Navigating the world of home loans can often feel like a daunting task, especially when you're faced with unexpected delays in processing your application. It's not uncommon to feel a mix of frustration and confusion during this time, but understanding the reasons behind these holdups can help ease your concerns. From missing documentation to increased demand for loans, there are various factors that can impact the timeline. If you're eager to learn more about how to manage these delays effectively, keep reading!

Loan Application Details

Delays in home loan processing can lead to unexpected challenges for applicants, potentially jeopardizing significant transactions such as property purchases. Factors contributing to delays may include incomplete documentation required by lenders like bank statements, income verification, or credit reports. In particular, the average processing time for home loans typically ranges from 30 to 45 days, depending on lender efficiency and applicant preparedness. For instance, specific lenders may require additional information during peak periods, leading to extended wait times. Applicants often find themselves impacted by these delays, affecting deadlines tied to purchase agreements in competitive real estate markets like Los Angeles or New York City. Clear communication with mortgage brokers and lenders is crucial in navigating these hurdles to ensure smooth processing of loan applications.

Reason for Delay Explanation

Home loan processing delays due to incomplete documentation can significantly impact the borrowing timeline for applicants. Instances such as missing income verification, which may include pay stubs or tax returns from the previous two years, can lead to setbacks. Additionally, issues with credit assessments, where credit scores below 620 may require additional scrutiny, contribute to prolonged processing times. Appraisal delays, influenced by local market conditions in areas like San Francisco or New York City, can further extend the timeline for final approvals. Such factors highlight the importance of thorough preparation and submission of complete financial records in the home loan application process.

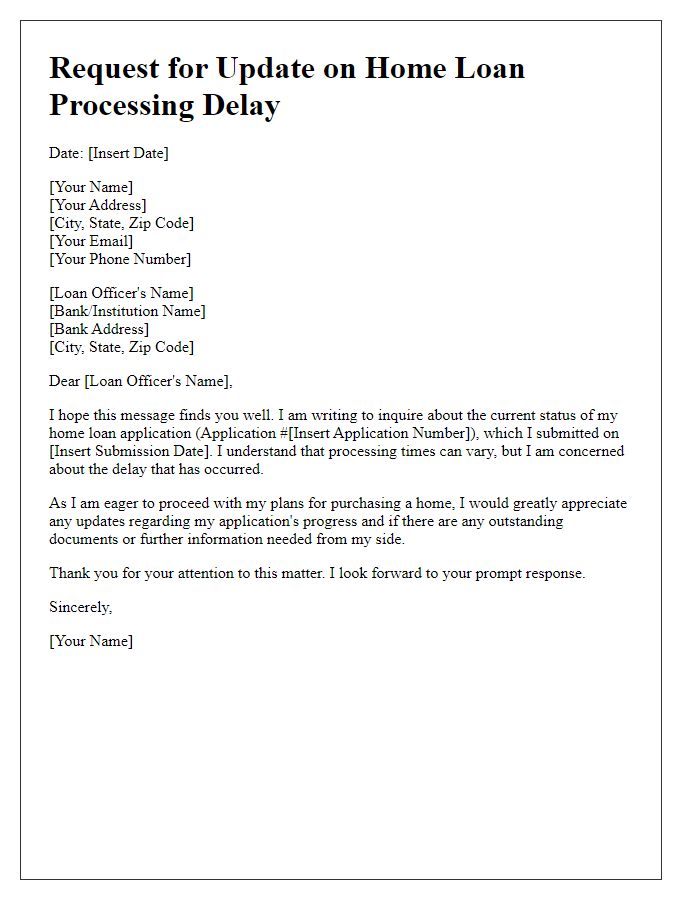

Request for Status Update

Home loan processing delays can significantly impact prospective homeowners, especially in metropolitan areas like New York City or Los Angeles where housing demand is high. Applications submitted to lenders (financial institutions offering home loans), such as Wells Fargo or Bank of America, may experience delays due to various factors including verification of documents (proof of income, credit history) or stricter lending regulations introduced in 2022. Standard processing times, which typically range from 30 to 45 days, can lead to anxiety among applicants eagerly awaiting approval. It is essential to maintain communication with loan officers and obtain status updates to ensure the timely progression of home purchase plans.

Anticipated Timeline for Resolution

Home loan processing delays can significantly affect prospective homeowners. The timeline for resolution can vary based on several factors, including documentation processing (often taking 5 to 10 business days), underwriting review (typically 7 to 14 days), and final approval (generally requiring another 3 to 7 business days). External factors such as market conditions or changes in interest rates, which may fluctuate significantly (by as much as 0.5% in a week), can further impact timelines. Clear communication with the lending institution, often established through regular updates (usually every few days), is crucial. Delays can prolong the closing date, potentially extending beyond the anticipated range of 30 to 45 days after application submission, and may lead to additional costs, such as extended rate locks or appraisal fees.

Contact Information for Further Inquiries

Home loan processing delays can arise from various factors, impacting borrowers' timelines and expectations. For instance, documentation issues may lead to extended reviews, with loan officers requiring additional information such as income verification and credit assessments. Furthermore, appraisal delays, particularly in busy markets like Los Angeles or Miami, can significantly stall the process, sometimes exceeding 30 days. Loan underwriting is another critical stage, during which lenders evaluate risk, a process that may take up to two weeks or longer depending on the complexity of the file. For further inquiries regarding specific loan status or additional requirements, borrowers often seek to contact their loan officer directly or reach the mortgage lending company's customer service at established support lines, ensuring efficient communication during the loan approval timeline.

Letter Template For Home Loan Processing Delay Samples

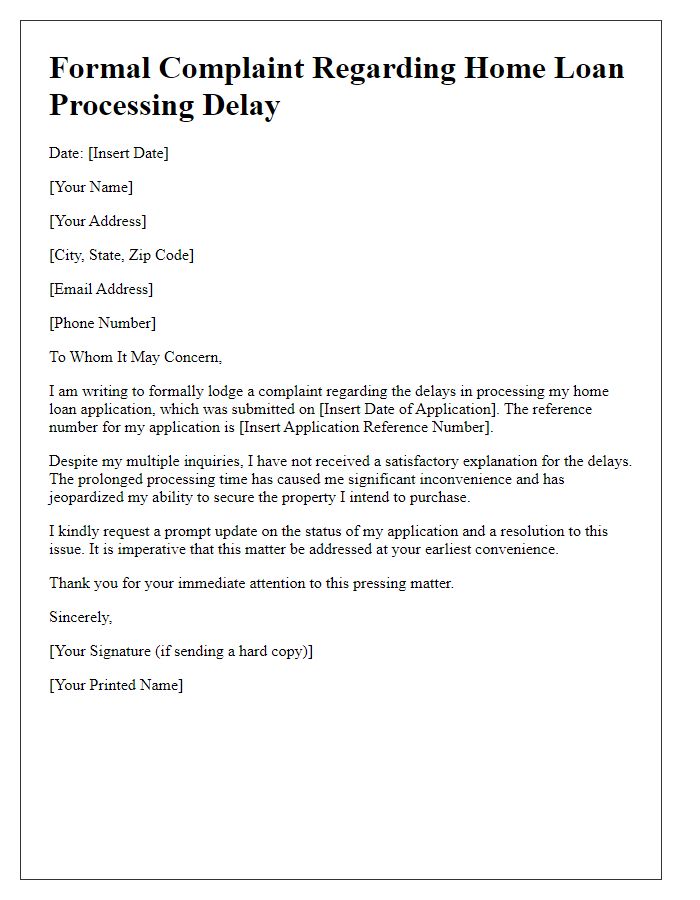

Letter template of formal complaint regarding home loan processing delay

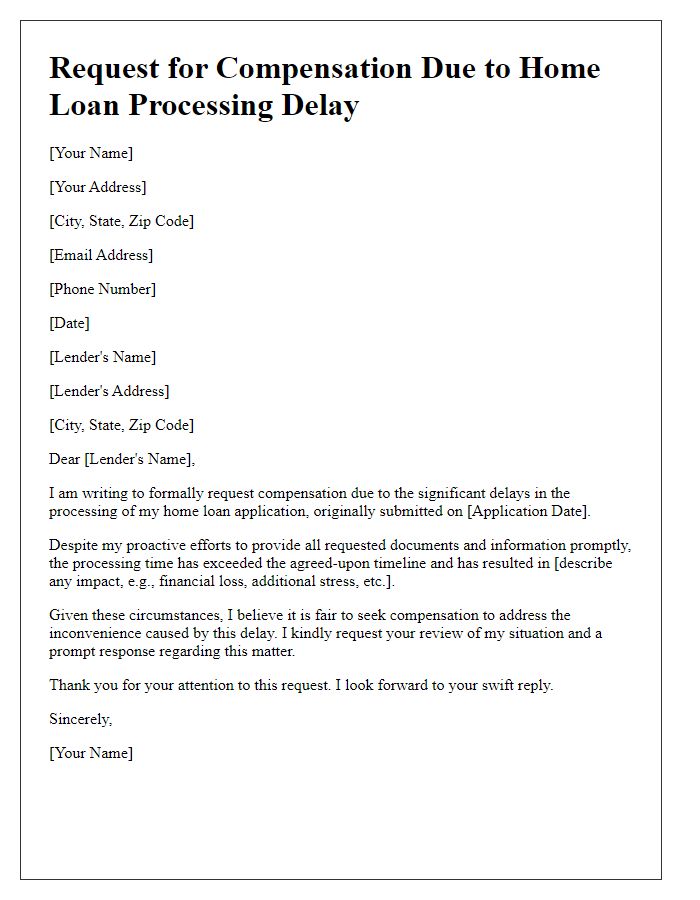

Letter template of request for compensation due to home loan processing delay

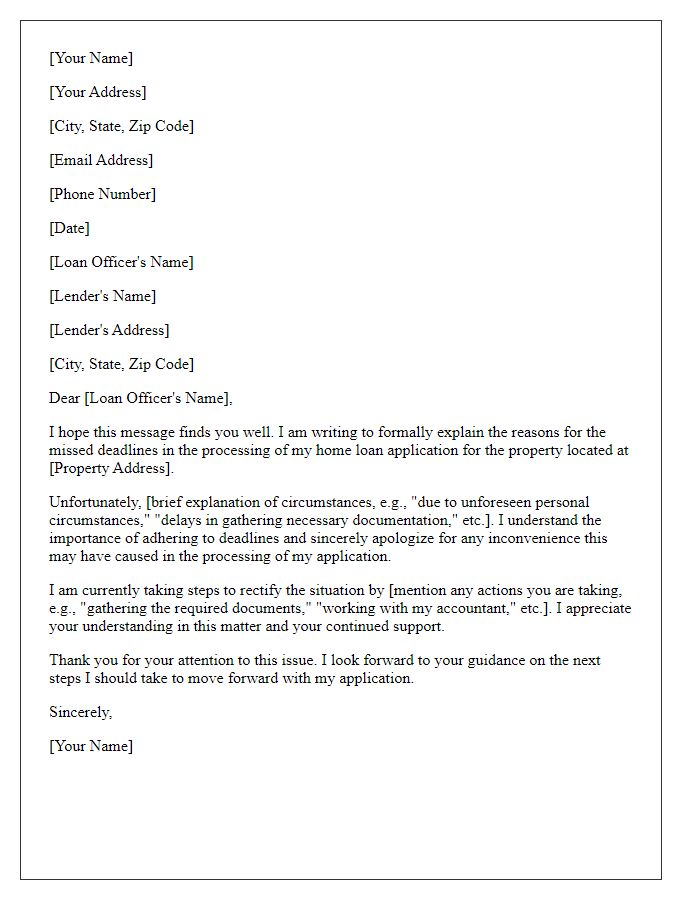

Letter template of explanation for missed home loan processing deadlines

Comments