Are you considering taking the plunge into an investment opportunity but need some financial support? Crafting the perfect letter to request a loan can be your first step toward achieving those goals. In this article, we'll guide you through the essentials of writing an effective investment loan request letter that captures attention and makes your case. So, let's dive in and explore the strategies to make your application stand out!

Clear Purpose Statement

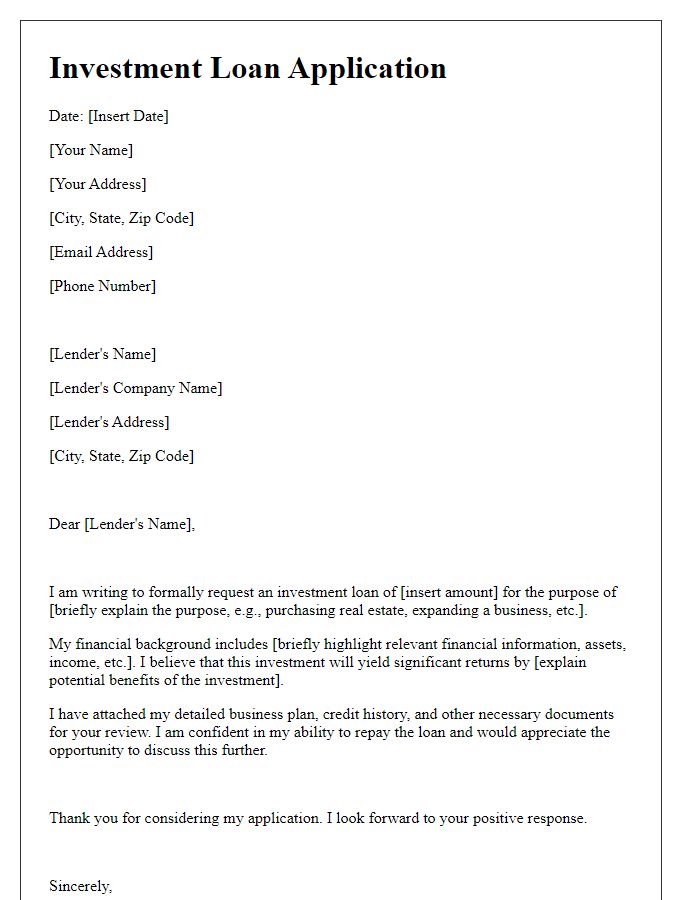

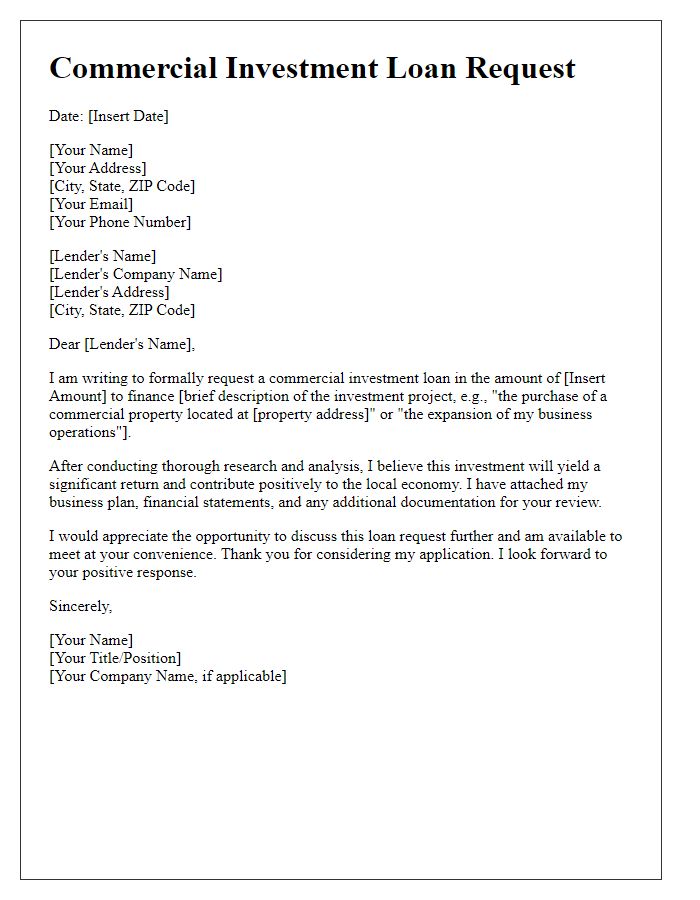

An investment loan request should begin with a clear purpose statement outlining the intended use of the funds. For instance, if seeking financing for a real estate project, specify details such as the property type, location (e.g., commercial properties in downtown Chicago), and the overall investment amount (e.g., $500,000). Mention the expected returns, duration of the investment (e.g., five years), and how the loan will facilitate the acquisition or development process (e.g., funding renovations to increase property value). Additionally, include any relevant market analysis demonstrating demand for the property type in the area and projected growth trends to reassure potential lenders of the viability of the investment.

Detailed Financial Plan

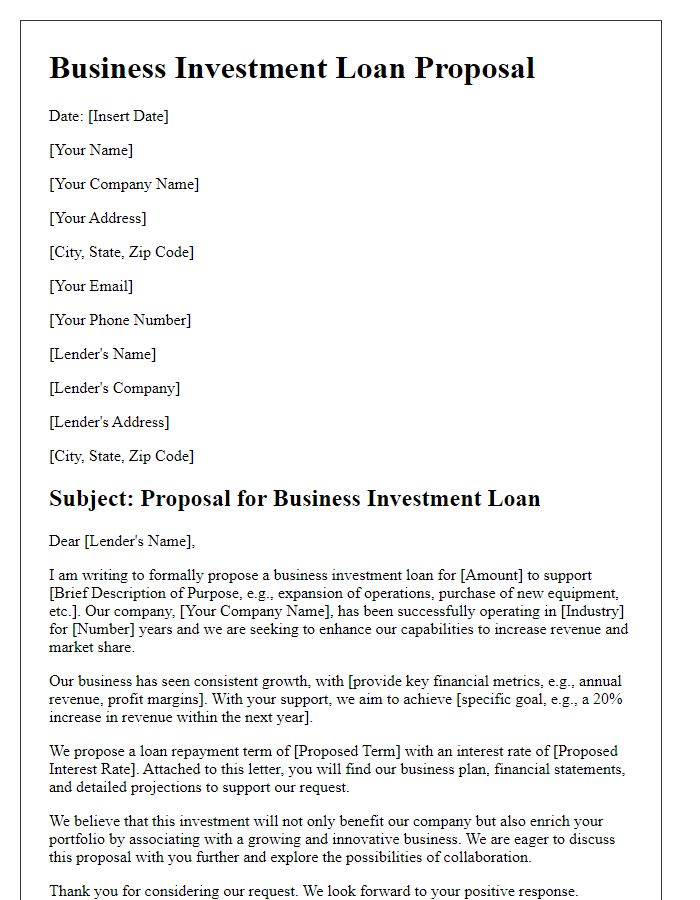

A detailed financial plan is crucial for securing an investment loan, outlining precise budgeting and forecasting strategies. This plan includes projected income statements, balance sheets, and cash flow analyses for the next three to five years. Key assumptions should be based on market research, such as anticipated growth rates (often estimated between 5% to 10% annually) and industry benchmarks relevant to the specific business sector. For instance, in the technology sector, a firm might project a 25% increase in user acquisition due to emerging trends, while a retail business may consider a 15% increase tied to seasonal sales events. Funding usage details highlight allocation percentages, indicating how much will be directed towards operational expenses, marketing campaigns, and capital expenditures. A break-even analysis illustrates when the business expects to become profitable, often requiring a thorough understanding of fixed and variable costs. Overall, this comprehensive financial blueprint aims to instill confidence in potential lenders by demonstrating a clear roadmap to profitability and sustainability in a competitive landscape.

Strong Business Case

Securing an investment loan requires a compelling business case that demonstrates the viability and profitability of the project. The proposal should highlight a detailed market analysis reflecting demographic trends, target audience, and competitive positioning. Financial projections should include realistic revenue estimates, expense forecasts, and a cash flow analysis over a minimum of three to five years. Additionally, outlining the intended use of loan funds is crucial, whether for equipment purchases, operational costs, or expansion efforts. Emphasizing risk mitigation strategies, such as diversifying revenue streams and maintaining adequate insurance coverage, will bolster confidence in the investment. A solid management team with relevant industry experience should also be showcased, highlighting individual qualifications and past successes in similar ventures to further validate the business case.

Risk Assessment

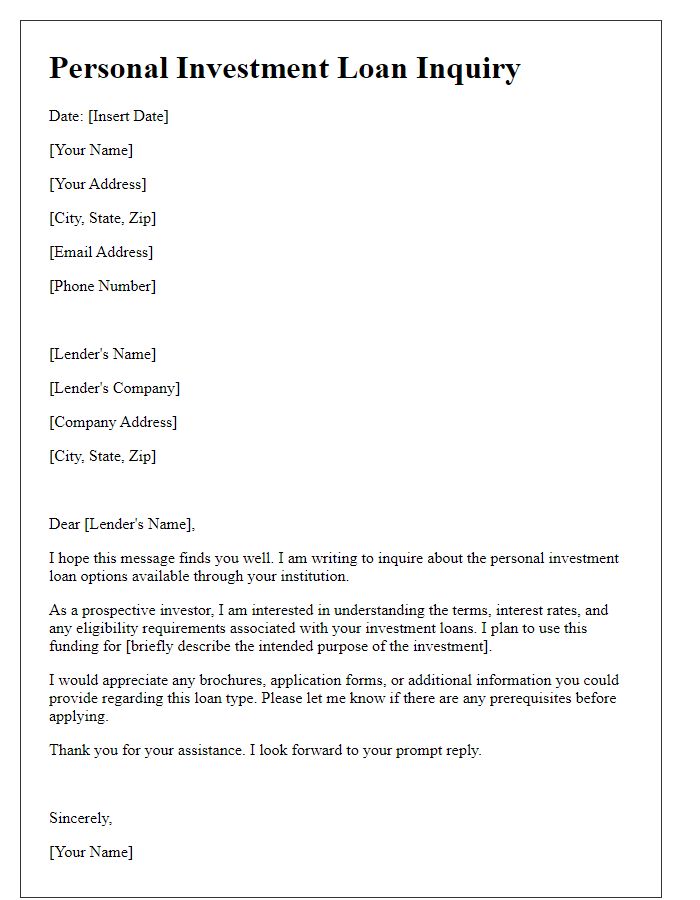

A comprehensive risk assessment for an investment loan can reveal potential pitfalls associated with the prospective project, such as fluctuating market conditions and economic downturns. Factors like interest rates, currently averaging 5% for commercial loans, can impact repayment capacity significantly. Additionally, specific industry risks, such as the volatile real estate market in metropolitan areas like San Francisco or New York City, may pose financial challenges. Regulatory changes can also affect investment feasibility; for instance, new zoning laws might restrict property development opportunities. Furthermore, borrower credit scores, typically considered acceptable above 700, play a crucial role in determining loan eligibility and terms. Assessing these elements is essential for mitigating risks and ensuring sustainable investment growth.

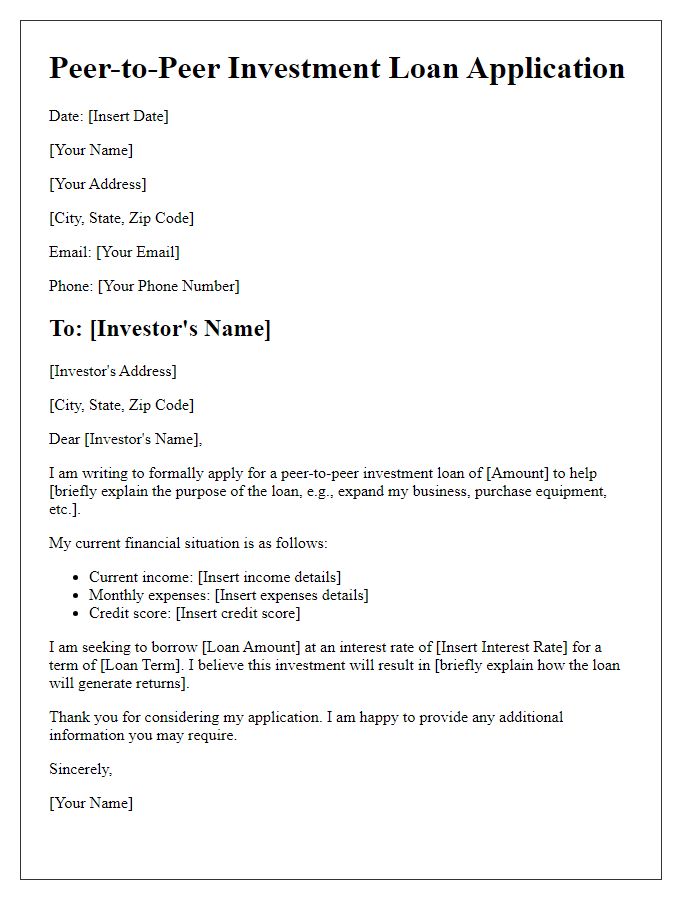

Professional Tone and Structure

A comprehensive investment loan request involves outlining the purpose, funding requirements, and repayment plans in clear detail. An investor seeking support for a business expansion in a prominent market, such as the technology sector in Silicon Valley, would typically include information on projected revenue growth (for example, a 20% increase over the next fiscal year), the specific amount needed (say $500,000), and the intended use of funds (such as purchasing advanced equipment or increasing staff). Additionally, highlighting the financial stability of the business, backed by solid historical performance metrics (like a 15% profit margin in the previous financial year), and a well-structured repayment plan--potentially offering a collateralized asset--reinforces the credibility of the request. Demonstrating sound market analysis and a comprehensive business strategy can further bolster the case for acquiring the investment loan.

Comments