Are you considering a bridge loan to navigate your financial needs? It's a practical solution that offers a temporary lifeline while you await longer-term financing or the sale of a property. This letter template will help guide you in articulating your request effectively. Ready to learn more about how to structure your application?

Purpose and Usage of Loan

The purpose of the bridge loan is to facilitate immediate financing for a real estate transaction, specifically the purchase of a residential property located at 123 Main Street, Springfield. The estimated cost of the property is $300,000, with a down payment of $60,000 sourced from the sale of the applicant's current residence. The bridge loan will cover the remaining $240,000, allowing for a seamless transition between properties while waiting for the sale to finalize. The loan is expected to be repaid within six months, once the current home, valued at approximately $350,000, is sold. This funding will also provide a cushion for unforeseen expenses during the transition period, ensuring that the applicant can maintain financial stability. Additional usage of funds may include minor renovations on the new property to enhance market value and expedite a potential future sale, projected to yield an increase in value of 10-15%.

Financial Details and Repayment Plan

A bridge loan serves as a temporary financial solution, often utilized during real estate transactions. This type of short-term loan typically lasts six months to three years and bridges the gap between the need for immediate cash flow and securing long-term financing. Borrowers may need to showcase detailed financial statements, including credit scores (ideally above 700), monthly income, and existing debts. The repayment plan usually involves regular monthly payments or a lump sum at the end of the loan term. Interest rates can range from 8% to 10%, depending on the lender and borrower's creditworthiness. Collateral, often the property itself or other significant assets, secures the loan. Understanding the lender's requirements and timing is crucial in ensuring seamless transition to permanent financing.

Collateral Information

A bridge loan application often involves detailed collateral information to assess risk and secure financing. For instance, property collateral such as residential real estate might include a two-story home located at 123 Maple Street, valued at $350,000 and mortgaged for $200,000. Additionally, inventory collateral could consist of a retail store's stock, estimated at $50,000, encompassing various electronics such as televisions and laptops. Also, accounts receivable may involve outstanding invoices totaling $75,000, with key clients located in the Chicago metropolitan area. In summary, providing comprehensive and precise collateral information, including property location, valuation figures, and types of assets involved, significantly enhances the prospect of securing a bridge loan.

Business or Project Overview

A bridge loan serves as a short-term financing solution for businesses seeking temporary capital to cover immediate expenses or bridge financial gaps until more permanent funding is secured. This type of loan typically has a term ranging from a few weeks to a few years and involves higher interest rates due to its risk factor. Such loans are often utilized in scenarios like real estate transactions where quick access to funds is critical, for example, purchasing a new property before selling the existing one. In the fast-paced business landscape of urban centers, companies may secure bridge loans to manage cash flow issues during transitional periods, such as launching new projects or covering payroll expenses. The flexibility and speed of bridge loans can facilitate timely growth and operational continuity in highly competitive industries.

Contact Information and Signoff

Contact information for potential lenders plays a crucial role in securing a bridge loan. Key details typically include the applicant's full name, email address, and phone number, ensuring direct communication regarding the loan application. A concise professional signoff, such as "Sincerely" or "Best regards," followed by the applicant's name, reinforces professionalism. Including current address information adds credibility and facilitates proper documentation. This structured approach makes it easier for lenders to contact applicants efficiently, streamlining the approval process for vital financial assistance in transitional periods.

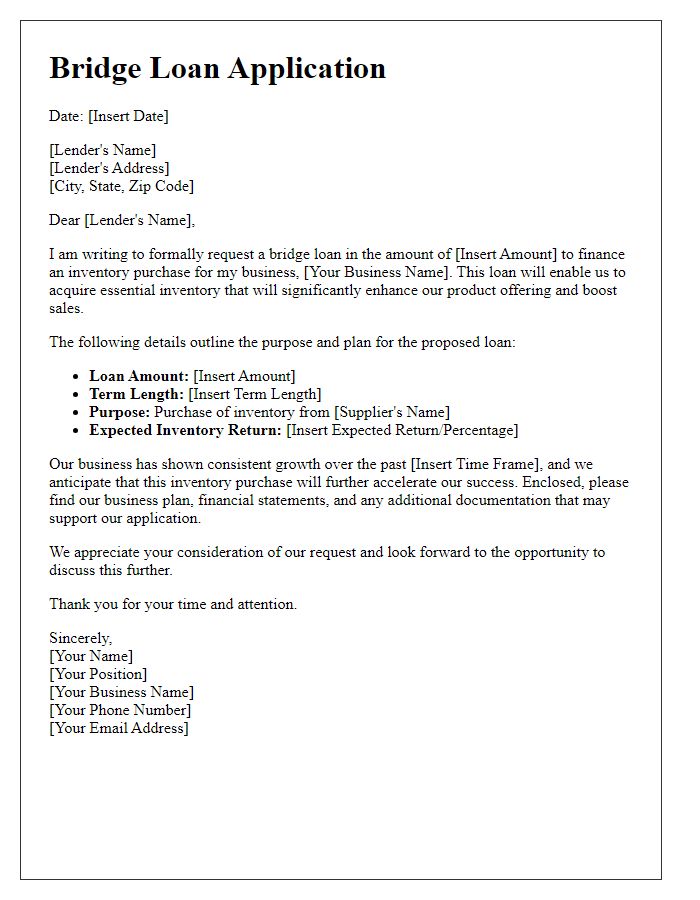

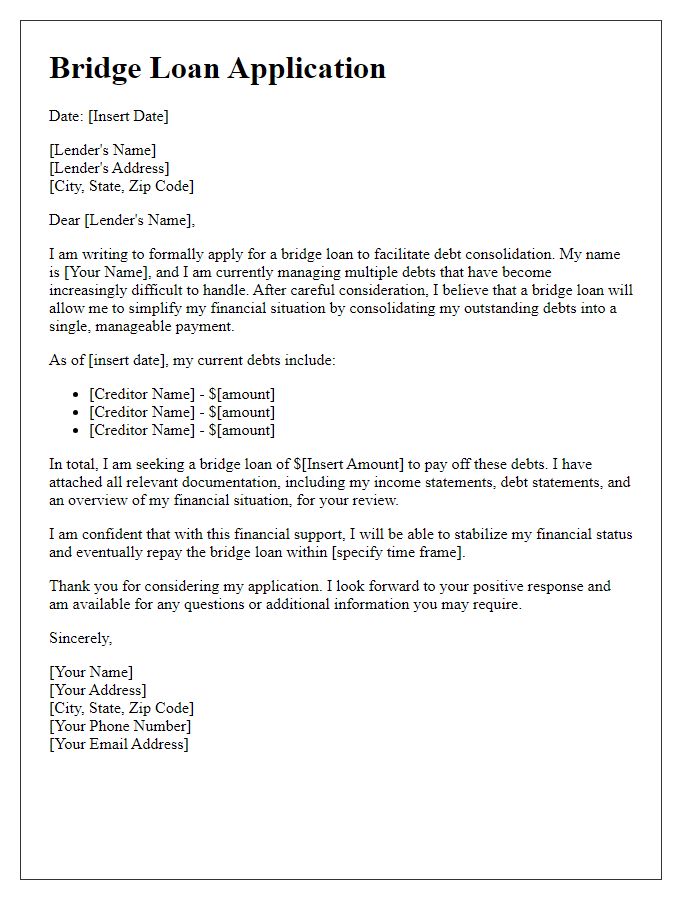

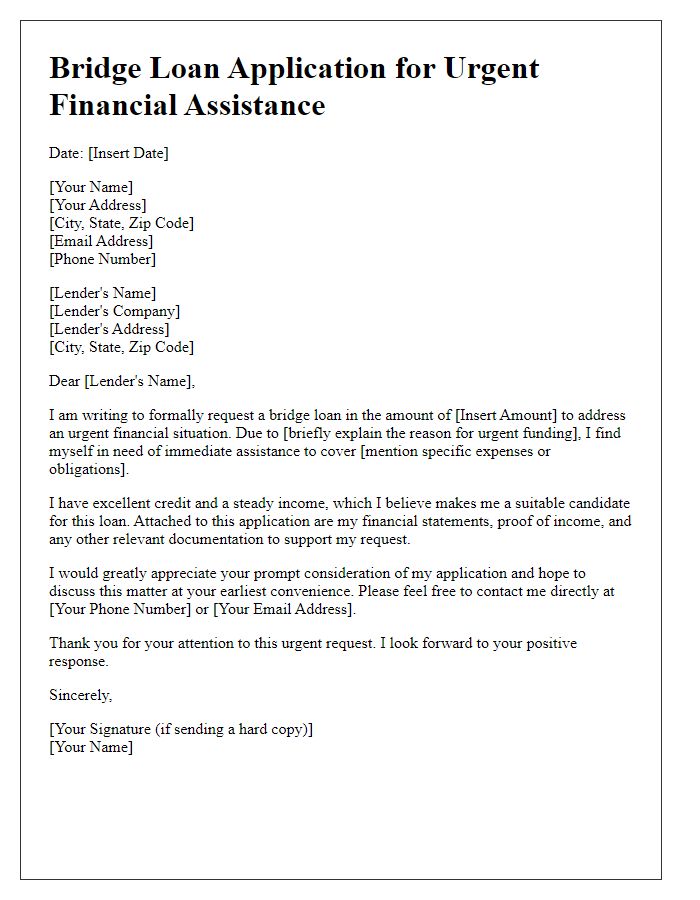

Letter Template For Application Of Bridge Loan Samples

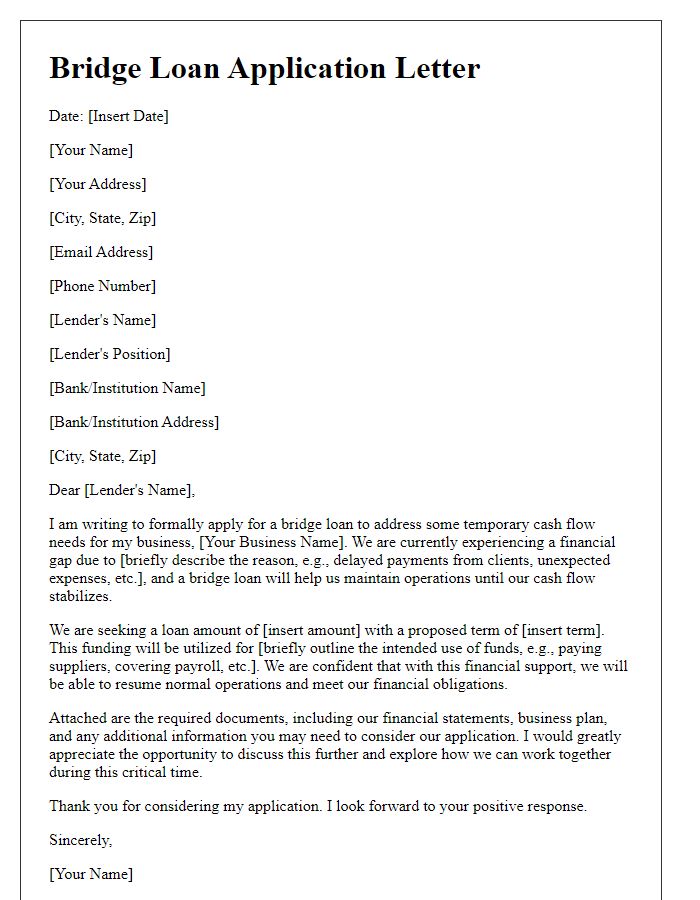

Letter template of bridge loan application for temporary cash flow needs.

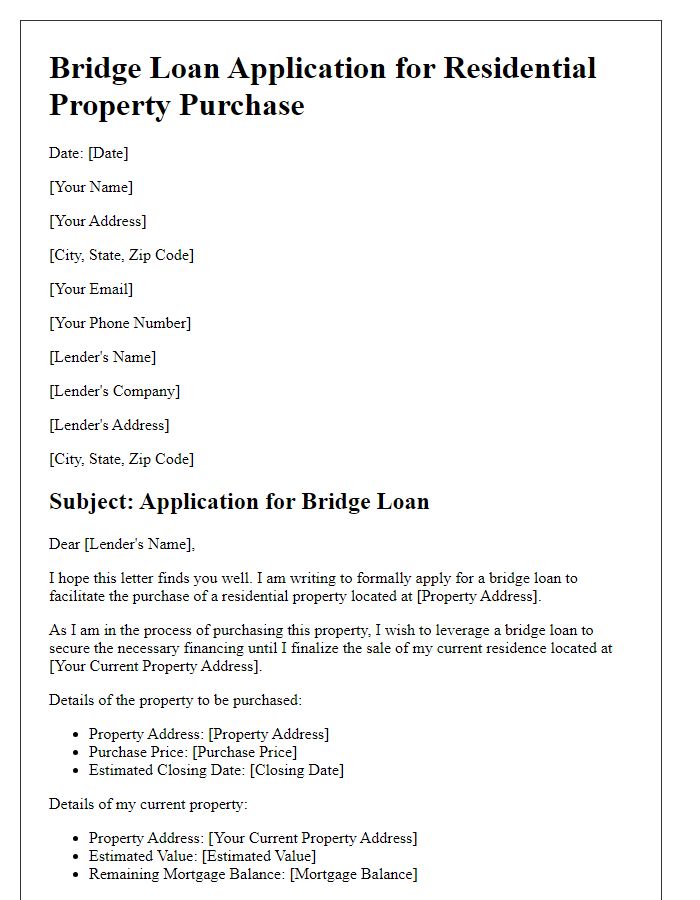

Letter template of bridge loan application for residential property purchase.

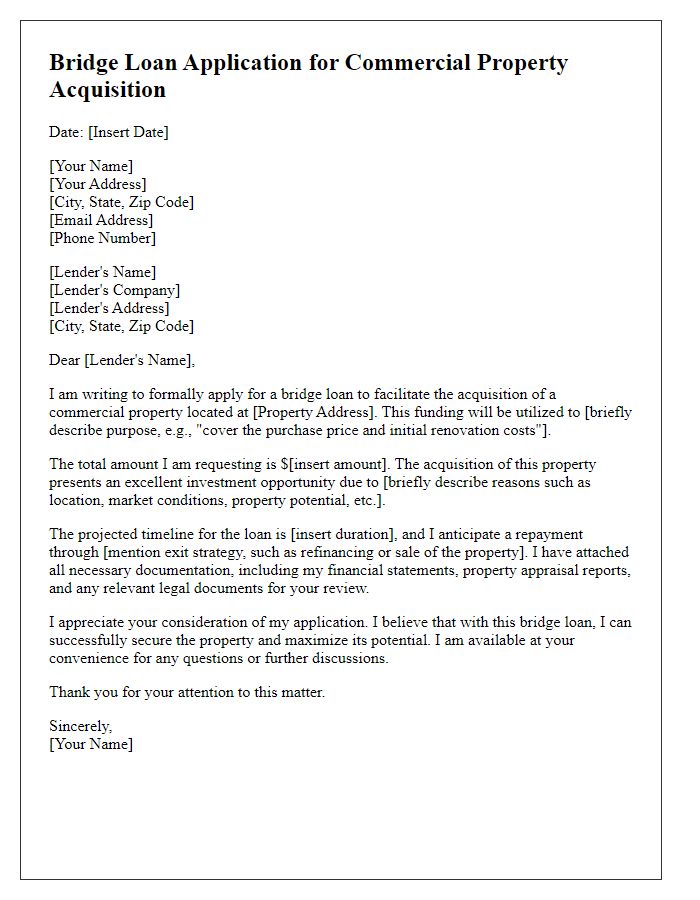

Letter template of bridge loan application for commercial property acquisition.

Comments