When it comes to securing a loan, having your listing verified can be a crucial step in the process. Not only does it ensure that your information is accurate, but it also gives lenders confidence in your financial credibility. In today's fast-paced environment, understanding the intricacies of loan listing verification can save you time and headaches down the road. Curious about how to navigate this process effectively? Dive in and read more to find out!

Borrower's personal information verification

Borrower's personal information verification process involves gathering and confirming critical data such as full name, social security number, residential address, and date of birth. In the United States, lenders typically require a government-issued identification document, such as a driver's license or passport, to authenticate identity. Additionally, verification may include sourcing employment documentation, like recent pay stubs or W-2 forms, to ensure income stability for repayment assurance. Credit history checks are essential, often involving reports from agencies like Equifax, Experian, or TransUnion, assessing credit scores and previous loan performance, which affects eligibility for loans. Completing this thorough verification is a vital step to prevent fraud and ensures that the lending process is secure and reliable for both parties.

Loan details accuracy

Loan listing verification is crucial for ensuring accurate financial transactions. Loan amounts typically range from $1,000 to $500,000, reflecting the borrower's needs and lender's policies. Interest rates, varying between 3% to 8% based on creditworthiness, significantly impact total repayment amounts. Verification activities involve cross-referencing borrower information, including credit scores (FICO scores range from 300 to 850), income statements, and employment history against lender databases. Timelines for loan processing can vary, often taking between 30 to 45 days from application to funding, affecting borrower expectations. Accurate documentation fosters trust between lenders and borrowers, enhancing the overall lending experience while reducing the likelihood of defaults and fraud.

Credit score validation

Credit score validation is a crucial step in the loan listing verification process, particularly for financial institutions assessing borrower reliability. A credit score, typically generated by agencies like FICO or VantageScore, ranges from 300 to 850, indicating an individual's creditworthiness based on payment history, debt levels, and credit utilization. In the United States, a credit score below 580 categorizes borrowers as subprime, while a score above 740 is often considered prime. Lenders, especially those operating in high-stakes environments like mortgage lending or personal loans, scrutinize these scores to minimize default risks. Additionally, credit reports from major bureaus (Equifax, Experian, and TransUnion) provide detailed insights into an applicant's financial background, enabling informed decisions regarding loan approvals, interest rates, and terms. Accurate credit information is imperative to ensure fair lending practices and safeguard against fraud.

Supporting document requirements

Loan listing verification requires essential supporting documents to ensure compliance and accuracy. Commonly requested items include proof of identity, such as a government-issued photo ID like a driver's license or passport, and proof of income, such as recent pay stubs or tax returns from the previous year, demonstrating stable financial status. Additionally, a social security number may be required for credit checks, while bank statements from the last three months can provide insights into financial health. Property-related documents, like purchase agreements or appraisals, may also be necessary for real estate loans, ensuring all submitted information aligns with lender requirements for a successful loan approval process.

Confirmation of employment and income

Loan listing verification requires a detailed confirmation of employment and income to ensure the borrower's ability to repay. Employment verification involves contacting the current employer, such as a corporation like Acme Corp, to confirm the individual's job title, duration of employment (usually requiring at least six months), and status (full-time or part-time). Income verification includes reviewing pay stubs, bank statements, and tax returns, typically from the last two years, to calculate gross monthly income, which must meet lender guidelines, usually at least three times the proposed monthly mortgage payment. Accurate information on these aspects directly influences the loan approval process and interest rates offered, with significant implications on long-term financial commitments.

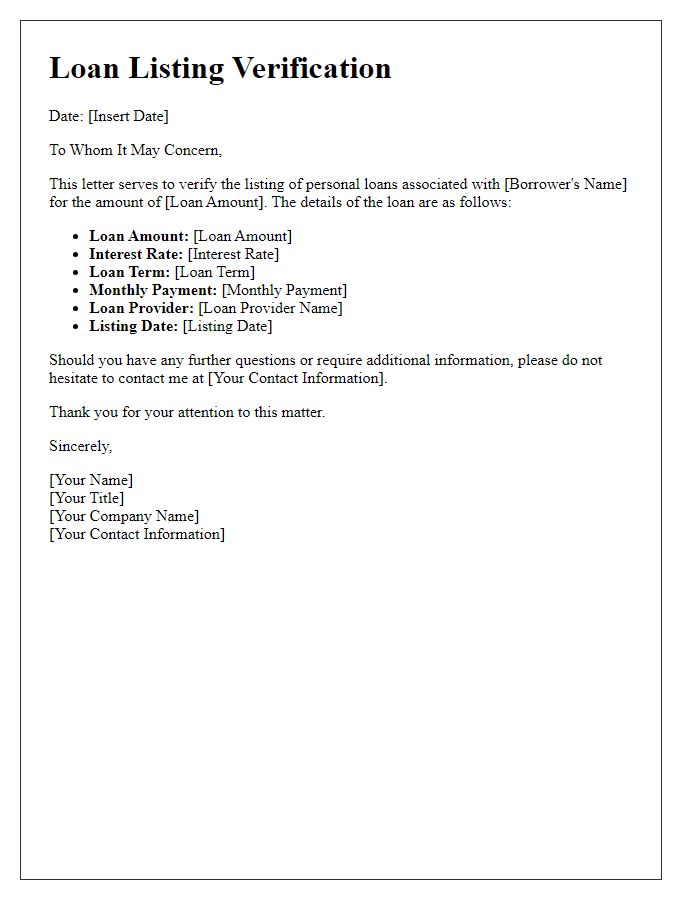

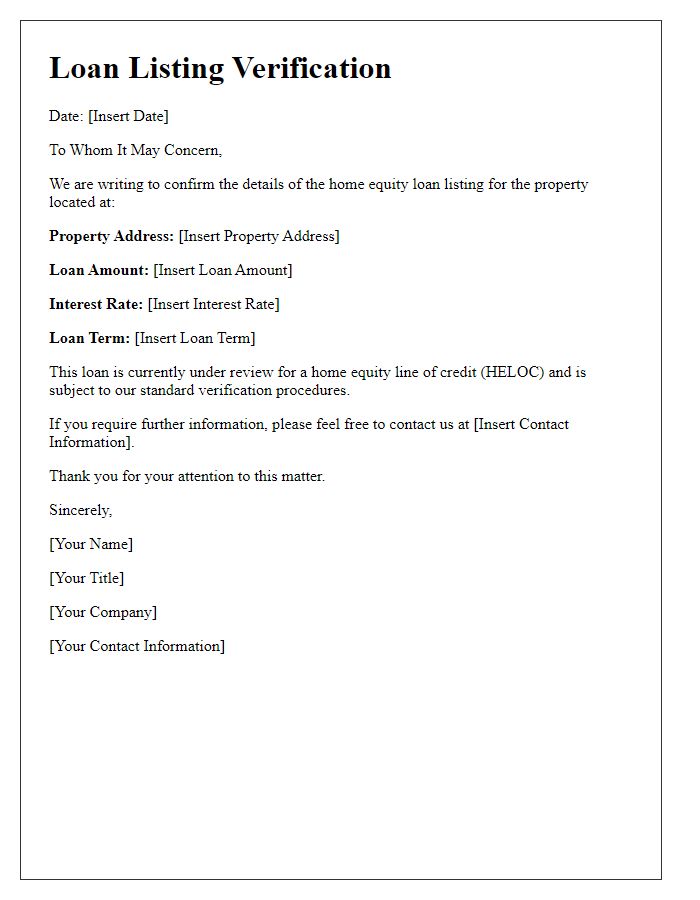

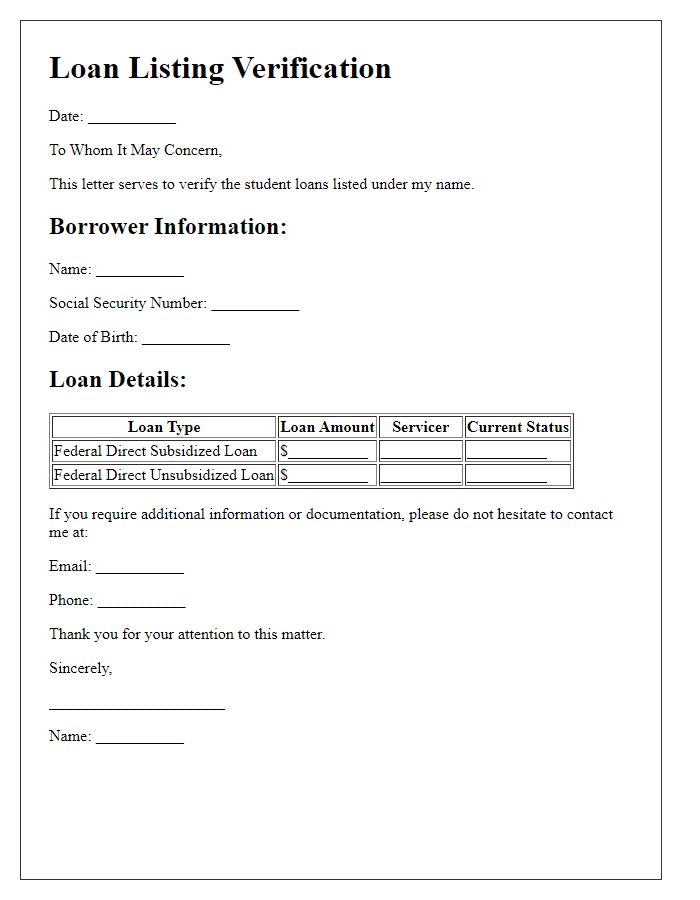

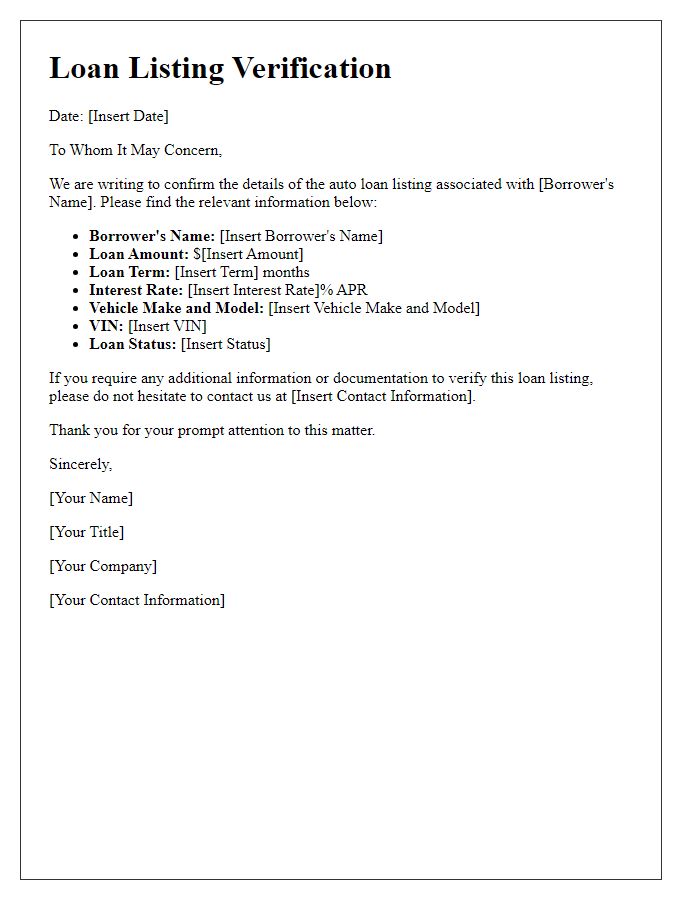

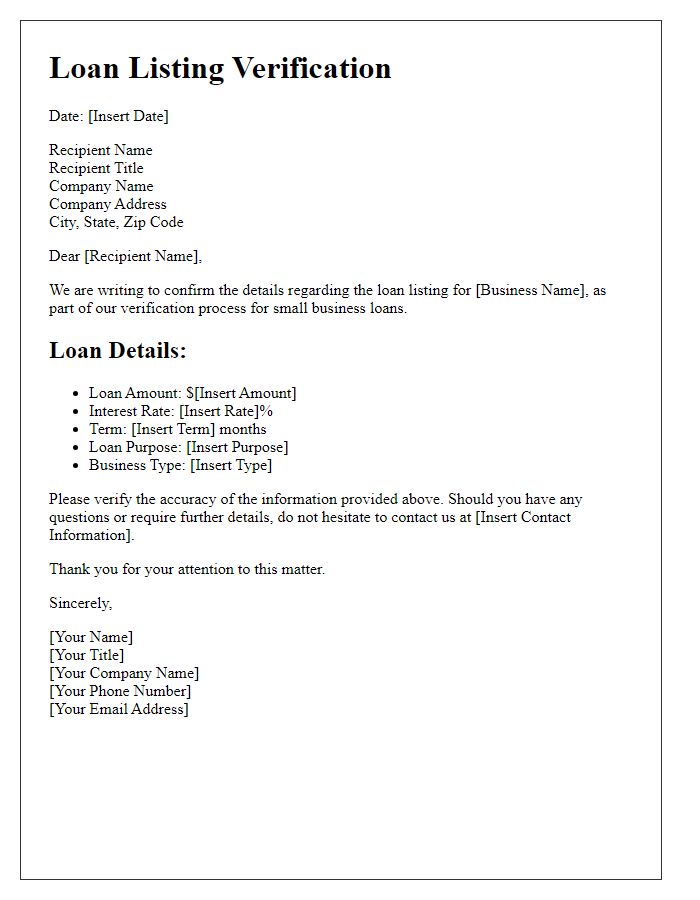

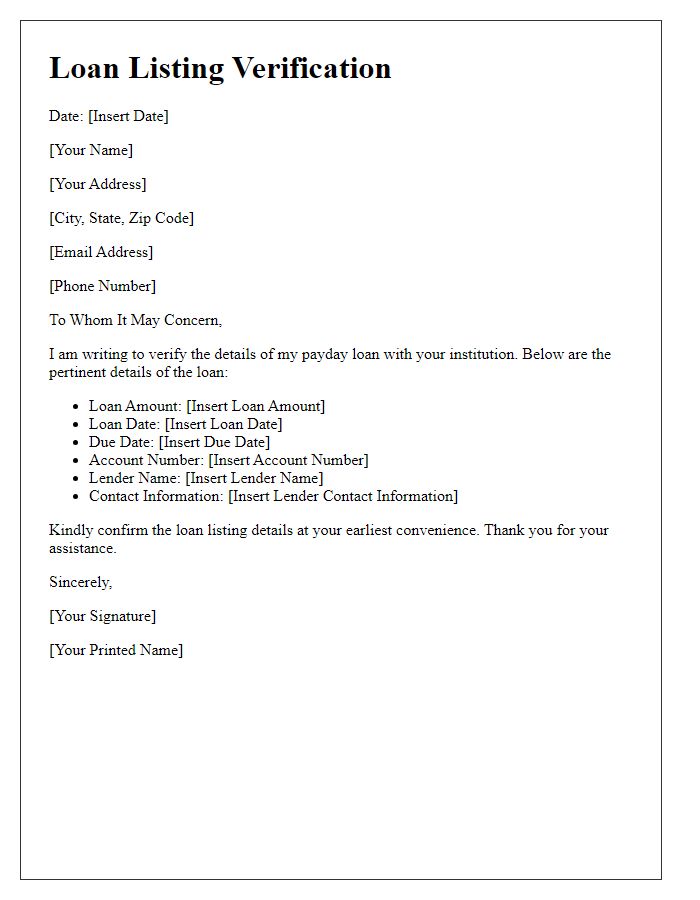

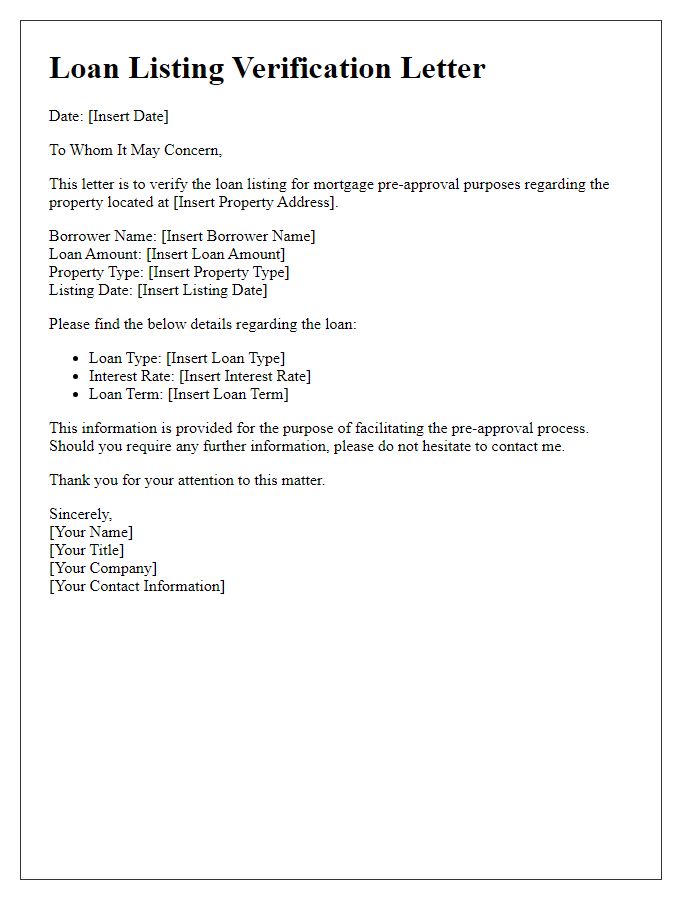

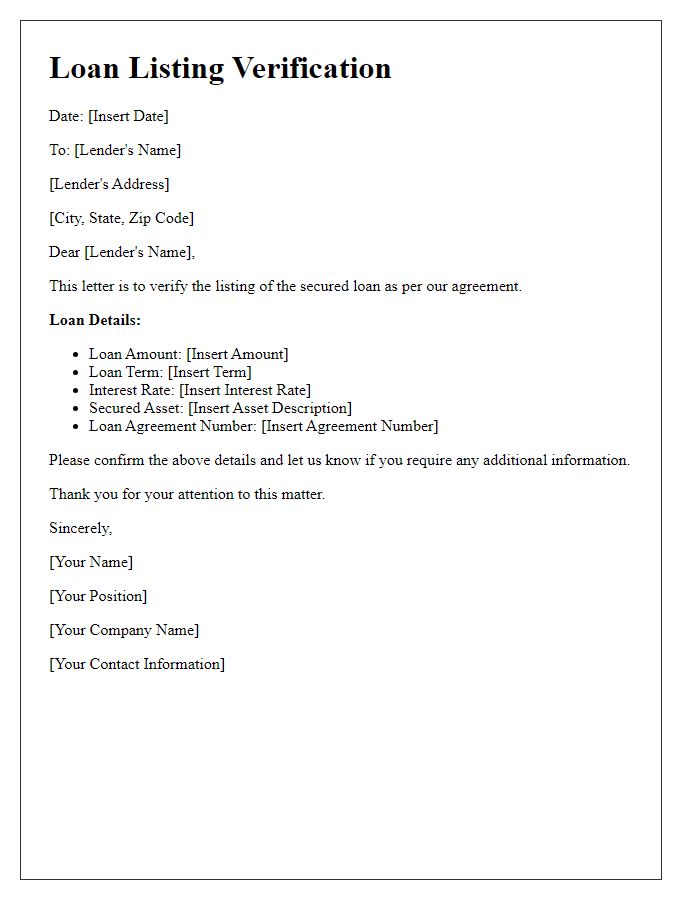

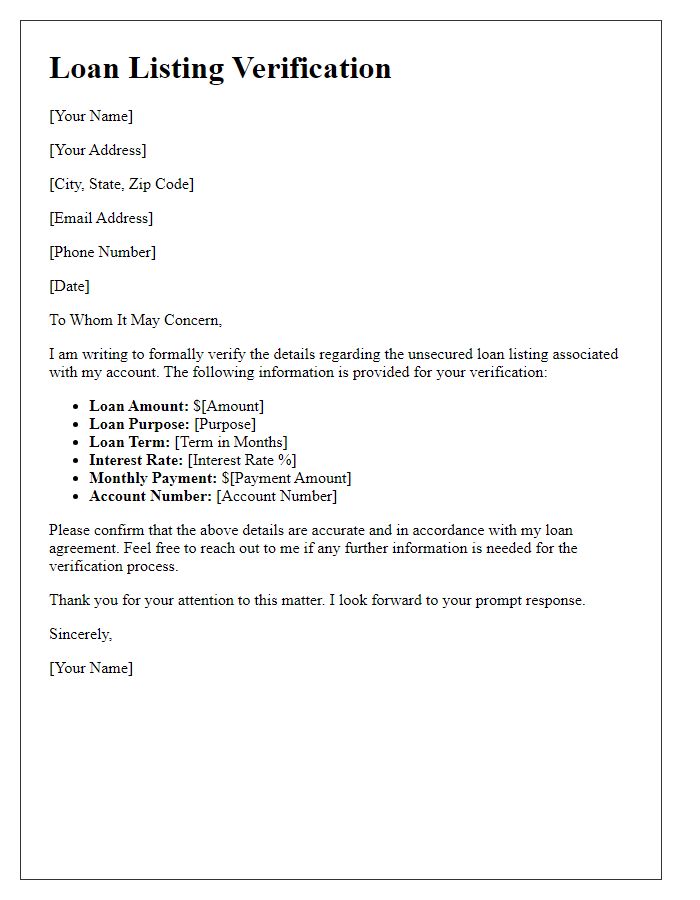

Letter Template For Loan Listing Verification Samples

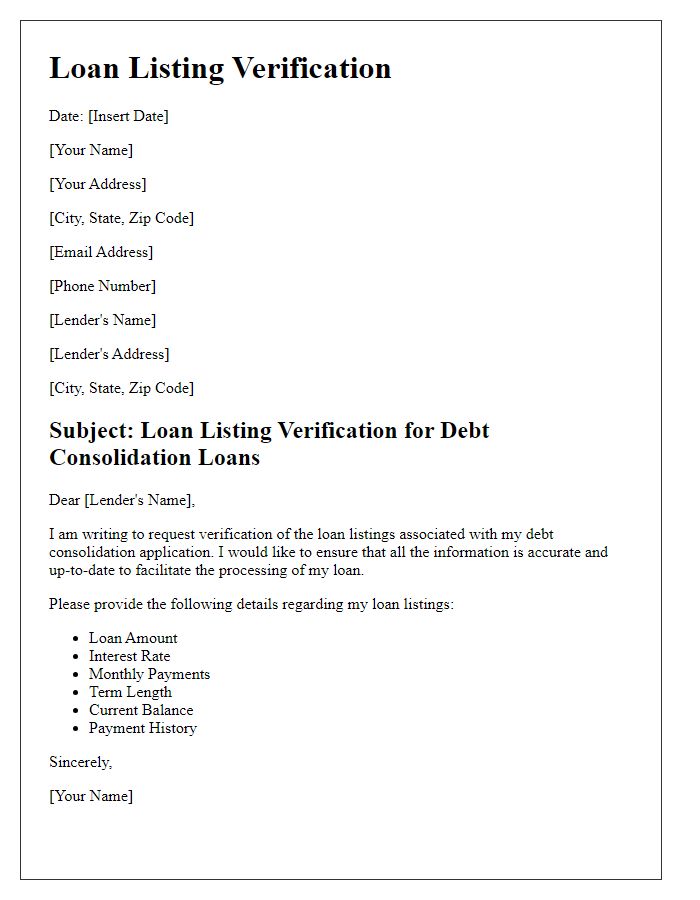

Letter template of loan listing verification for debt consolidation loans.

Comments