When it comes to navigating the world of loans and credit, removing a cosigner can often feel like a daunting task. Whether you're celebrating a major milestone or simply seeking more financial independence, it's essential to know how to officially document this change. In this article, we'll walk you through a straightforward letter template designed to help you communicate the removal of a cosigner effectively. So, let's dive in and explore the steps to make this process as simple as possible!

Header Information: Date, Contact Details

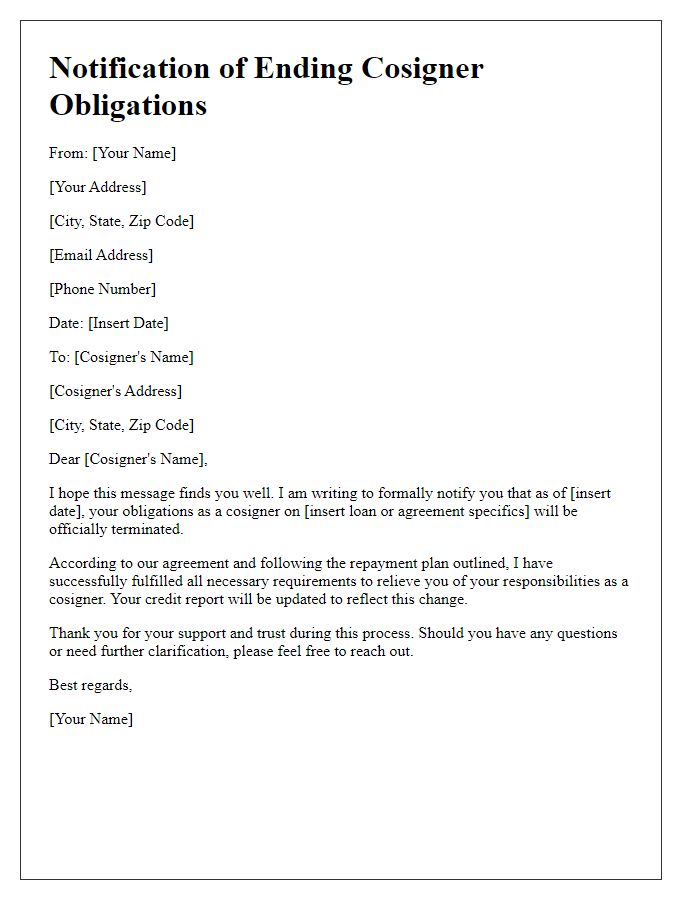

A document for cosigner removal should include specific header information to ensure clarity and proper communication. The top of the document should feature the date (for instance, October 3, 2023), essential contact details (including the name of the primary borrower, their address, city, state, zip code), and contact information such as phone number and email address. Additionally, it may be beneficial to include the lending institution's name and contact information (including office address and customer service phone number) to facilitate any necessary correspondence regarding the cosigner's removal. This structured header lays the groundwork for an organized and professional document.

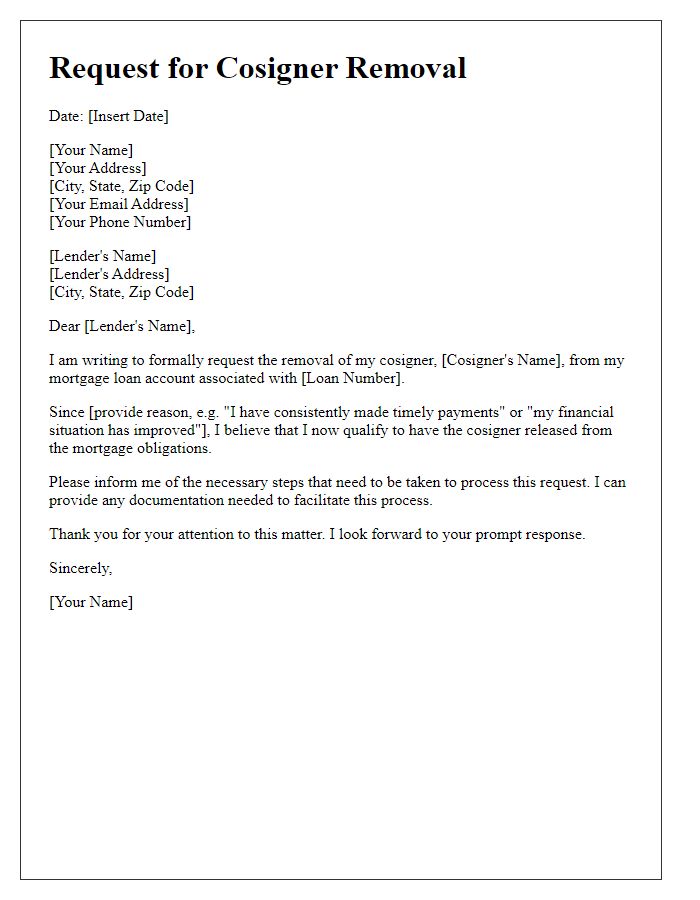

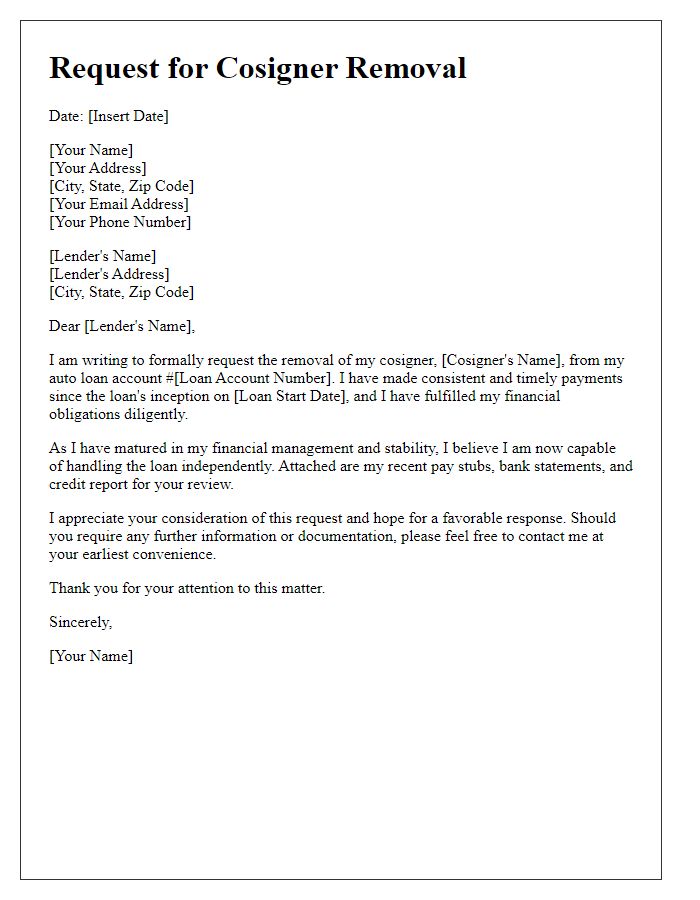

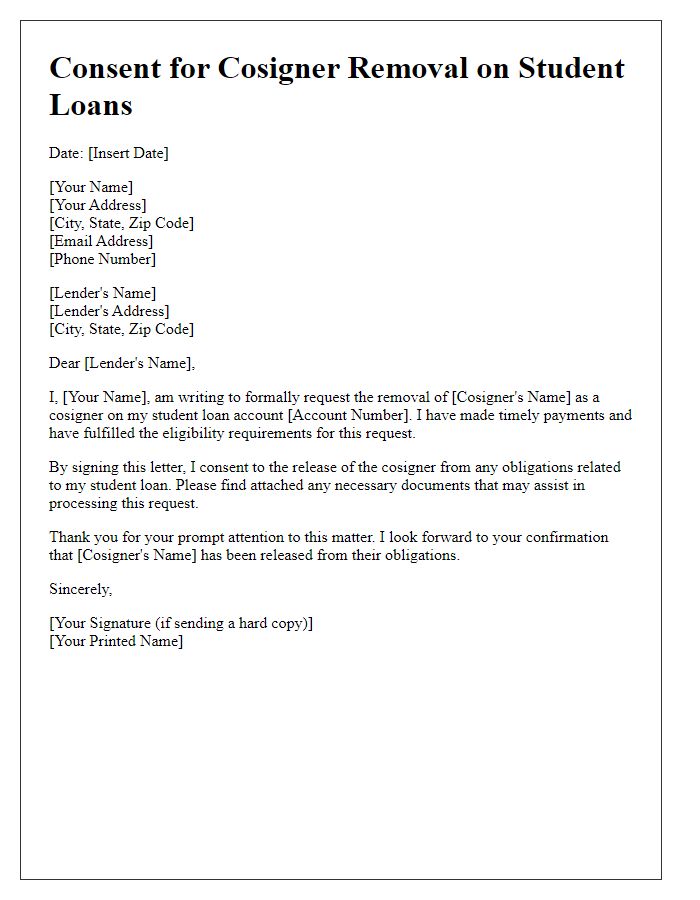

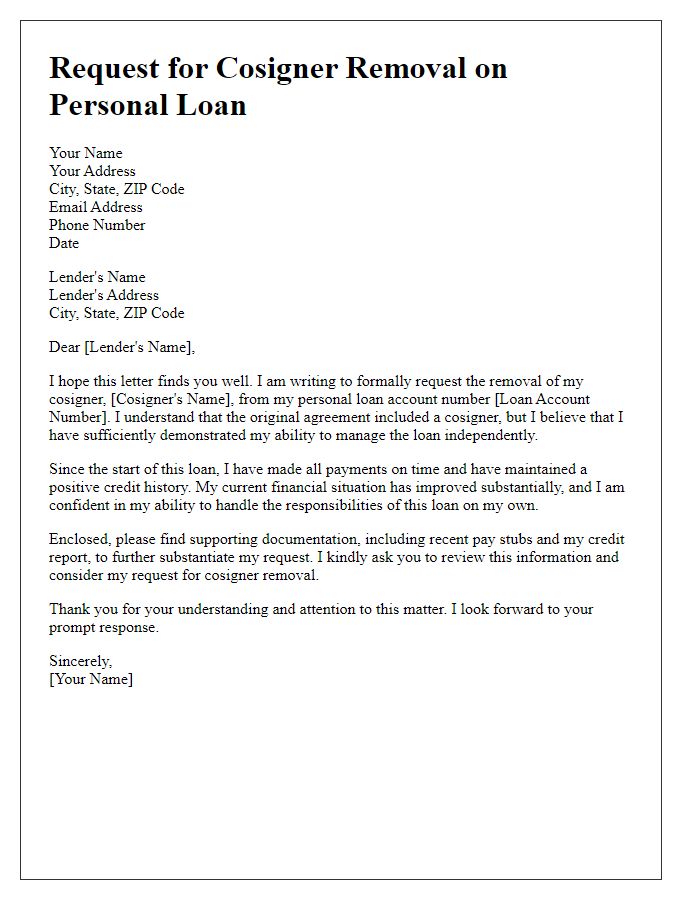

Subject Line: Request for Cosigner Removal

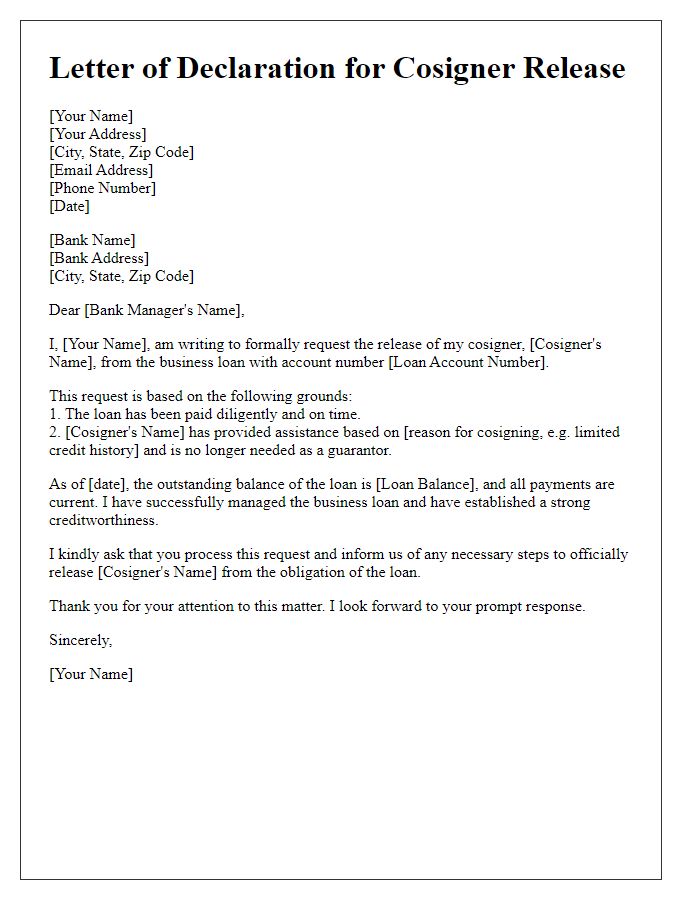

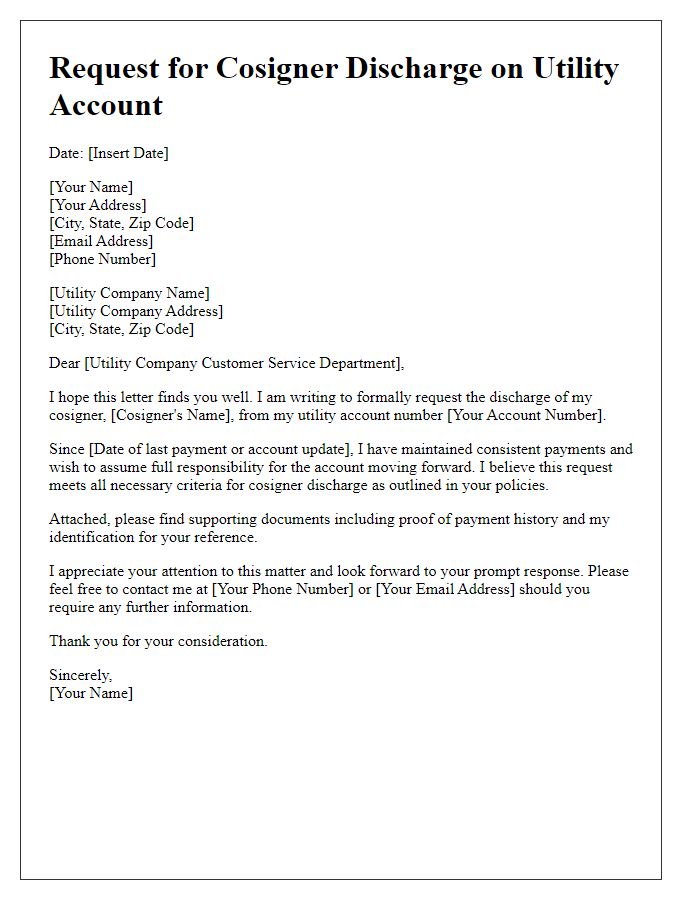

The process of cosigner removal involves the critical step of analyzing the financial obligation of a loan, such as a student loan from a federal institution or a mortgage from a private lender. A cosigner, typically a parent or guardian, may initially help secure favorable terms by improving creditworthiness, especially when the borrower's credit history is insufficient or poor. In the United States, lenders often require a formal application for removal, alongside documentation proving the borrower's ability to handle repayment independently, including credit scores (preferably above 650) and proof of steady income, which can be substantiated through pay stubs from a reputable employer or bank statements. Once a lender, for example, Chase Bank or Sallie Mae, approves the request, they often send official documentation confirming the release of the cosigner from the loan agreement, thus granting the primary borrower full responsibility for the debt.

Borrower Information: Name, Account Number

Documenting cosigner removal involves ensuring accurate representation of the borrower's details for processing. The borrower's name, which identifies the individual responsible for the account, needs to be clearly stated alongside the unique account number, essential for referencing the specific loan agreement within the financial institution's database. It is vital to include the date of request, explanations for the cosigner removal, and any relevant loan specifics, such as the original loan amount, payment history, and current balance, to provide a comprehensive context for the removal process. Additionally, verification of the borrower's ability to assume full responsibility without a cosigner is critical, often requiring an evaluation of creditworthiness or income documentation.

Cosigner Information: Name, Updated Details

Documenting the removal of a cosigner involves essential information about the involved parties. The cosigner's full name, such as John Doe, along with any updated contact details like a new phone number or address, must be accurately recorded. This process typically occurs in instances like refinancing a loan or when the primary borrower, perhaps Jane Smith, has demonstrated financial responsibility over a consistent period, such as 12 months of on-time payments, showcasing improved creditworthiness. Proper documentation should include the loan account number and the financial institution's name, such as ABC Bank, ensuring that the records reflect the change in cosigner status effectively.

Justification and Supporting Documentation

Cosigner removal can significantly impact loan agreements, especially for individuals seeking independence in financial responsibilities. A successful removal process necessitates clear justification, such as improved credit scores or income stability, typically indicated by a credit report and recent pay stubs. Supporting documentation may include the original loan agreement from [Lender's Name], payment history showcasing timely payments over the past 12 months, and a statement from the primary borrower confirming their request for cosigner release. It is crucial to ensure that all presented documents align with the lender's requirements, as this enhances the likelihood of approval for cosigner removal.

Letter Template For Documenting Cosigner Removal Samples

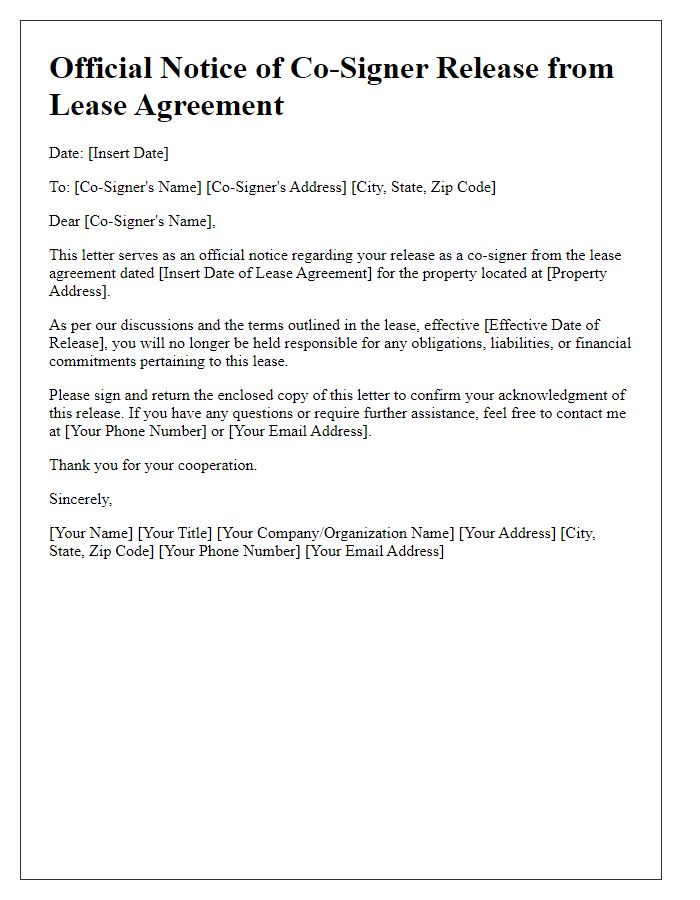

Letter template of official notice for cosigner release from lease agreement.

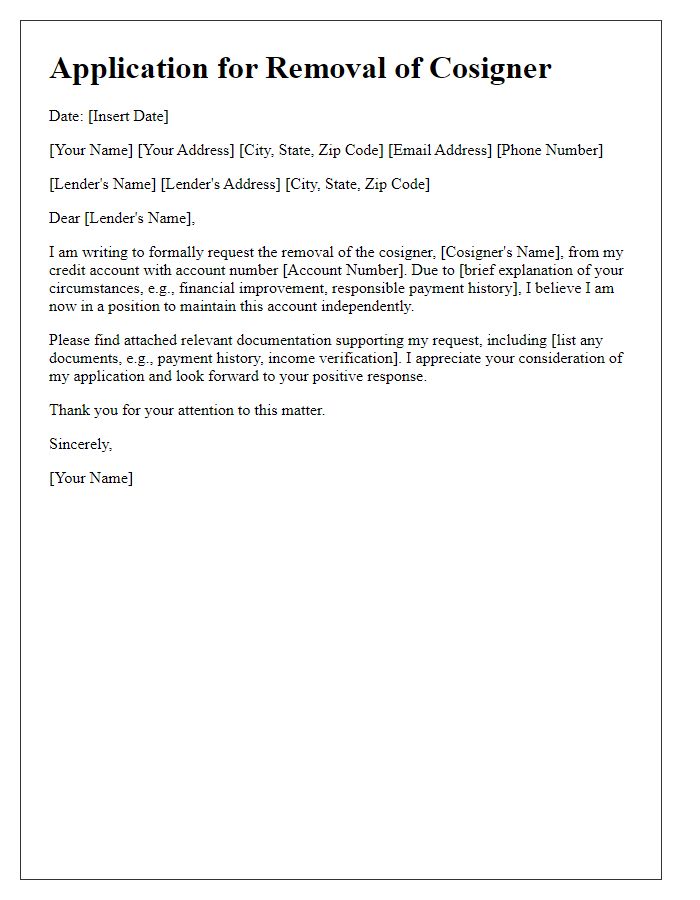

Letter template of formal application for removal of cosigner on credit account.

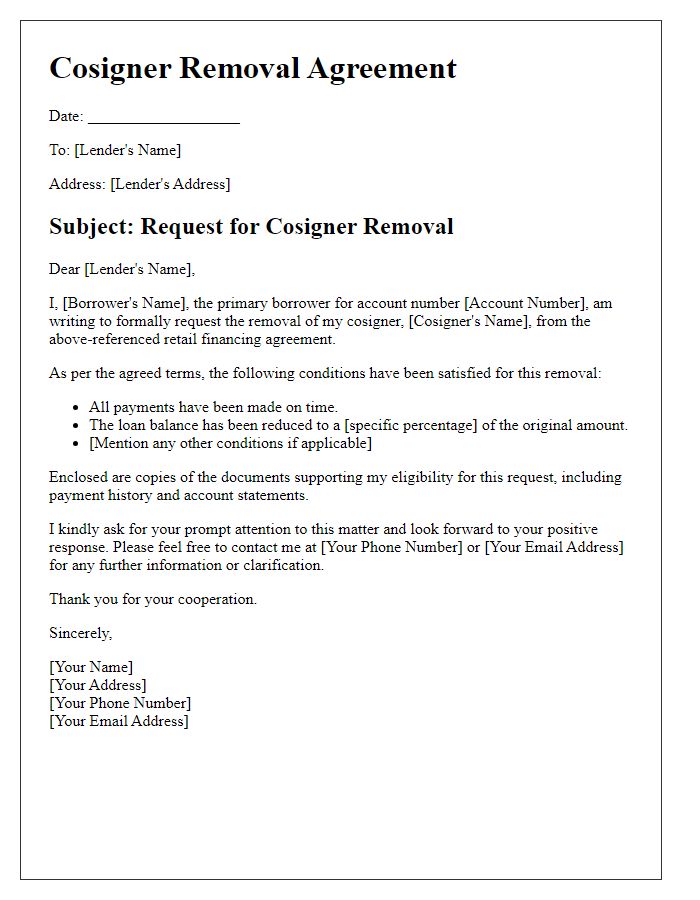

Letter template of agreement for cosigner removal from retail financing.

Comments