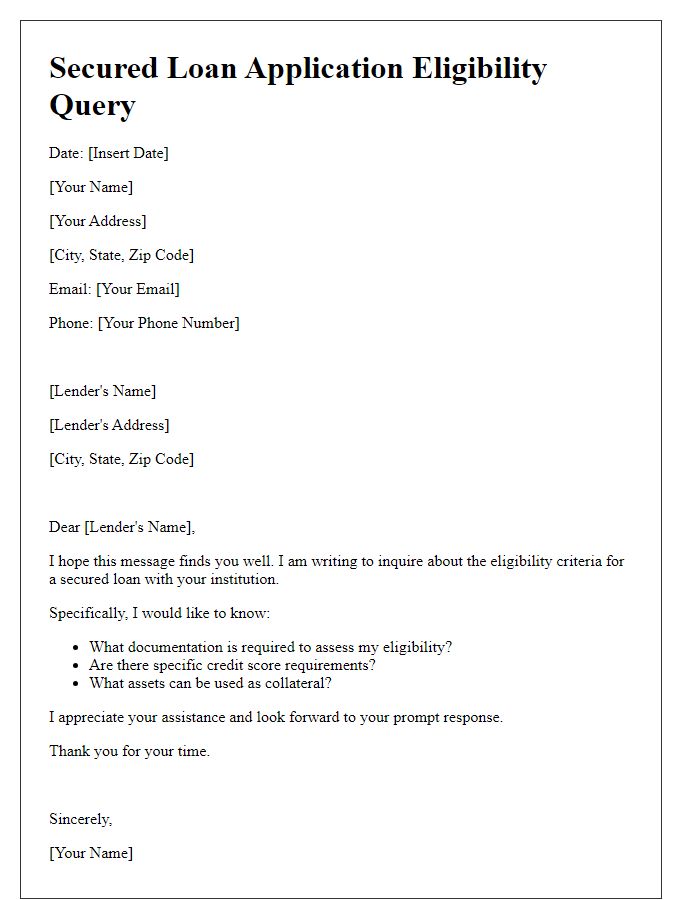

Are you considering applying for a secured loan but have questions about the process? It's completely normal to feel a bit overwhelmed with so many details to sort through. Secured loans can offer great benefits, but understanding the requirements and choices available can make all the difference in your application experience. Join us as we dive deeper into the ins and outs of secured loans, and discover the insights you need to make an informed decision!

Loan amount and purpose.

In a secured loan application, the loan amount often ranges from thousands to millions of dollars, determined by the value of collateral, such as real estate, vehicles, or savings accounts. The purpose of the loan significantly influences approval chances and interest rates. Common purposes include home improvements, debt consolidation, and major purchases like a car or education expenses. Lenders typically assess the borrower's credit score, income stability, and the valuation of the collateral to justify the loan amount requested. Understanding these key elements can enhance the chances of a successful loan application.

Collateral details.

A secured loan application requires detailed information about collateral, often real estate, vehicles, or financial instruments. Accurate valuation (current market value) is essential; for instance, residential properties in cities like Austin, Texas, average around $400,000 in value. Documentation, such as appraisal reports or title deeds, is crucial to prove ownership and market value. If using a vehicle, details like VIN (Vehicle Identification Number) and current mileage help determine worth. Financial assets, like stocks or bonds, should include recent account statements showing their value. Being thorough with these details ensures a smooth loan processing experience.

Applicant's financial status.

The financial status of an applicant plays a crucial role in the assessment of a secured loan application, especially for institutions such as banks and credit unions. Key factors include credit score (typically ranging from 300 to 850), debt-to-income ratio (often assessed against the threshold of 43 percent), and total assets. Documentation of income sources such as salaries, rental properties, or dividends contributes to verifying financial stability. Additionally, the value of the collateral, which might include real estate (properties appraised in the current market conditions), vehicles, or other tangible assets, determines the potential approval of the loan. An applicant's financial history, including previous loans, defaults, and repayment records, offers further insight into reliability and risk assessment for lenders.

Interest rate terms.

Interest rates for secured loans can vary significantly based on several factors, including lender policies, borrower credit profiles, and collateral type. For instance, conventional banks may offer fixed interest rates (typically ranging from 3% to 7% annually) while credit unions often present lower rates due to their member-focused approach. Loan terms can extend from 5 to 30 years depending on the loan purpose, such as home equity loans, which are secured by property value, or auto loans, secured by the vehicle purchased. Additionally, annual percentage rates (APRs) can increase with the length of the loan term, along with variations in fees associated with underwriting and processing. Understanding these terms is vital for making informed financial decisions regarding repayment obligations.

Contact information for follow-up.

When applying for a secured loan, having accurate contact information is essential for effective communication with financial institutions. Include your full name, current residential address, email address, and primary phone number. For instance, your address may be a specific real estate property located in Oakwood Avenue, Springfield, with zip code 12345. Providing a reliable means of contact ensures timely updates about your loan application status and facilitates any required documentation or information requests from the lender. It is advisable to double-check the accuracy of the details entered to avoid any delays during the application process.

Comments