Are you feeling overwhelmed by your current installment loan payments? You're not alone; many people find themselves in similar situations, seeking ways to adjust their financial commitments without sacrificing stability. In this article, we'll explore practical steps you can take to negotiate an installment loan adjustment that works for you. So, grab a cup of coffee and join me as we delve into this important financial topic!

Borrower's information

Borrower information is crucial for the installment loan adjustment process. Essential details include the borrower's full name, such as John Smith, along with the unique Social Security Number (SSN) for verification purposes. The loan account number, for instance, 123-456-789, identifies the specific loan being adjusted. It is also important to include the current address, including city and zip code, for accurate communication. The borrower's contact number, such as (555) 123-4567, ensures efficient follow-up regarding the loan adjustment request. Additionally, the borrower's email address, like john.smith@example.com, may provide an alternative method for communication throughout the adjustment process. Providing complete and accurate borrower information facilitates a smoother adjustment procedure.

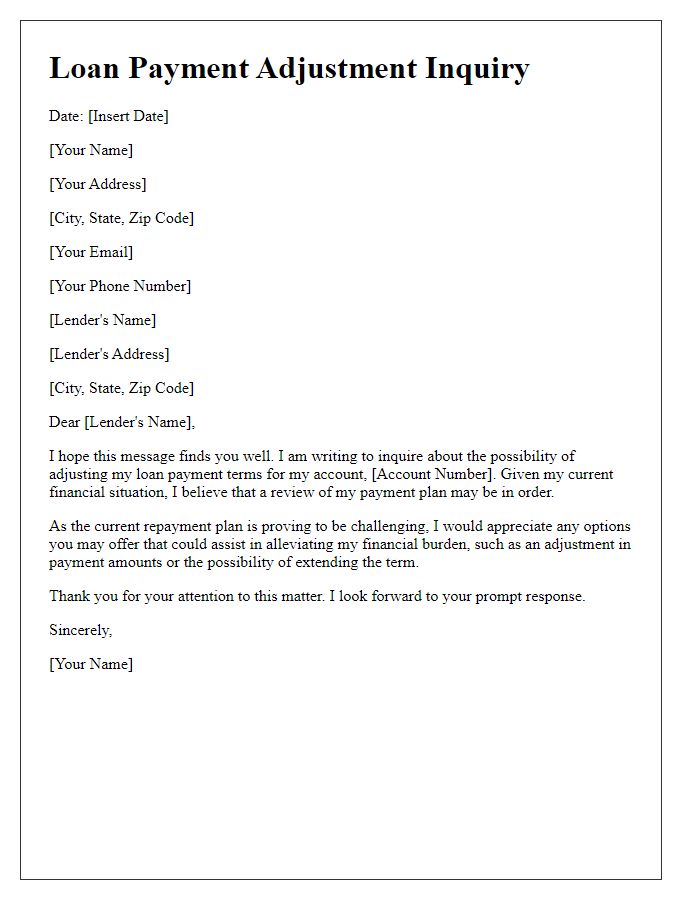

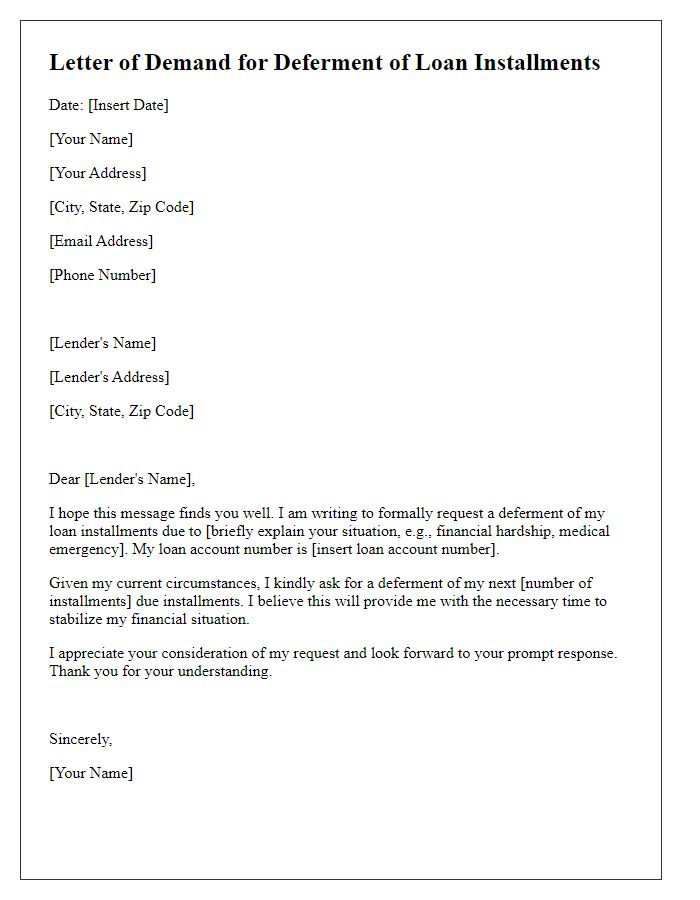

Lender's information

In the process of seeking an installment loan adjustment, including relevant lender information like the lender's name, contact address, and customer service phone number is essential for clarity. A lender, such as a financial institution that provides loans, may be identified by specific attributes like their unique identification number or licensing information, crucial for verifying their legitimacy. Including the lender's service hours ensures borrowers can reach out for assistance efficiently. Additionally, precise details about the loan, including account number and repayment terms, will streamline communication and facilitate the adjustment process.

Loan details (original terms, account number)

An installment loan adjustment involves changes to the repayment terms of a loan, which may include altering the monthly payment amount, interest rate, or loan duration. Borrowers often seek adjustments due to financial difficulties or changes in life circumstances. Original terms typically encompass details such as loan amount, interest rate (fixed or variable), repayment schedule, and the total duration, often expressed in months or years. The account number serves as a unique identifier for tracking the loan within the lending institution's records. Clear communication regarding these details is essential for processing any adjustments effectively.

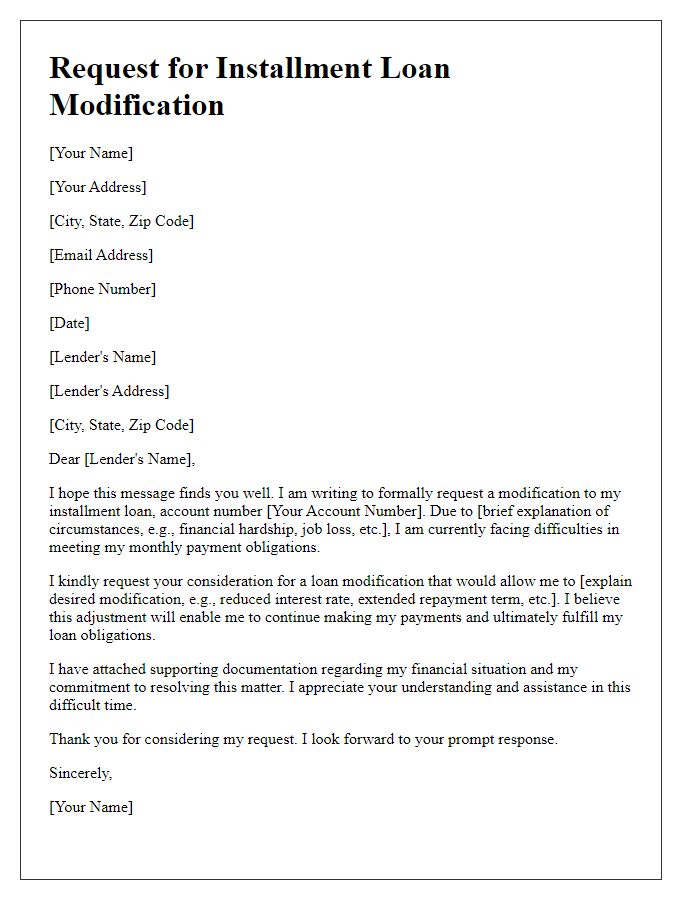

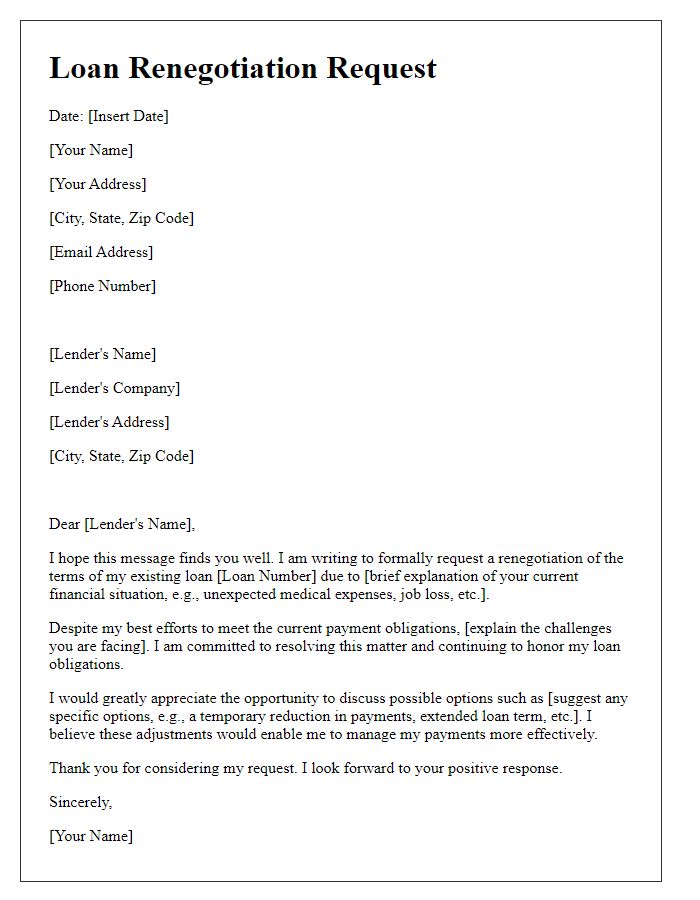

Reason for adjustment request (financial hardship, change in circumstances)

Financial hardships, such as sudden job loss or medical emergencies, can significantly impact an individual's ability to make timely payments on an installment loan, like a personal loan from a bank or credit union. With many Americans facing unexpected changes in income or expenses, it's crucial to communicate with lenders to discuss potential adjustments. Informing the lender about the current financial situation, including the loss of employment or increased medical bills, can facilitate negotiations for modified payment plans or temporary forbearance. Providing documentation, such as a termination letter from the employer (with a date to provide context) or a recent medical bill (indicating the amount incurred), strengthens the case for a loan adjustment.

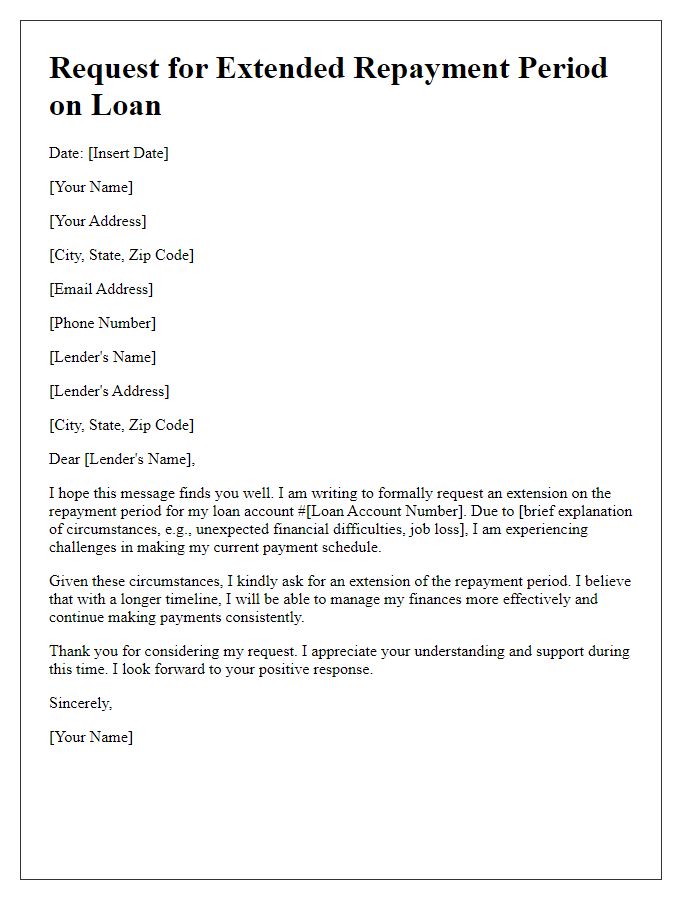

Proposed new terms (adjusted payment amount, extension timeframe)

A proposed adjustment for an installment loan typically involves changes to the payment structure to accommodate the borrower's financial situation. For example, a revised payment amount may decrease from $500 to $350 per month, while the extension of the timeframe could lengthen the term from 36 months to 48 months. This adjustment seeks to ease financial pressure, allowing the borrower to manage payments more effectively. Such changes may involve recalculating interest balances and ensuring compliance with lender policies to maintain repayment schedules. Documentation submitted to the lender would need to specify these detailed terms for clarity and record-keeping, further fostering a transparent communication process.

Letter Template For Installment Loan Adjustment Samples

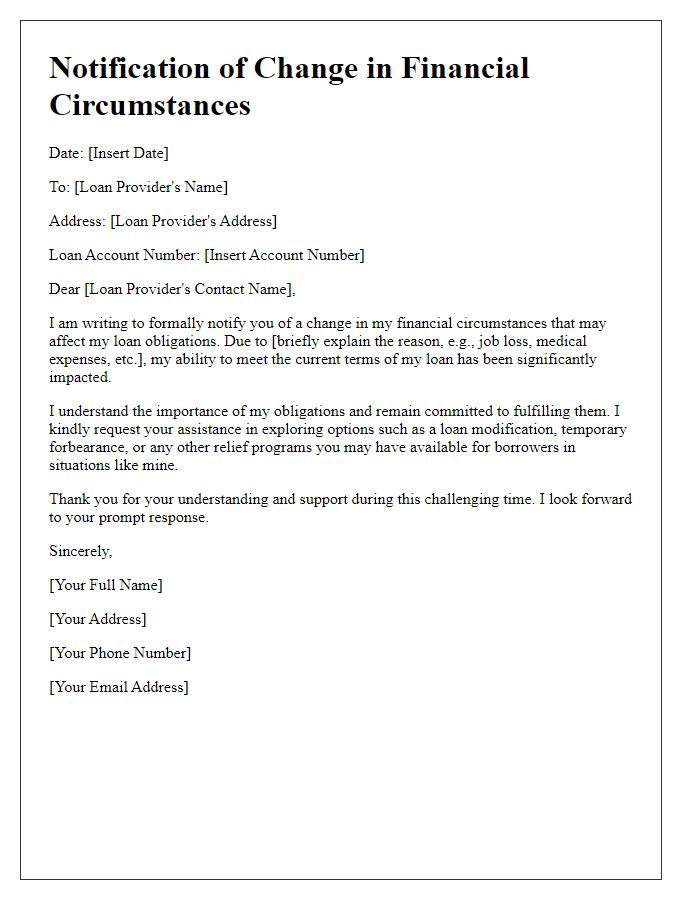

Letter template of notification for financial circumstances change affecting loan.

Comments