Are you considering a deferred payment loan agreement but unsure how to draft the perfect letter? Crafting a well-structured letter can make all the difference in conveying your intentions and securing the terms you need. It's essential to include key details such as the loan amount, interest rates, and the specific conditions for the deferment to ensure clarity for both parties. Keep reading for a comprehensive template that will guide you in drafting your own effective deferred payment loan agreement letter.

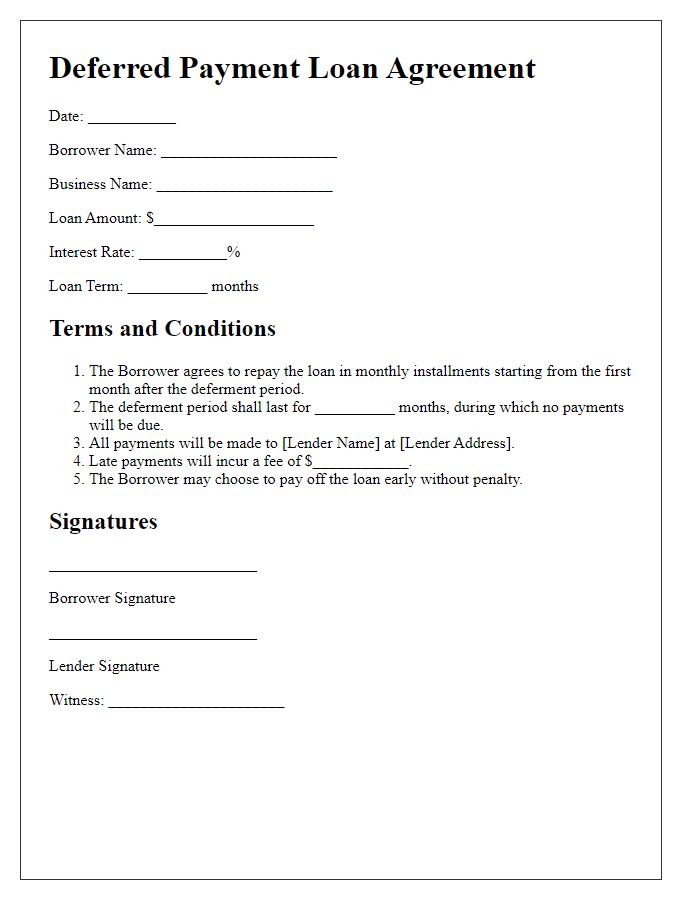

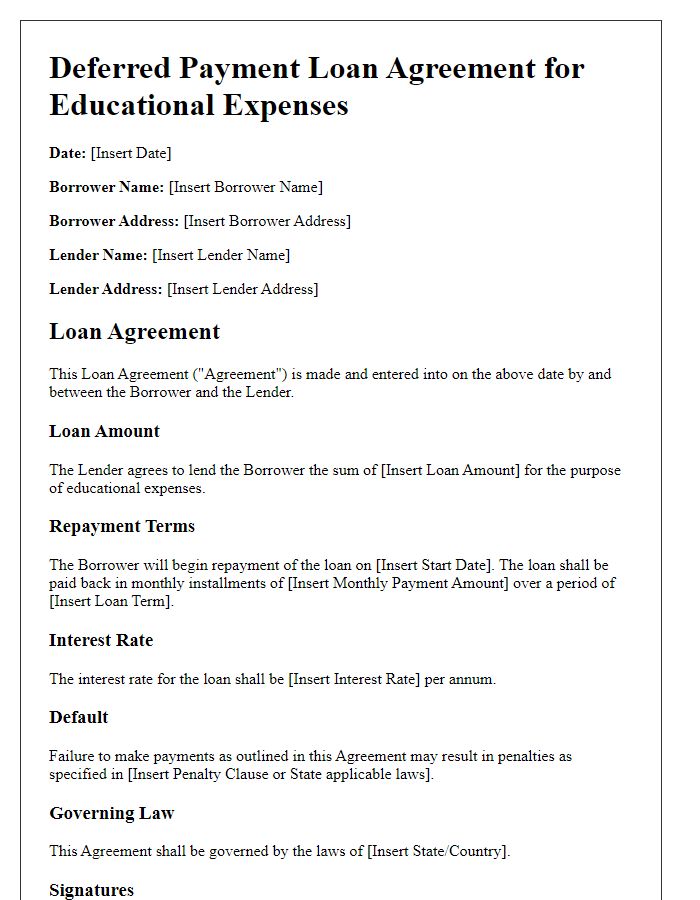

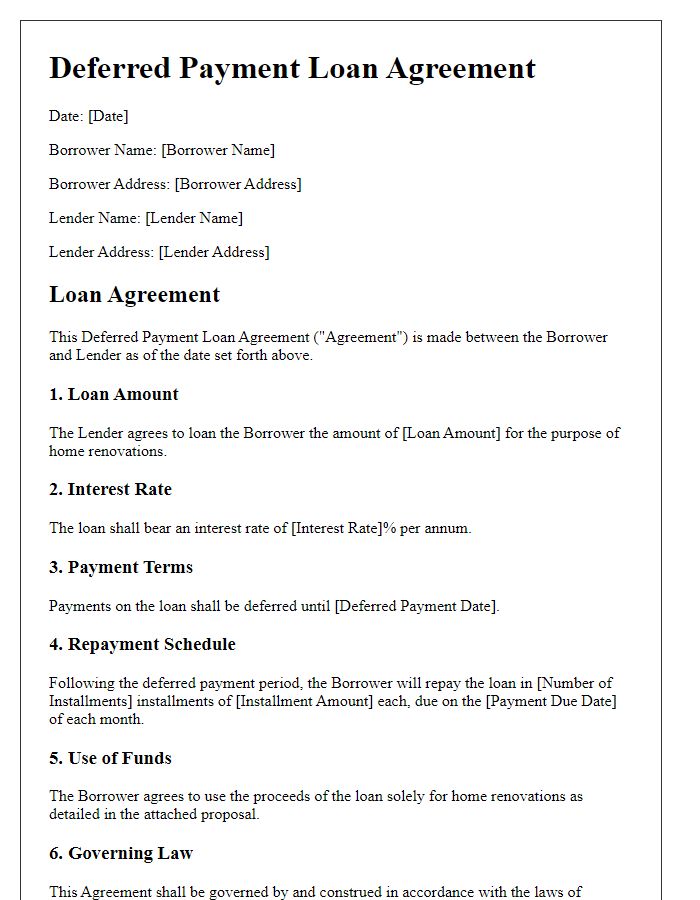

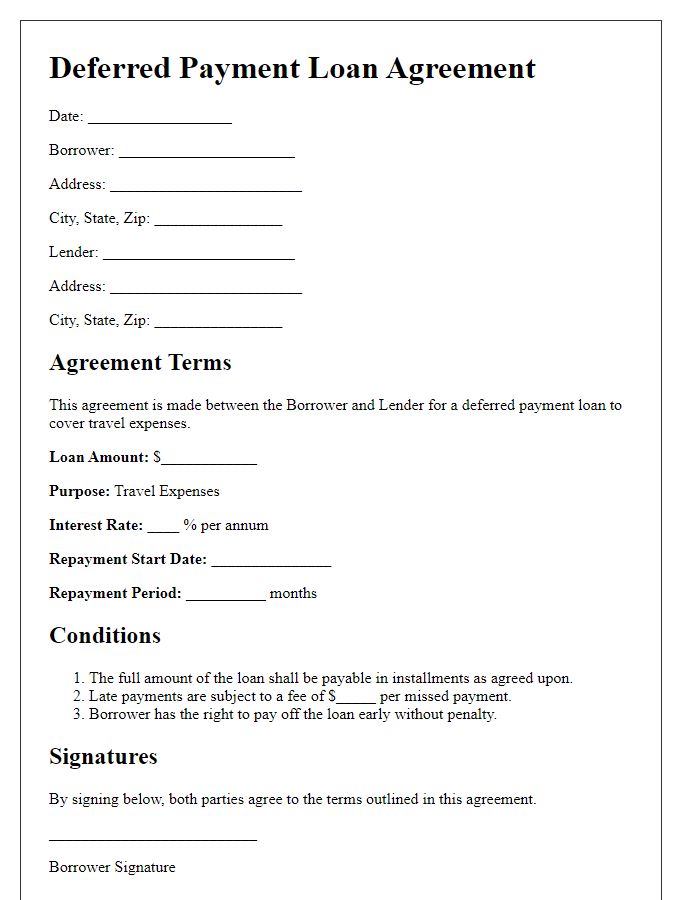

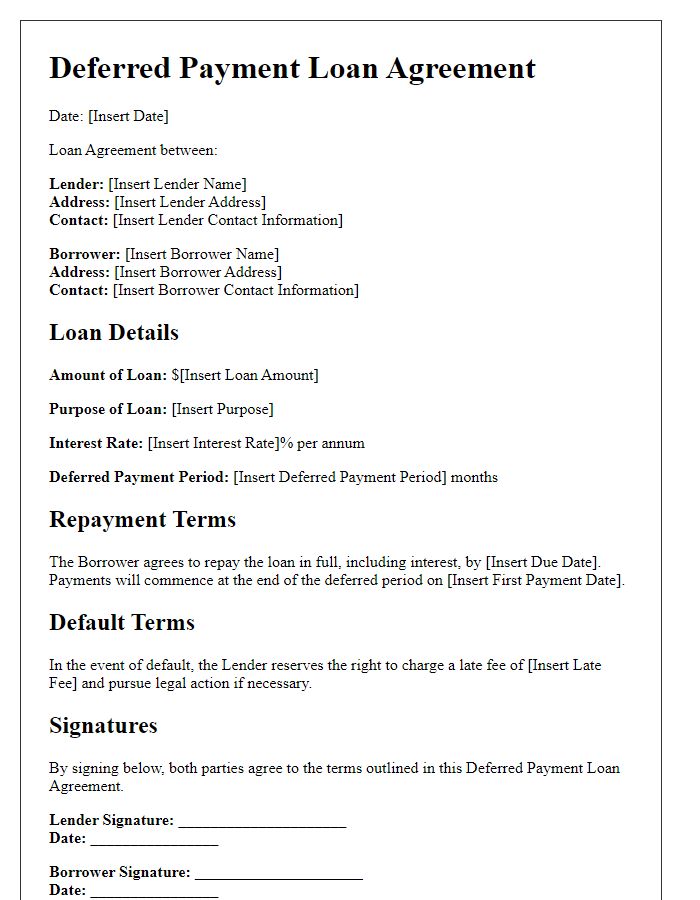

Borrower and Lender Information

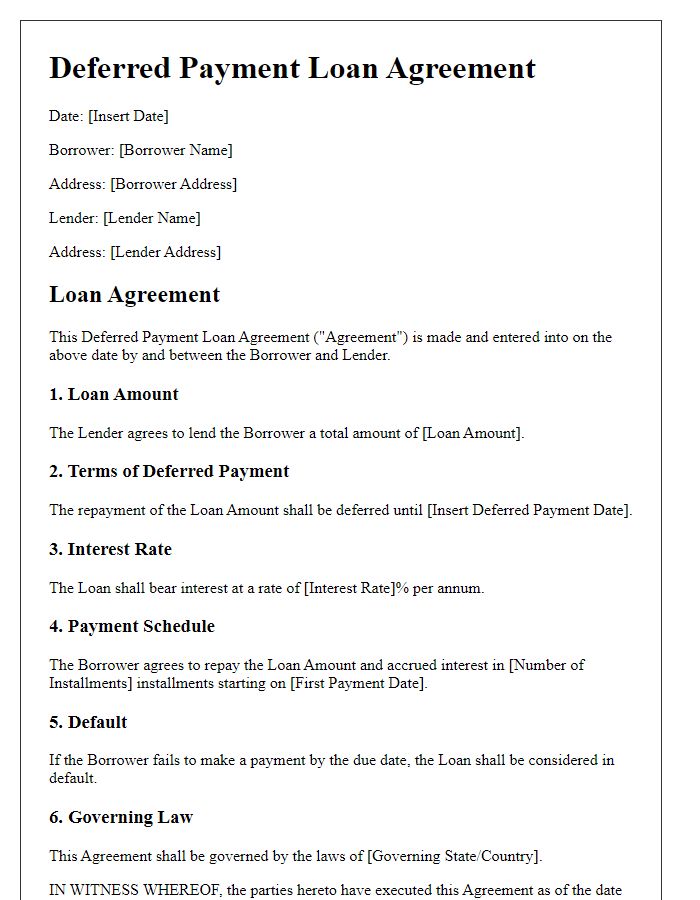

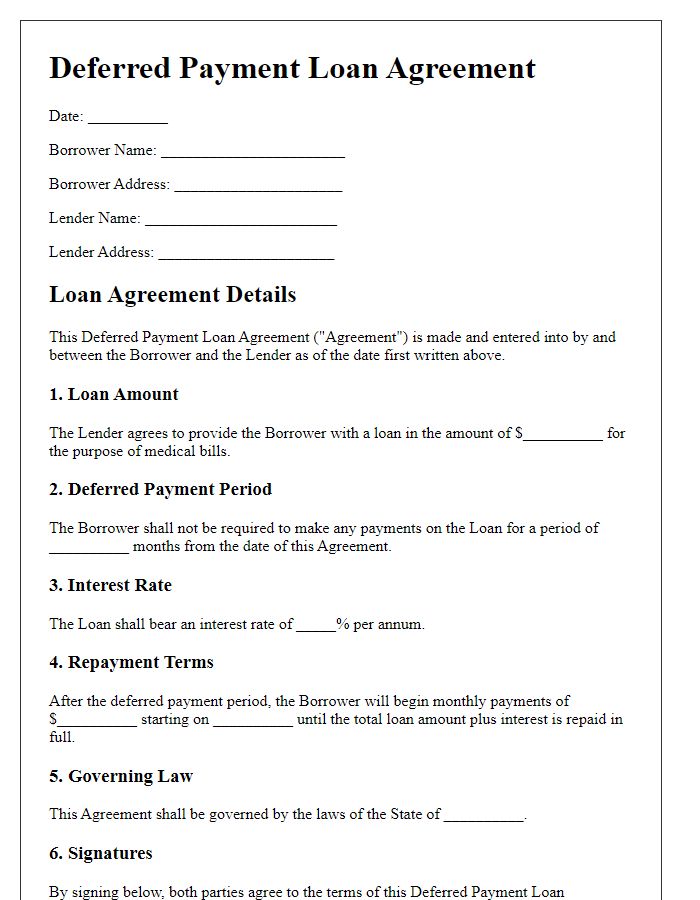

The deferred payment loan agreement states essential details about the Borrower, typically an individual or business seeking funds, often including their name, address, and identification numbers such as Social Security or Tax Identification Number (TIN). The Lender, usually a financial institution like a bank or credit union, is identified with its name, address, and required regulatory information. The document outlines the specific terms of the loan, including the total loan amount, interest rate (often expressed as an annual percentage rate), and the length of the deferment period, which can range from a few months to several years, depending on the agreement. The terms also specify the repayment schedule, detailing when payments will begin and the frequency of those payments (monthly, quarterly, etc.). Additionally, any fees associated with the loan, such as origination fees or late payment penalties, are clearly delineated, ensuring both parties are aware of their financial commitments.

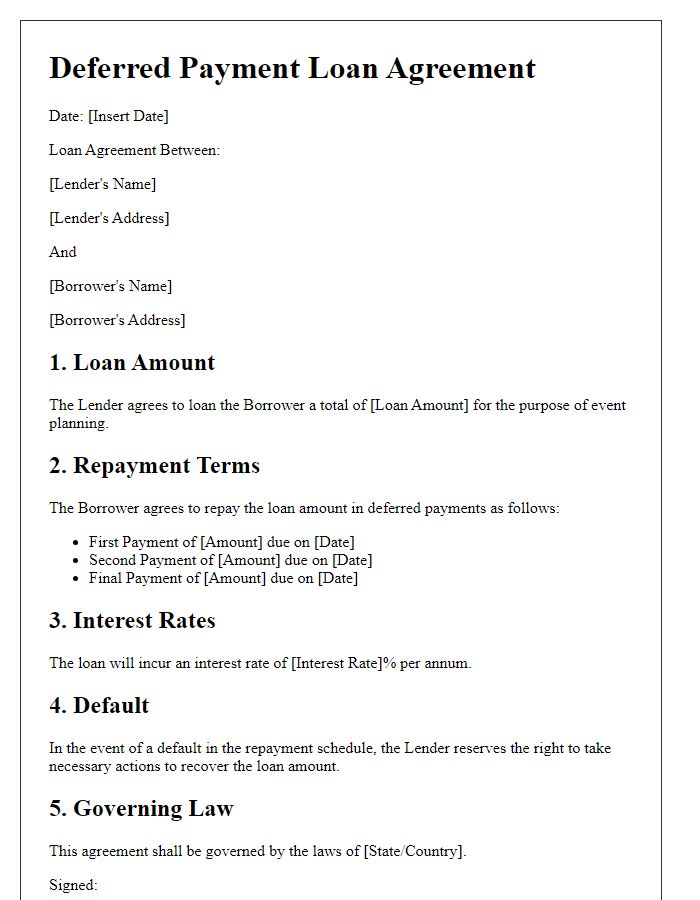

Loan Amount and Terms

A deferred payment loan agreement specifies a loan amount along with distinct terms that dictate repayment. Loan amounts can range widely, often falling between $1,000 to $50,000, depending on the lender's policies and the borrower's creditworthiness. Key terms might include an interest rate, which could be fixed or variable, typically between 5% to 20%. The repayment period often spans from 1 to 10 years with specific monthly payment amounts due. Additionally, there are clauses detailing late fees, default consequences, and prepayment penalties, ensuring the borrower understands their obligations. Overall, this agreement provides clarity and protects the interests of both the lender and borrower throughout the loan term.

Interest Rate and Repayment Schedule

Deferred payment loan agreements typically include essential financial details to ensure clarity between the lender and borrower. Interest rates should be specified, usually expressed as an annual percentage rate (APR), reflecting both fixed and variable variations based on current market trends. Repayment schedules outline the frequency of payments, which could occur monthly, quarterly, or annually, detailing the duration of the loan, commonly ranging from 1 to 30 years, depending on the amount borrowed. Additional terms may include any fees associated with late payments, conditions for prepayments, and consequences of defaulting on the loan, ensuring both parties understand their obligations and rights under the agreement.

Default and Late Payment Penalties

Late payment penalties can significantly impact borrowers engaged in deferred payment loan agreements, particularly in commercial financing. Typically, a borrower may incur fees of 5% of the overdue amount if payments are not received within a grace period of 15 days. Continuous defaults can lead to additional consequences, including increased interest rates, which could rise from 4% to 7%, depending on the lender's terms. Locations such as New York City, where regulations on debt collection are stringent, may impose restrictions on penalty amounts or methods. Borrowers facing financial difficulties may consider negotiating with lenders to modify terms, potentially avoiding the harsh impacts of default. Understanding the specific clauses in the loan agreement regarding default and penalties is crucial for ensuring compliance and maintaining financial stability.

Signatures and Notary Acknowledgment

In a deferred payment loan agreement, signatures are crucial for validating the commitment of both parties involved, the lender and the borrower. Each party must provide their signature, demonstrating their consent to the terms outlined within the agreement. The notary acknowledgment serves as an official verification process, confirming the identities of the signatories. Typically, this involves a licensed notary public who witnesses the signing, ensuring that the agreement has been executed voluntarily and without coercion. Such a procedure is often required for legal enforceability, particularly in jurisdictions where specific loan agreements are regulated by law. This formal acknowledgment adds an additional layer of protection against potential disputes, reinforcing the authenticity and seriousness of the contractual obligations.

Letter Template For Deferred Payment Loan Agreement Samples

Letter template of deferred payment loan agreement for business financing.

Letter template of deferred payment loan agreement for educational expenses.

Letter template of deferred payment loan agreement for home renovations.

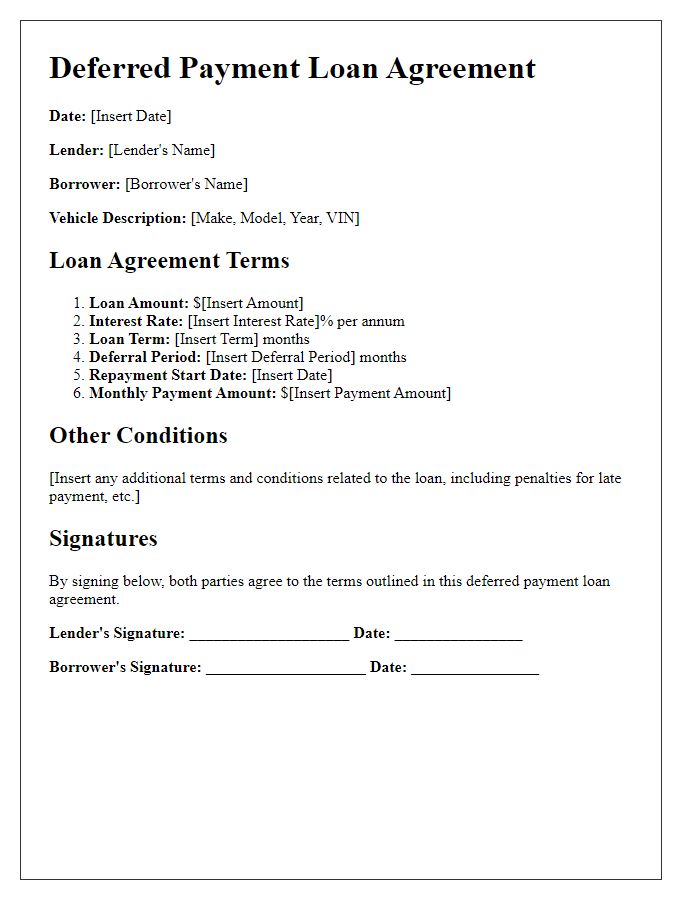

Letter template of deferred payment loan agreement for vehicle purchase.

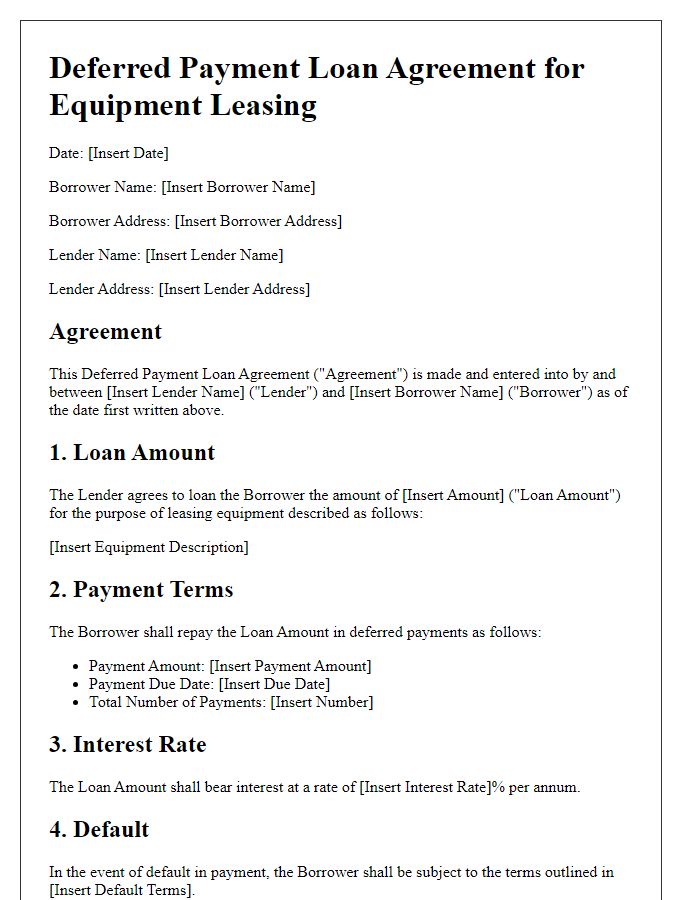

Letter template of deferred payment loan agreement for equipment leasing.

Comments