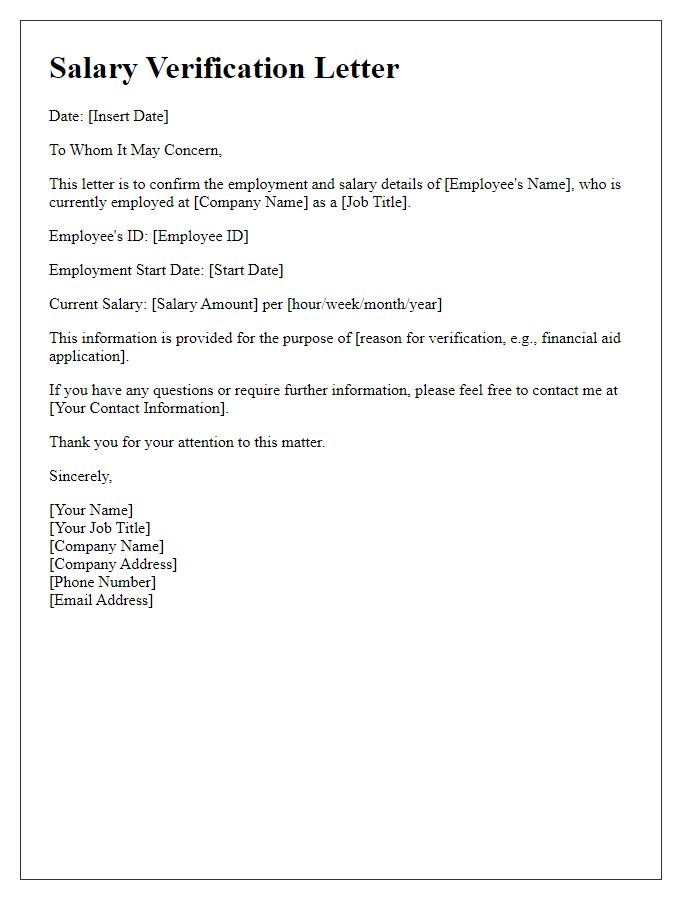

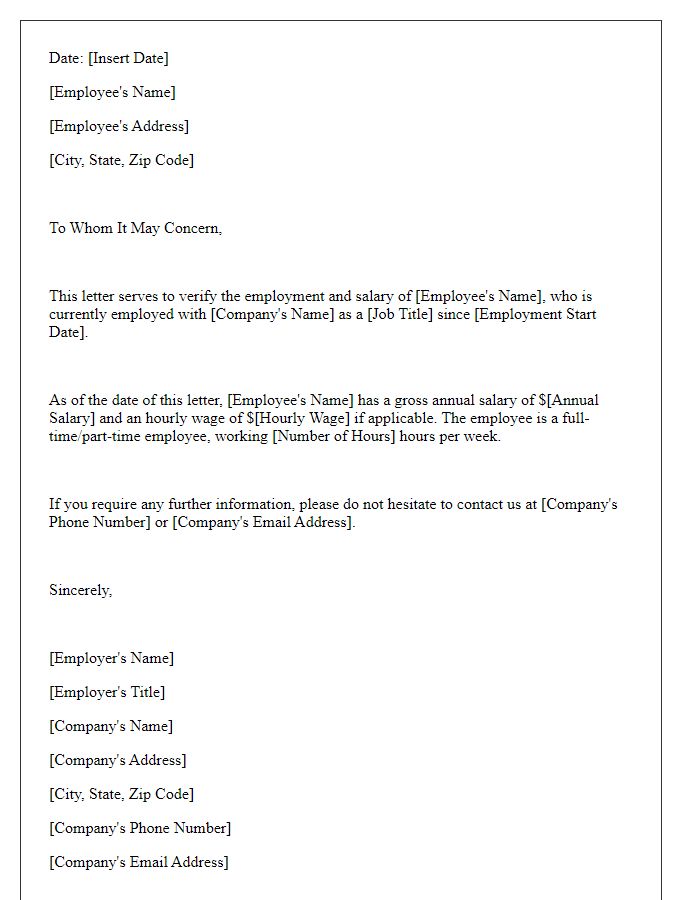

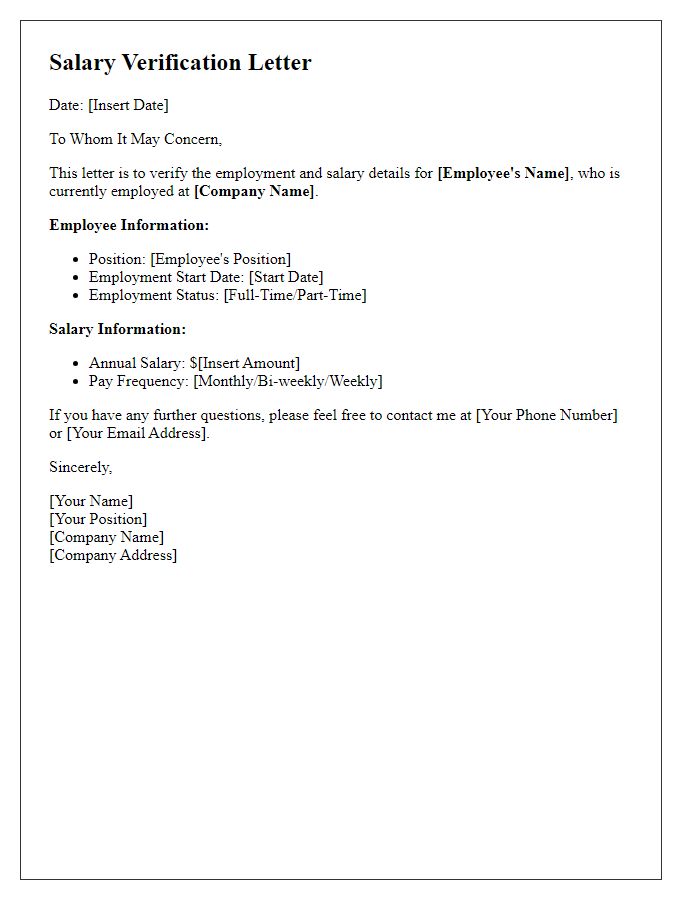

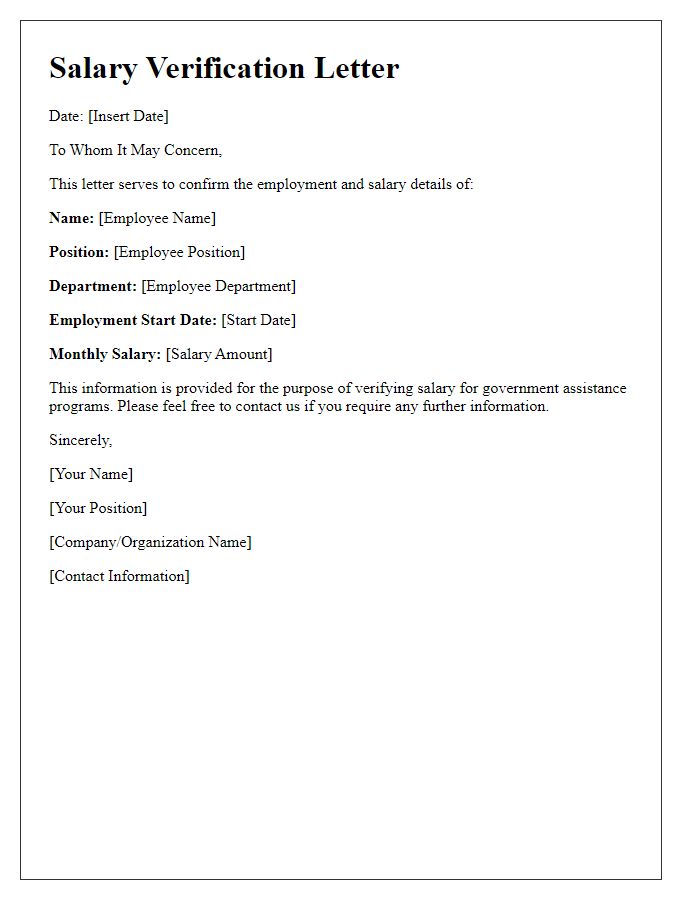

Are you in need of a reliable employee salary verification letter? Whether you're applying for a loan, renting an apartment, or seeking other financial opportunities, having a professionally crafted letter can make all the difference. In this article, we'll guide you through the essential components of a salary verification letter and provide a handy template to help you get started. So, let's dive in and explore how to create a seamless verification letter that meets your needs!

Employee's Full Name and Position

Employee's full name, John Doe, holds the position of Senior Software Engineer at Tech Innovations Ltd, a leading software development company located in Silicon Valley, California. The employee's annual salary stands at $100,000, with a bi-weekly pay schedule of approximately $3,846. This compensation reflects not only his technical proficiency in programming languages such as Python and Java but also his contributions to successful projects like Project Phoenix, which generated $2 million in revenue. Additionally, the company's benefits package includes health insurance, retirement plans, and performance bonuses, enhancing overall employee satisfaction and retention.

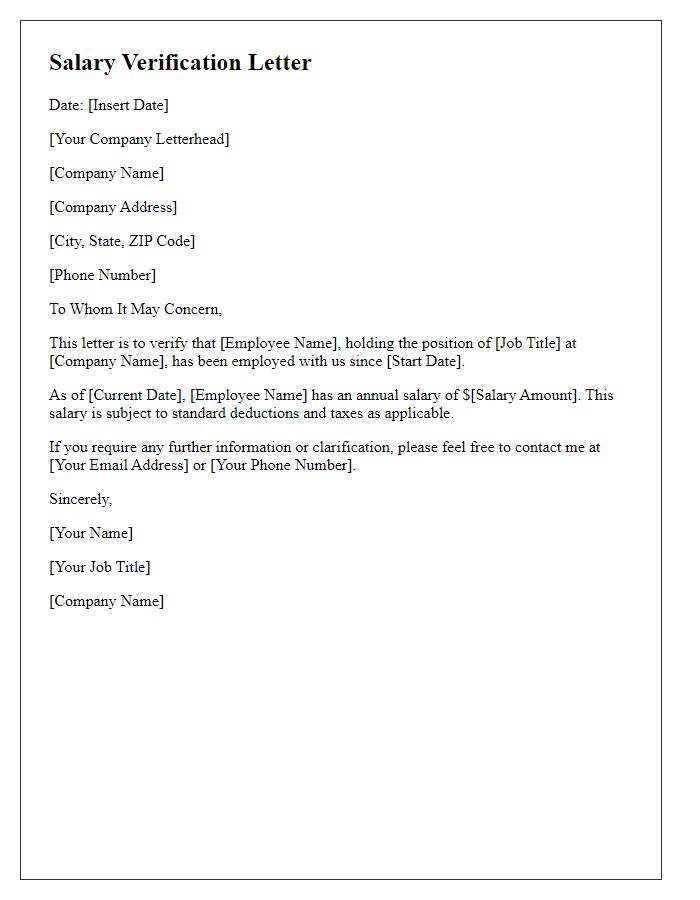

Company Name and Contact Information

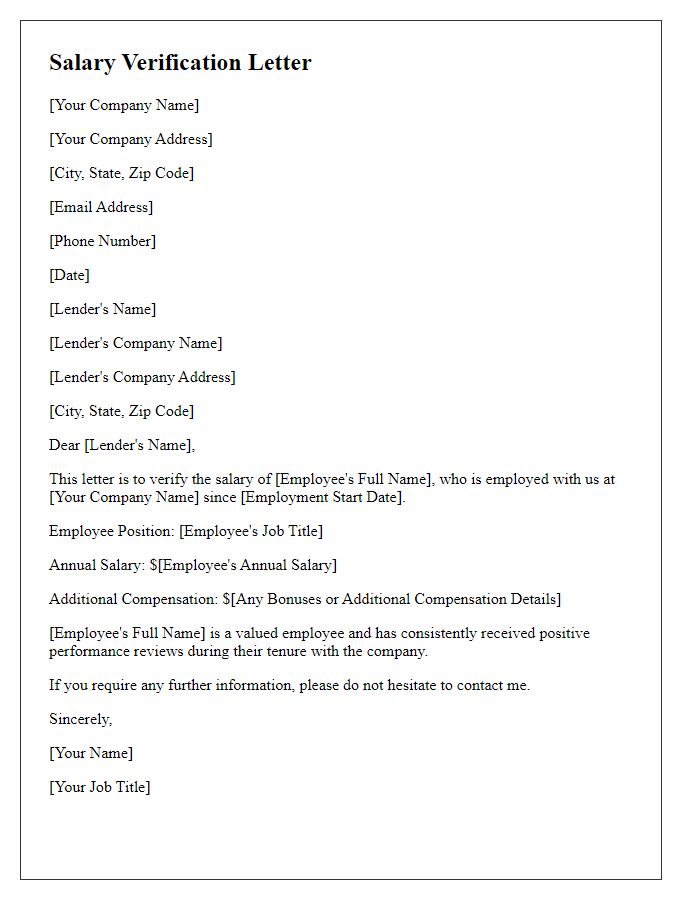

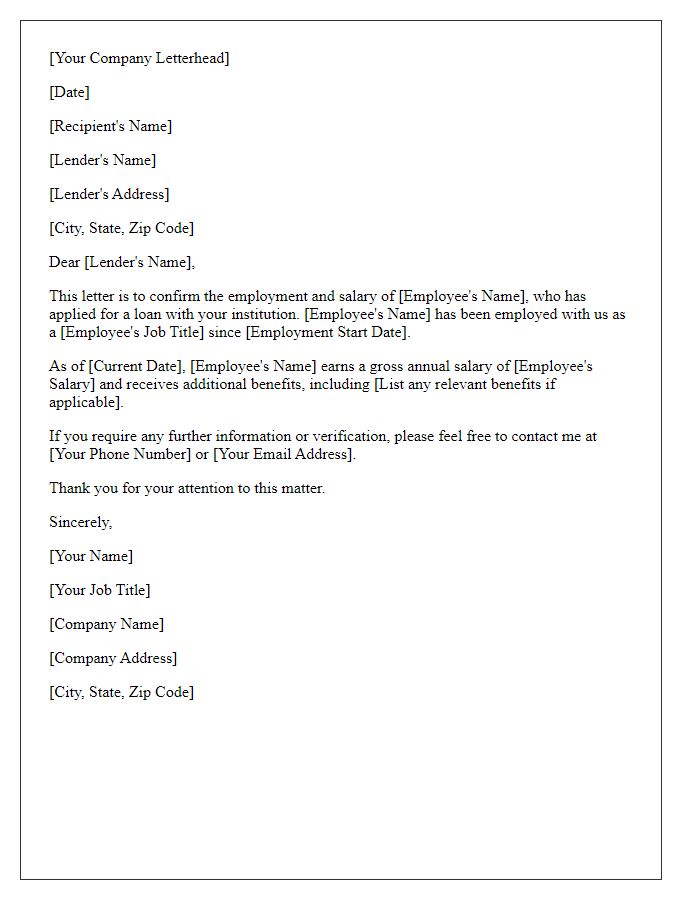

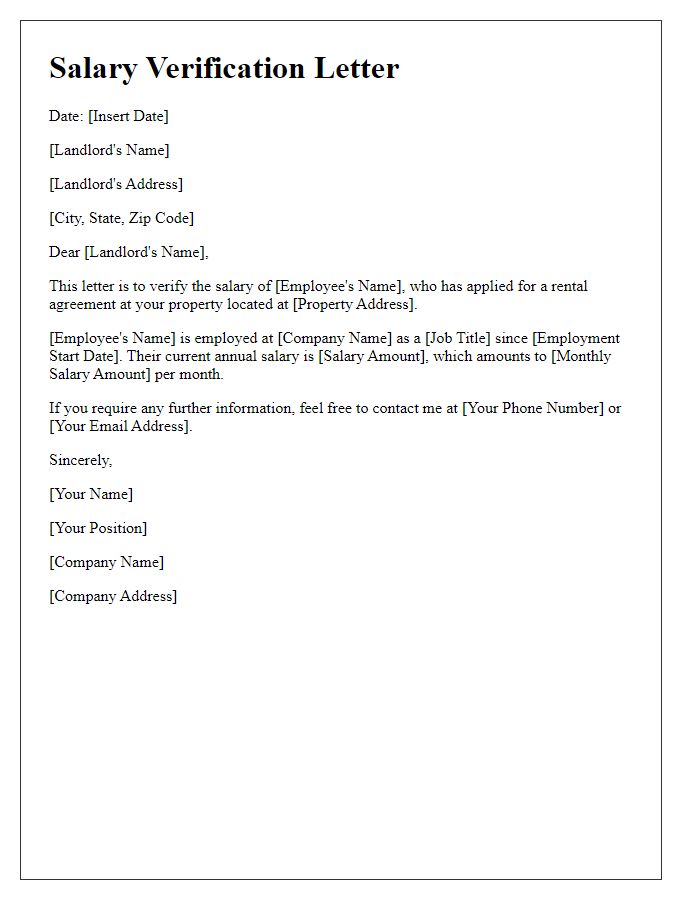

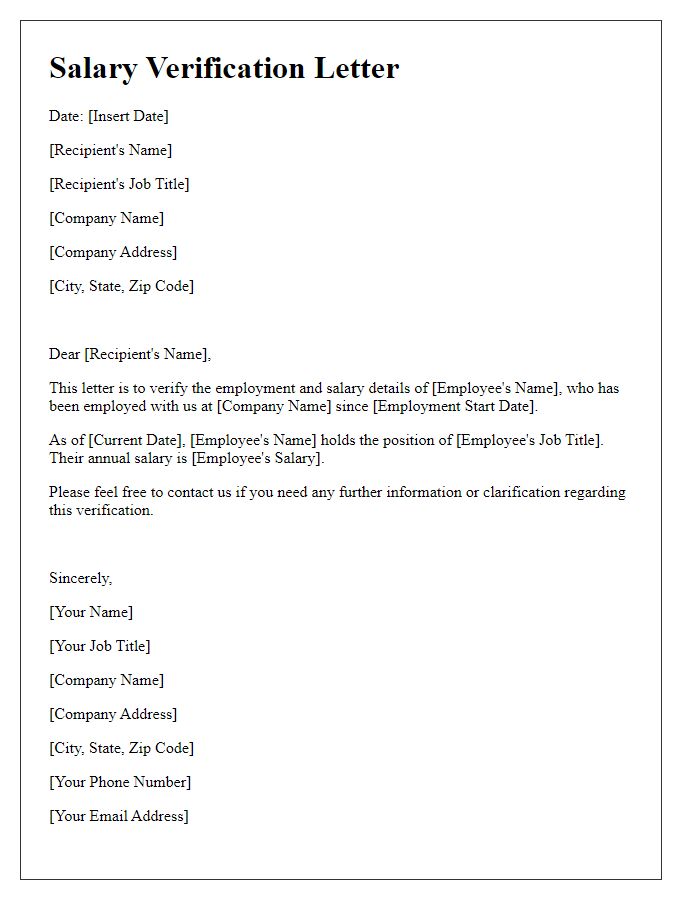

A salary verification letter typically serves to confirm an employee's position, salary, and employment status for various purposes such as mortgage applications or loan approvals. The letter would typically include key details such as Company Name (XYZ Corporation), address (123 Business Lane, City, State, ZIP), and contact information (Phone: (555) 123-4567, Email: hr@xyzcorporation.com). It confirms the employee's role (e.g., Software Engineer) along with the annual salary amount ($75,000) and the length of employment (since January 2020). This document is essential for external parties to validate income and employment reliability during financial evaluations.

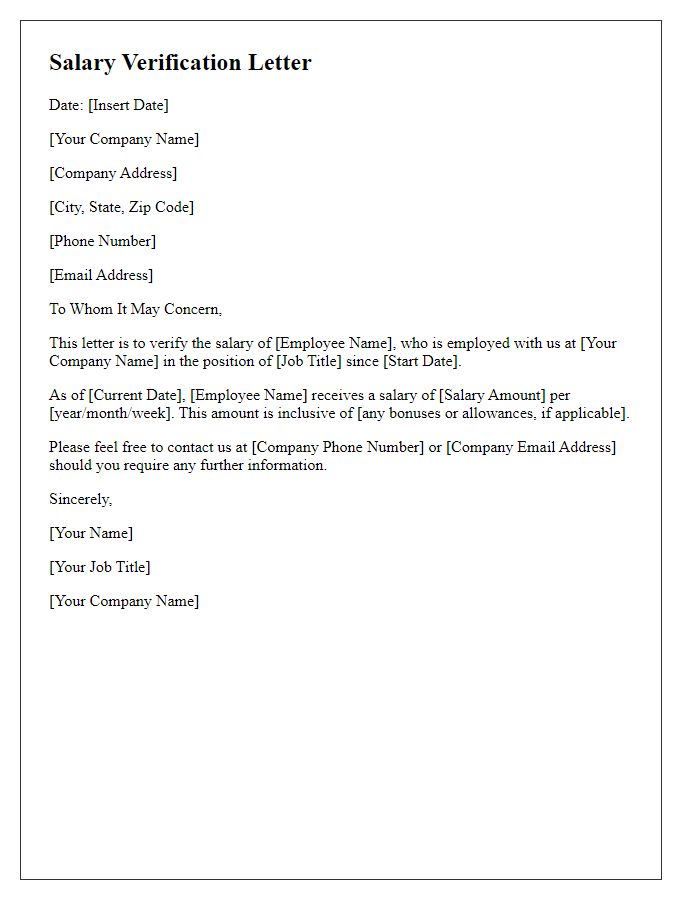

Employment Duration and Status

Employee salary verification serves as a vital process for confirming an individual's employment status, along with the duration of employment, to ensure accurate financial transactions and compliance requirements. The verification typically includes key details such as the employee's start date, which may range from days to years, the role or job title held by the employee, and the current employment status (active, terminated, or on leave) as of the verification date. Organizations often require this information for various purposes, including loan applications, renting agreements, or background checks by prospective employers. It is essential to include the name of the company, its address for correspondence, and contact details of the HR department to facilitate efficient communication and verify accuracy. Additionally, specific numbers associated with salary figures and their payment frequency (monthly, bi-weekly) enhance the clarity of the verification document.

Salary Details and Compensation Structure

Salary verification serves to authenticate an employee's compensation, crucial for loan applications, rental agreements, and financial assessments. The salary details typically encompass the base salary--often listed as an annual figure--for positions like software engineer or marketing manager. Additional compensation components may include bonuses, which can vary widely--averaging 10-20% of base salary--health benefits, and retirement contributions, such as a 401(k) with company matching options. Deductions for taxes, insurance, and retirement plans must be noted for clarity. Understanding these elements aids in presenting a comprehensive perspective of the employee's financial standing, beneficial in various professional interactions.

Authorized Signature and Company Seal

Employee salary verification is a formal process that confirms a worker's earnings at a specific organization, such as ABC Corp., established in 2005. The verification document often requires an authorized signature from a Human Resources representative and may include the company seal to validate its authenticity. Employee details should include the individual's full name, job title, and employment duration, typically ranging from a few months to several years. Salary figures should be presented clearly, including base pay, bonuses, and benefits, to provide a comprehensive overview. This document is often requested for various purposes, such as loan applications, leasing agreements, or credit approvals, making its accuracy crucial for both the employee and the organization.

Comments