Are you looking for a simple way to confirm your auto loan payoff? Writing a verification letter doesn't have to be a daunting task; it can be straightforward and effective. In this article, we'll guide you through creating a professional auto loan payoff verification letter that covers all the essential details. So, if you're ready to take the next step in your financial journey, keep reading!

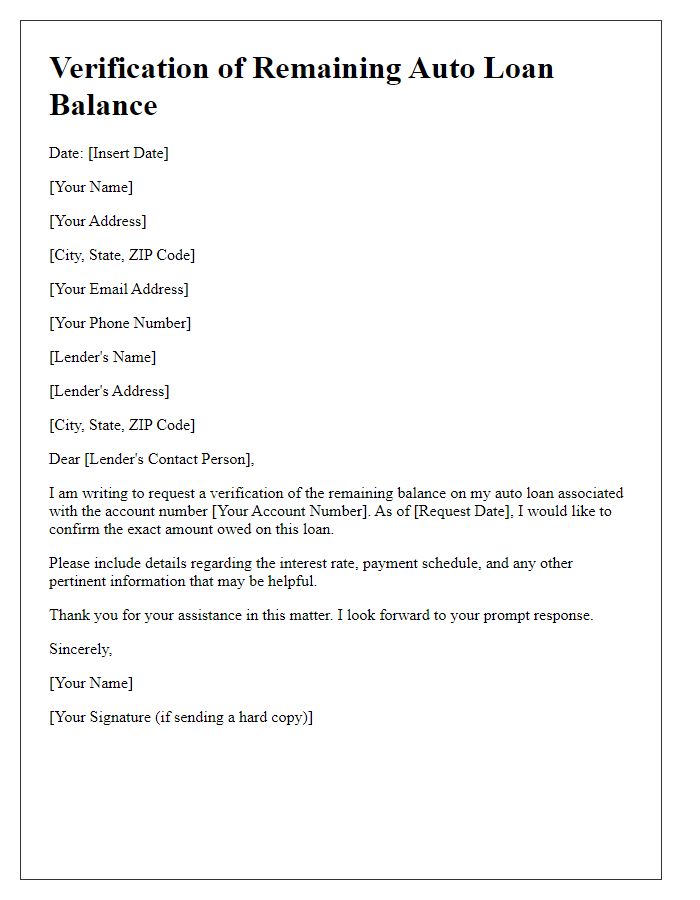

Borrower's full name and contact information

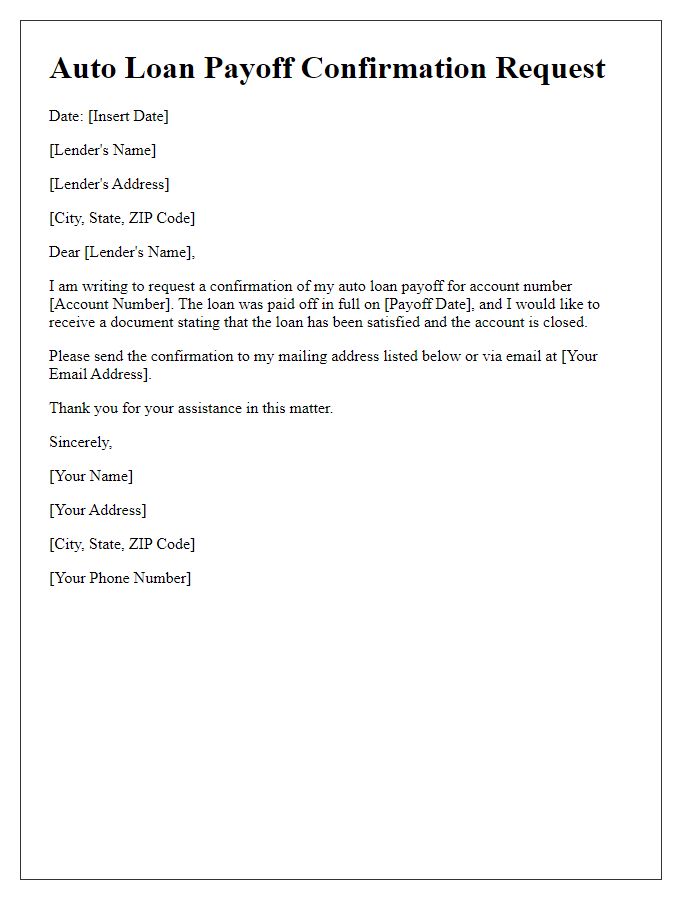

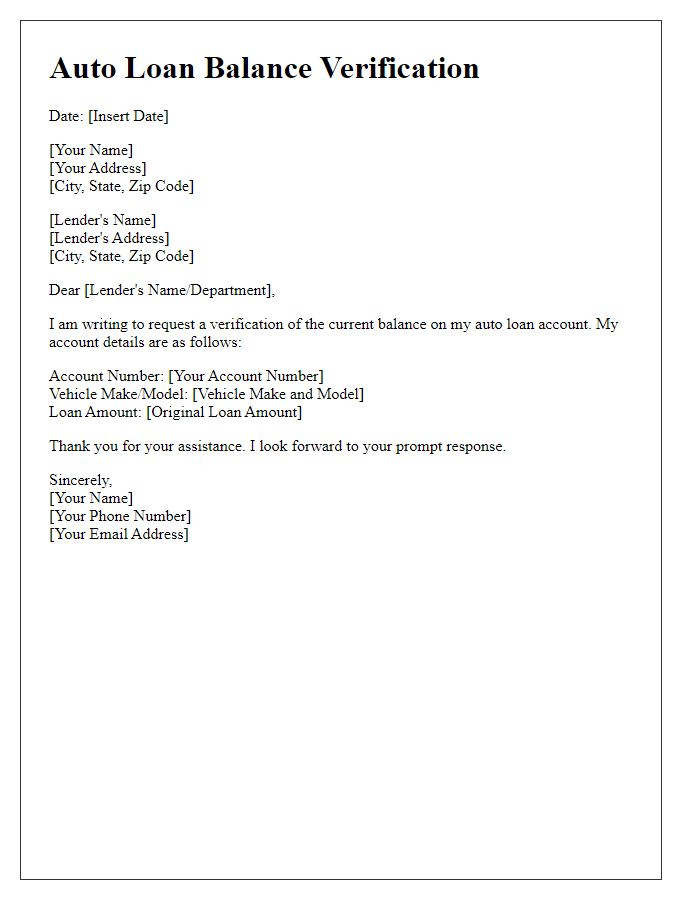

Auto loans, such as those obtained from financial institutions like banks or credit unions, often require verification of payoff amounts. Borrower's full name, which uniquely identifies the individual account holder, alongside accurate contact information, including phone number and email address, is crucial for seamless communication. Specific details about the loan, including account number and outstanding balance, ensures precise verification. Timely payoff confirmation is essential to avoid penalties or negative impacts on credit scores, especially in states like California where extra fees may apply upon loan closure. Proper documentation aids in resolving any disputes that may arise post-payment.

Loan account number

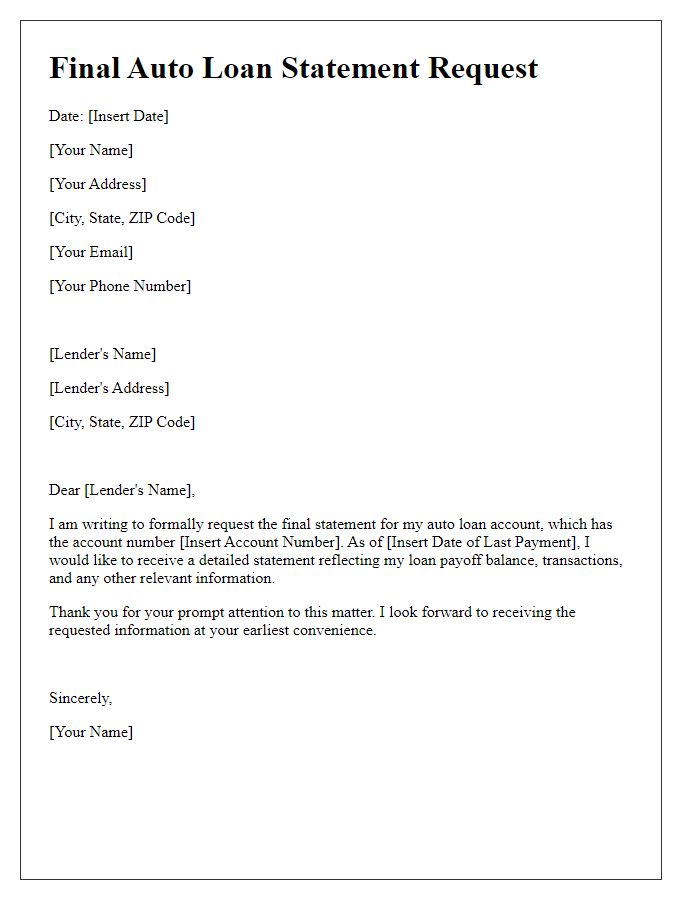

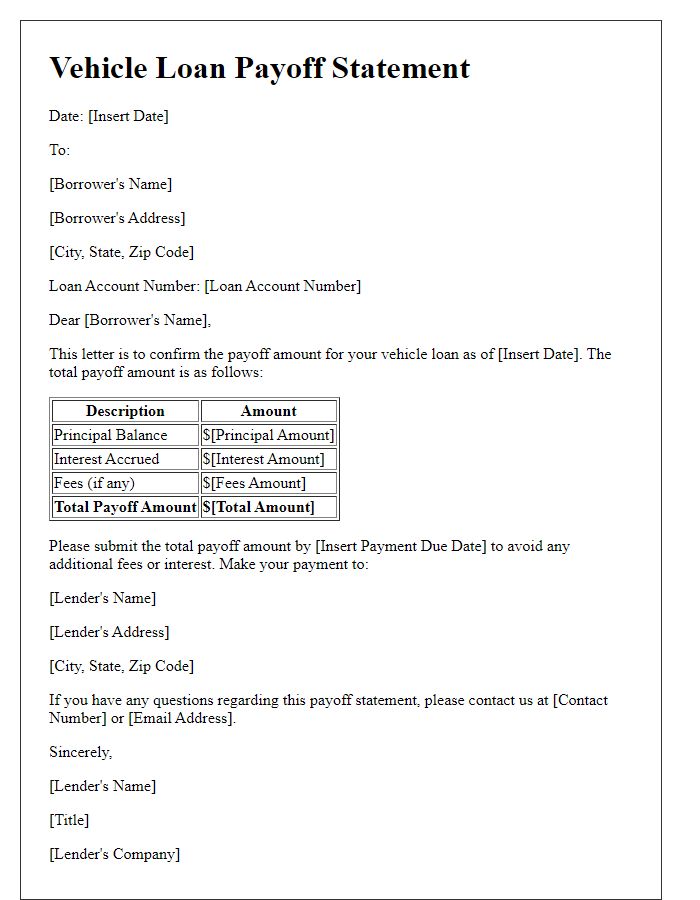

A detailed auto loan payoff verification request should include specific information such as the loan account number, usually a 10 to 15-digit identification code. This request is often made after either selling or trading in the vehicle (which may have occurred in a dealership). Borrowers should provide their personal information, including their name associated with the loan and contact details, ensuring financial institutions can locate the account efficiently. Specify the payoff amount, typically a sum due to fully settle the outstanding loan balance, and include a request for a written confirmation of this amount. This statement validates that the loan has been satisfied, which is essential for ownership transfer in various jurisdictions. Overall, clarity and completeness in detailing the loan account information greatly facilitate the verification process.

Vehicle identification details (make, model, VIN)

The auto loan payoff verification process requires thorough documentation to confirm the completion of payments on the vehicle. Essential details include the vehicle identification information, specifically the make (for example, Honda), model (such as Accord), and the Vehicle Identification Number (VIN), which is a unique 17-character code that acts as the vehicle's fingerprint. Accurate reporting of these details ensures proper association with the loan account, preventing any potential mix-ups during the verification process. For example, a 2018 Honda Accord with VIN 1HGCV1F12JA061234 needs to be clearly outlined to facilitate the seamless conclusion of the auto loan obligations.

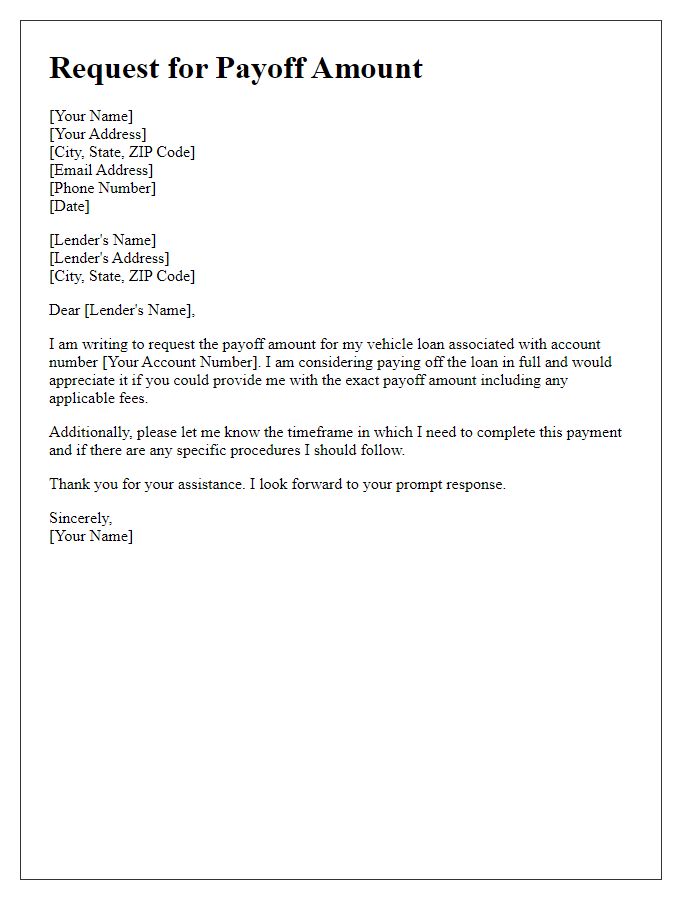

Request for official payoff amount and payment instructions

Auto loan payoff verification involves requesting an official payoff amount from the lender, along with detailed payment instructions. This process is crucial for individuals seeking to clear their auto loan, ensuring that they understand the exact balance remaining on their loan, which typically includes principal, interest, and any applicable fees. The inquiry should specify the loan account number for clarity and identify the necessary payment methods accepted by the lender, such as electronic transfer, check, or wire transfer. Additionally, ensuring the request is directed to the correct department will facilitate a timely response, allowing for a smooth transaction and the satisfying resolution of the auto loan.

Contact details for follow-up or clarification

A clear and concise auto loan payoff verification may include the specific outstanding balance on a vehicle loan held by a lending institution such as Bank of America or Wells Fargo, along with the loan identification number. Essential dates such as the loan origination date (e.g., March 1, 2020) and the payoff date (e.g., June 30, 2023) should be noted. For any follow-up inquiries or clarifications, providing direct contact information for a loan servicing representative, including their email address (e.g., rep@bank.com) and phone number (e.g., 1-800-555-0199), is crucial for facilitating communication. Additional documentation like the payment history for the duration of the loan may enhance verification accuracy.

Comments