Are you considering taking the plunge into the world of loans for the first time? Understanding the process can feel overwhelming, but with the right guidance, it can be smooth sailing. In this article, we'll break down everything you need to know, from preparing your application to what to expect during approval. So grab a cup of coffee and let's dive deeper into your loan journey!

Applicant's personal information (name, contact details, employment status).

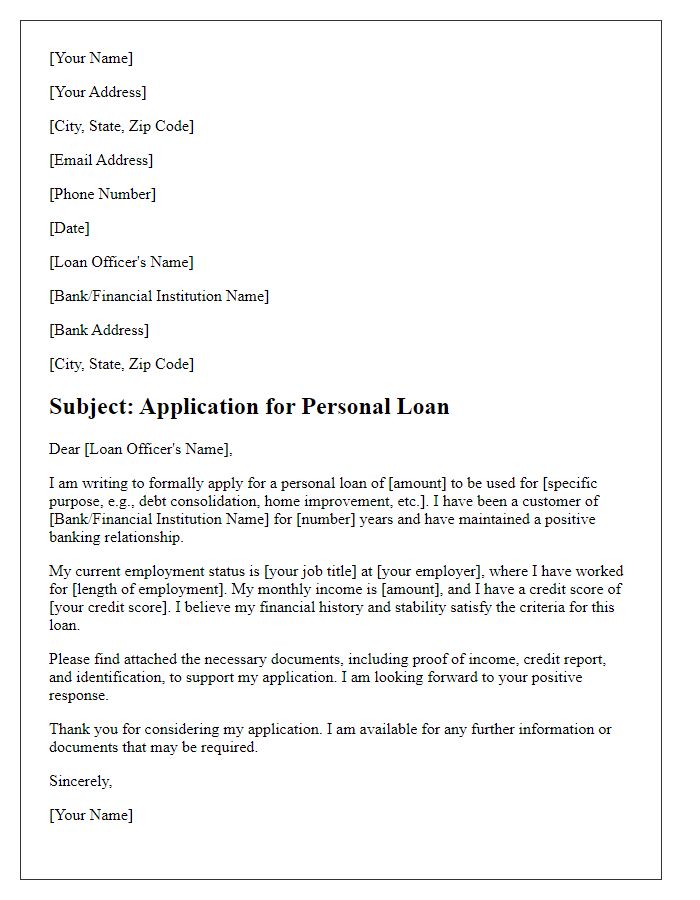

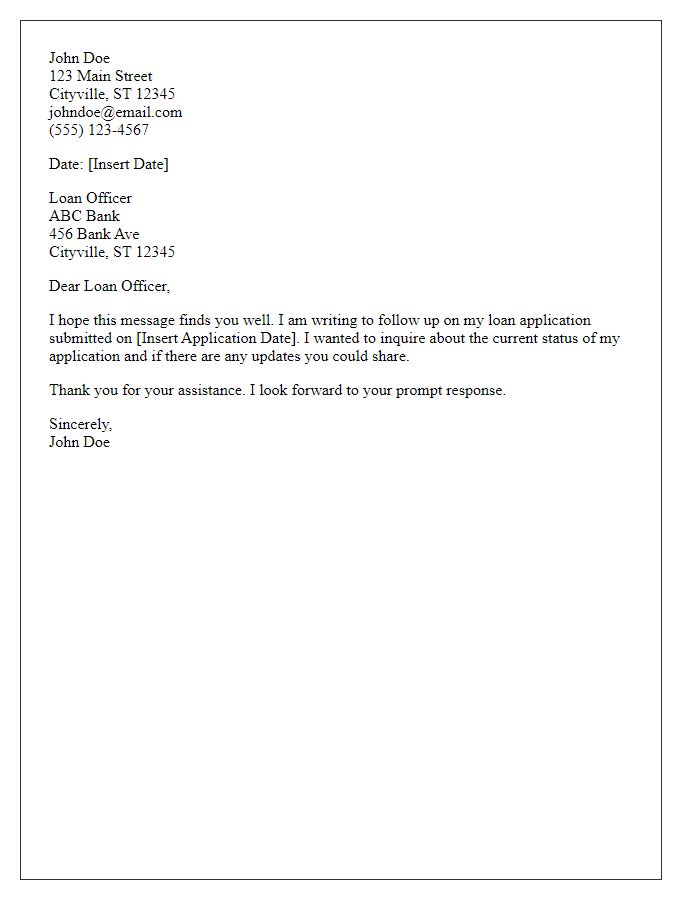

John Doe, a first-time loan applicant, submission includes essential personal information such as his name, contact details including phone number (123-456-7890) and email address (john.doe@example.com), and current employment status as a full-time software engineer at Tech Innovations, a company located in San Francisco, California, renowned for its cutting-edge technology solutions. John seeks to secure a personal loan of $15,000 to finance home renovations. His credit score stands at 720, categorizing him in the good range for loan approval. Providing detailed documentation such as payslips from the past three months and a recent tax return, he aims to establish credibility and financial responsibility to increase his chances of approval.

Purpose of the loan and loan amount requested.

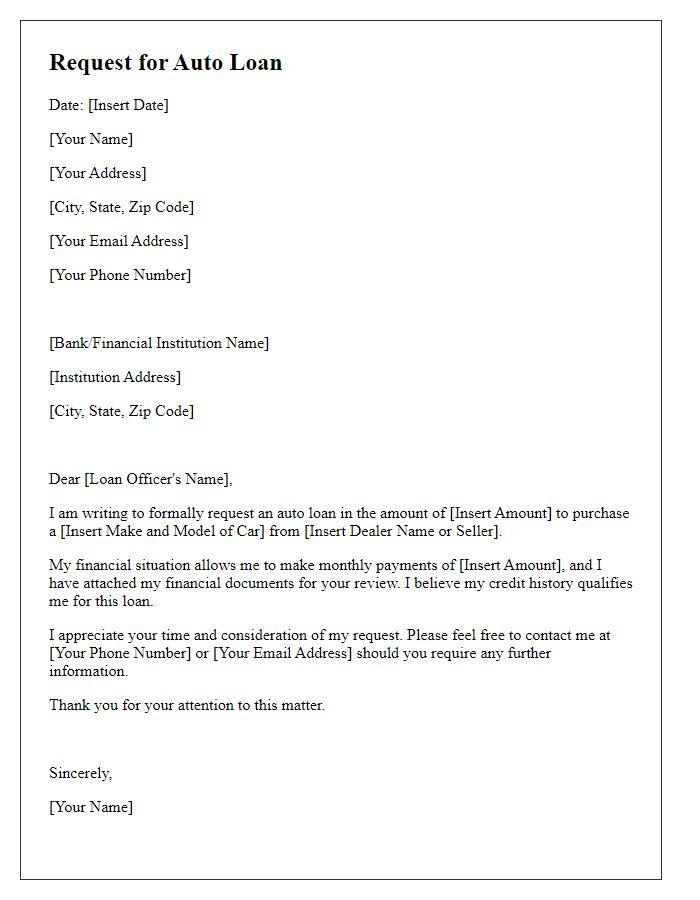

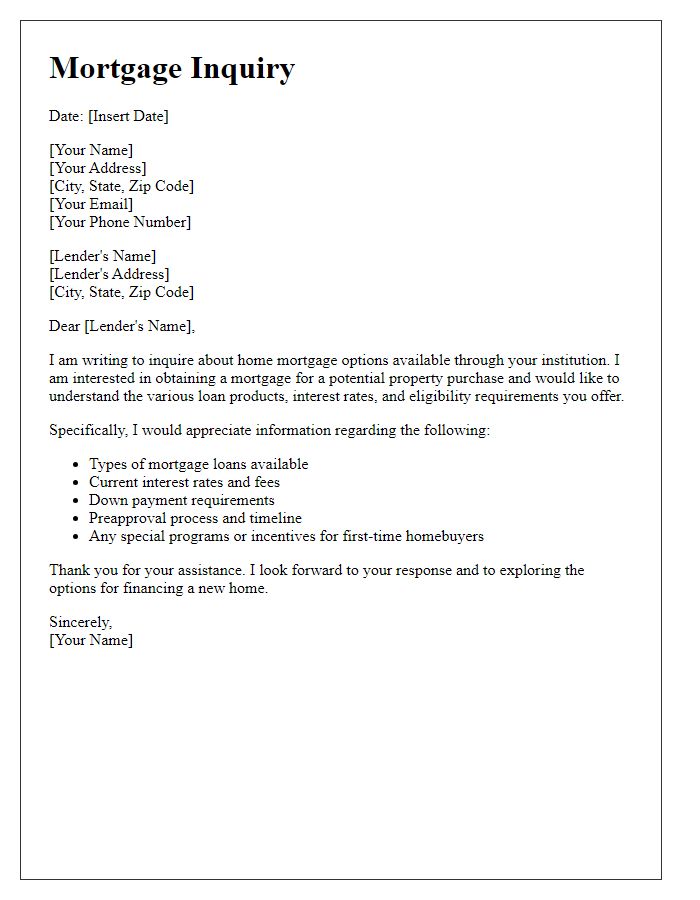

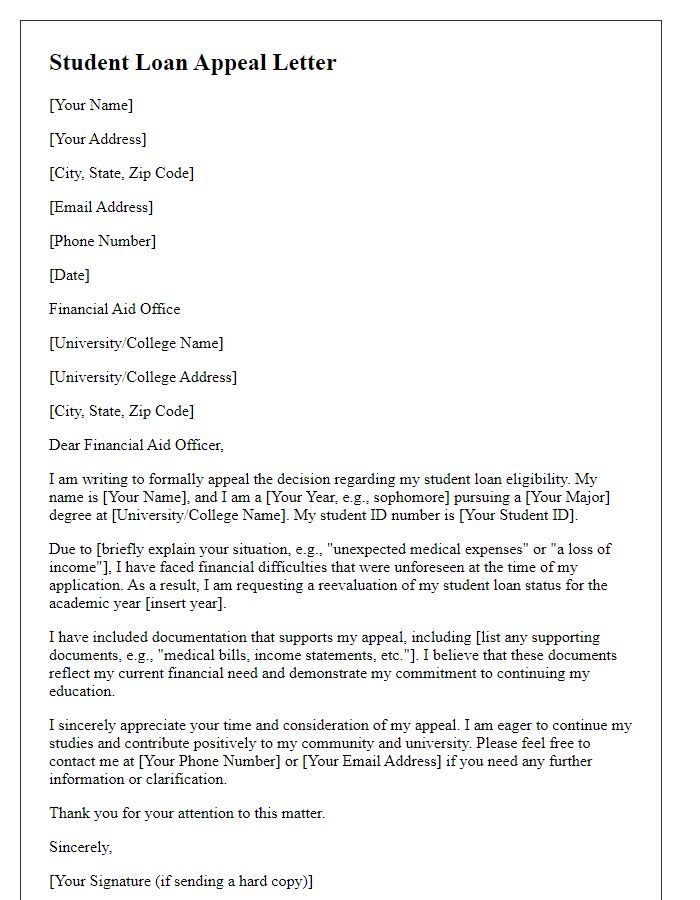

A first-time loan applicant often seeks financial assistance for various purposes such as home purchase, education expenses, or starting a business. For instance, an applicant may request a mortgage loan amount of $250,000 to purchase a family home in Seattle, Washington. The motivation behind this request can stem from the desire for stability and a community-oriented environment, essential for family growth. Alternatively, an applicant might pursue an education loan of $20,000 to cover tuition fees at a prominent university, such as the University of California, Berkeley, aiming to obtain a degree in computer science. Another scenario could involve a small business loan amounting to $50,000 for establishing a startup in Austin, Texas, driven by the bustling tech scene and entrepreneurial spirit prevalent in the area. Each of these loan requests reflects a significant step toward achieving personal and financial goals tied to larger life milestones.

Financial background (current income, credit score, existing debts).

First-time loan applicants often face various financial considerations that significantly influence approval chances and loan terms. Current income plays a crucial role; for example, a monthly income of $4,000 may suggest sufficient cash flow for repayments. Credit scores, ranging from 300 to 850, are critical indicators of creditworthiness, with scores above 700 generally considered favorable by lenders. Existing debts, such as student loans averaging $30,000 or a car loan totaling $15,000, can impact the debt-to-income ratio, an essential metric for assessing the ability to manage additional financial obligations. Understanding these financial elements is vital for navigating the loan application process successfully.

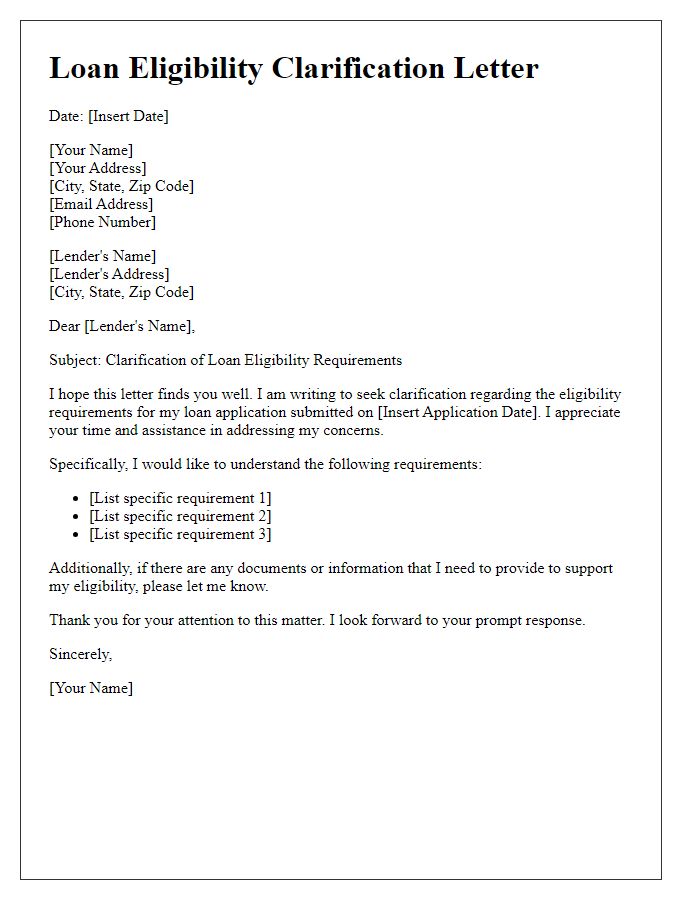

Documentation requirements (proof of income, identification, collateral if needed).

For first-time loan applicants, essential documentation is required to facilitate the approval process. Applicants must provide proof of income, such as recent pay stubs, tax returns, or bank statements, demonstrating financial stability and ability to repay. Identification documents, including a government-issued ID like a driver's license or passport, are necessary to verify the applicant's identity and legal residency. Additionally, if the loan is secured, collateral documentation, such as property deeds or vehicle titles, may be required to assess the value of the asset being pledged. This comprehensive documentation ensures the lending institution can accurately evaluate the applicant's creditworthiness and financial situation.

Loan terms and conditions (interest rate, repayment plan, penalties).

A first-time loan applicant should carefully examine the loan terms and conditions outlined in the agreement. The **interest rate**, a critical factor, represents the cost of borrowing money, influencing the total amount repayable over the loan's duration; typically expressed as an annual percentage. The **repayment plan** details how the borrower will repay the loan, including the duration, frequency of payments, and potential adjustments based on financial circumstances or interest fluctuations. **Penalties** may apply for late payments or defaults, potentially resulting in additional fees or a negative impact on the borrower's credit score, emphasizing the importance of understanding these implications before committing to the loan. Each of these elements plays a vital role in shaping the financial obligations and commitments of the borrower.

Comments