Are you on the journey to securing a secondary loan approval? We understand how important this step is in achieving your financial goals, and it can often feel overwhelming. That's why we've crafted a letter template that simplifies the process and helps you present your case more effectively. So, grab a cup of coffee and read on to discover how this template can pave your way to financial success!

Clearly stated purpose of the letter.

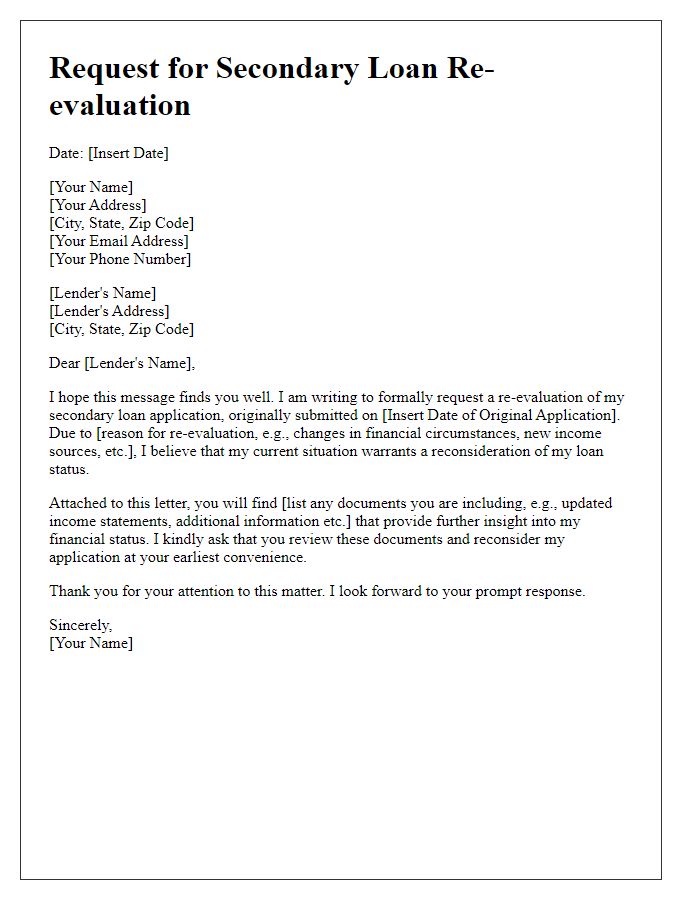

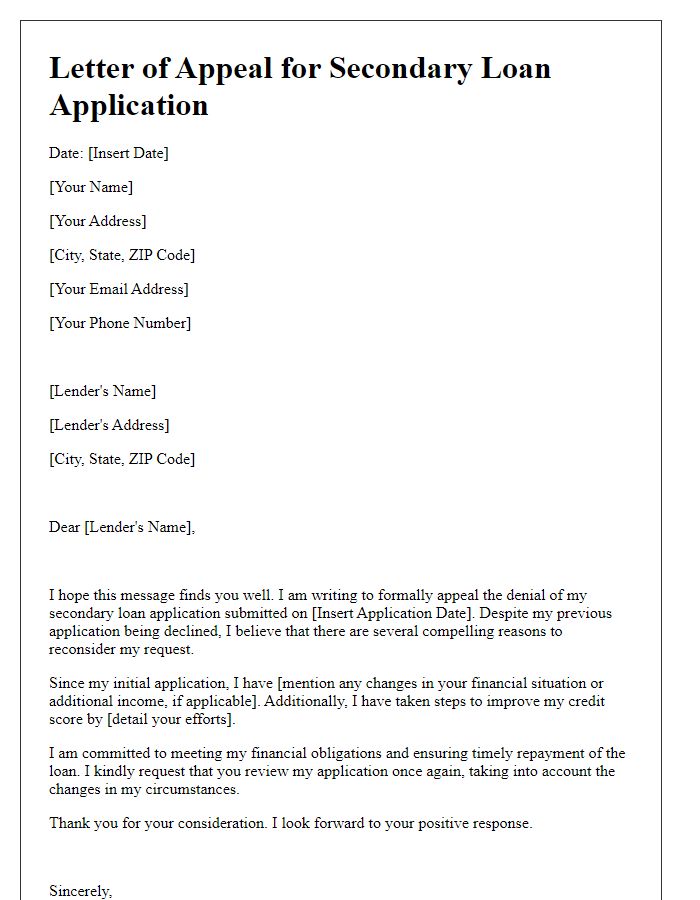

A secondary loan approval pursuit is crucial for financing opportunities, particularly concerning funding for renovations or unexpected expenses. This scenario often involves applying for a home equity line of credit (HELOC) or a personal loan to assist homeowners in areas such as residential property enhancements. The requested approval amount might be determined by the current market value of the home, appraised at $350,000, with a sought loan of $50,000 aimed at making significant upgrades. The recipient of the letter, typically a bank loan officer, plays a vital role in the approval process, ensuring compliance with lending standards and evaluating the borrower's financial history, creditworthiness, and existing debts to ascertain the feasibility of this additional financial support.

Detailed financial information.

Navigating the secondary loan approval process requires comprehensive financial documentation. Detailed financial information encompasses income statements, such as pay stubs and tax returns, which typically include the last two years of earnings for accurate assessment. Credit reports from agencies like Experian reveal credit scores, payment histories, and any outstanding debts, crucial for determining loan eligibility. Furthermore, asset statements detail bank account balances, investment portfolios, and real estate properties, providing lenders insight into the borrower's financial health. Debt-to-income ratios, calculated by comparing monthly debt payments to gross monthly income, play a significant role in evaluating repayment capacity. Clear documentation of liabilities, including existing loans and credit card debts, alongside an explanation of any financial fluctuations or significant expenses, strengthens the case for loan approval, showcasing responsibility and readiness for additional borrowing.

Justification for loan necessity.

A secondary loan approval pursuit is often driven by significant financial needs that require additional funding. For example, home renovations can enhance property value, while a figure of $30,000 may be necessary for a comprehensive kitchen remodel in a suburban area. Emergency medical expenses can also contribute to the necessity, where an average procedure cost of $15,000 can arise unexpectedly. Moreover, unforeseen job loss can lead to an immediate cash flow shortage, making an additional loan essential to cover living expenses such as rent or mortgage payments, typically averaging $1,500 monthly in urban regions. Securing this loan can provide much-needed relief and stability, allowing individuals and families to navigate through challenging financial situations effectively.

Evidence of creditworthiness.

Evidence of creditworthiness is crucial in securing secondary loan approval, particularly in large financial institutions such as Wells Fargo or JPMorgan Chase. Key factors include a credit score, which statistically ranges from 300 to 850, with scores above 700 considered favorable. Demonstrating a strong payment history on existing debts, such as regular payments on a mortgage or an auto loan, can significantly enhance credibility. Debt-to-income ratio (DTI), ideally below 36%, also plays a critical role, reflecting the percentage of monthly income that goes towards servicing debt. Documentation such as tax returns, bank statements, and employment verification letters further substantiates an individual's financial stability. Lenders, especially those focused on personal loans or mortgages, require a comprehensive analysis of these elements to evaluate the risk before granting additional credit.

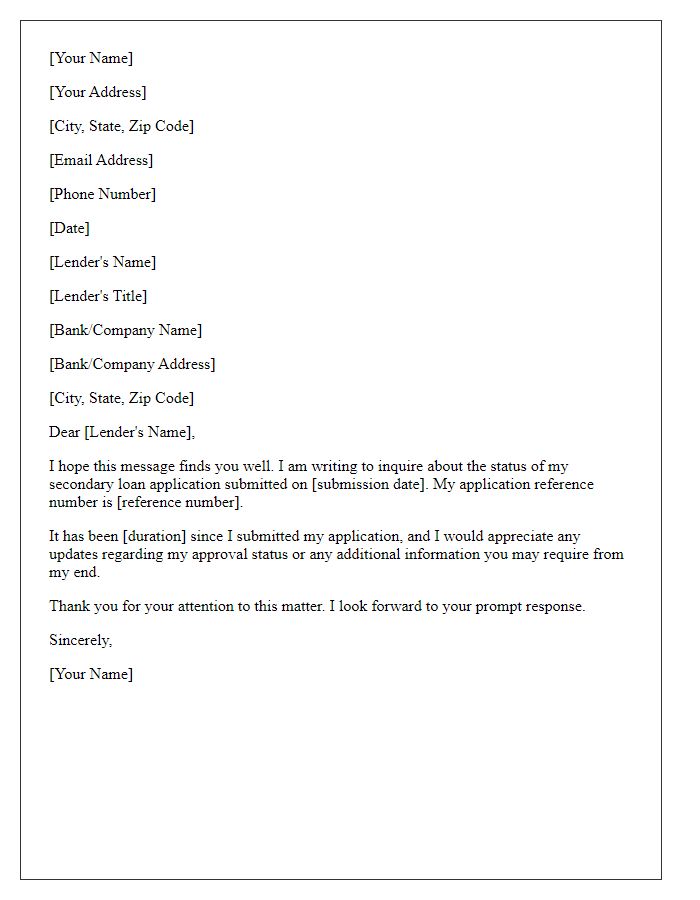

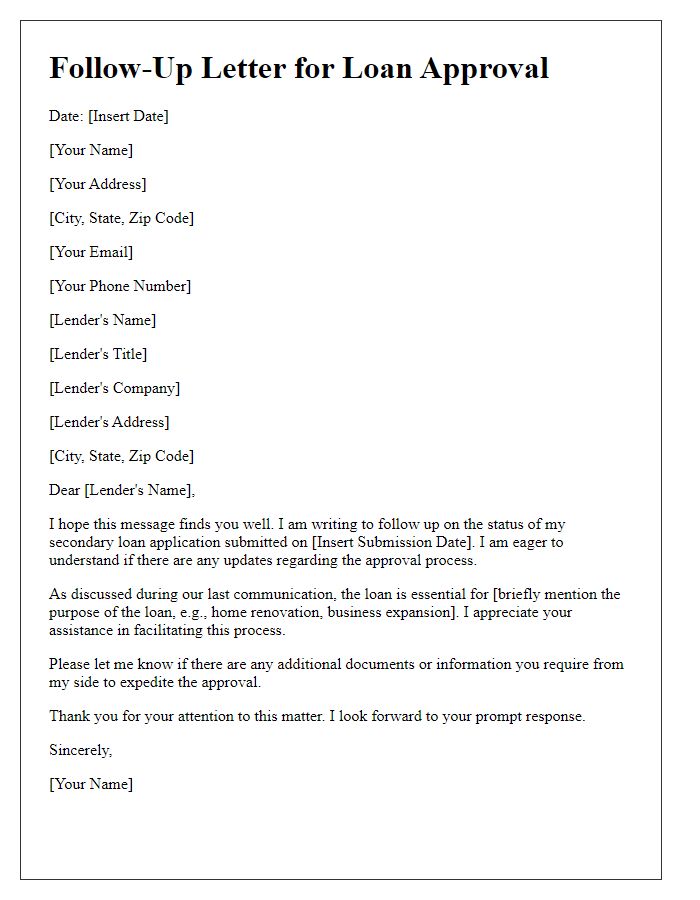

Contact information and closing statement.

Pursuing secondary loan approval requires precise communication. Clear contact information, including phone numbers (e.g., home vs. mobile) and email addresses, is crucial for prompt responses from lenders. Proper closing statements can emphasize gratitude and anticipation, reinforcing a positive relationship with the loan officer. Specify the desired loan amount, purpose, and timeline to clarify the request, ensuring all necessary documentation supports the appeal for secondary approval. It creates an organized approach, showcasing professionalism throughout the process.

Letter Template For Secondary Loan Approval Pursuit Samples

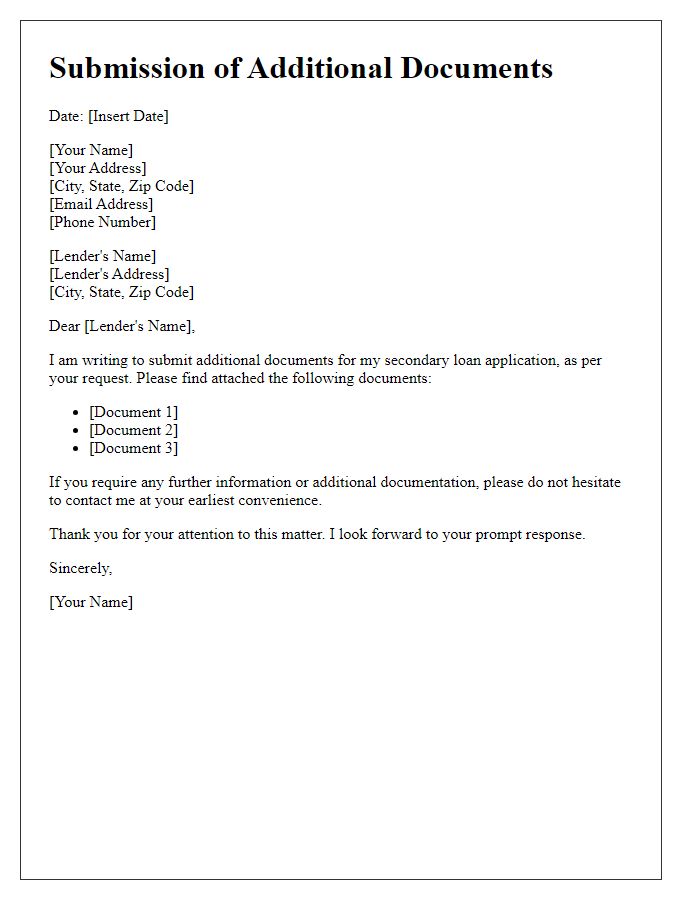

Letter template of submission for additional documents for secondary loan

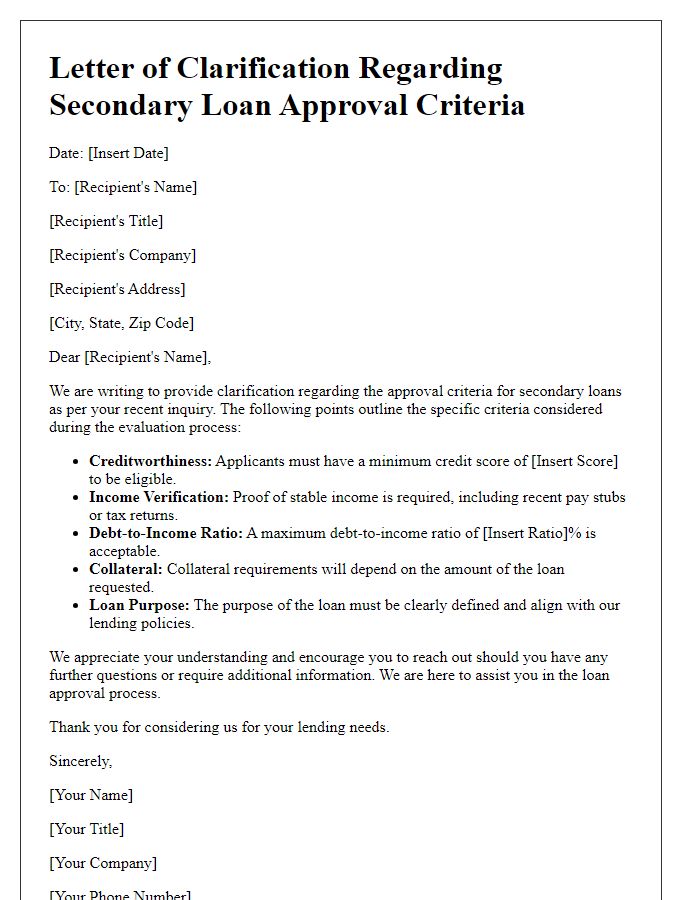

Letter template of clarification regarding secondary loan approval criteria

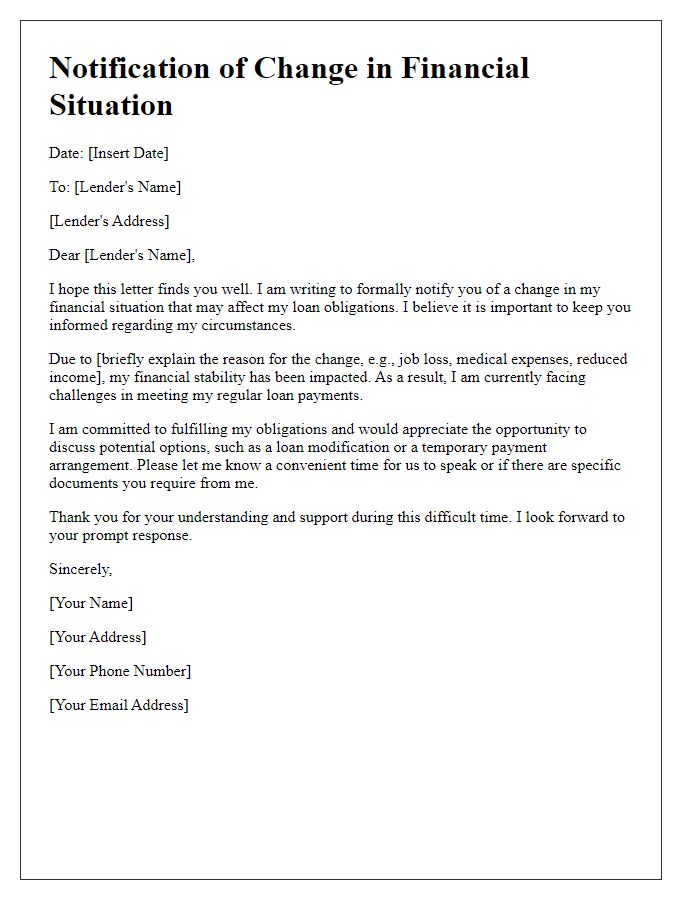

Letter template of notification for change in financial situation for loan

Comments