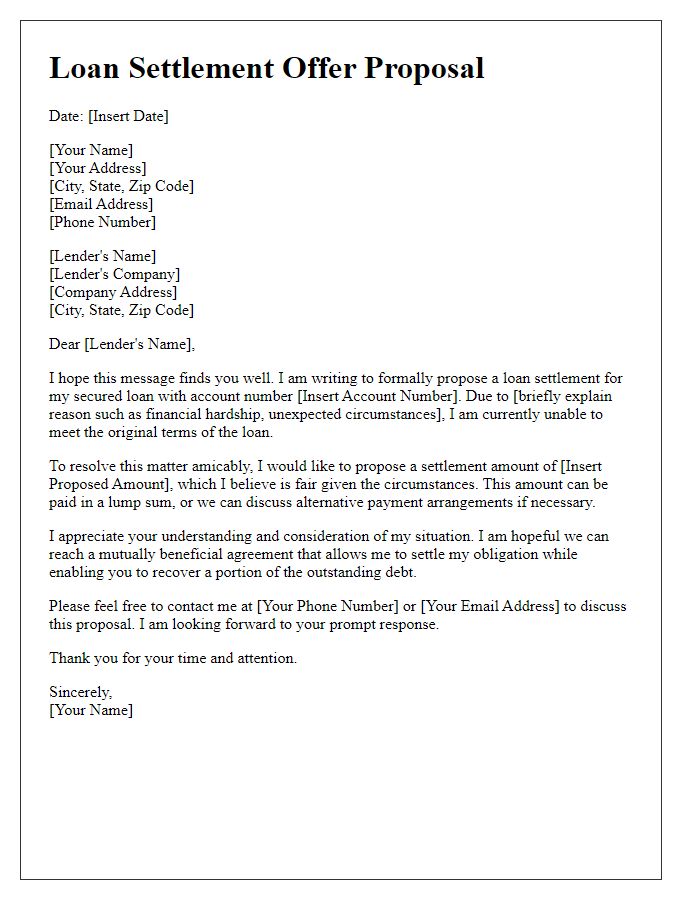

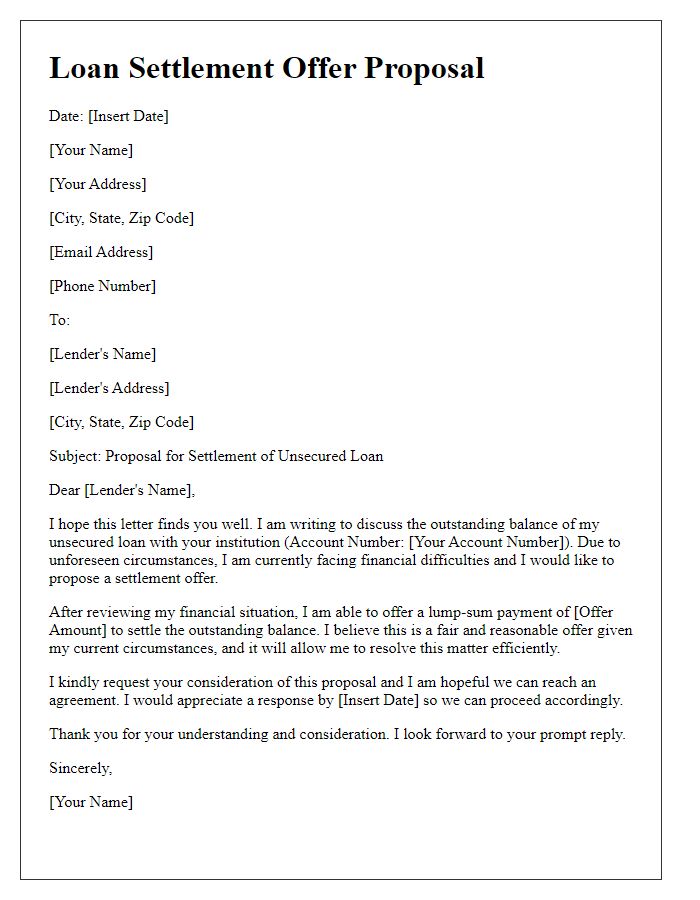

Are you grappling with the complexities of crafting a loan settlement offer proposal? Navigating the nuances of financial negotiations can feel daunting, but with the right approach, you can set yourself up for success. In this article, we'll break down the essential elements of an effective letter template, ensuring that your offer is clear, compelling, and persuasive. Ready to take the next step in your financial journey? Let's dive in!

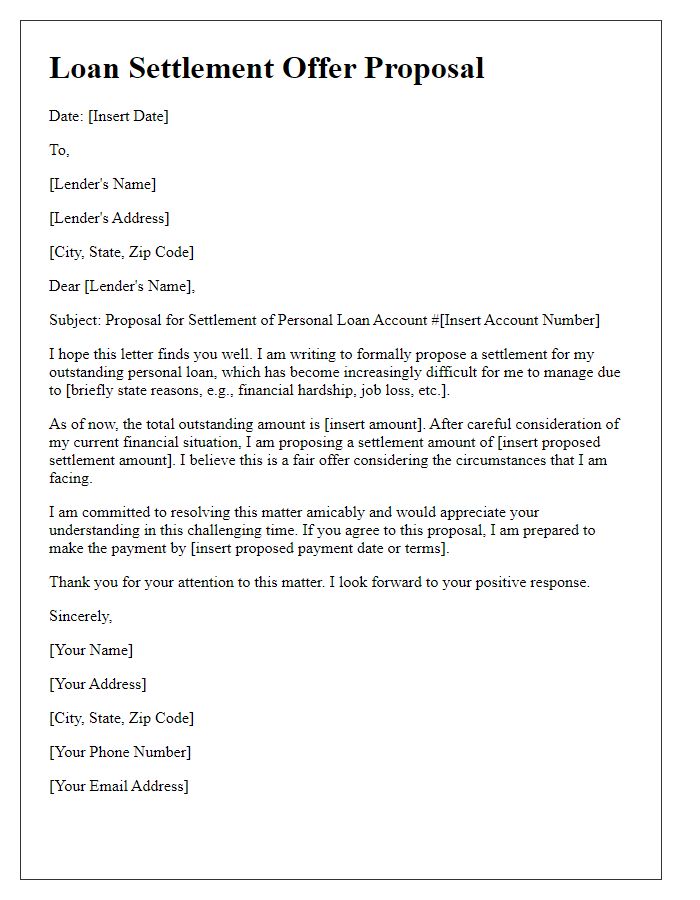

Clear Identification of Parties

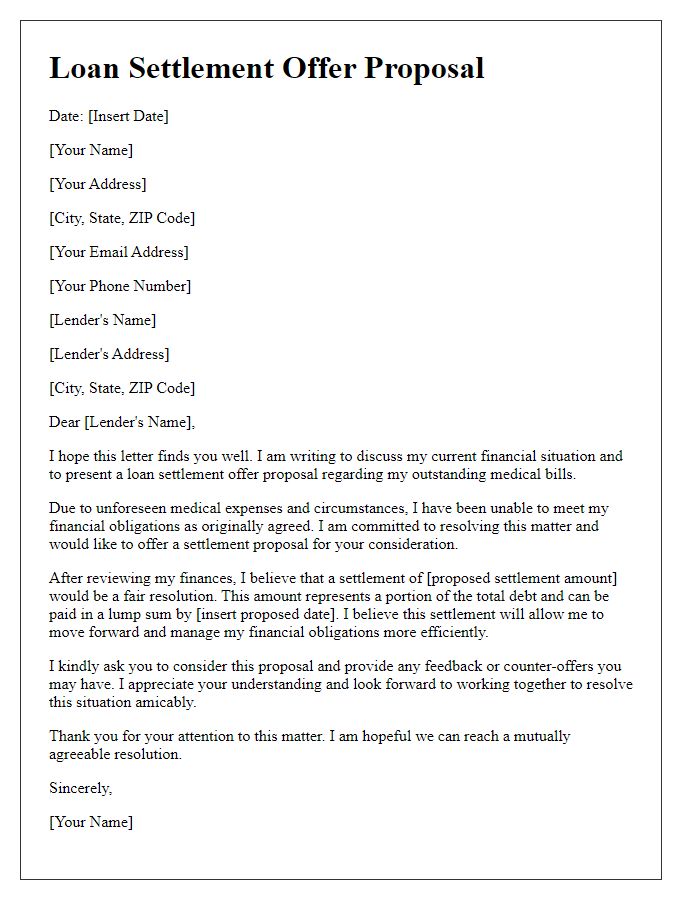

Parties involved in a loan settlement offer proposal include the Borrower, a person or entity that has received a loan, and the Lender, typically a bank or financial institution that provided the loan. Clear identification involves full legal names, addresses, and contact information for both parties. For example, the Borrower could be John Smith residing at 123 Main Street, Anytown, USA, with a contact number of (555) 123-4567. The Lender might be ABC Bank located at 456 Bank Avenue, Financial City, USA, reachable at (555) 987-6543. Accurate details ensure effective communication and legal clarity throughout the settlement process.

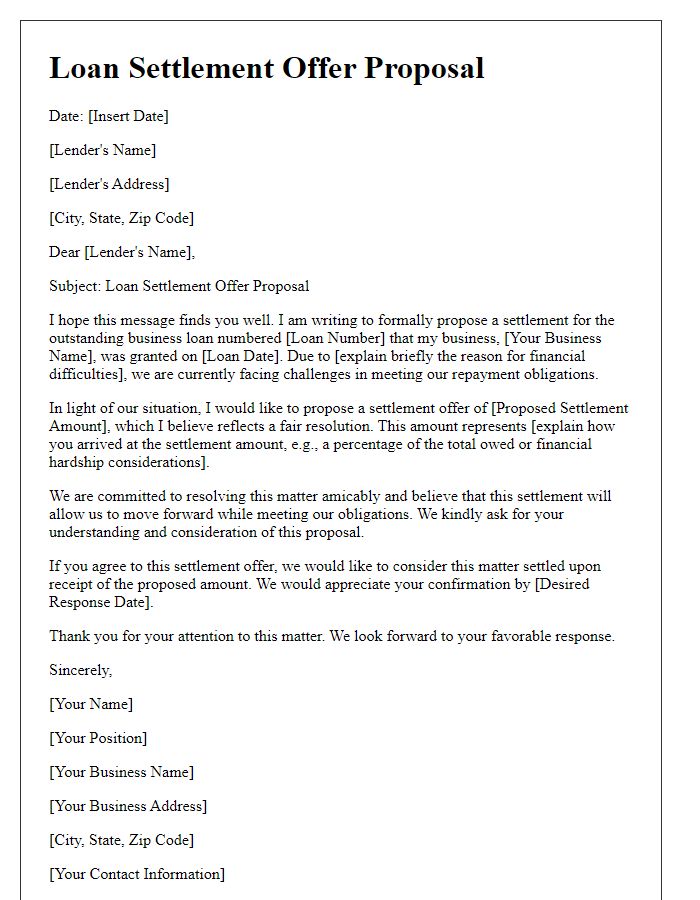

Precise Loan Details

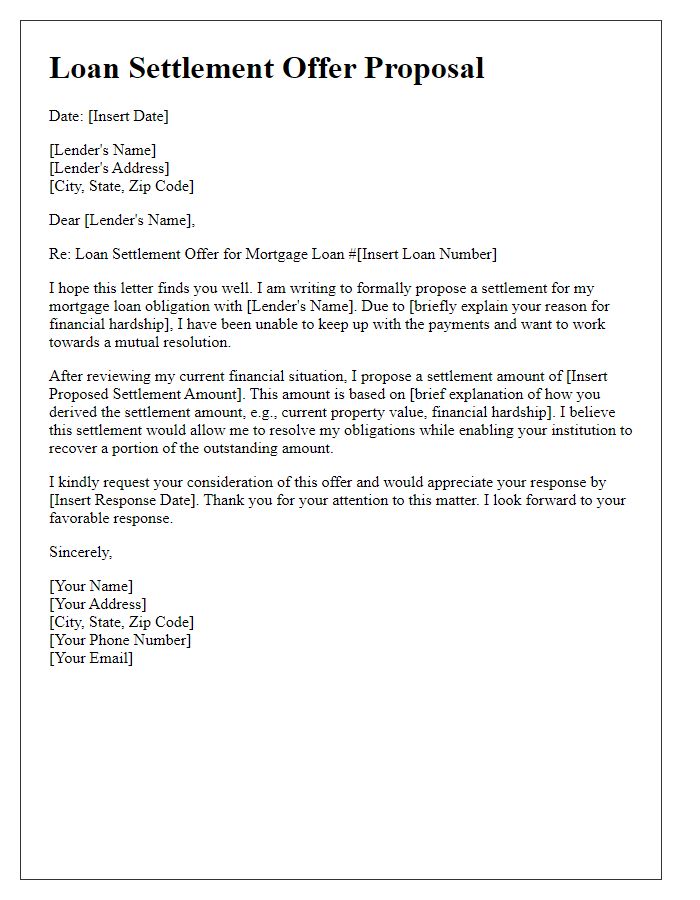

The precise loan details include the original loan amount of $50,000 issued on January 15, 2020, with a specified interest rate of 5.75% over a 30-year term, leading to a monthly payment of $291.67. As of October 2023, the remaining balance is approximately $45,000, reflecting regular payments made across 44 months, with a total interest of $10,250 paid to date. The purpose of this loan was to finance a home purchase located at 123 Maple Street, Springfield, valued at $200,000, providing a crucial asset in an area with high property demand and future investment potential. Offering a settlement figure, ideally reduced to $30,000, is a strategic approach to resolving the loan efficiently, minimizing further interest accrual while enabling the lender to recover a portion of the remaining balance.

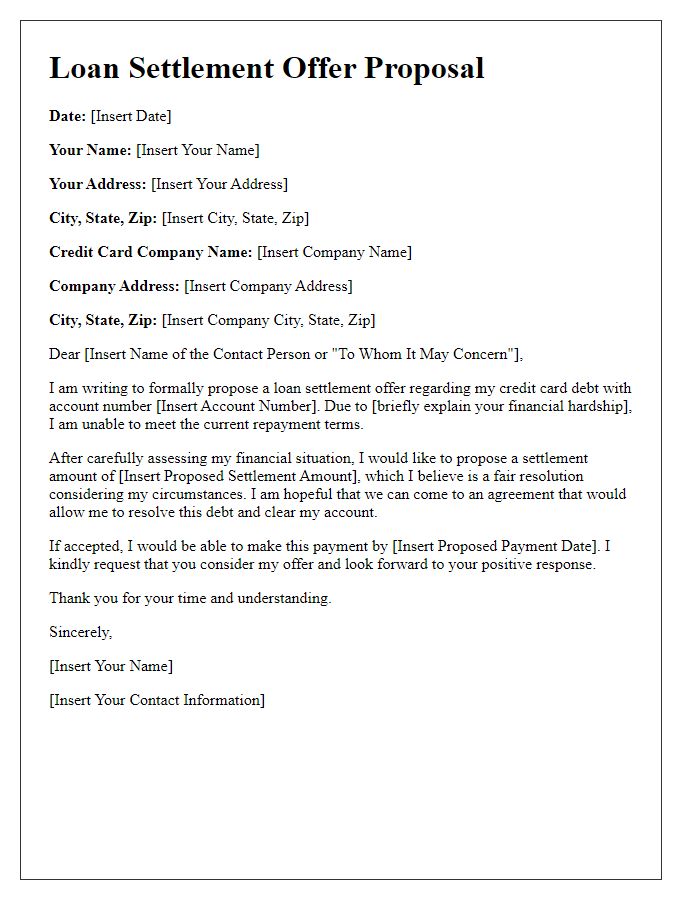

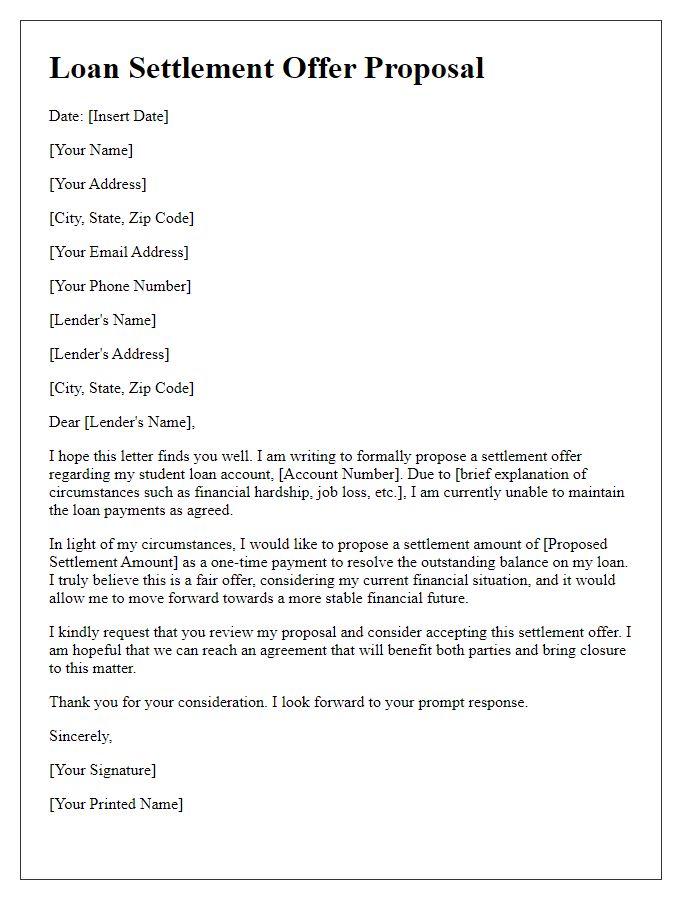

Settlement Amount and Terms

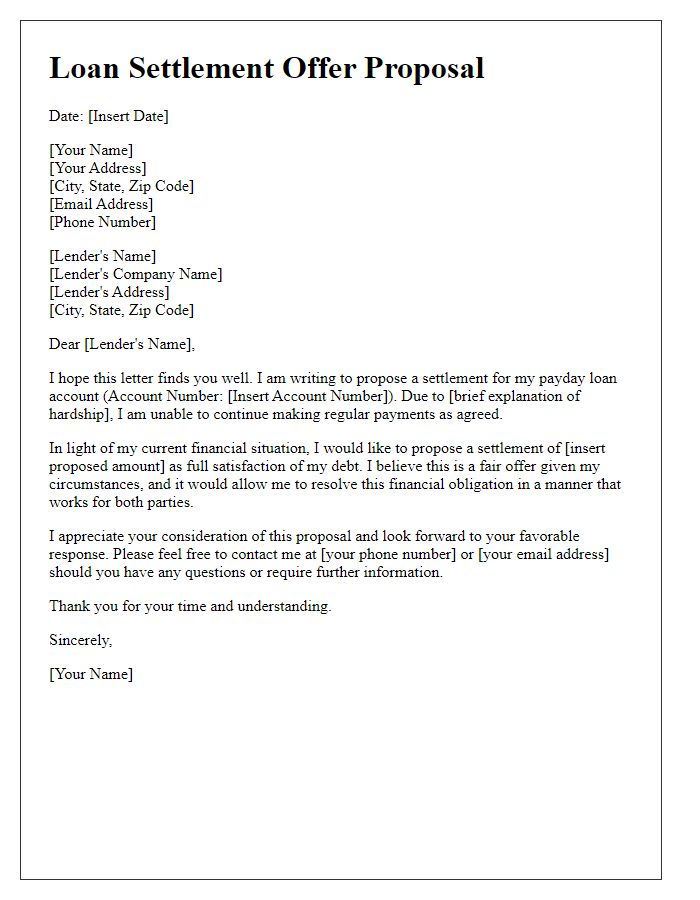

The loan settlement offer proposal outlines a strategic plan to resolve outstanding debt, particularly for unsecured loans like personal loans or credit card debt. A settlement amount is typically negotiated, often significantly lower than the full balance owed, potentially representing a percentage reduction, often ranging from 30% to 70%. Terms associated with the settlement can include specific payment timelines (e.g., a lump sum payment within 30 days), the method of payment (such as bank transfer or check), and the stipulation that upon settlement completion, the lender will report the debt as settled to credit reporting agencies. Additionally, it may be essential to include clauses addressing tax implications, as forgiven debt may be considered taxable income by the IRS. This proposal aims to provide a clear path to debt resolution, ensuring both parties understand their rights and obligations for a successful settlement negotiation.

Proposed Payment Plan

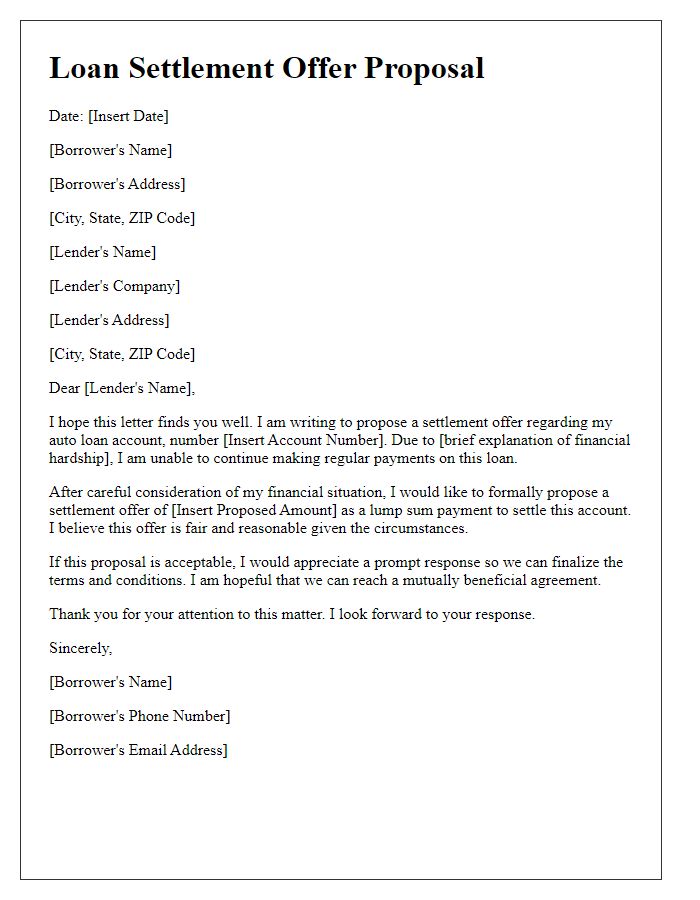

A structured loan settlement proposal outlines a clear path for resolving outstanding debts effectively. The proposal typically includes detailed information on the amount owed, the proposed settlement figure, and a breakdown of payment terms. For instance, a proposal might suggest a total debt of $15,000, with an offered settlement of $9,000, payable in three installments over three months. Additionally, it could specify payment dates, such as April 15, May 15, and June 15 of the current year. Clear articulation of the rationale behind the settlement offer, such as financial hardship or unexpected medical expenses, enhances the proposal's credibility, demonstrating the borrower's willingness to honor obligations while seeking a manageable resolution. This strategic approach aims to provide both parties with clarity and facilitate a smoother negotiation process, ultimately aiming for an amicable resolution in the financial arrangement.

Contact Information for Communication

Effective communication for loan settlement proposals requires clear contact information. Include your name, email, and phone number prominently at the top. Your address should follow to establish your identity. Specify best times for contact, noting time zone differences, especially for long-distance communication. If applicable, mention alternative contact methods, such as a trusted representative, to ensure responsive communication. Highlight confidentiality preferences, ensuring sensitive information is handled securely. Include preferred modes of digital communication, such as secure messaging apps, for enhanced security. Properly formatted contact information enhances professionalism in correspondence related to loan settlements.

Comments