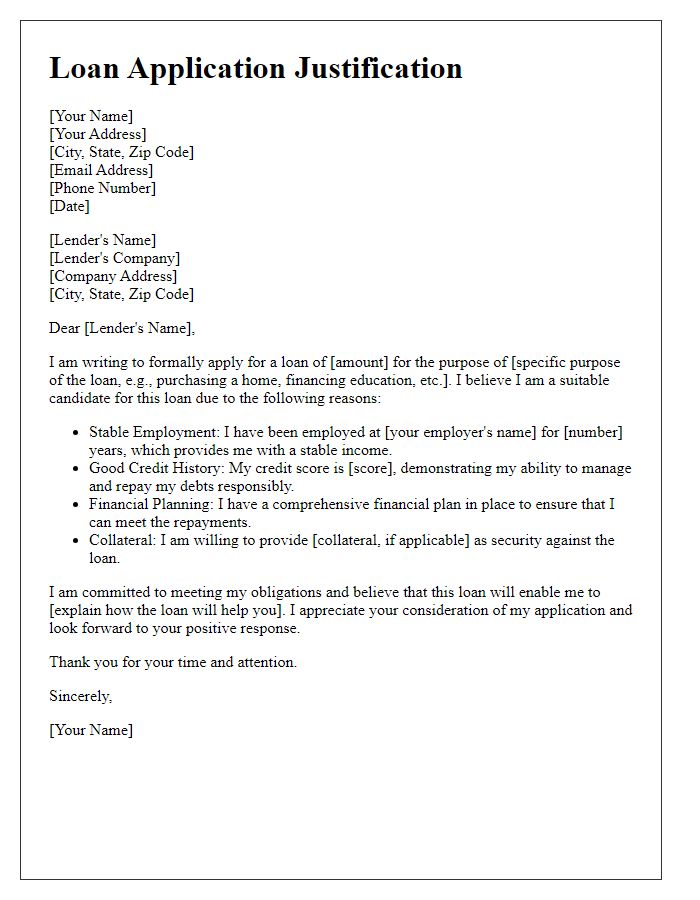

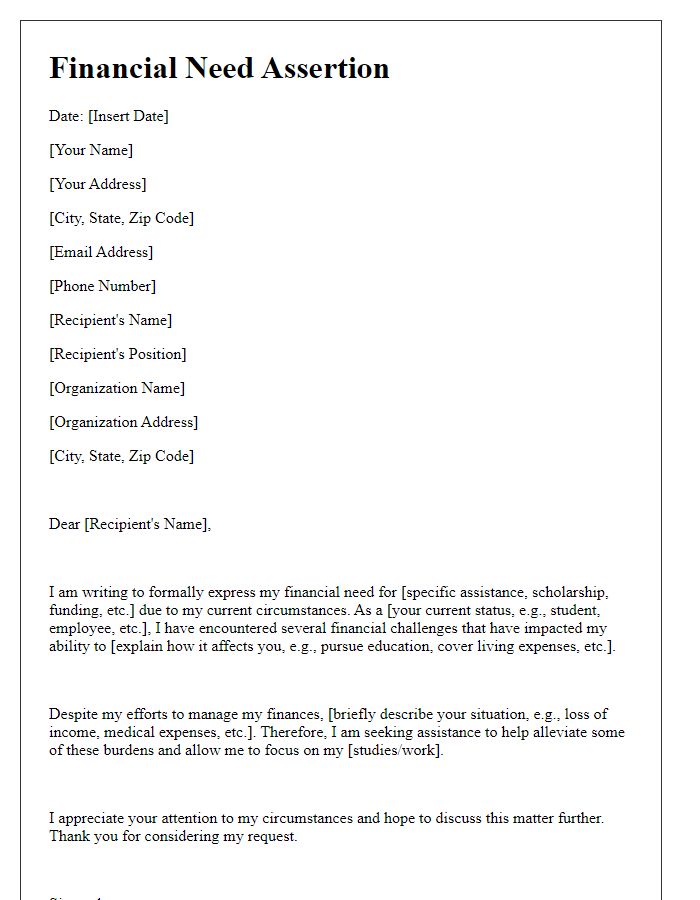

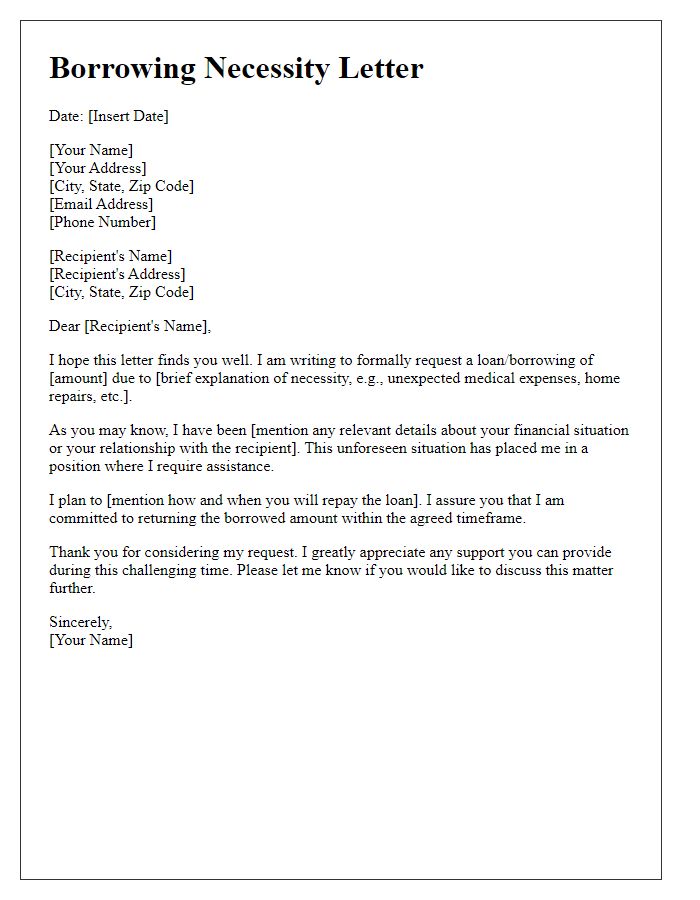

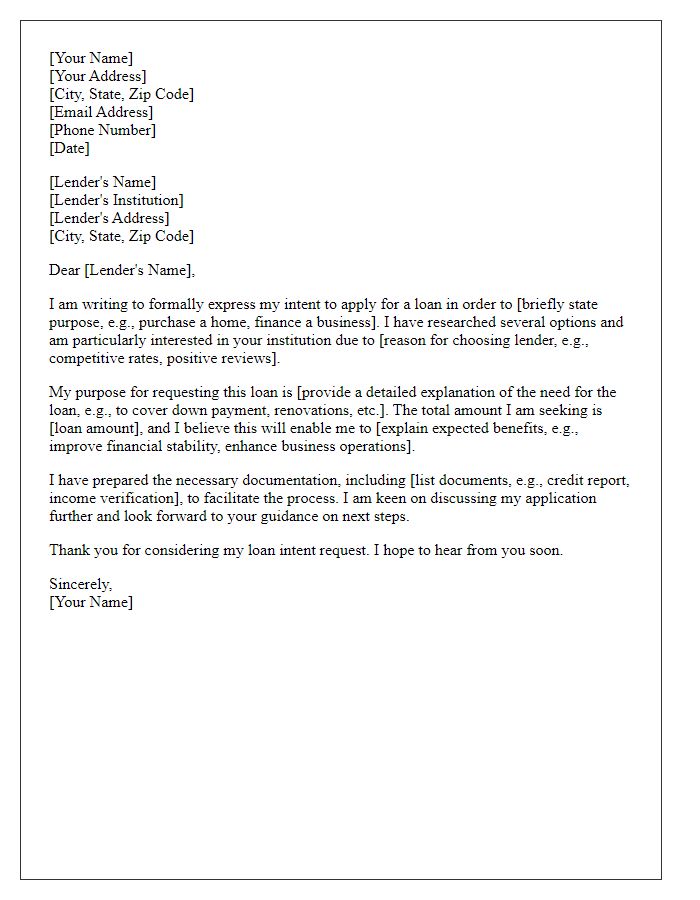

Are you considering taking out a loan and wondering how to articulate your purpose clearly? Writing a well-structured letter can make all the difference in conveying your intentions and enhancing your chances of approval. In this article, we'll explore how to draft a compelling loan purpose explanation letter that captures attention and provides the necessary details. Join us as we guide you through effective strategies to make your letter stand out and increase your likelihood of securing that loan!

Loan Purpose Description

A loan purpose description provides clarity about the intended use of borrowed funds. Commonly, personal loans serve various needs including debt consolidation, medical expenses, home renovations, or significant purchases (like automobiles or appliances). Business loans typically support efforts like operational costs, inventory purchases, or equipment upgrades, particularly in small to medium enterprises (SMEs). For instance, in 2022, small businesses in the United States sought approximately $130 billion in loans to bolster cash flow and investments. Understanding the specific purpose helps lenders assess risk and financial viability, ensuring that the borrower can meet repayment obligations in a timely manner.

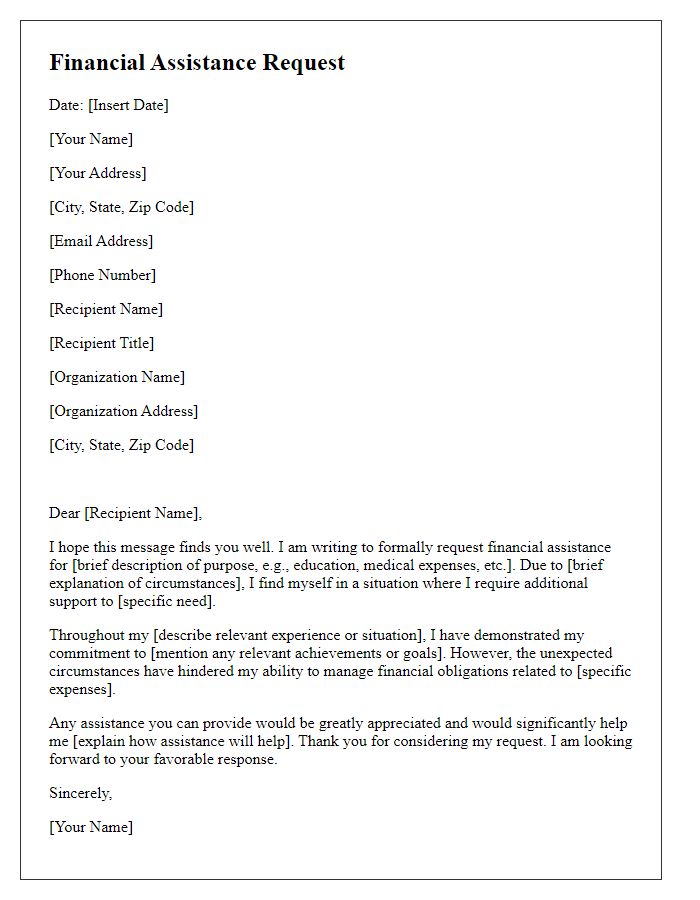

Financial Details

Financial situations require clear explanations to understand obligations, incomes, and expenditures for loan purposes. Essential details include total annual income, such as W-2 earnings, self-employment profits, and any additional sources like rental income. Monthly expenses should encompass fixed costs like mortgage payments (averaging $1,500 in suburban areas), utility bills (around $250), and leisure or discretionary spending (approximately $300). Credit scores, which impact loan approval rates, often fluctuate between 300 to 850, with a benchmark of 680 considered good. Existing debts, including student loans (average $30,000 for graduates), should be listed alongside minimum monthly payments, presenting a comprehensive overview of financial health. This information enables lenders to assess repayment capacity and risk.

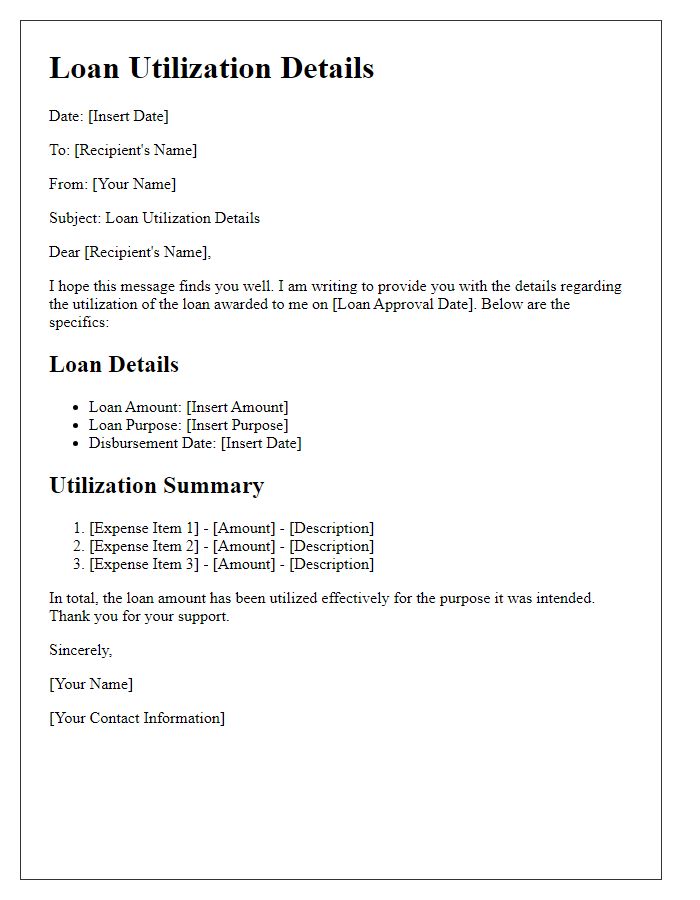

Repayment Plan

A structured repayment plan outlines a borrower's strategy to return borrowed funds, typically through monthly payments. A standard plan often includes specific details such as loan amount (e.g., $10,000), interest rate (e.g., 5% annually), and loan term (e.g., 5 years). For instance, a borrower may propose a repayment schedule with fixed monthly installments of approximately $188, which accounts for both principal and interest. The plan might specify the payment dates and methods, like bank transfers or checks, ensuring timely repayments. Additionally, it can incorporate provisions for early repayments without penalties, ensuring flexibility. Clear communication of the repayment plan enhances trust and demonstrates a commitment to fulfilling loan obligations.

Supporting Documentation

When applying for a loan, providing comprehensive documentation is essential. This includes personal identification documents such as a government-issued ID, proof of income like recent pay stubs or tax returns from the previous two fiscal years, and credit report details reflecting current credit scores. Property information may also be required, particularly if the loan is secured against real estate, necessitating documents such as the property deed and recent tax assessments. Bank statements from the past three months give lenders insight into financial stability. Overall, thorough and well-organized documentation can significantly enhance the loan approval process.

Contact Information

When seeking a loan, it is crucial to present clear and straightforward contact information, ensuring lenders can easily reach you for inquiries or documentation. Your phone number should include the area code, often formatted in parentheses (e.g., (123) 456-7890). An email address should be professional, comprising your name or business name, followed by a widely recognized domain (e.g., yourname@example.com). Additionally, your physical address must be accurate, including street number, name, city, state, and ZIP code to facilitate any necessary correspondence or verifications. Providing this information in a concise manner can enhance communication efficiency throughout the loan application process.

Comments