Are you looking to secure a business loan but don't know where to start? Crafting a compelling loan proposal is crucial for making a strong impression on financial institutions. In this article, we'll guide you through essential elements to include in your letter, ensuring you present your business in the best light possible. Ready to take the next step in your funding journey? Keep reading for our expert tips and templates!

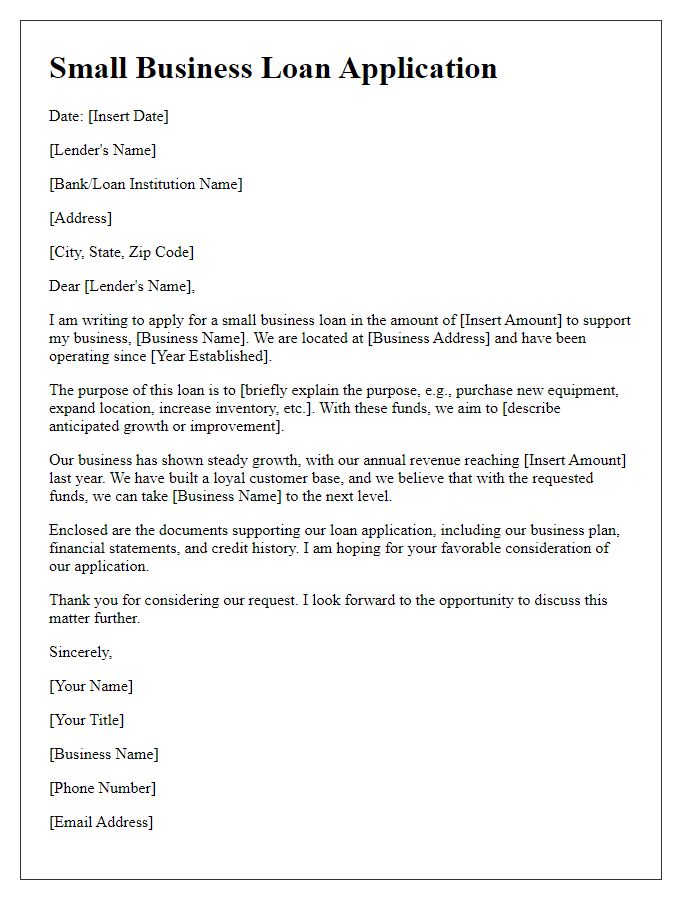

**Company Overview**: Business history, mission, products/services, and market position.

The company overview provides a comprehensive insight into the business landscape of XYZ Enterprises, established in 2010 in Austin, Texas. With a mission to deliver sustainable and innovative solutions in the renewable energy sector, XYZ Enterprises specializes in solar panel installation and maintenance, catering to both residential and commercial clients. The product line includes high-efficiency solar panels, energy storage systems, and customized installation services. Over the past decade, the company has positioned itself as a market leader, securing a 20% market share in Texas, thanks to its commitment to quality and customer satisfaction. This strategic focus has earned XYZ Enterprises numerous accolades, including the Best Green Business Award in 2022. The growing demand for renewable energy solutions, driven by environmental concerns and government incentives, enhances the company's potential for future growth and profitability.

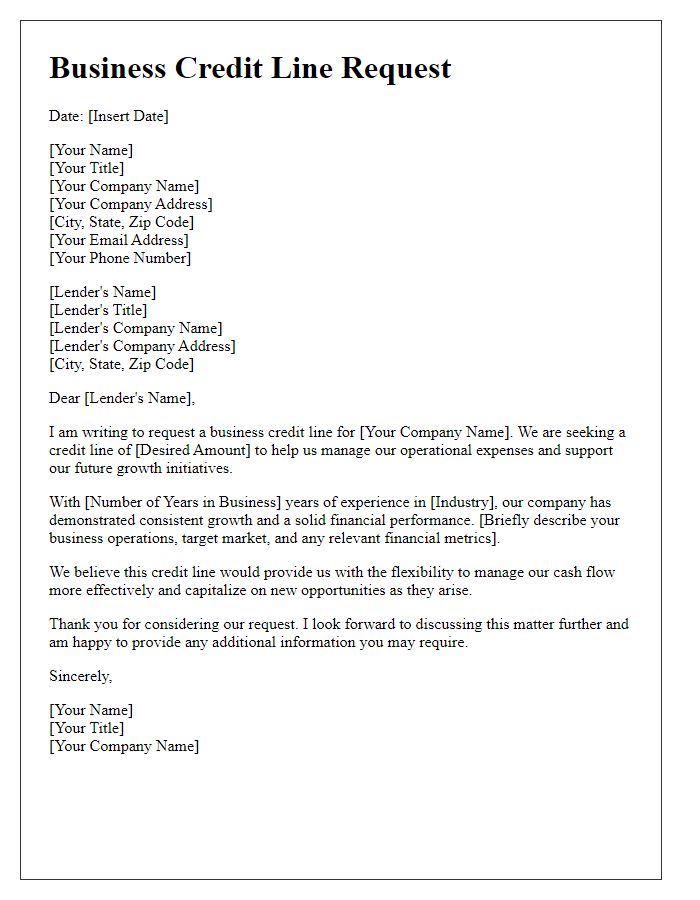

**Financial Data**: Detailed financial statements, cash flow projections, and profit margins.

The business loan proposal requires comprehensive financial data to support the request. Detailed financial statements, including balance sheets from the past three fiscal years (showing assets, liabilities, and equity), income statements (reflecting revenue, expenses, and net income), and cash flow statements (demonstrating liquidity and cash management), are essential. Cash flow projections for the next 12 to 36 months will offer insights into expected revenue streams and planned expenditures, showcasing financial sustainability. Profit margins, calculated as a percentage of revenue remaining after variable costs are subtracted, should be presented for historical performance and projected figures, indicating the business's profitability and operational efficiency. This financial overview provides lenders with a clear understanding of fiscal health and potential for growth.

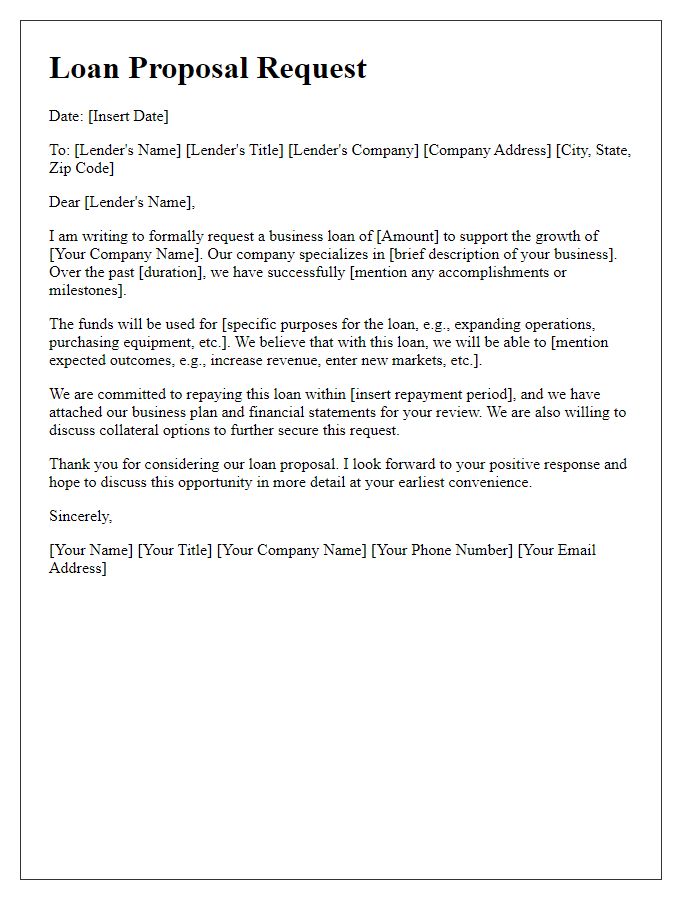

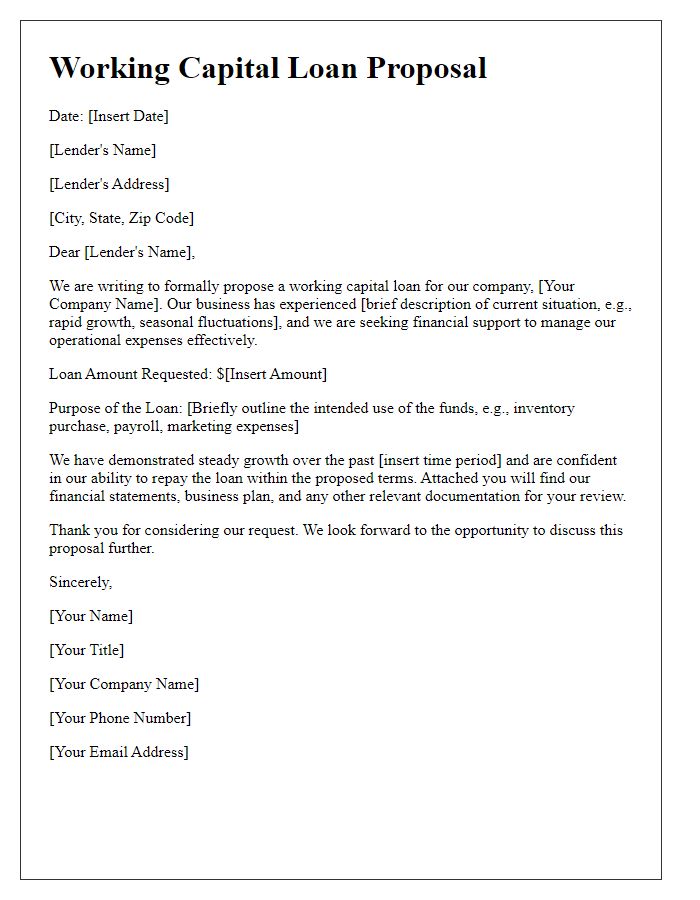

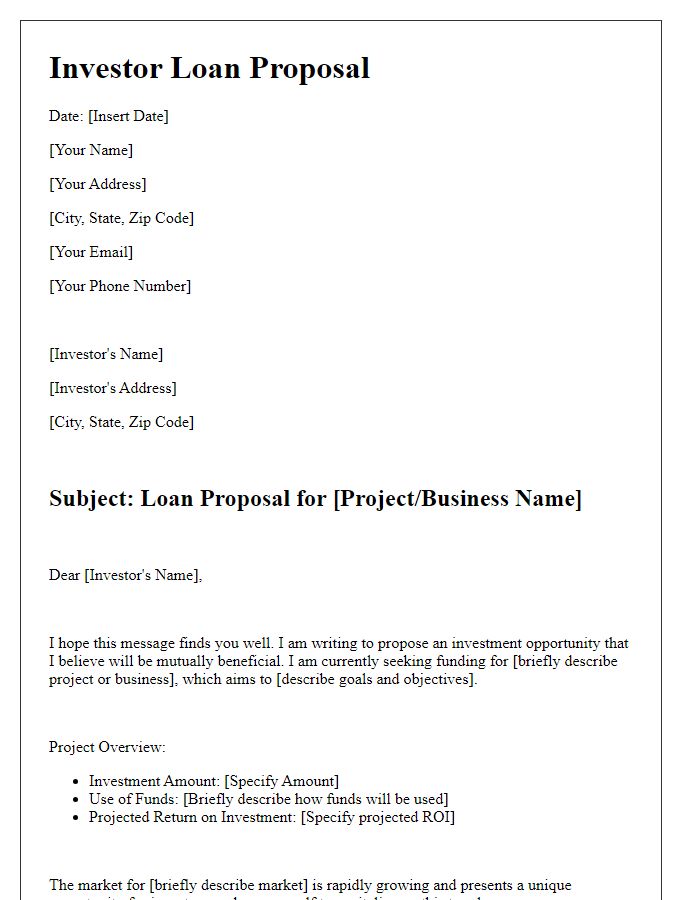

**Loan Purpose**: Specific use of funds, expected benefits, and strategic goals.

A business loan proposal outlining the purpose for the funds seeks to enhance operational capacity and drive strategic growth for the company. The specific use of funds includes expanding the manufacturing facility in Springfield, increasing production capabilities by 30% to meet rising demand. This expansion is expected to generate an additional $500,000 in annual revenue, significantly improving cash flow. Strategic goals include launching two new product lines by Q2 2024, which will diversify offerings and capture a larger market share in the eco-friendly consumer goods sector. Improved production efficiency will also reduce lead times by 20%, strengthening supplier relationships and enhancing customer satisfaction. Ultimately, this investment aims to solidify the company's position as a leader in sustainable products within the Midwest region.

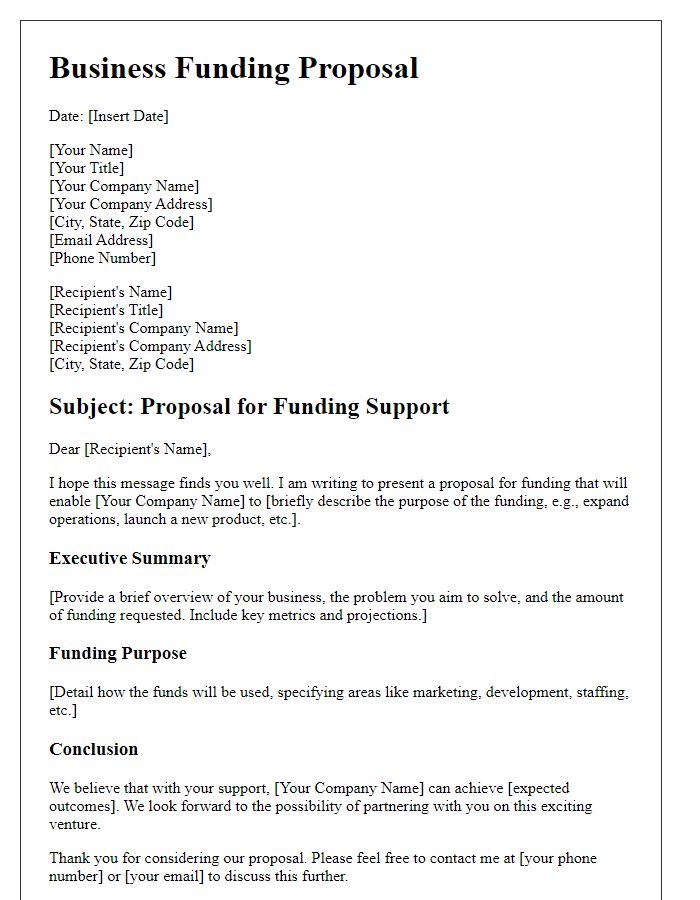

**Repayment Plan**: Timetable, sources of repayment, and risk management strategies.

A detailed repayment plan outlines the timetable for loan repayment, ensuring clarity on the timeline and structure. The proposed timeframe spans 36 months, with monthly payments of $5,000 commencing one month after loan disbursement. Primary sources of repayment include revenue from increasing sales forecasted at 20% annually, generated from enhancing service offerings in the urban market of New York City. Additionally, a contingency fund of $15,000 is set aside to address any unexpected downturns. Risk management strategies involve diversifying customer contracts, minimizing reliance on a single client, and implementing quarterly financial reviews to monitor cash flow. These measures ensure sustainable repayment while safeguarding against potential business fluctuations.

**Supporting Documentation**: Business plan, credit history, and collateral details.

Supporting documentation for a business loan proposal typically includes three key components: a comprehensive business plan outlining operational strategies, market analysis, and financial projections, a detailed credit history showcasing the creditworthiness of the business and its owners, including credit scores and past borrowing behavior, and specific collateral details that provide a clear description of assets, such as real estate or equipment, which can be pledged to secure the loan. This documentation serves to establish credibility and mitigate the lender's risk, ultimately improving the chances of securing the funding necessary for business growth or expansion.

Comments