Are you feeling overwhelmed by your current loan payment plan and searching for a way to ease your financial burden? You're not alone; many people find themselves in a similar situation, seeking adjustments to make their payments more manageable. In this article, we'll explore a practical letter template that you can use to request a revision of your loan payment terms. So, if you're ready to take control of your finances and find a solution that works for you, read on!

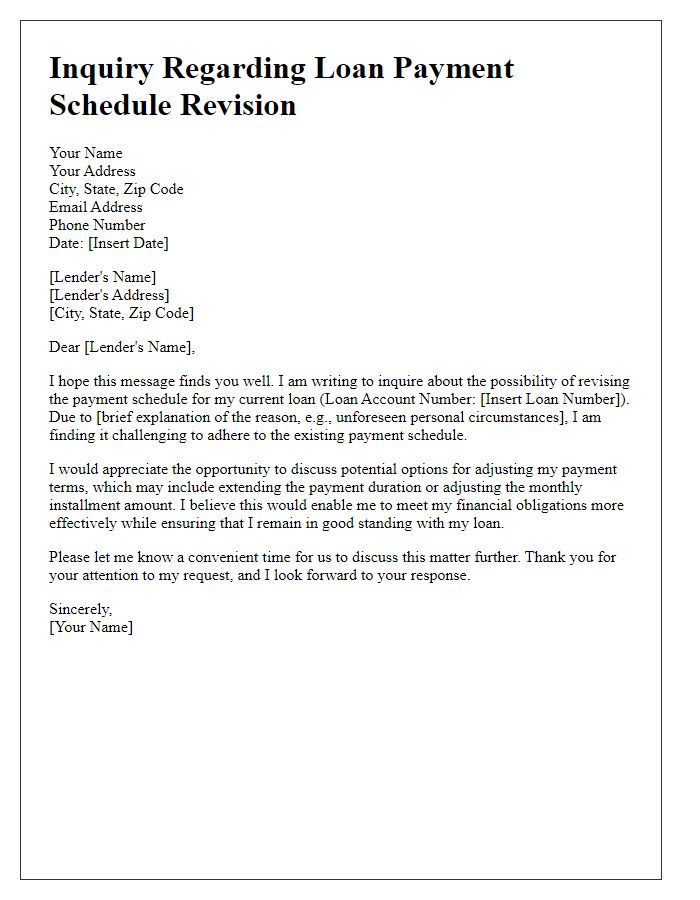

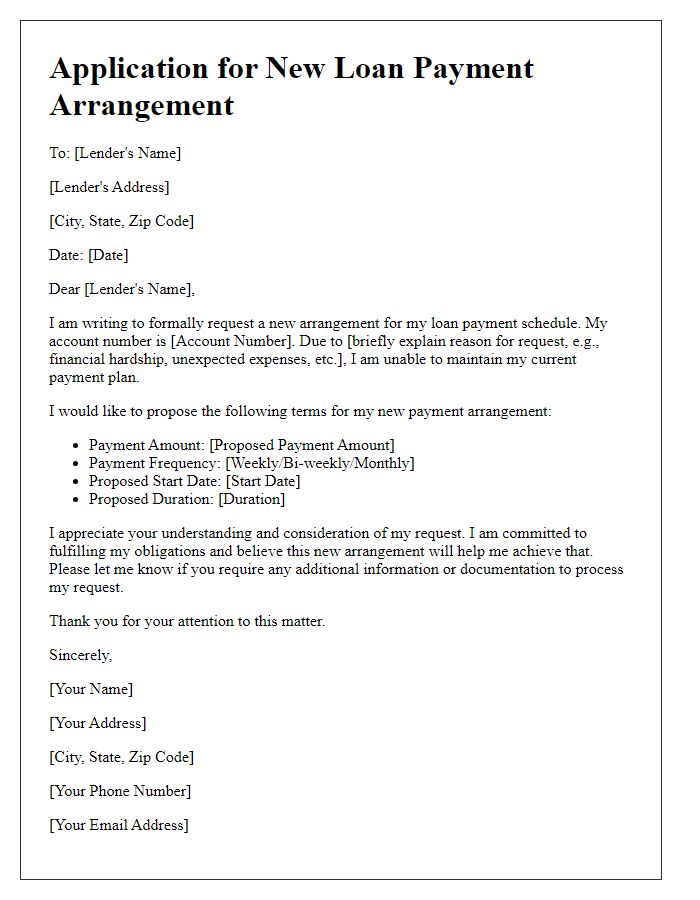

Clear Subject Line

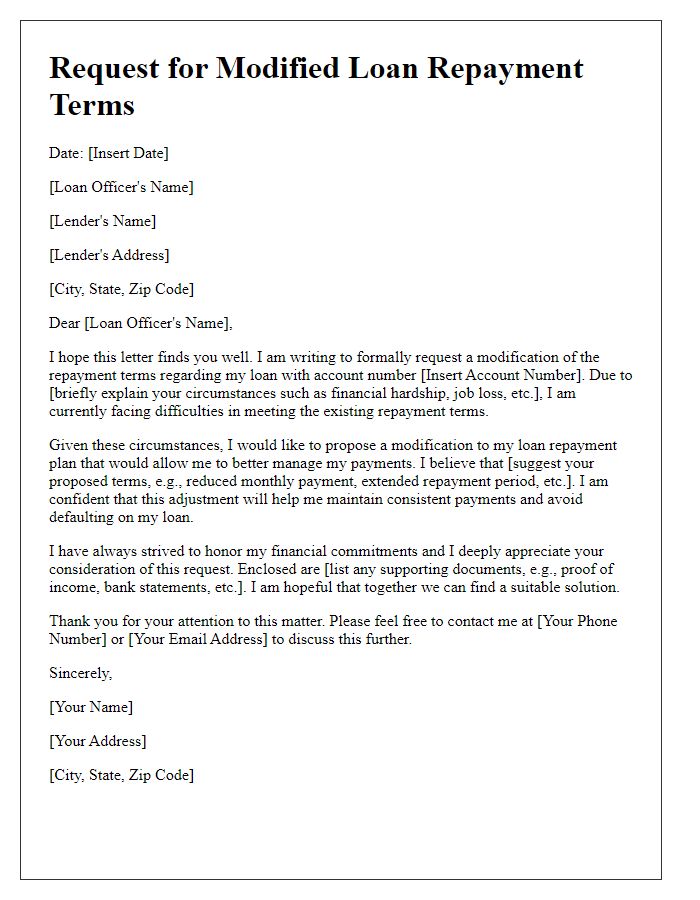

A loan payment plan revision is necessary for those facing financial challenges, such as unexpected medical expenses or job loss. Establishing a revised payment structure can provide relief and ensure timely repayments. Notable lenders, including major banks and credit unions, often offer options for adjustments, including temporary forbearance or reduced monthly payments. It is essential to communicate directly with the financial institution's customer service, provide necessary documentation, and clearly outline the reasons for the requested changes. Properly revising a loan payment plan can prevent further financial stress and maintain a positive credit history.

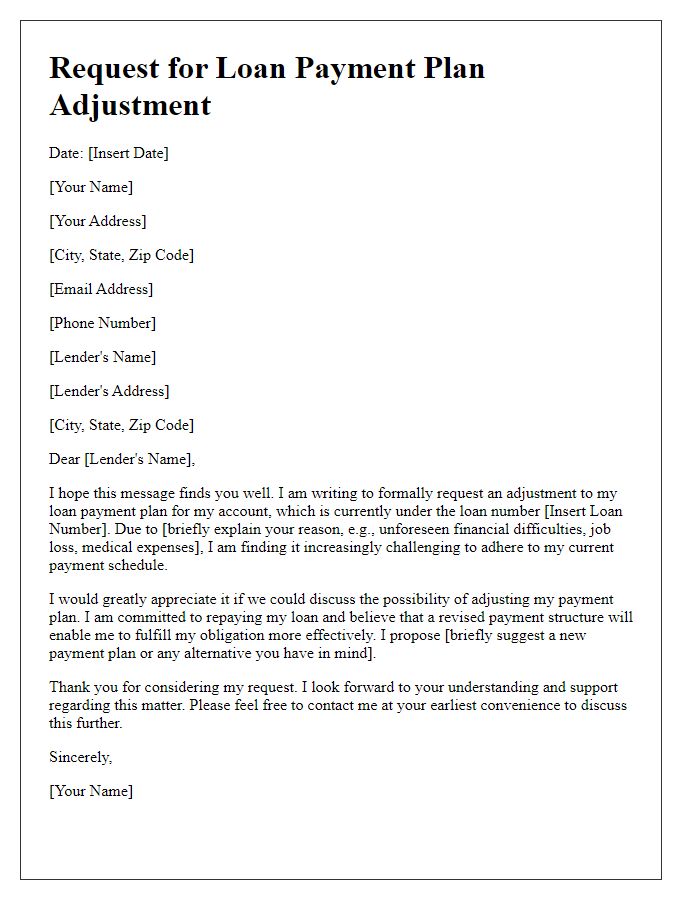

Applicant's Contact Information

An applicant's contact information includes essential details such as their full name, postal address, phone number, and email address. This information is crucial for maintaining effective communication between the lender and the borrower. For example, an applicant residing in New York City (ZIP code 10001) may provide a mobile phone number including the area code (like 212 or 646) and a personal email domain. Accurate contact information ensures timely updates regarding loan alterations or payment schedules, aiding in the overall management of the loan agreement.

Account Details

Account details for loan payment plans are crucial for ensuring accurate adjustments and timely transactions. Key identifiers include account numbers, which typically comprise 10-12 digits unique to each borrower, alongside the lender's name, such as Wells Fargo or Bank of America. The loan type, such as personal loans or mortgages, provides context for payment structures, often indicated in terms of fixed or variable interest rates, which can range from 3% to 10% annually. Payment schedules may occur monthly or bi-weekly, often specifying due dates to avoid late fees. Furthermore, the total principal amount, which may vary widely, affects the payment plan, commonly ranging from $1,000 to $500,000 based on individual financial needs. Noting these details ensures clarity and facilitates effective communication with the lending institution regarding revisions to the payment plan.

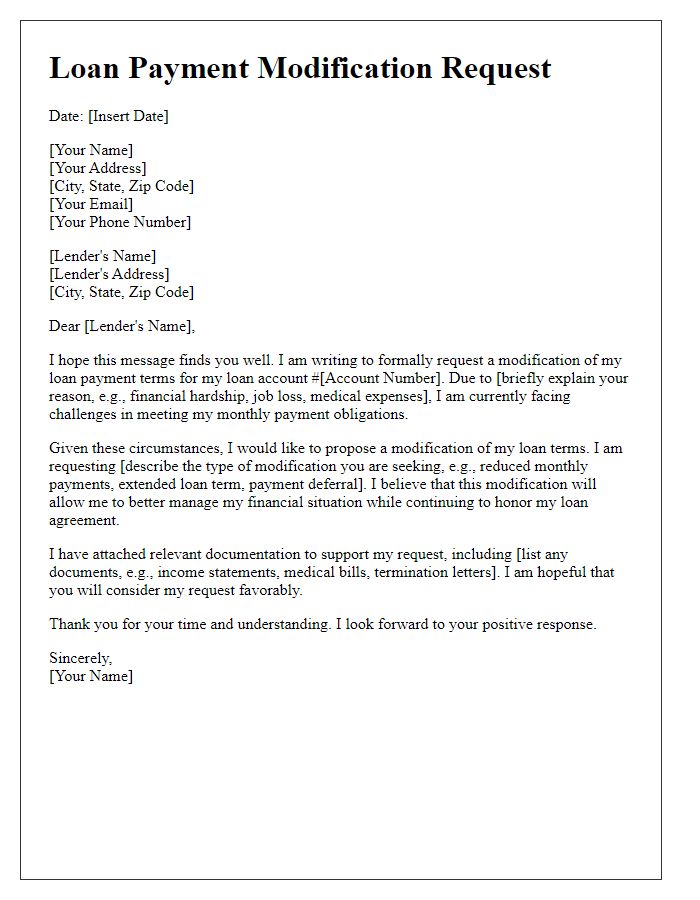

Loan Terms Request

Loan payment plan revisions are crucial for borrowers experiencing financial difficulties. Essential details include the loan amount, interest rate, and current monthly payment. Borrowers might request adjustments such as extended repayment periods to lower monthly payments. Specific financial events impacting payments often include job loss or medical emergencies. Lenders typically require documentation, like income statements or medical bills, for a comprehensive review. Keeping open communication with the lender is vital for a successful loan modification process. Properly formatted requests include borrower information, loan details, and clear explanations for the requested change.

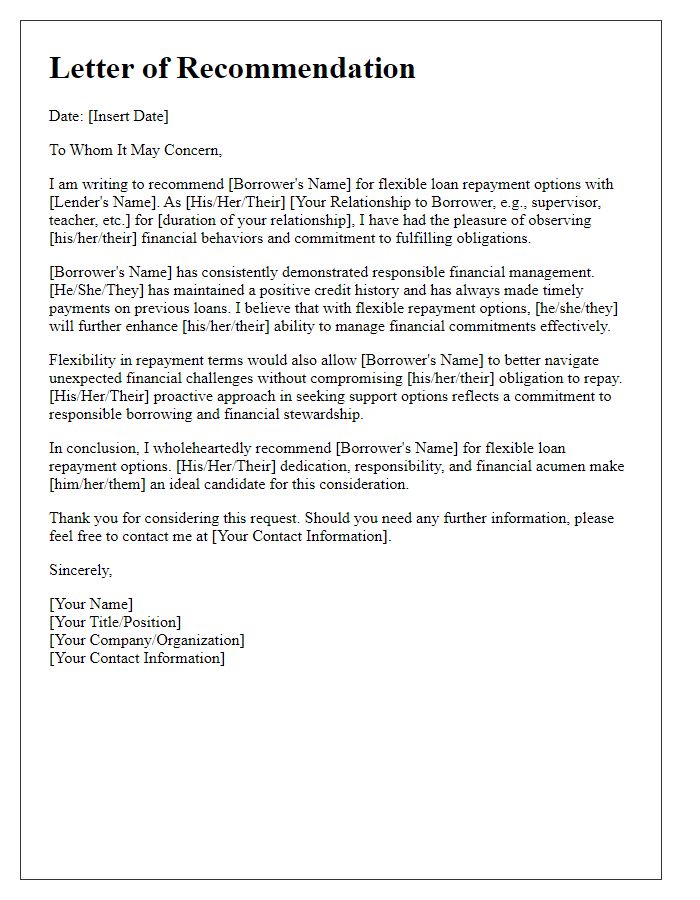

Supporting Financial Documents

Acknowledging the request for a loan payment plan revision often necessitates presenting supporting financial documents. Essential documents include recent pay stubs, typically from the last two months, tax returns from the previous year to demonstrate overall income stability, and a current bank statement showcasing monthly expenses. Additionally, a budget worksheet detailing income sources and expenditures assists in clarifying financial circumstances. If applicable, a letter of hardship explaining the reasons for the requested revision--like job loss or unexpected medical expenses--can provide further context. Providing these documents strengthens the application for changing the loan terms to more manageable levels.

Comments