Are you tired of high loan interest rates eating into your finances? You're not alone! Many individuals are seeking ways to lower their monthly payments and save money in the long run. In this article, we'll explore how to write a convincing letter to request a lower loan interest rate, and we invite you to read on for practical tips and sample templates that can help you achieve your financial goals.

Personal Information (Name, Address, Contact)

Requesting a lower loan interest rate can potentially lead to significant savings. Current financial market trends, particularly as of October 2023, suggest that many lenders are offering competitive rates influenced by the Federal Reserve's recent monetary policy adjustments. Personal information such as the borrower's name, home address, and contact details (phone number and email) is vital for identification and processing. Relevant factors such as credit score, employment history, and loan repayment track record further emphasize a borrower's stability and reliability. Articulating the rationale for the request, such as better financial circumstances or market comparisons, can strengthen the appeal for reconsideration of the interest rate.

Loan Account Details (Loan Number, Amount)

Requesting a lower loan interest rate can significantly reduce monthly payments, especially for personal loans or mortgages. Loan accounts, such as personal loans from financial institutions, often have specific loan numbers associated with them, like 123456789. For instance, if the original loan amount was $50,000 with an interest rate of 6%, a reduction to 4% could save borrowers a substantial amount over the life of the loan. Furthermore, the borrower should reference their payment history and credit score to support their case for a reduced interest rate. Effective communication with the lender's customer service or loan modification department is key to initiating this request.

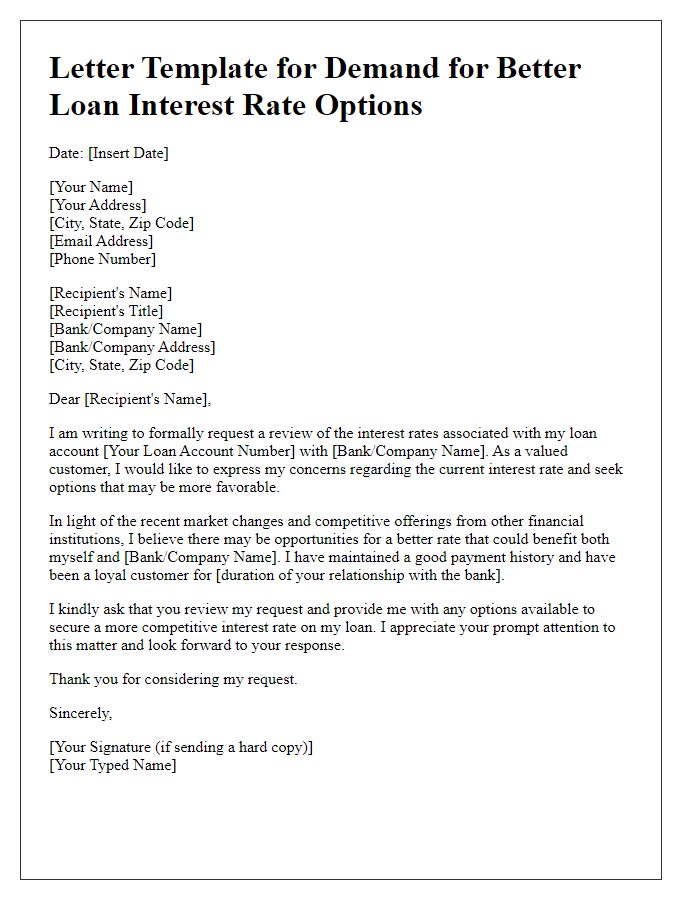

Reason for Request (Financial Situation, Market Conditions)

Many borrowers seek to lower their loan interest rates due to changing financial situations or market conditions. A drastic reduction in personal income (such as job loss or medical expenses) can strain monthly budgets, prompting a need for more affordable payment options. Additionally, the current market conditions featuring historically low interest rates give many borrowers the leverage to request reconsideration of their existing loan terms. For instance, as of October 2023, average mortgage rates have dropped to around 3%, significantly lower than the original rate of 5% many borrowers obtained in previous years. This mismatch between prevailing rates and borrower obligations creates a compelling case for renegotiation, allowing individuals to save substantial amounts on monthly payments and overall loan costs.

Supporting Documentation (Income Proof, Credit Score)

Borrowers often seek lower loan interest rates to reduce financial burdens and improve repayment conditions. Supporting documentation is crucial in this process, particularly income proof (such as pay stubs or tax returns) to demonstrate consistent earnings, and credit score reports originating from major agencies like Experian or TransUnion to illustrate creditworthiness. Typically, borrowers aim for scores above 700 to qualify for preferential rates. These documents can help lenders assess risk, ultimately leading to a potential reduction in interest rates, which can save thousands of dollars over the life of the loan. Institutions may also request additional documentation related to employment history or debt-to-income ratios to further evaluate the borrower's ability to meet revised loan terms.

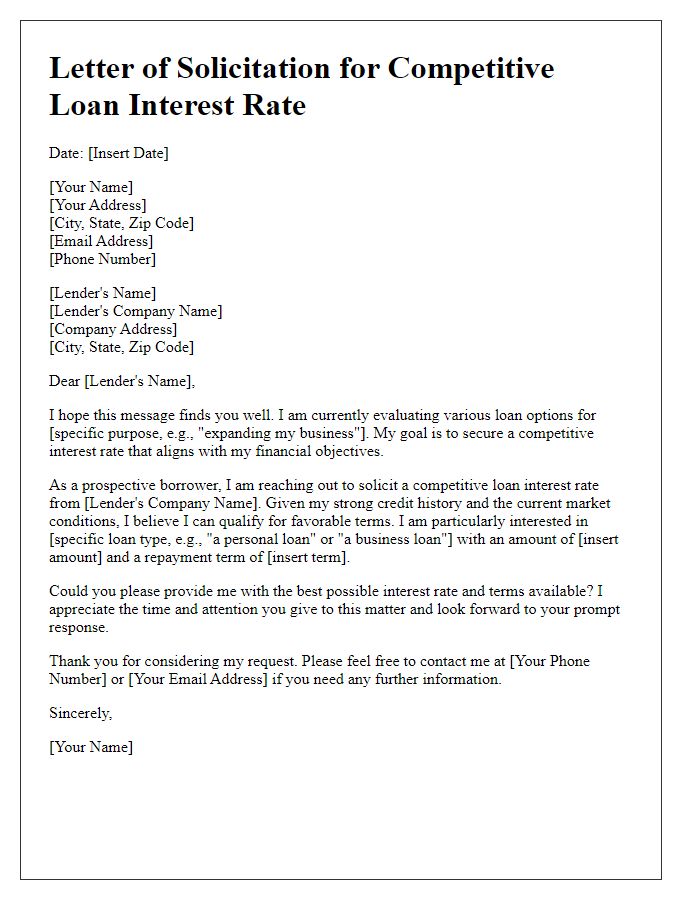

Formal Request Statement (Desired Interest Rate, Terms)

Requesting a lower loan interest rate can significantly alleviate financial burdens for borrowers. A formal request statement should include specific details such as the desired interest rate, typically expressed as a percentage (e.g., 3.5%), and any terms associated with the loan, such as the duration (e.g., 15-year or 30-year term). It is also beneficial to provide context, such as recent market trends or changes in personal financial circumstances that support the request. For instance, if the borrower has improved their credit score from 650 to 750, highlighting this enhancement can strengthen the argument for a reduced rate. Additional information about the loan's original amount (e.g., $200,000) and the potential monthly payments at the requested rate may further emphasize the impact of the adjustment.

Comments