Are you feeling overwhelmed by an outstanding loan amount that just doesn't add up? It's not unusual to encounter discrepancies in loan statements, and addressing them can feel daunting. In this article, we'll guide you through the essential steps to dispute an outstanding loan amount effectively, ensuring your concerns are heard and understood. Dive in as we unravel this process and empower you to take control of your financial situation!

Borrower Information

Outstanding loan amounts can lead to significant financial disputes, particularly for borrowers. Detailed borrower information includes personal identification such as full name, social security number, and contact details. Loan specifics include original loan amount, interest rate, term length, and repayment schedule. Documentation may encompass loan agreements, payment history, and correspondence from lenders regarding the disputed amount. Accurate records of payments made and outstanding balance verification are essential in resolving discrepancies. Clear communication with the lender, adhering to dispute resolution timelines, and applicable consumer protection laws are paramount to ensure borrower rights are protected.

Loan Account Details

Disputes regarding outstanding loan amounts require careful review of loan account details, including principal amount, interest rate, payment history, and remaining balance. Loan Account Numbers track financial agreements, ensuring clarity in disputed figures. Examination of amortization schedules provides insights on payments applied towards principal versus interest. It is crucial to investigate discrepancies in monthly statements, which may highlight missed payments or miscalculations detrimental to the borrower's financial standing. Engaging with loan servicers or financial institutions on the matter is essential for resolution, ensuring all documentation maintains accuracy throughout the dispute process.

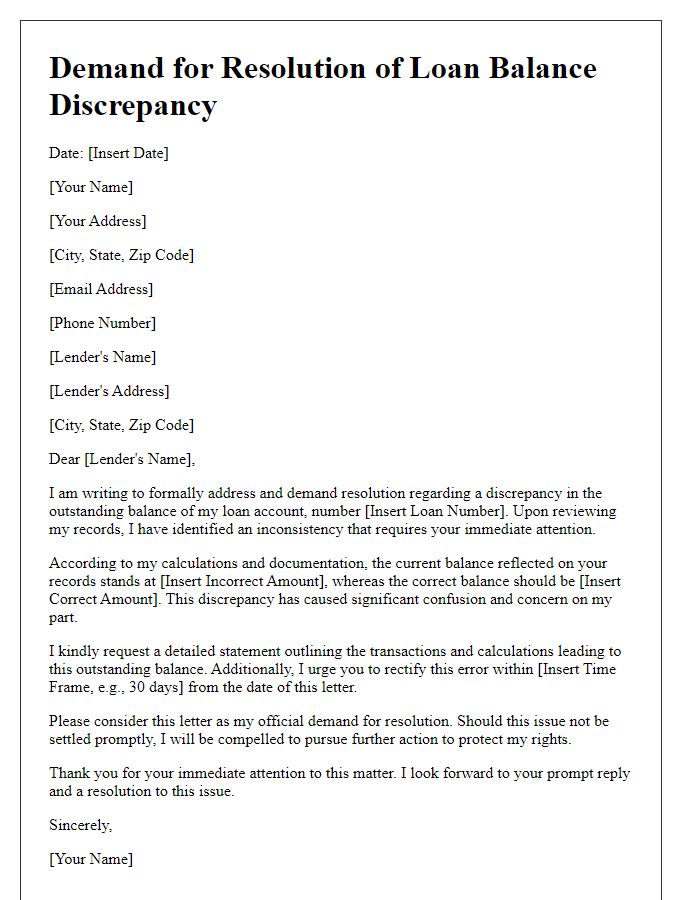

Disputed Amount and Explanation

Disputed loan amounts can stem from various reasons, such as billing errors or misapplied payments. In financial institutions, discrepancies often arise during loan servicing, particularly with amortization schedules or interest calculations. For instance, a borrower may notice an outstanding amount of $5,000 on a mortgage issued by XYZ Bank. This could be due to incorrect application of payments or adjustments not communicated effectively. Documentation from previous payment records or statements plays a crucial role in substantiating claims. A detailed explanation outlining the timeline of payments and the specific amounts in dispute enhances clarity and supports resolution efforts. An accurate and methodical approach can assist in addressing the issue efficiently and restoring the borrower's account standing.

Evidence and Documentation

Outstanding loan amounts often lead to disputes that require meticulous evidence and documentation to resolve effectively. Loan agreements detail terms such as interest rates (often ranging from 5% to 30% depending on the lender and borrower creditworthiness) and repayment schedules, outlining specific monthly payments. Invoices (which can include transaction dates and amounts) serve as proof of payments made, while bank statements can validate these transactions. Additionally, correspondence records with lenders (such as emails or letters detailing discussions about the loan) are critical in establishing communication history. Gather all relevant receipts, notice of default (which indicates the borrower has failed to meet repayment obligations), and credit reports reflecting the loan status to substantiate the dispute and aid in negotiations. Providing comprehensive documentation ensures a clearer understanding of the loan situation and may impact any legal considerations if the dispute escalates.

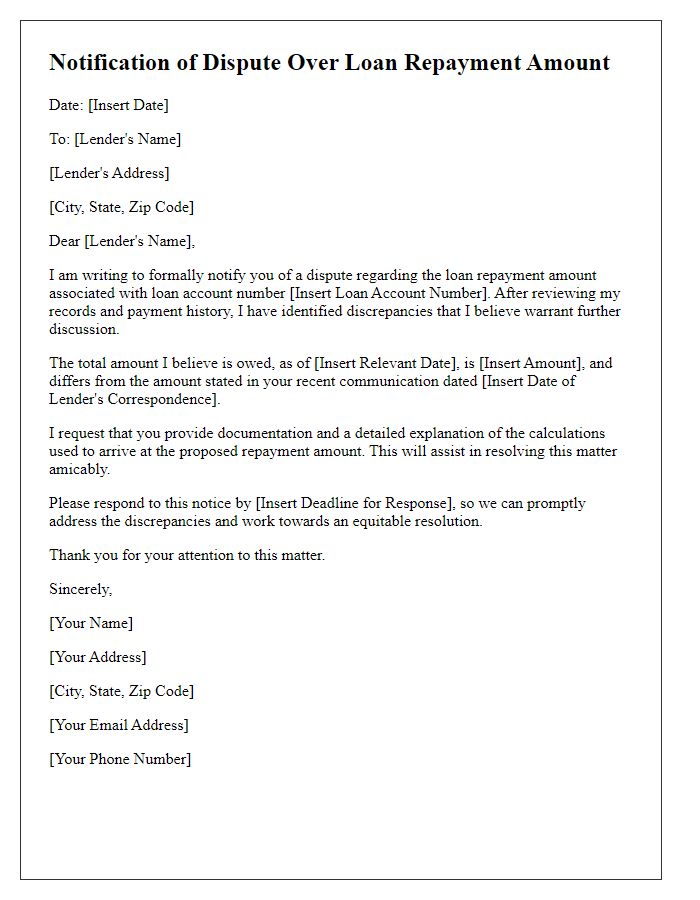

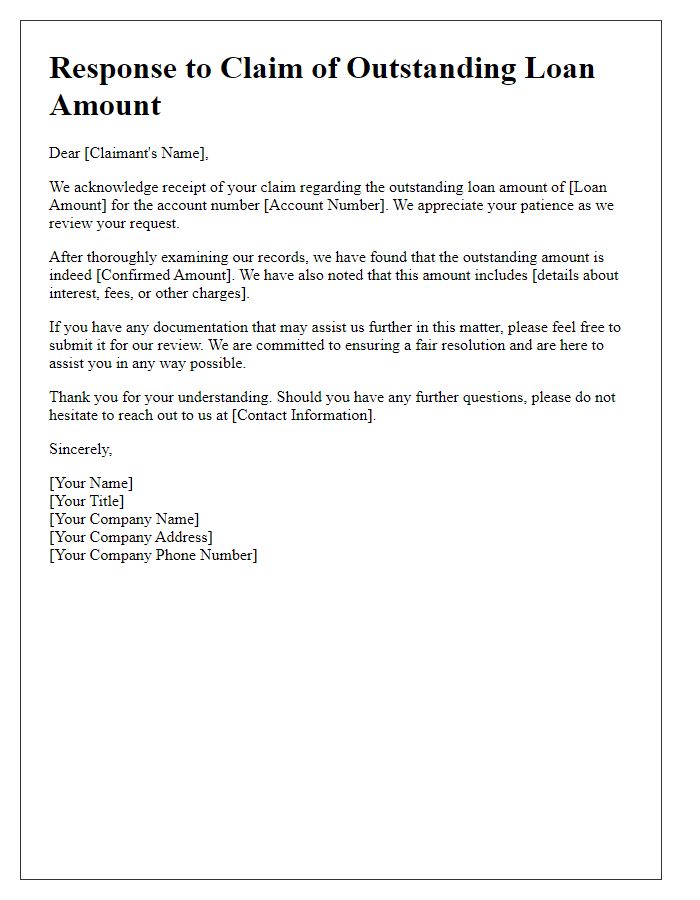

Requested Action and Resolution

Disputes regarding outstanding loan amounts can significantly impact financial health. A borrower may review loan documents, account statements, and past payment history to identify discrepancies. Engaging with the lending institution, such as a bank or credit union, could involve submitting a formal dispute letter outlining specific concerns. Key components to address include loan origination date, original loan amount, payment terms, and interest rates. Providing relevant supporting evidence such as receipts, canceled checks, or correspondence can strengthen the case. A clear request for investigation and resolution should be articulated, emphasizing the importance of resolving the matter swiftly to avoid negative impacts on credit scores or further legal implications.

Letter Template For Outstanding Loan Amount Dispute Samples

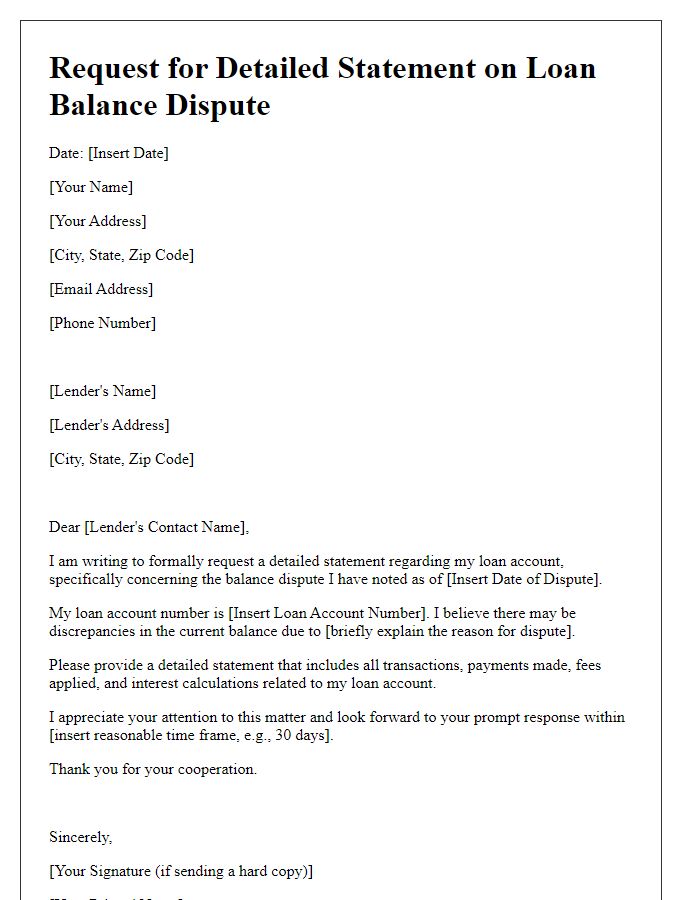

Letter template of request for detailed statement on loan balance dispute

Comments