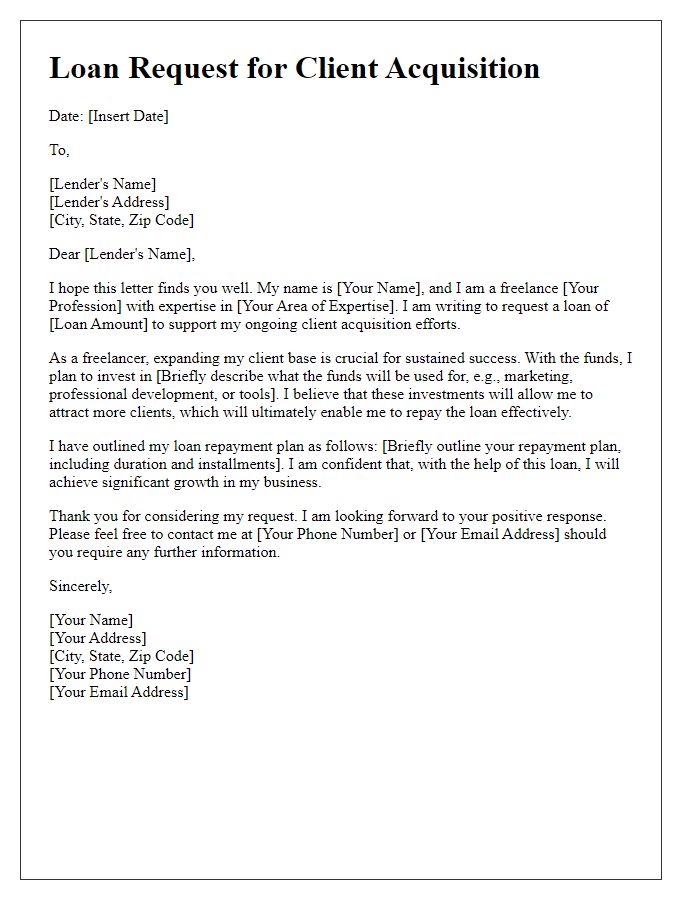

Repayment Plan and Timeline

A well-structured repayment plan is essential for any freelance loan request, especially when outlining how to manage borrowing responsibly. Clear timelines form the backbone of repayment strategies. For instance, specifying a six-month commitment for the initial phase outlines an organized approach to finances. Monthly payments, such as $300, provide transparency and ease of calculation for both lender and borrower. Key dates, such as the first payment on January 15, 2024, highlight accountability. Including financial milestones, like increasing payments after three months based on projected income growth, showcases adaptability. Overall, a defined plan enhances trust and demonstrates commitment to fulfilling the loan obligations in a timely manner.

Comments