Are you considering an unsecured loan but unsure where to start? Navigating the world of loans can be overwhelming, especially with the multitude of options available. Understanding the details of your application and what lenders are looking for can make all the difference in securing the funds you need. Join us as we dive deeper into the specifics of unsecured loan applications and offer valuable tips to streamline your inquiry process.

Clear subject line

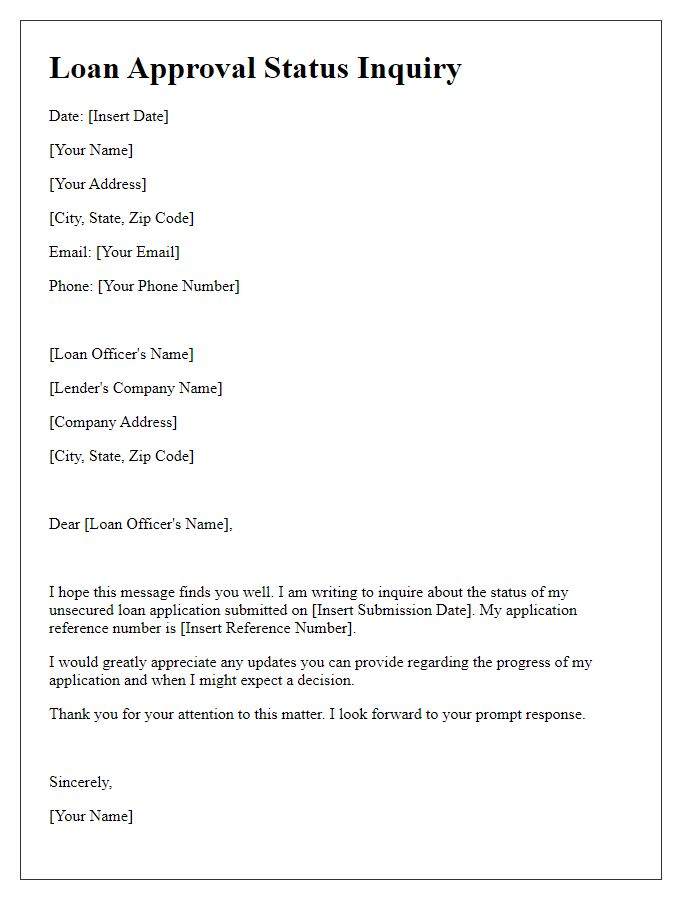

Unsecured Loan Application Inquiry: Request for Information and Guidance

Personal introduction

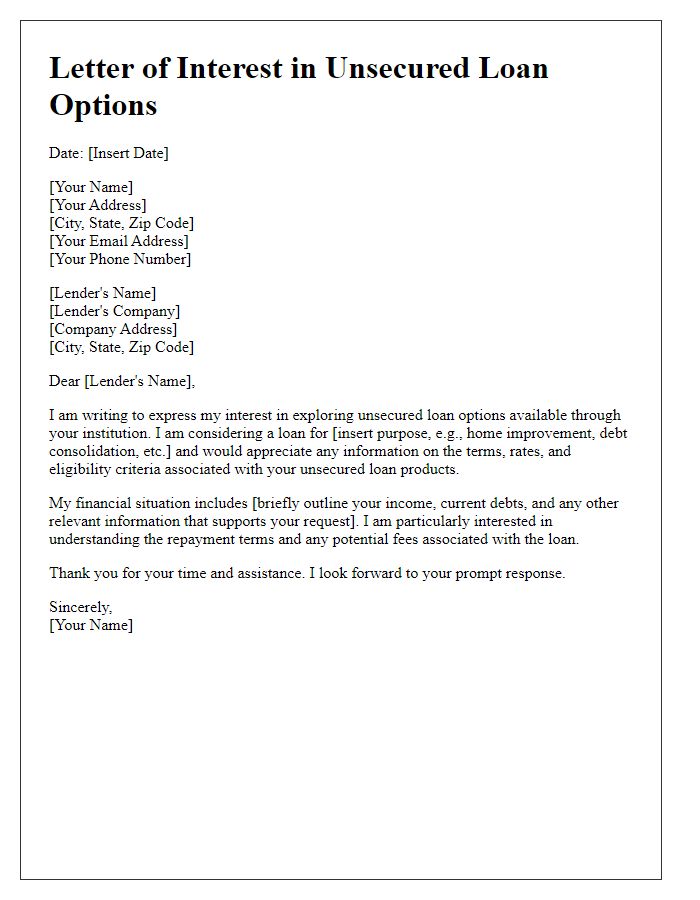

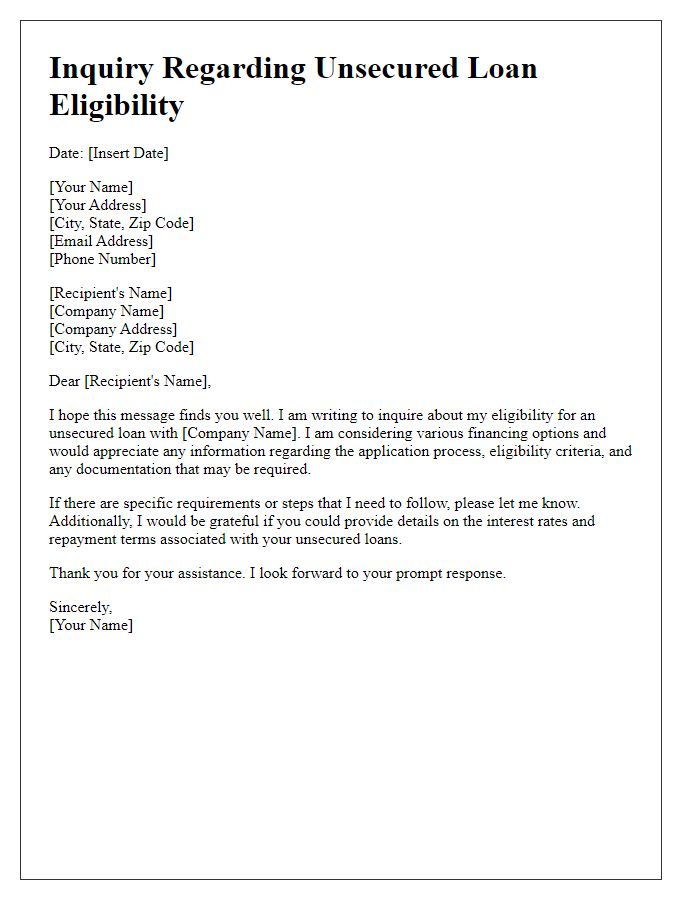

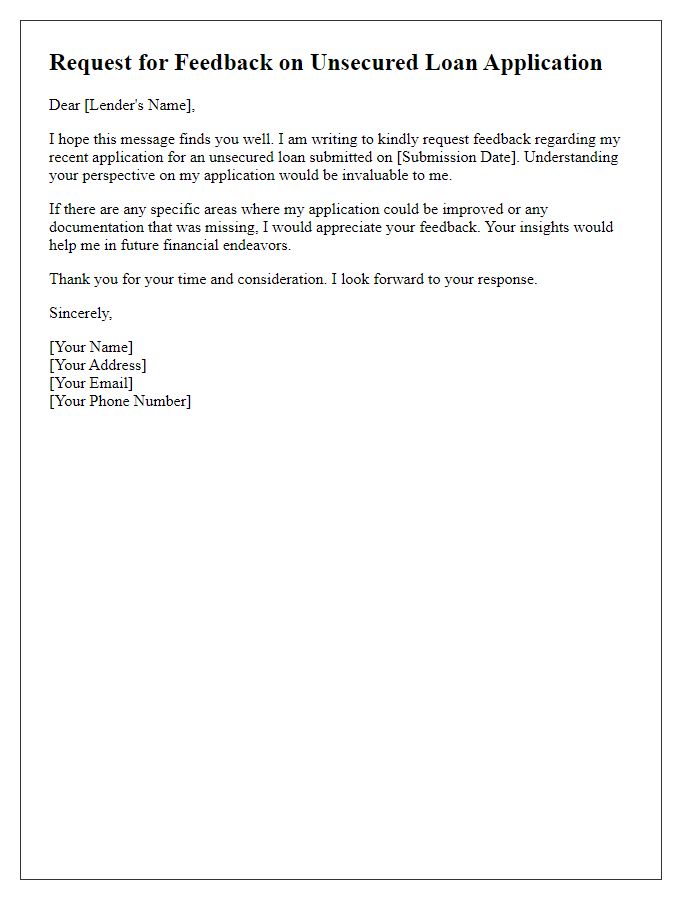

An unsecured loan application inquiry involves assessing financial options without requiring collateral. Individuals often approach banks or credit unions seeking personal loans for various purposes, such as debt consolidation, home improvements, or unexpected medical expenses. The process typically requires information about income, credit score, and employment history to determine eligibility and interest rates. Lenders generally assess risk based on these factors, with competitive rates often influenced by the borrower's creditworthiness. Understanding the terms, such as repayment timelines and possible fees, is crucial for making informed decisions about unsecured loans.

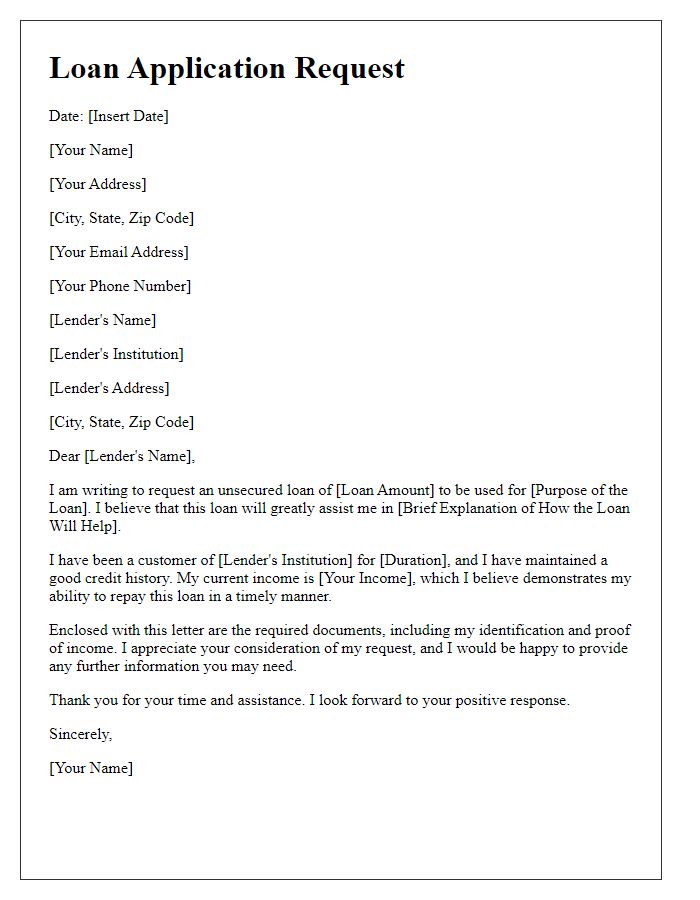

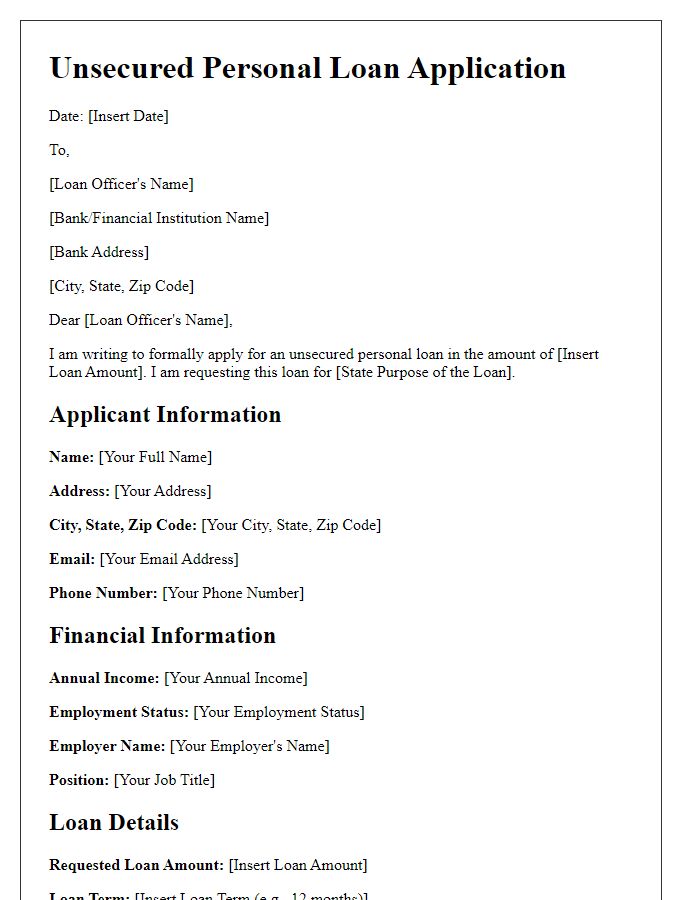

Detailed loan amount and purpose

Unsecured loans provide individuals with an opportunity to borrow funds without the need for collateral. A common approach is through financial institutions such as banks or credit unions. Inquire about specific loan amounts, often ranging from $1,000 to $50,000, depending on the lender's policies. The purpose of the loan can vary significantly, including debt consolidation, medical expenses, home improvements, or funding a small business. It is critical to provide accurate financial details, including credit history and income, as these factors directly influence loan approval and interest rates, which can range from 5% to 36% annually. Understanding the repayment terms, which typically span from one to five years, is essential for effective budgeting and management of financial obligations.

Comprehensive financial information

A comprehensive financial inquiry regarding unsecured loans typically includes a detailed analysis of an individual's income, credit history, existing debts, and overall financial stability. Key financial elements include the individual's monthly income, which is crucial for determining repayment capability; credit score, a numerical representation reflecting creditworthiness; and outstanding debts, such as mortgages or credit card balances, which indicate financial obligations. Additionally, assets such as savings accounts, investments, and property values play a significant role in assessing financial health. Lenders often require documentation like pay stubs or tax returns to validate this information, ensuring a complete picture of the applicant's financial situation before extending an unsecured loan.

Contact information and availability

Unsecured loan applications require specific documentation and information for processing. Applicants should prepare personal details such as full name, address, and date of birth. Financial information, including annual income and employment status, needs to be clearly stated. Additionally, providing contact information such as a phone number and email address is essential for timely communication. Availability for consultation can enhance the application process; suggest specific days and times for a representative to reach out. Clear and accurate information expedites assessments from financial institutions, helping applicants receive potential loan offers more efficiently.

Comments