Have you ever wondered what it feels like to finally reach the finish line in your loan application process? Completing your loan package is a significant milestone that can pave the way for new opportunities and financial freedom. In this article, we'll guide you through the essential steps to ensure your confirmation is secure and stress-free. So, keep reading to learn more about finalizing your loan package and what to expect next!

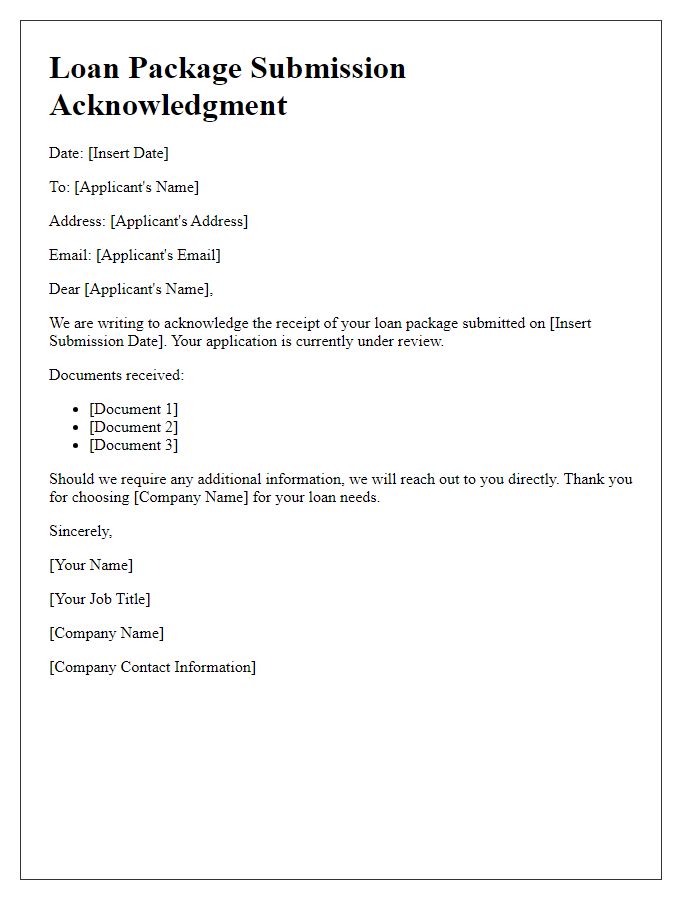

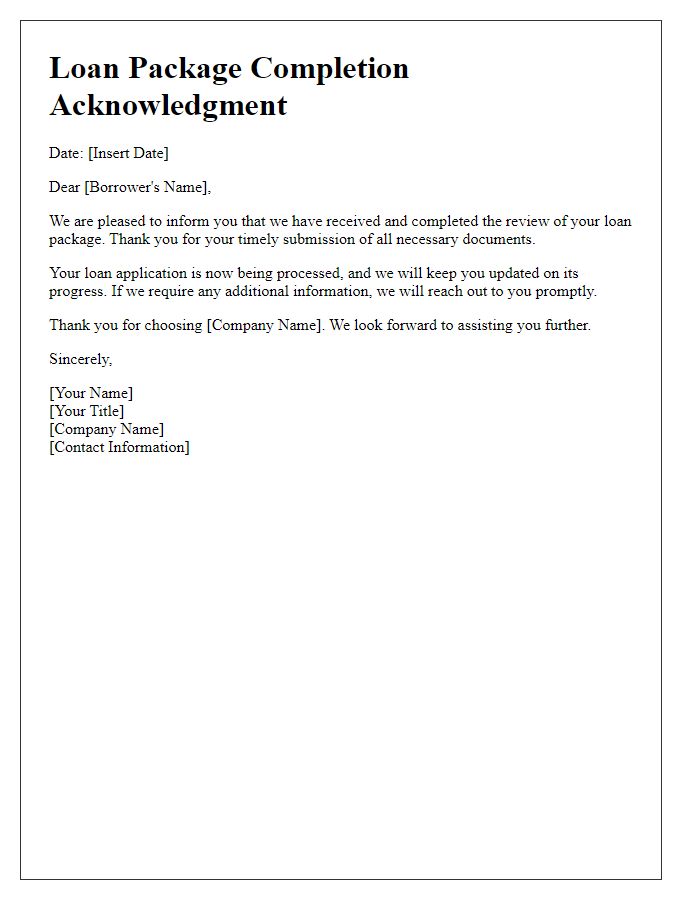

Borrower and lender information.

Loan package completion confirmation is essential in the lending process. The borrower, often an individual or entity seeking funds, must provide accurate personal or business information, such as name, address, and social security number (necessary for credit checks) to the lender. The lender, typically a financial institution or organization offering loans, requires precise details including institutional name, contact information, and licensing numbers. Upon completion, both parties should review key documents, including the loan agreement, financial disclosures, and repayment schedule to ensure accuracy. Compliance with regulations, such as the Truth in Lending Act, is also crucial in confirming the loan package's legitimacy and effectiveness.

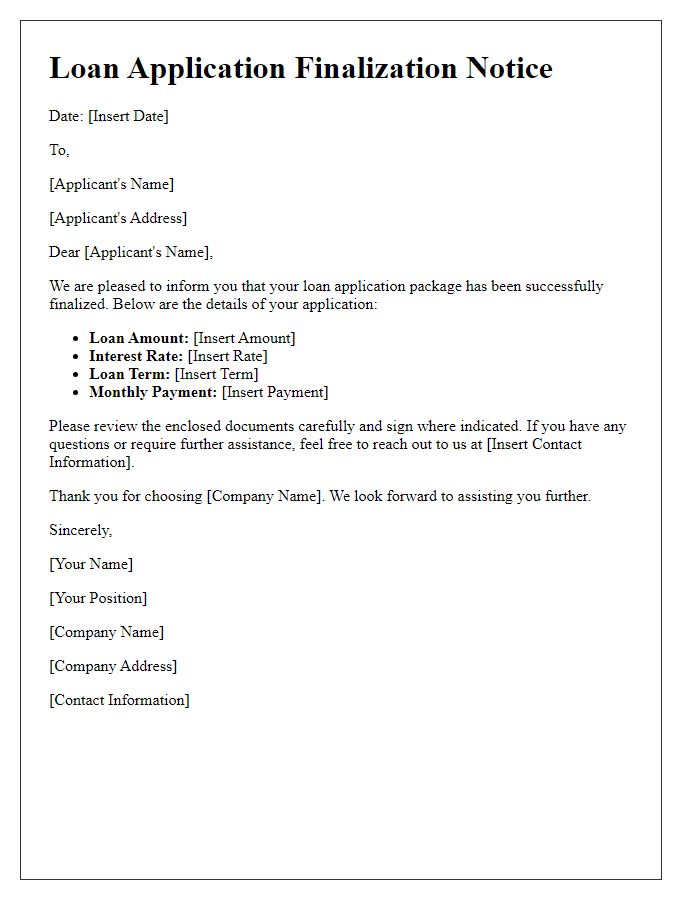

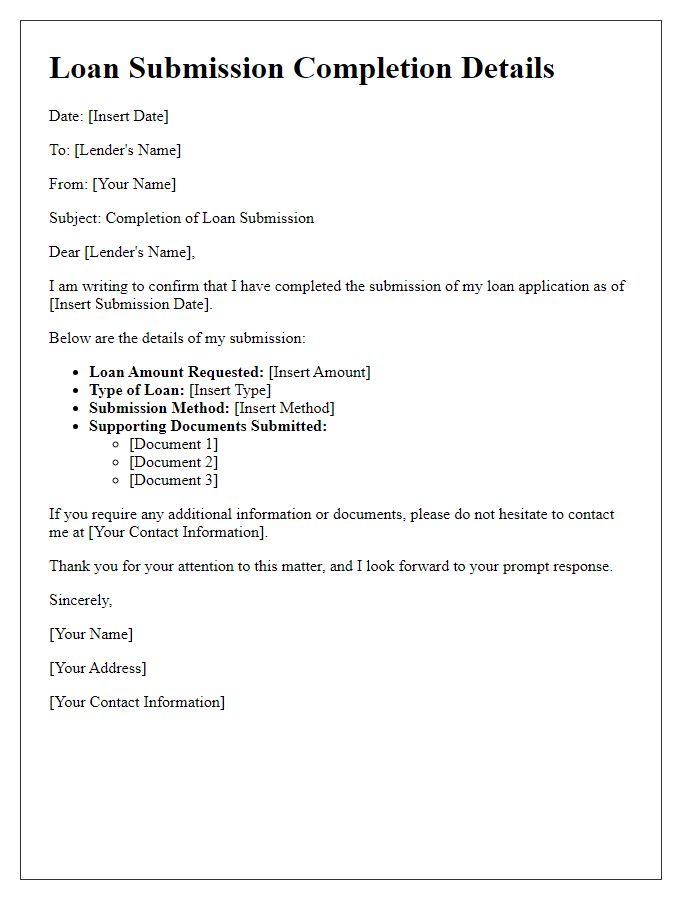

Loan package details and references.

Loan package completion confirmation signifies a critical step in the borrowing process, encompassing essential documents like the loan agreement, income verification, and credit history report. Lenders such as banks or financial institutions require complete verification of loan package details, often referencing real estate properties (with assessed values often over $300,000), personal identification (government-issued ID), and employment confirmations (pay stubs from the last two months). Each component aids in determining borrower eligibility for amounts often exceeding $50,000 and terms typically spanning 15 to 30 years. Properly compiled loan documentation facilitates timely processing, reduces opportunities for delays, and enhances the likelihood of favorable loan approval terms.

Confirmation of document receipt.

The successful completion of a loan package involves the effective receipt of critical documents such as loan applications, credit reports, and income verification forms. This process typically includes at least five key documents: the Uniform Residential Loan Application (Fannie Mae Form 1003) contains important borrower information, the credit report provides essential financial history, the pay stubs verify income, and tax returns (1040 Form) confirm financial stability. As of October 2023, lenders may also require additional documents for compliance with recent regulations, enhancing the scrutiny of borrower eligibility to prevent fraud. Timely submission of these documents is crucial for the approval timeline, which often spans 30 to 45 days, particularly in competitive markets such as California or New York.

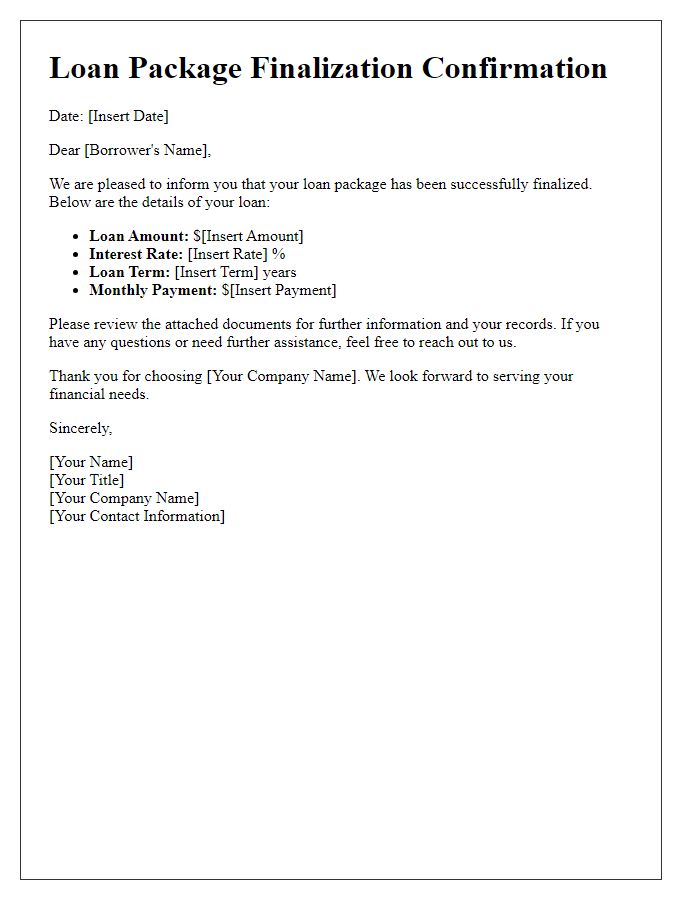

Instructions for next steps or actions required.

Loan package completion confirmation signifies the successful assembly of required documents for processing by financial institutions. Essential documents include the loan application form, proof of income (tax returns, pay stubs), credit report, and property appraisal certificate. Next steps involve submitting the completed package to the underwriting department at the lending institution (such as Wells Fargo or Bank of America) for evaluation. Expect communication within 3 to 5 business days regarding approval status. Applicants should prepare for potential additional documentation requests during underwriting. Final loan terms, including interest rate and repayment schedule, will be detailed in the loan agreement upon approval.

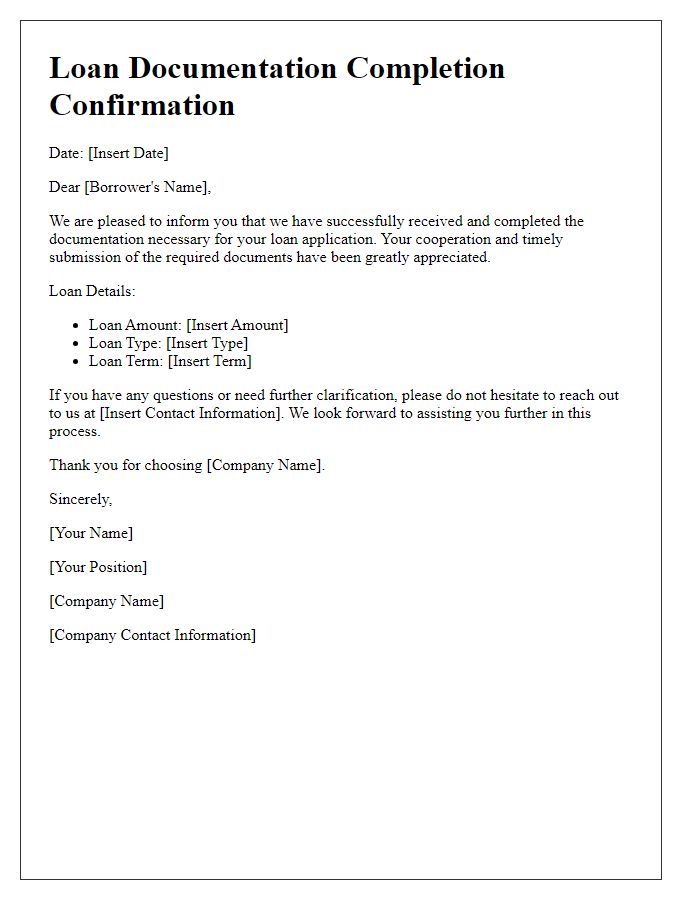

Contact information for inquiries and support.

Loan package completion confirmation provides a crucial endpoint in the financing process for borrowers. It ensures all necessary documentation, such as income verification forms, credit reports, and financial disclosures, has been successfully submitted for review. For inquiries regarding the status of a loan application or support, contact information includes dedicated phone lines, typically operating from 9 AM to 5 PM, or email addresses linked to customer service teams familiar with financial protocols. A clear understanding of this contact information streamlines communication, facilitates quicker responses, and enhances borrower satisfaction throughout the financing journey.

Comments