Are you considering a home renovation but unsure how to finance it? Applying for a home renovation loan can be a straightforward journey with the right guidance. In this article, we'll explore essential steps and tips to help you craft a compelling loan application that catches the lender's attention. Stick around, as we dive deeper into the ins and outs of securing the perfect financing for your dream home!

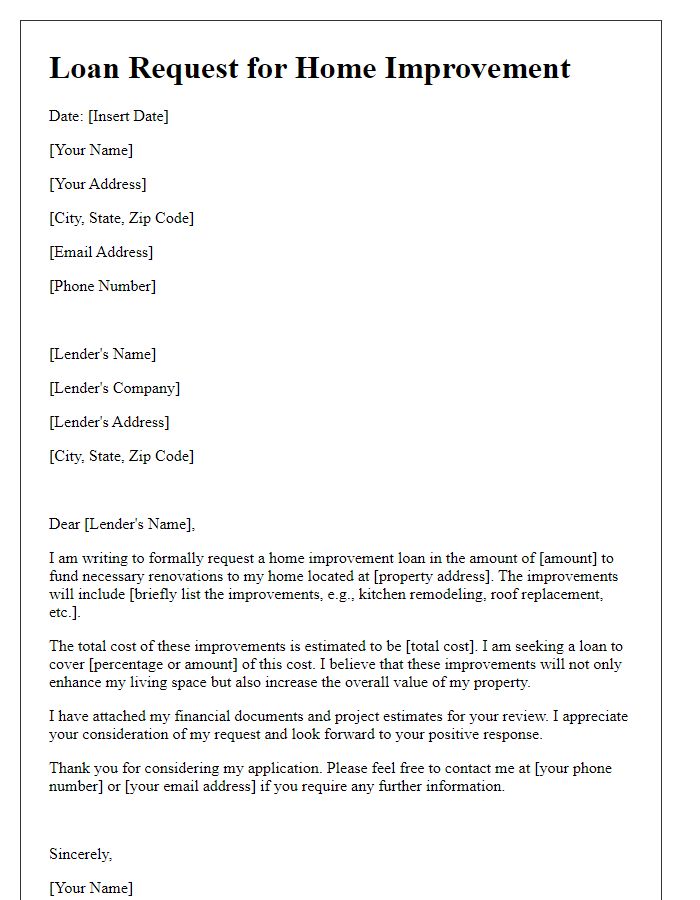

Personal Information

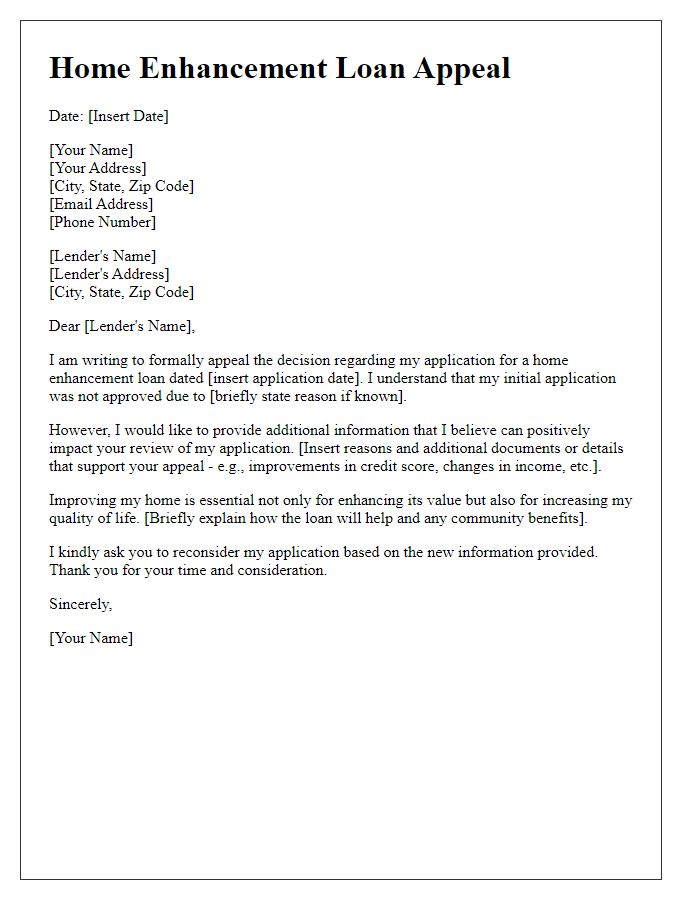

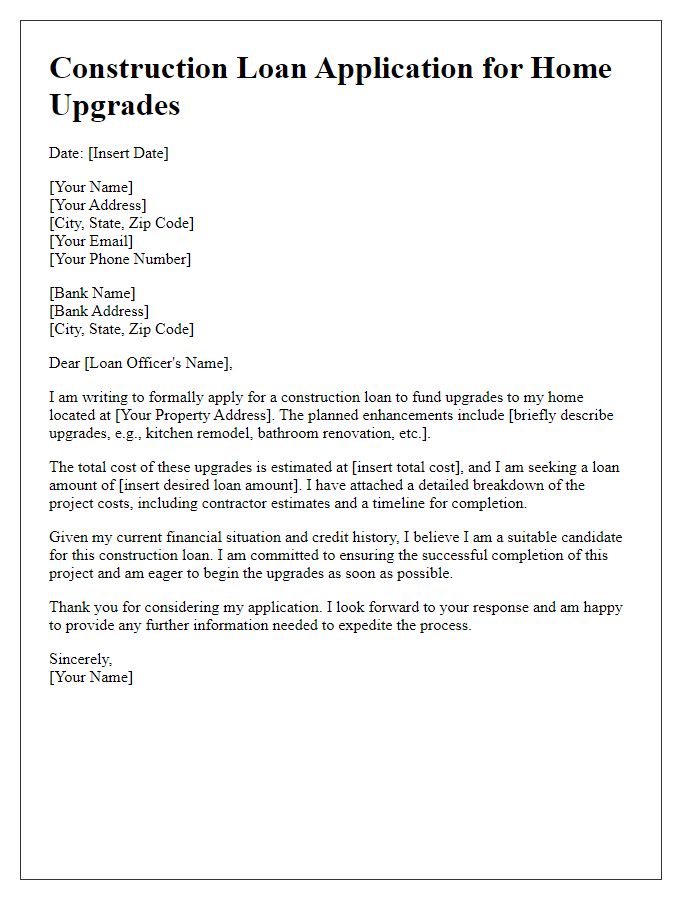

Home renovation loans serve as crucial financial tools for homeowners seeking to improve their living spaces. Personal information, such as full name, date of birth, social security number, and current address, plays a significant role in the application process, allowing lenders to assess creditworthiness. Additionally, employment details including employer name, job title, and annual income help determine repayment capacity. Financial obligations, such as existing mortgages or debts, also need to be documented, providing a comprehensive view of the applicant's financial health. Accurate personal information ensures a smooth application review process, which is essential for timely funding of renovation projects.

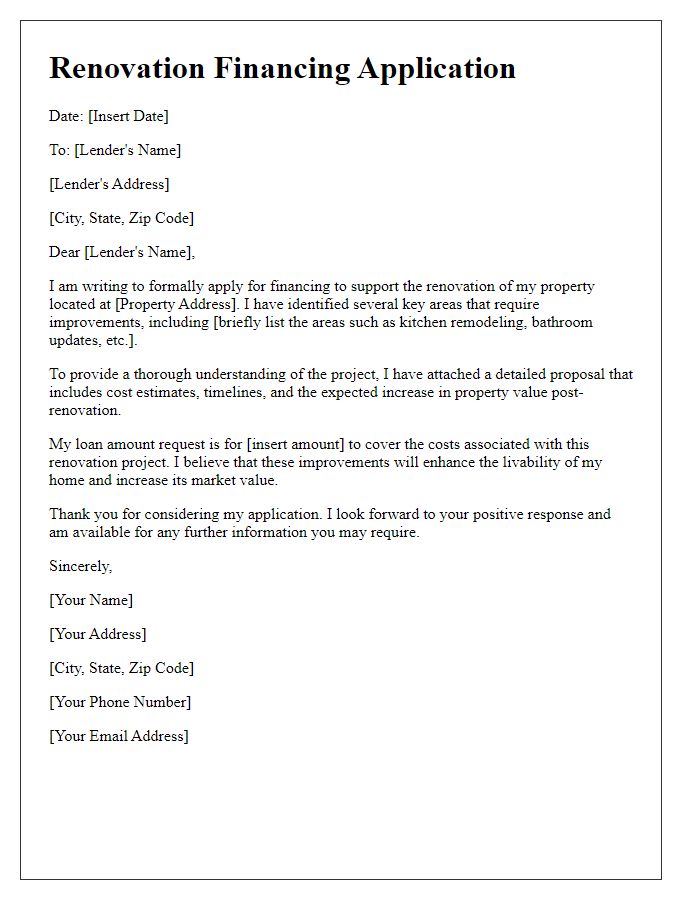

Loan Amount Requested

Home renovation loan applications often seek substantial financial assistance for various upgrade projects. Applicants frequently request amounts ranging from $10,000 to $100,000, depending on the scale of renovations. For instance, a modern kitchen remodel could cost approximately $20,000, while extensive exterior renovations like roof replacement may reach $30,000. Meanwhile, bathroom updates typically average around $15,000. Applicants must detail specific projects, their estimated costs, and plans for enhancing property value. Additionally, factors such as home location (for example, properties in high-demand areas like San Francisco) can influence loan approval and amount, showcasing the necessity for precise financial documentation.

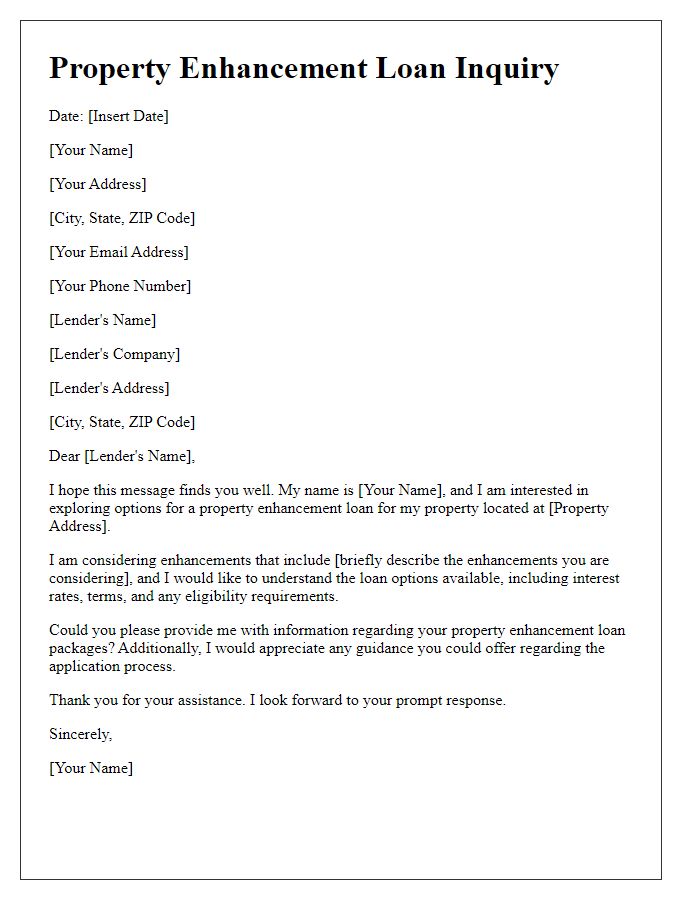

Purpose of Renovation

Home renovation projects enhance property value and improve living conditions. Kitchen upgrades, such as modern appliances and eco-friendly countertops, often yield a high return on investment. Bathroom renovations, including energy-efficient fixtures, not only increase comfort but also support sustainability initiatives. Structural updates, like roof repairs or foundation work, ensure safety and longevity of the home. Curb appeal improvements, such as landscaping or exterior painting, contribute to the overall aesthetics and increase marketability. Energy-efficient upgrades, like insulation or solar panel installations, reduce utility costs and environmental impact. Home renovations can transform a property, making it a more enjoyable and valuable investment.

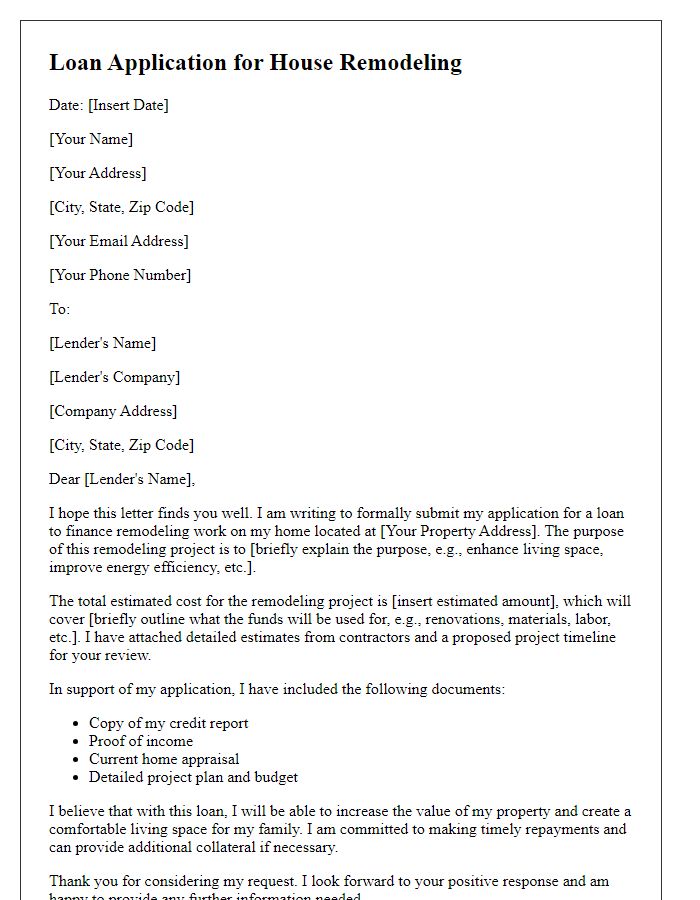

Budget and Financial Projections

Home renovation projects often necessitate careful financial planning and budgeting to ensure successful completion. The estimated budget for this renovation, including materials, labor, and unexpected expenses, totals $50,000. Detailed cost breakdown includes $20,000 allocated for kitchen updates featuring modern cabinetry and energy-efficient appliances, $15,000 for bathroom renovations emphasizing sustainable fixtures, and $15,000 for overall structural improvements ensuring safety and compliance with local building codes. Financial projections anticipate a return on investment (ROI) of approximately 70% post-renovation, assuming an increase in property value by $35,000 in the real estate market of San Francisco, California. Secure financing through a home renovation loan at a competitive interest rate of 4.5% over 15 years enables manageable monthly payments under $400, facilitating timely budget adherence and effective cash flow management throughout the project.

Property Details and Valuation

The property located at 123 Maple Street, Springfield, is a single-family residence built in 1995, encompassing 2,500 square feet of living space. The current market valuation of the property stands at approximately $350,000, based on recent sales data for comparable homes in the neighborhood, which has undergone significant development in the last five years. The property features a well-maintained exterior with updated landscaping, three bedrooms, and two bathrooms, attracting prospective buyers and investors. Recent renovations to the kitchen and bathroom, completed in 2022, have increased the home's appeal, contributing to its valuation. Local amenities, such as Springfield Park and the Oakwood Shopping Center (both within a 2-mile radius), further enhance the property's desirability, indicated by a steady rise in property values in the area. Appraisals from licensed professionals have confirmed the estimated value, ensuring its validity for the loan application process.

Comments