Are you considering a bridging loan but unsure how to start your application? Navigating the world of financing can feel overwhelming, especially when you're looking to secure a short-term loan. A well-crafted letter can make all the difference in presenting your case to lenders. Join us as we dive into the essential components of a compelling bridging loan application letter!

Borrower's Personal and Contact Information

Borrowers seeking a bridging loan often need to provide personal information such as full name, date of birth (typically formatted as MM/DD/YYYY), and current residential address including postal code. Contact details are crucial, including phone number (preferably a mobile for immediate communication) and email address for correspondence. Additionally, financial history may include details like income sources, existing debts, and credit score metrics to assess eligibility. The inclusion of employer information, including position held and duration of employment, enhances the financial profile of the borrower.

Purpose of the Bridging Loan

A bridging loan serves as short-term financing designed to bridge the gap between immediate cash requirements and longer-term financing solutions. Commonly utilized in property transactions, bridging loans can facilitate purchases before selling an existing property, enabling buyers to secure properties, such as residential estates in London, without waiting for a property sale to finalize. These loans typically carry higher interest rates compared to traditional mortgages, reflecting their urgency and risk profile, often spanning a period of 1 to 18 months. Investors and homeowners may utilize these loans for various purposes including renovations on properties, auction purchases, or cash flow during transitional business phases. Accurate assessment of the loan amount needed, repayment strategy, and exit plan is crucial for efficient financial management.

Detailed Financial Information and Asset Details

Bridging loans serve as short-term financing solutions, often utilized to facilitate property transactions. These loans typically range from PS25,000 to PS15 million, catering to diverse financial needs. Applicants must provide comprehensive financial information, including annual income, outstanding debts, and credit score (with scores below 600 indicating higher risk). Asset details play a crucial role; for instance, primary residences in London may appreciate at 7% per annum, while commercial properties in industrial areas could yield significant rental income. Effective documentation, such as bank statements and property appraisals, enhances the approval process. In regions like the Southeast where property values are rising, bridging loans can be a strategic tool for real estate investors aiming to seize time-sensitive opportunities.

Loan Amount, Duration, and Repayment Plan

Bridging loans, often employed in real estate transactions, provide temporary financing to cover the gap between purchasing a new property and selling an existing one. Typical loan amounts range from PS25,000 to PS25 million, depending on the lender and the property value, ensuring flexibility for various financial needs. Durations for these loans usually span from 1 to 18 months, allowing borrowers to secure sufficient time for property sales or renovations. A repayment plan often involves monthly interest payments, with the principal amount due upon completion of the property sale or refinancing into a more permanent mortgage solution. This strategic financial instrument caters to homeowners, property investors, and developers seeking time-sensitive opportunities in dynamic markets.

Supporting Documentation and Collateral Details

A bridging loan application requires comprehensive supporting documentation to validate borrower eligibility and loan security. Essential documents typically include proof of identity, such as a government-issued photo ID (passport or driver's license), and proof of address, often through utility bills or bank statements labeled with the applicant's name and recent date. Financial documentation covering income verification, including payslips or tax returns, further showcases the applicant's financial health. Details about the property serving as collateral are crucial, including recent property value assessments or appraisal reports. Applicants must provide an official title deed, which confirms ownership and any existing liens on the property. Clarity in this documentation ensures that loan amount estimates align with the property's market value, paving the way for a smooth loan approval process.

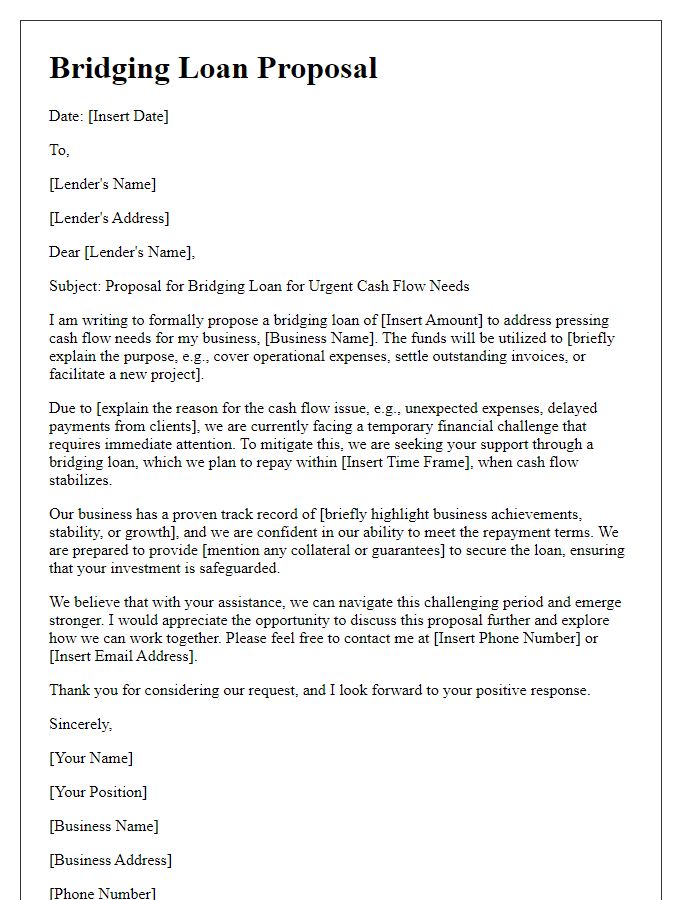

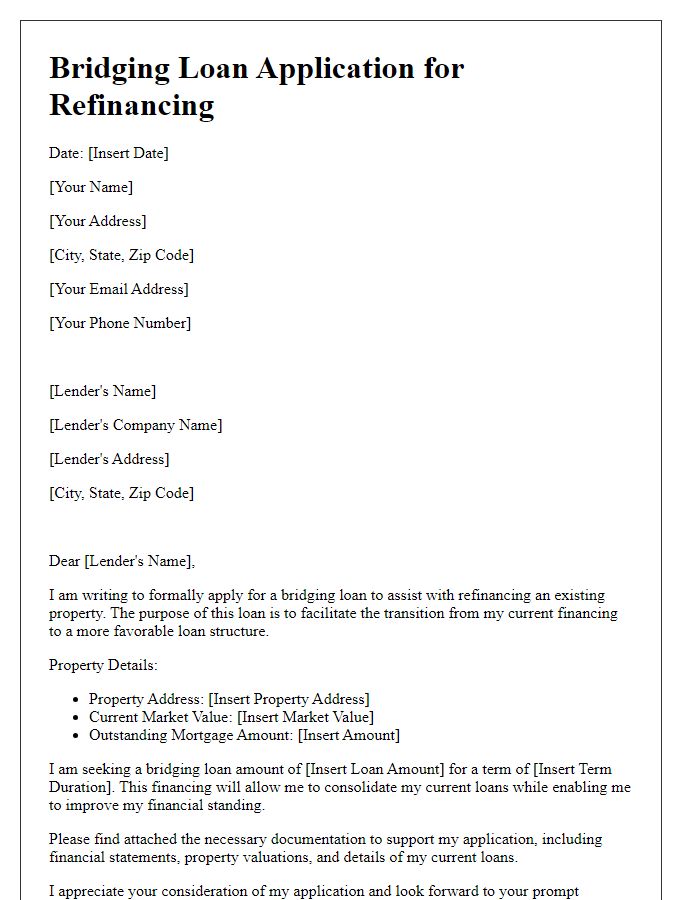

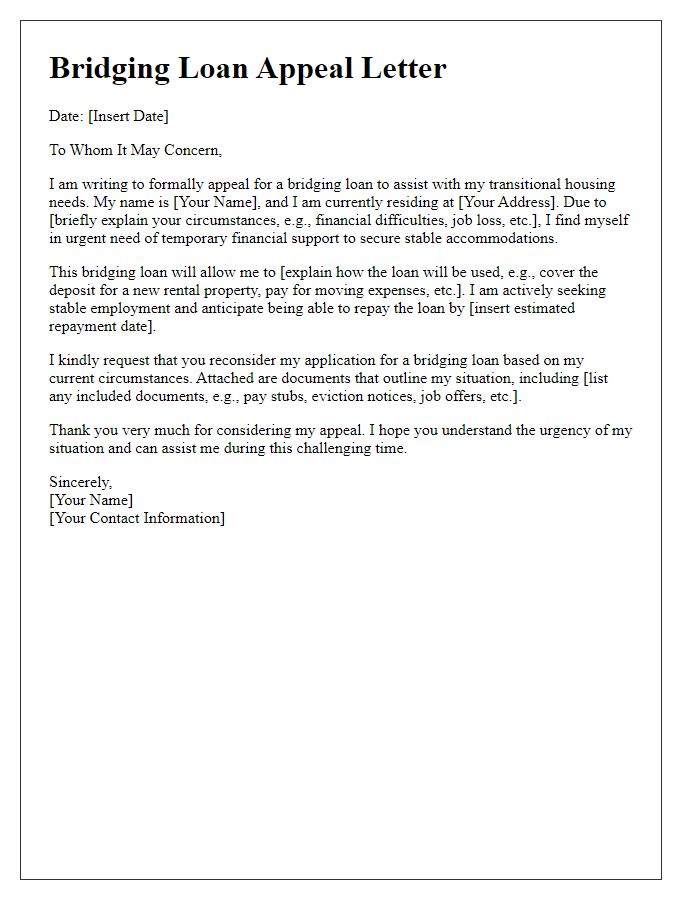

Letter Template For Bridging Loan Application Samples

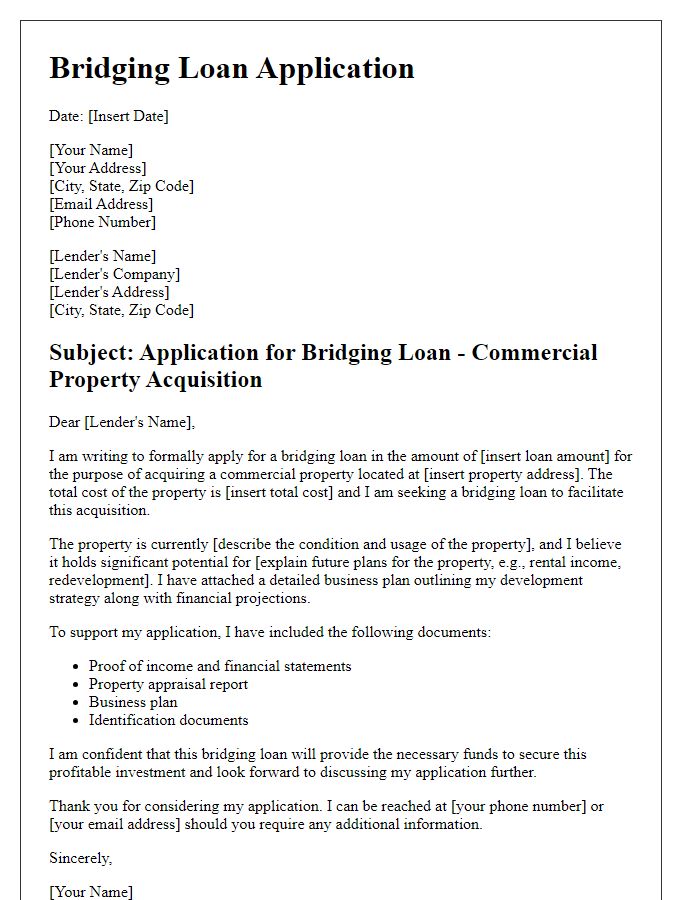

Letter template of bridging loan application for commercial property acquisition.

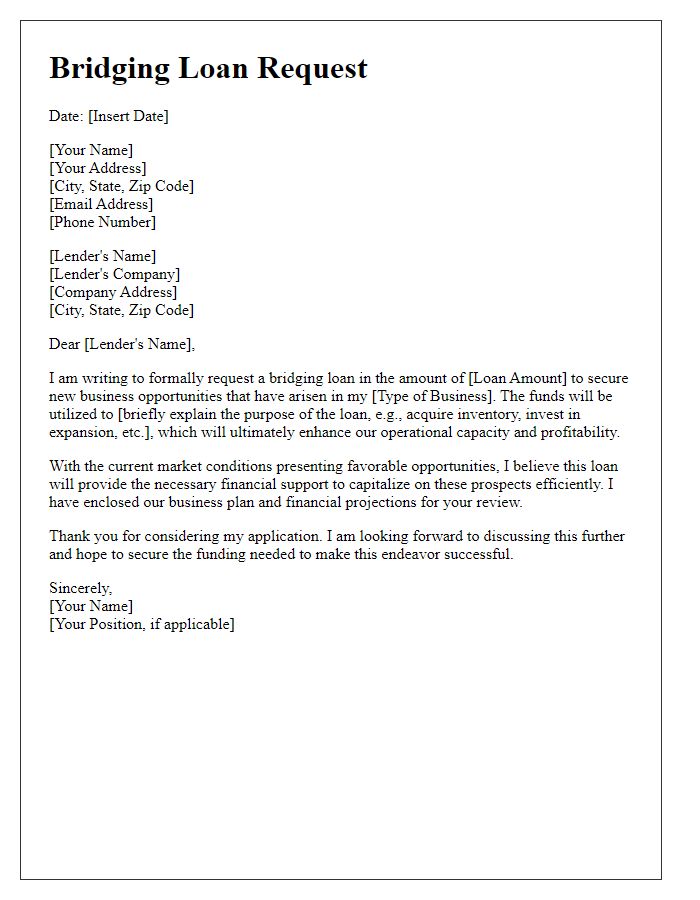

Letter template of bridging loan request for securing new business opportunities.

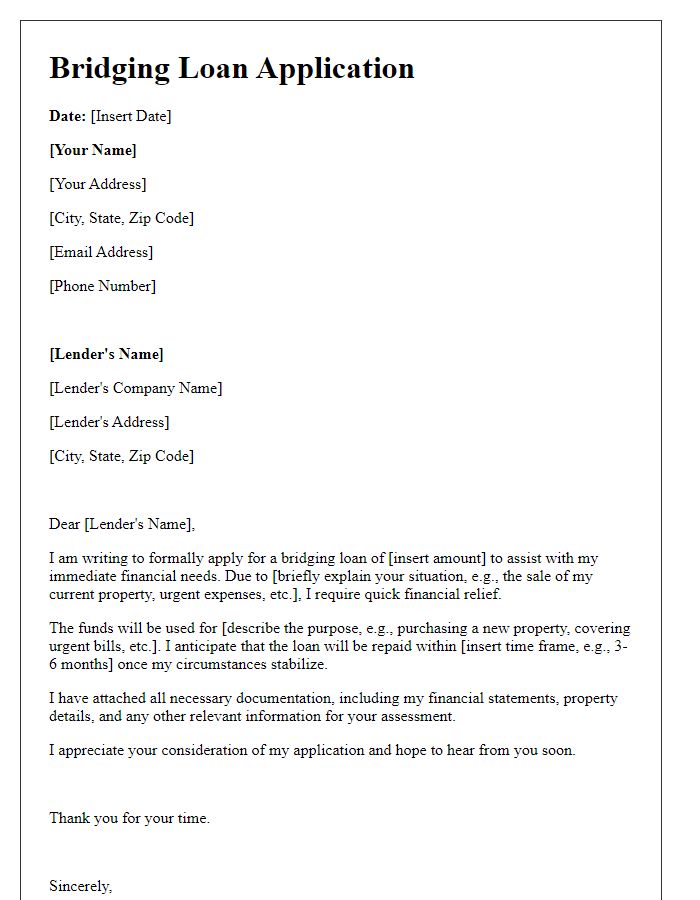

Letter template of bridging loan application for quick financial relief.

Letter template of bridging loan documentation for real estate development.

Comments