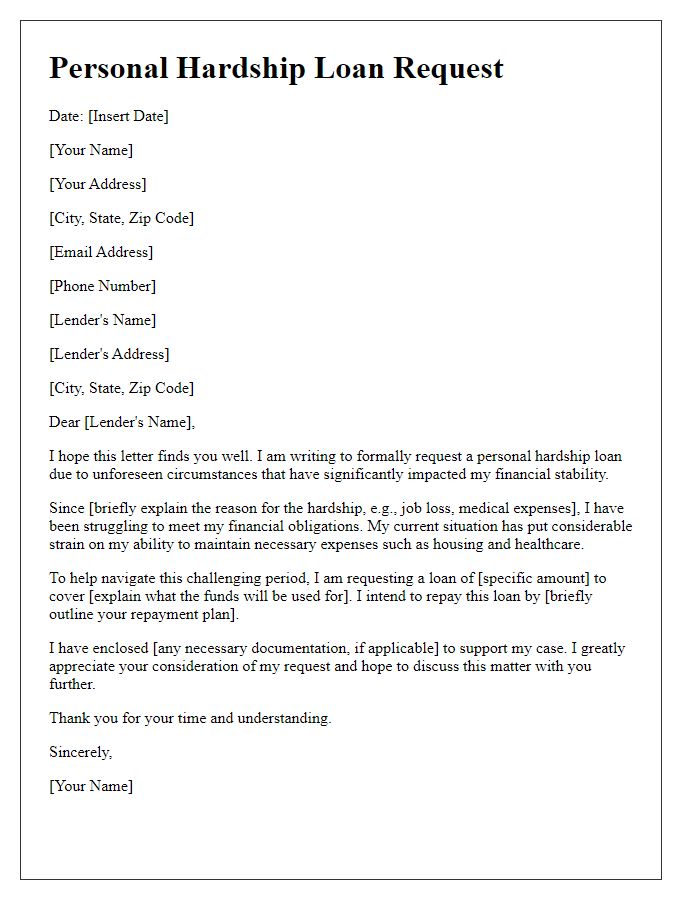

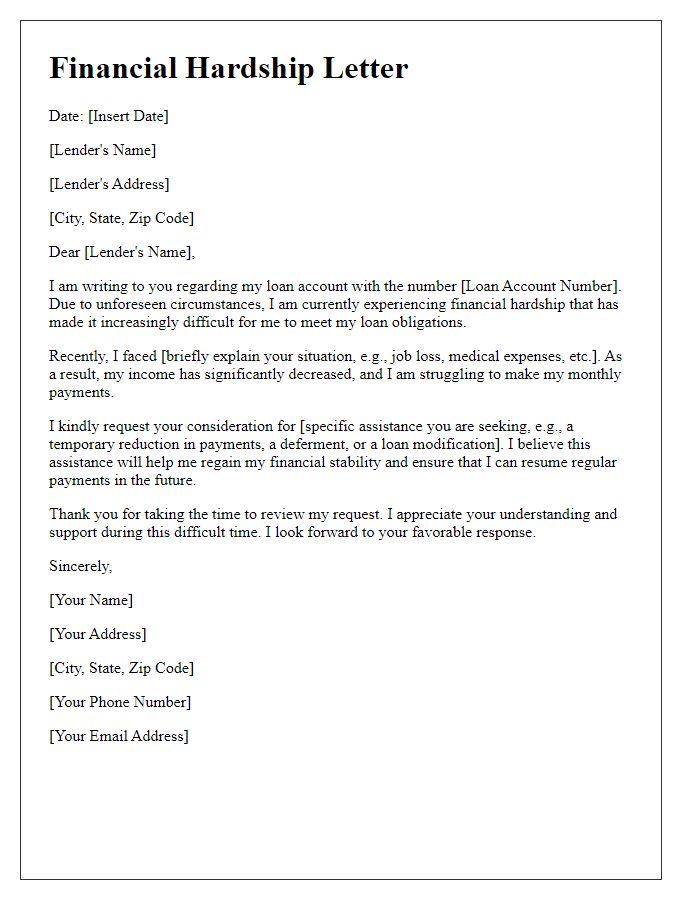

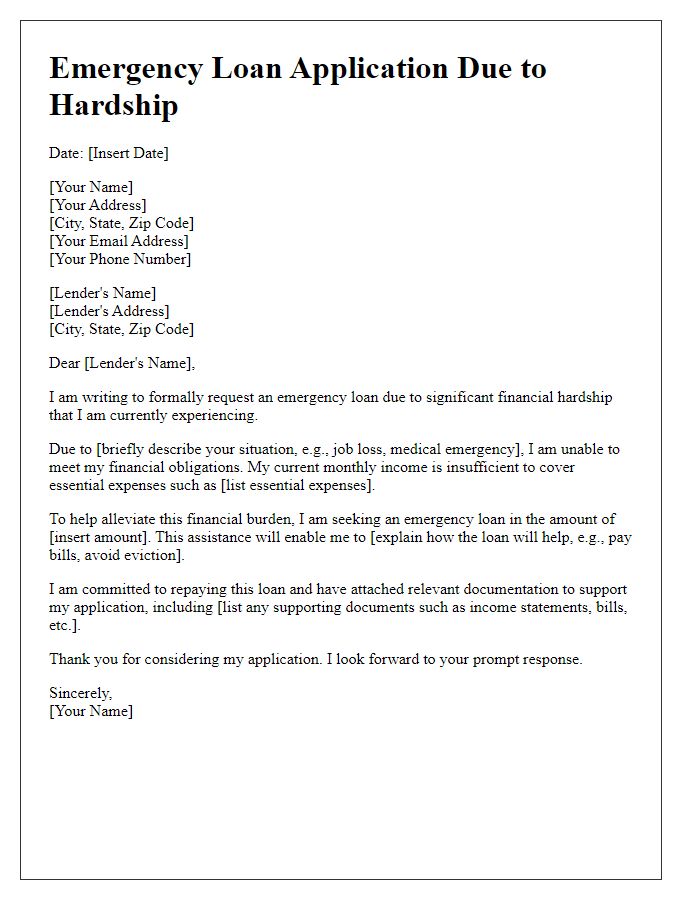

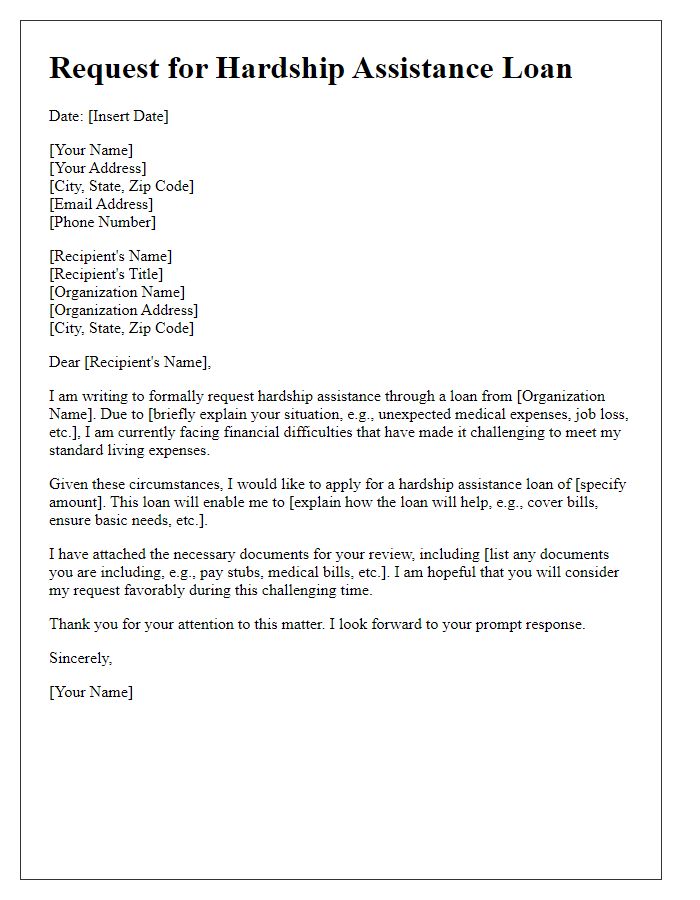

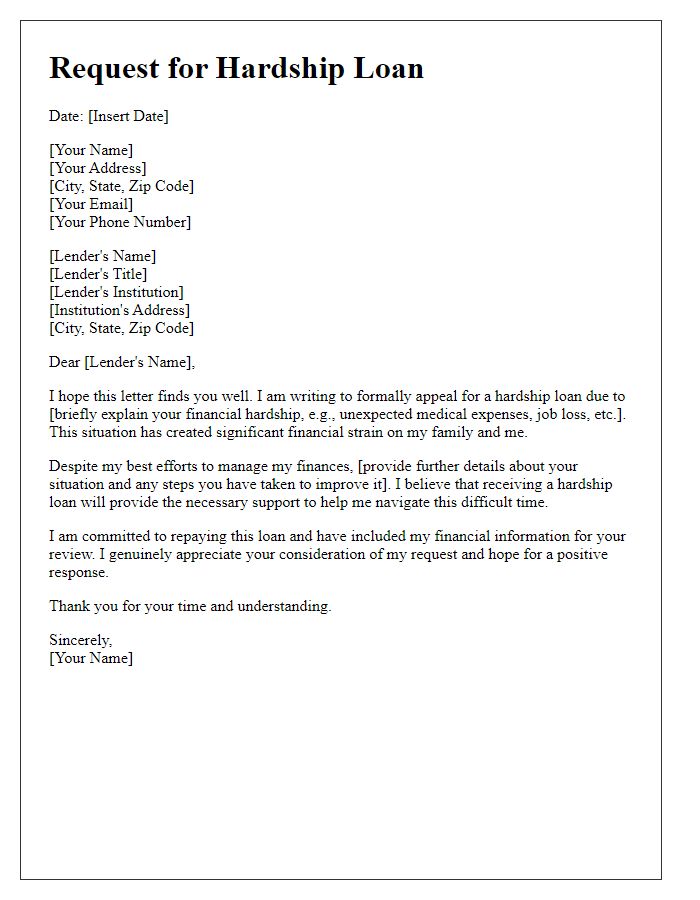

In times of financial difficulty, it's crucial to have the right support to navigate through the challenges. When applying for a hardship loan, crafting a well-structured letter can make all the difference in presenting your case effectively. This letter serves as an opportunity to clearly outline your situation, needs, and the steps you've taken to manage your finances. If you're unsure where to start, keep reading to discover tips on how to create a compelling hardship loan application letter.

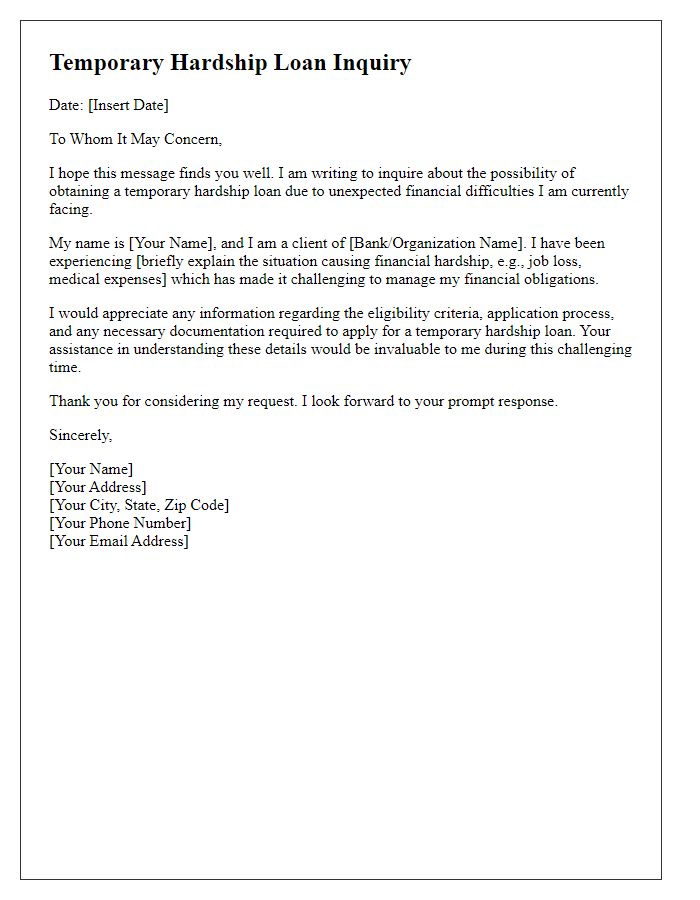

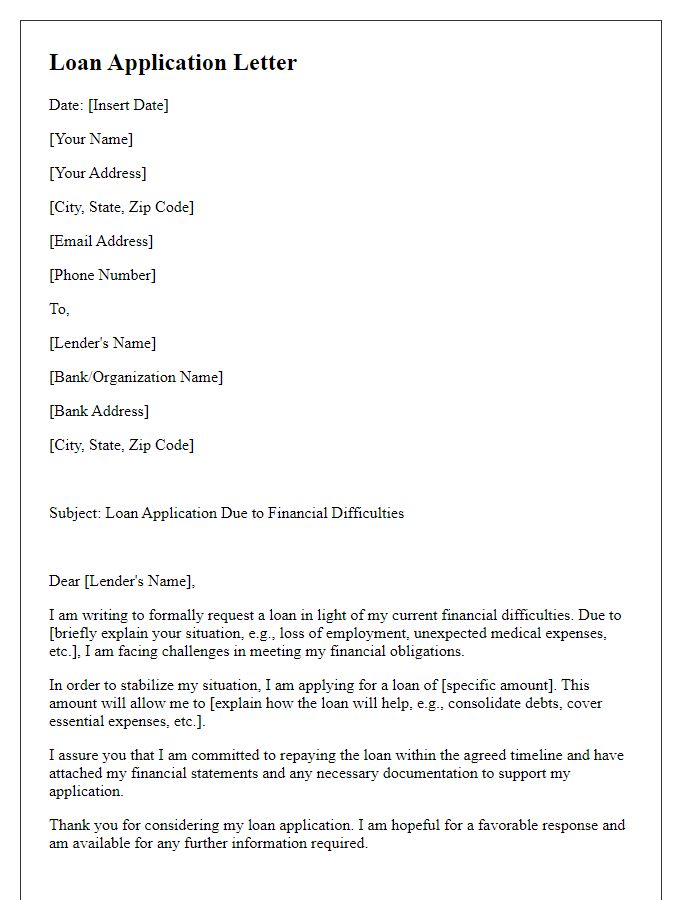

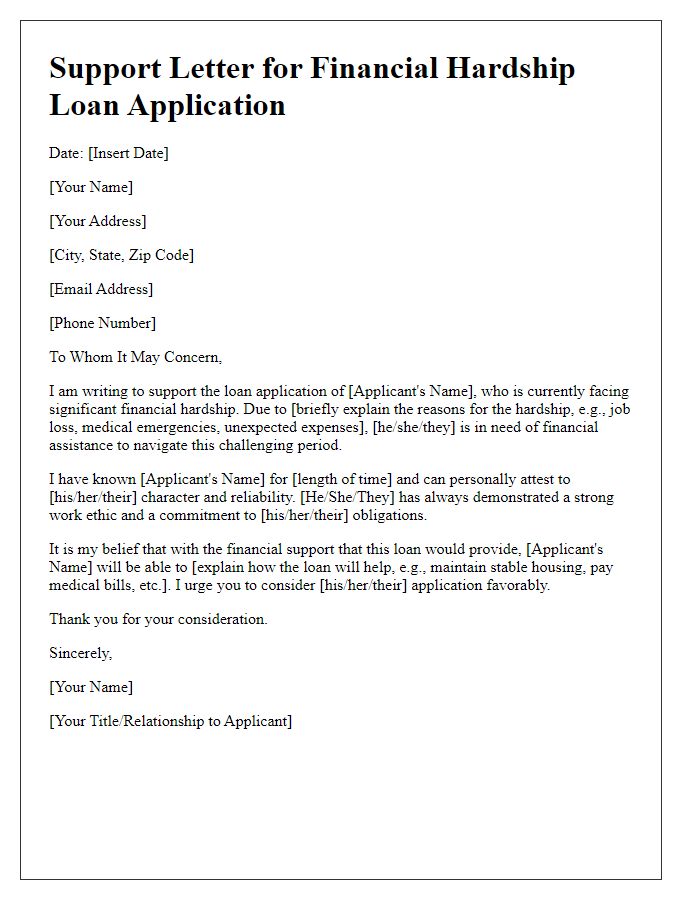

Personal Identification Information

Personal identification information is crucial for a hardship loan application, ensuring verification of identity and financial status. Include full legal name (first, middle, last), date of birth (providing age context), Social Security Number (SSN for unique identification), current residential address (street, city, state, ZIP code for location verification), and phone number (for contact purposes). Additionally, provide email address (for communication) and employment status (indicating your source of income). Documenting these details accurately facilitates the processing of the hardship loan request effectively.

Detailed Explanation of Hardship

Many individuals face unexpected financial hardships due to circumstances like job loss, medical emergencies, or natural disasters. Such events can quickly deplete savings and create a pressing need for assistance. For instance, in September 2022, approximately 3 million Americans were unemployed, prompting many to seek financial support. Medical bills, particularly for severe conditions like cancer or heart disease, can exceed thousands of dollars, adding to the financial strain. Unexpected repairs from events like hurricanes (e.g., Hurricane Ian in October 2022) can also lead to significant expenses, making it difficult for families to manage their daily needs. Obtaining a hardship loan becomes essential in these situations to cover immediate expenses like housing, utility bills, and groceries, allowing individuals to regain financial stability.

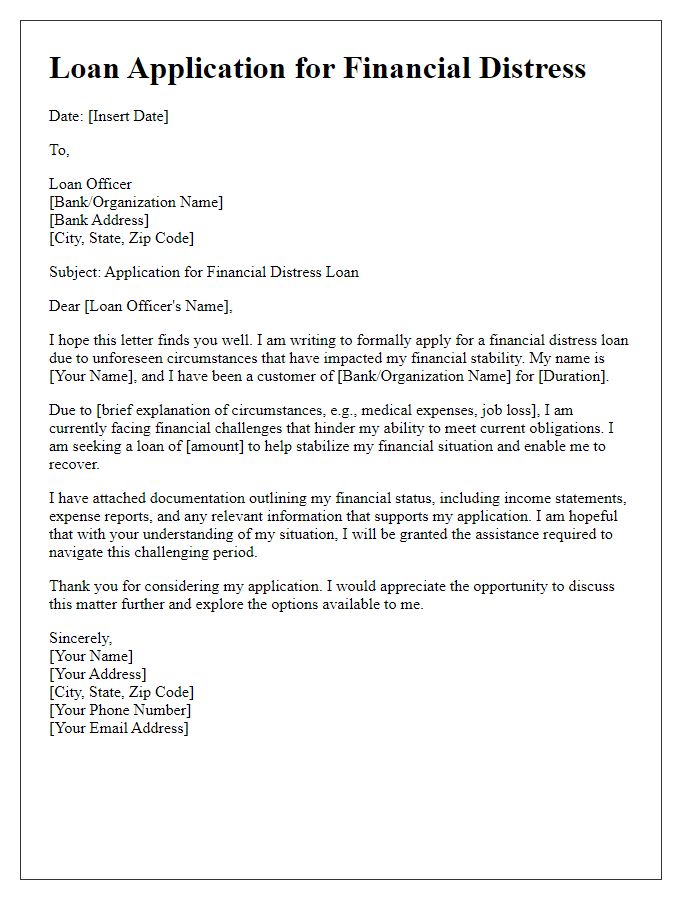

Requested Loan Amount and Purpose

A hardship loan application often details the requested loan amount and its specific purpose. For instance, an individual might request a loan amount of $5,000 to cover unexpected medical expenses resulting from a recent hospitalization at Springfield General Hospital. In this case, the funds will be allocated towards outstanding medical bills, urgent medication, and necessary follow-up appointments. Individuals facing financial distress may emphasize the impact of these expenses on their current financial stability, highlighting that timely financial assistance is crucial to manage debt and maintain essential living standards.

Current Financial Situation and Income

Current financial situations can significantly impact loan applications, particularly for hardship loans. Many individuals face unexpected events such as job loss, medical emergencies, or natural disasters that disrupt their income streams. For instance, unemployment rates soared to over 14% during the COVID-19 pandemic, drastically affecting household income levels. Documentation of current income sources such as employment wages, social security benefits, or rental income is crucial. Furthermore, monthly expenses, including rent or mortgage payments, utilities, and food costs, should be detailed. A clear picture of the financial landscape helps lenders understand the applicant's circumstances and need for financial assistance in times of crisis, leading to more informed loan decisions.

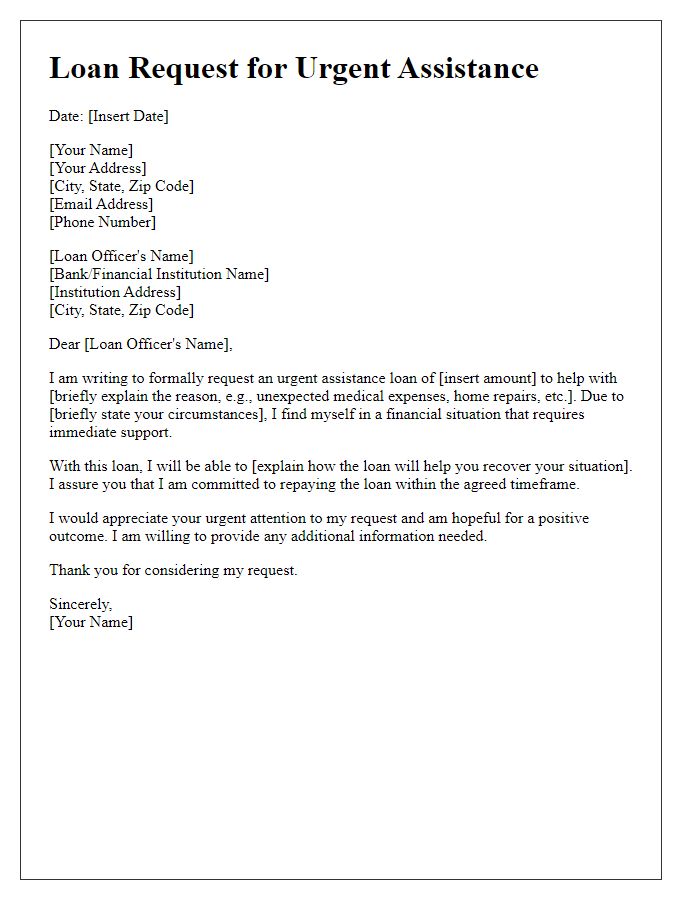

Repayment Plan Proposal

A well-structured repayment plan proposal for a hardship loan application can demonstrate your commitment to addressing financial difficulties. Essential elements include a detailed budget showcasing income sources, such as monthly wages from employment at local businesses with current average pay rates, and any government assistance programs such as unemployment benefits or food stamps. Include specific expenses, like rent costing approximately $1,200 per month, utility bills averaging $150, and essential grocery spending around $300. Outline proposed repayment amounts, indicating percentages allocated towards loan repayment based on available cash flow, ensuring that the plan outlines a realistic timeline, stating intentions to pay off the loan over an estimated period of 2 to 5 years. Provide supporting documentation, including pay stubs, bank statements, and correspondence with creditors, to enhance credibility and transparency in the proposal.

Comments