Are you feeling overwhelmed by your student loans and considering a deferral? You're definitely not aloneâmany students face this challenging situation as they juggle studies, work, and life. To help you navigate this process smoothly, we've crafted a helpful letter template for requesting a student loan deferral. Keep reading to discover how you can take the first step towards managing your loans with ease!

Personal Information

Students facing financial difficulties may consider requesting a deferral on their loans, particularly under circumstances such as economic hardship. A deferral temporarily suspends loan payments for a specified duration, allowing students to focus on their studies without the burden of financial obligations. Institutions like the U.S. Department of Education provide options for forbearance or deferment for federal student loans, offering relief during difficult times. Borrowers must submit a formal request to their loan servicer, including personal details such as their student identification number, contact information, type of loan, and reasons for the deferral, which can include enrollment status or unforeseen financial events. Detailed documentation, such as pay stubs or proof of unemployment, strengthens the application, increasing the chances of approval from financial institutions or educational bodies.

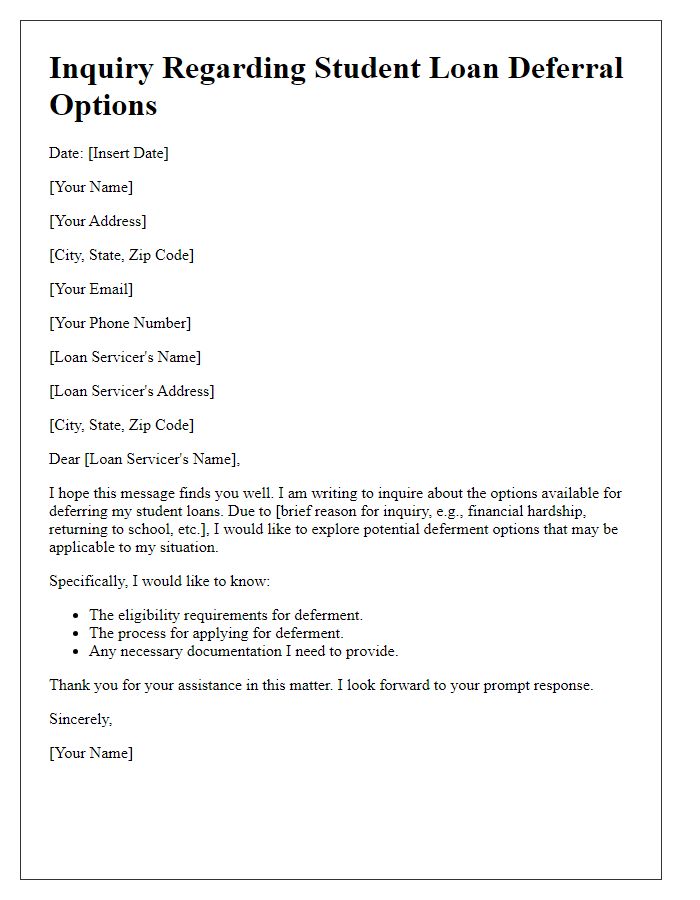

Loan Account Details

A student loan deferral request typically involves specific account information to ensure proper processing. The loan account details include the loan account number, which uniquely identifies the loan in the lender's database, and the current balance, which provides insight into the total amount owed. The type of loan, such as Federal Direct Subsidized or Unsubsidized Loans, affects eligibility for deferral options. Additionally, information about the loan servicer, including their name and contact details, is essential for communication regarding the request. Accurate documentation of both primary and secondary borrower information, if applicable, facilitates the approval of the deferral application and ensures that all parties remain informed throughout the process.

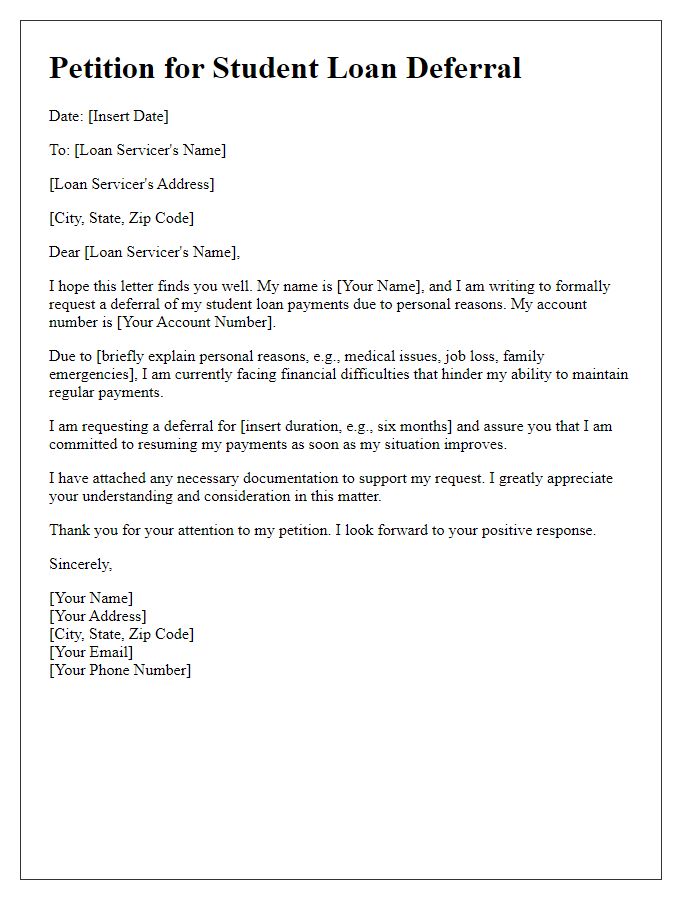

Reason for Deferral

Many students apply for loan deferral due to various circumstances affecting their financial situation. Unexpected job loss, medical emergencies, or enrollment in further education programs can create the need for temporary relief from loan repayment obligations. The United States government offers several programs that allow borrowers to request a deferment for federal student loans, typically enabling them to postpone payments for up to three years. Additionally, private lenders may have different policies regarding deferment requests. Borrowers must document their reasons, providing supporting evidence such as termination letters or medical records. Understanding the eligibility criteria and types of deferments--such as economic hardship or graduate school enrollment--can help students navigate their options effectively.

Supporting Documentation

In the process of requesting a student loan deferral, providing comprehensive supporting documentation is crucial. Essential documents may include proof of income, such as recent pay stubs or tax returns, demonstrating financial need or changes in employment status. Additionally, any official communication from educational institutions confirming enrollment status or program details can substantiate the request. For individuals facing significant financial hardships, documentation like medical bills or unemployment verification may also be relevant. Lastly, a detailed letter explaining the rationale for the deferral request, along with specific loan account information, will ensure clarity and aid in the approval process.

Contact Information

A student loan deferral request often includes essential details relevant to the borrower and the loan servicer. Contact information should provide clarity, allowing prompt communication. Include full name, such as Emily Johnson, alongside a current mailing address, such as 123 Maple Street, Springfield, IL 62701. Also, include phone number (such as (555) 123-4567) and email address (like emily.johnson@email.com) to facilitate direct notifications. Additionally, mention the loan servicer, for example, Federal Student Aid, ensuring the request reaches the right department. Including a reference number specific to the loan, like 1234567890, can expedite processing and tracking.

Letter Template For Student Loan Deferral Request Samples

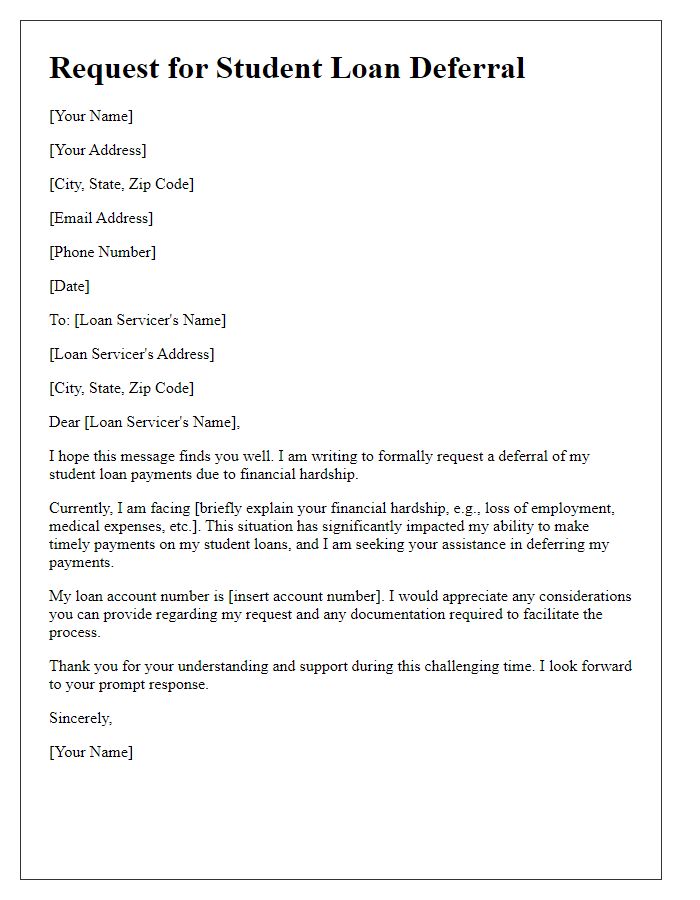

Letter template of request for student loan deferral due to financial hardship.

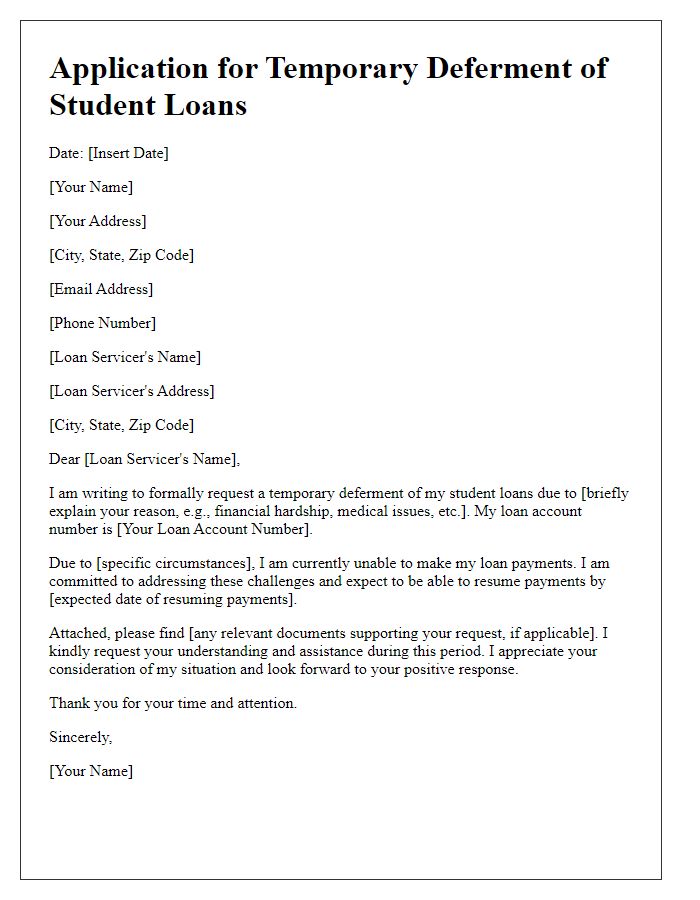

Letter template of application for temporary deferment of student loans.

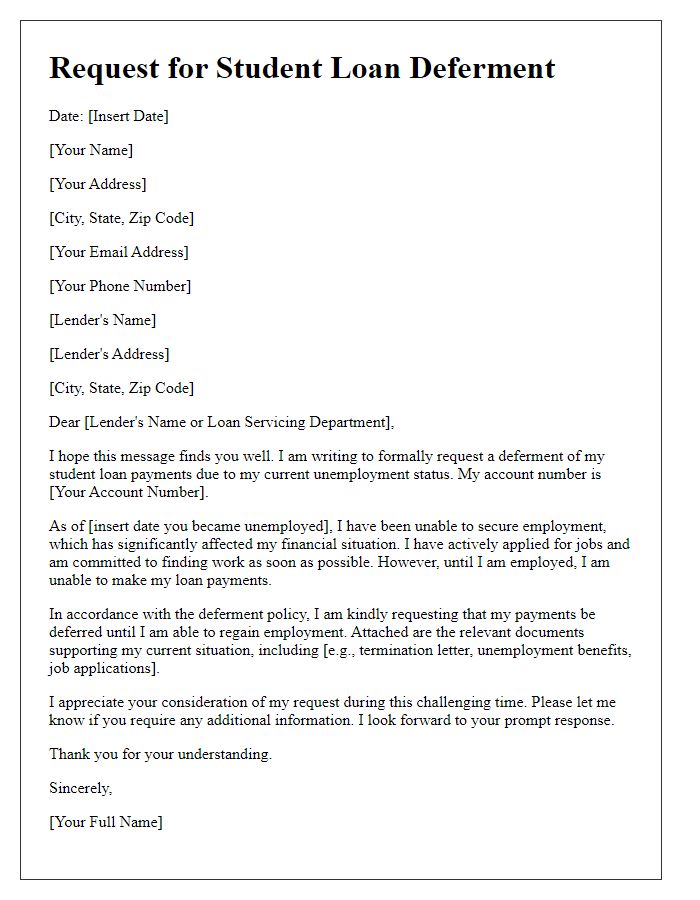

Letter template of formal request for student loan deferment based on unemployment.

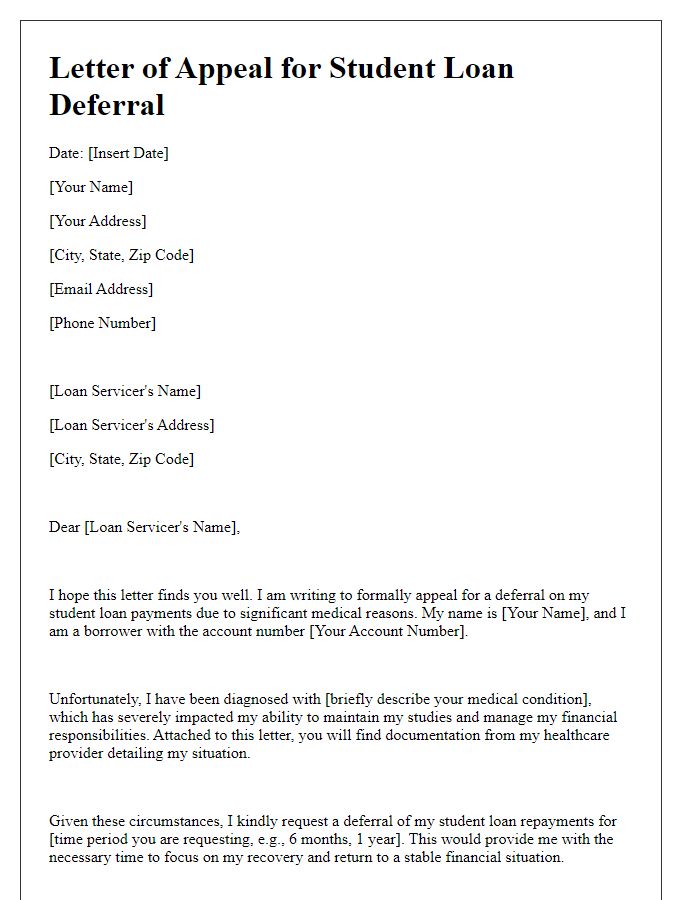

Letter template of appeal for student loan deferral citing medical reasons.

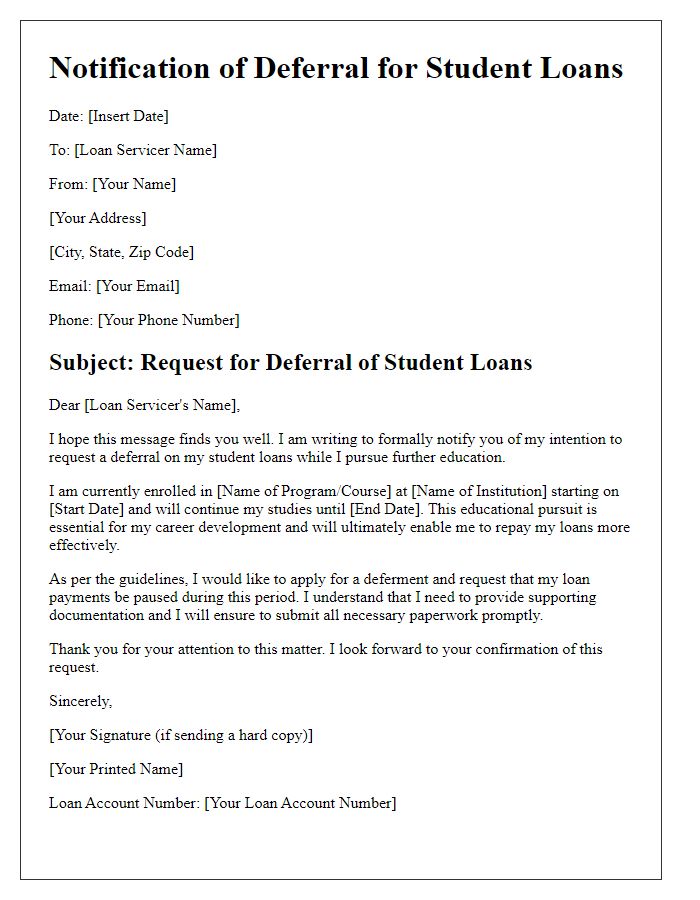

Letter template of notification for deferral of student loans while pursuing further education.

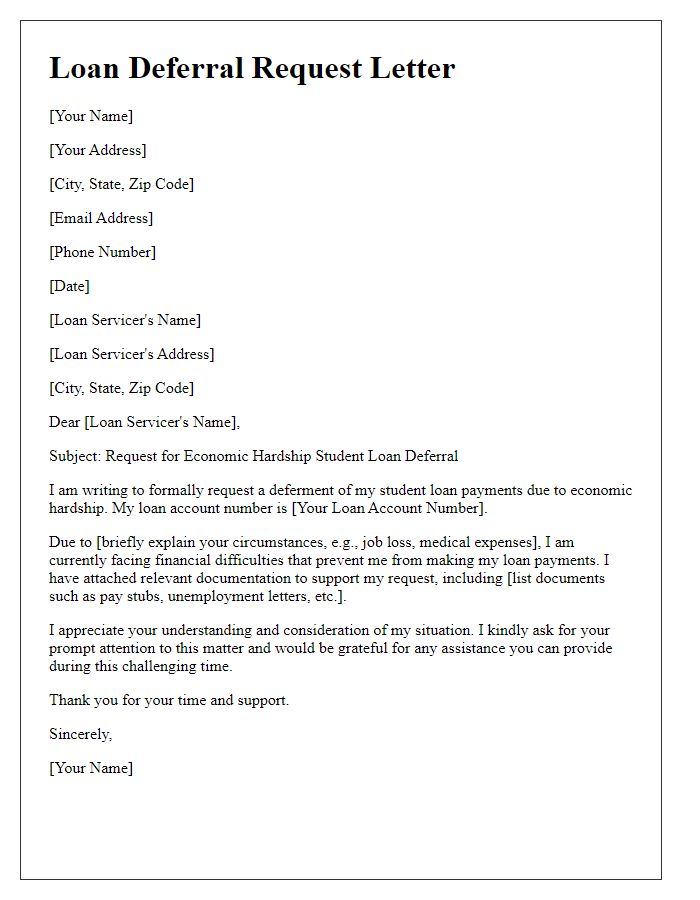

Letter template of submission for economic hardship student loan deferral.

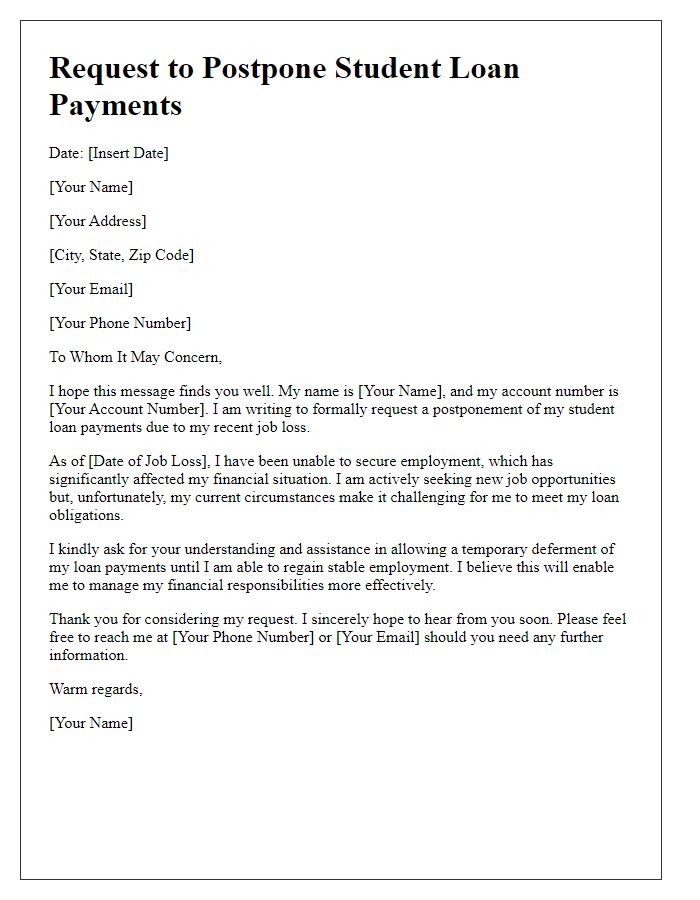

Letter template of request to postpone student loan payments due to job loss.

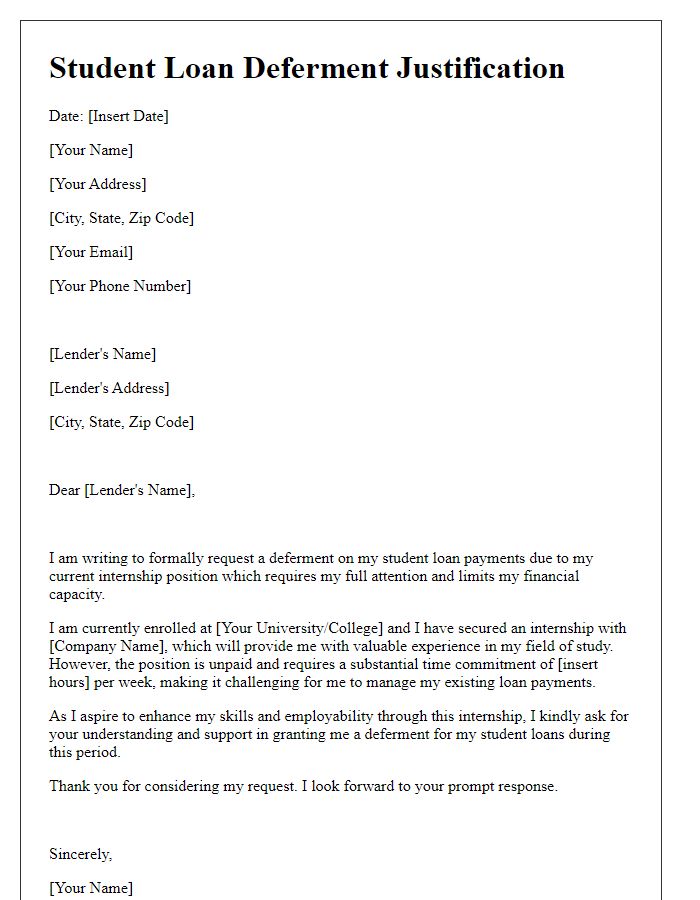

Letter template of justification for student loan deferment during internship.

Comments