Are you dealing with the frustration of a loan processing delay? You're not aloneâmany individuals find themselves in a similar boat, navigating the often-complicated world of financial approvals. Understanding the reasons behind these delays can empower you and help ease your worries. Let's dive deeper into the common causes and what you can do about them!

Clear Subject Line

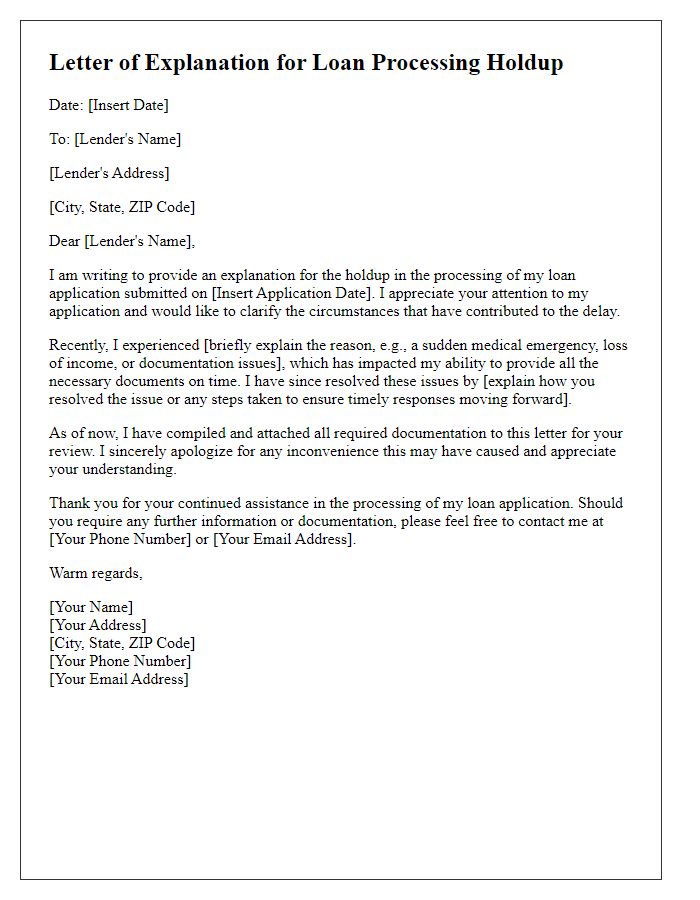

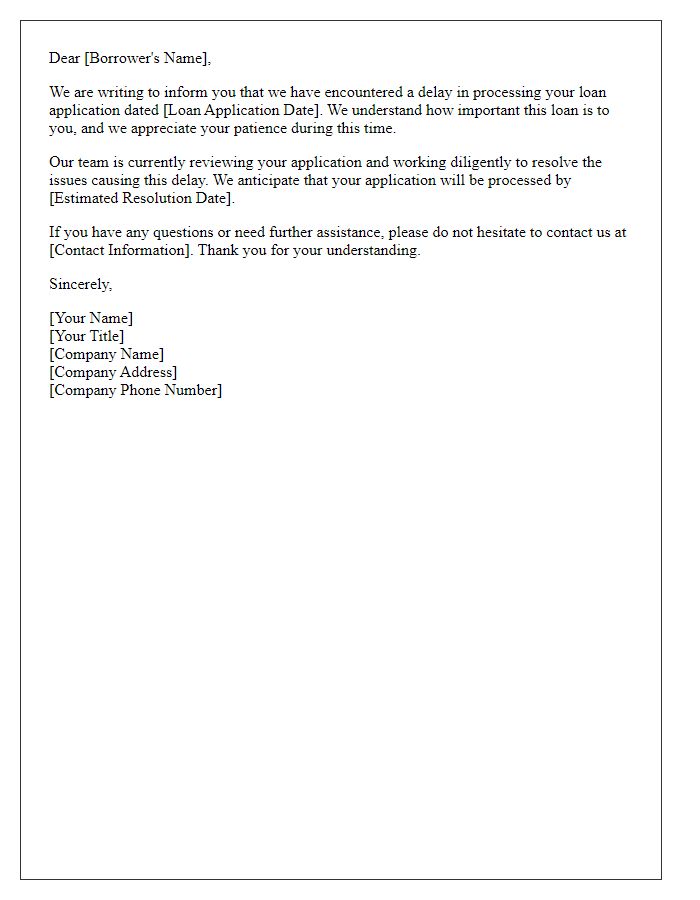

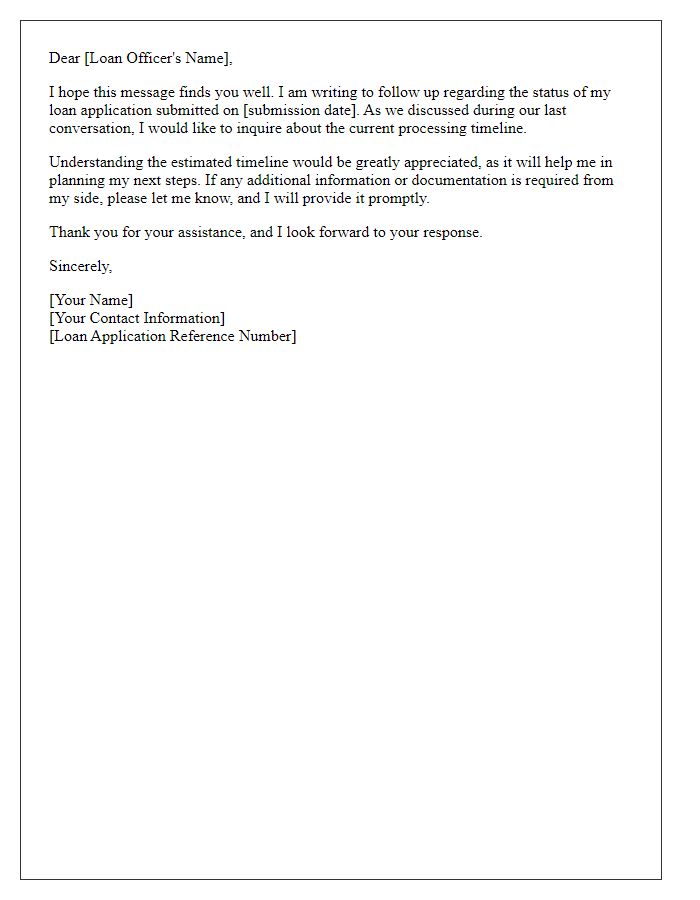

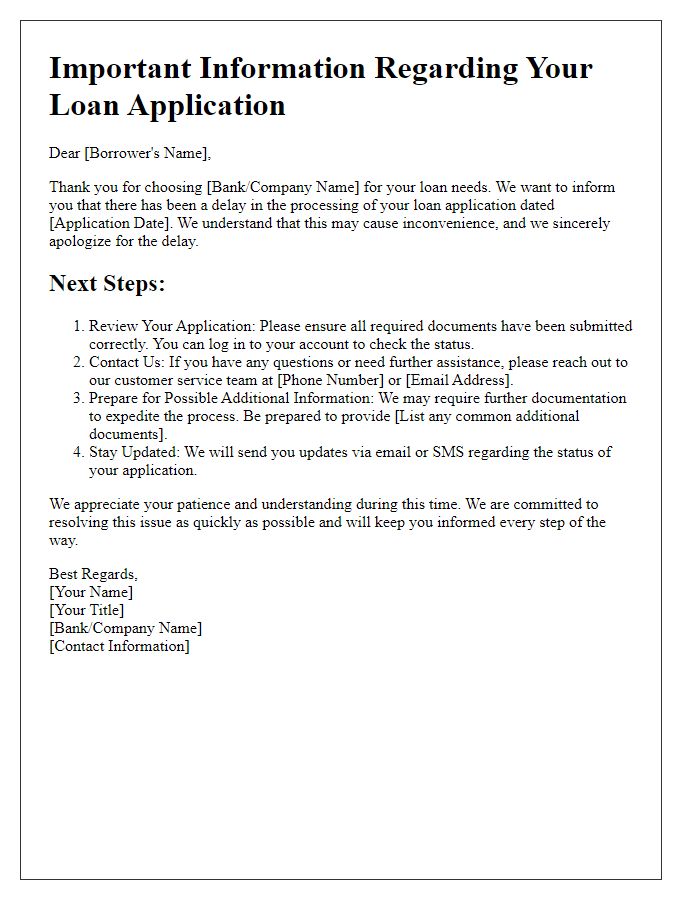

Loan processing delays often arise from incomplete documentation or verification issues, impacting the overall timeline significantly. In many cases, additional information may be required, such as detailed income statements or collateral evaluations. Industry standards recommend a response time of 30 to 45 days for loan processing, yet complications can extend this duration. Borrowers should be advised on the status of their application, potential next steps, and any outstanding items to ensure a smooth progression towards loan approval. Communicating timelines transparently helps manage expectations and fosters trust between lenders and clients.

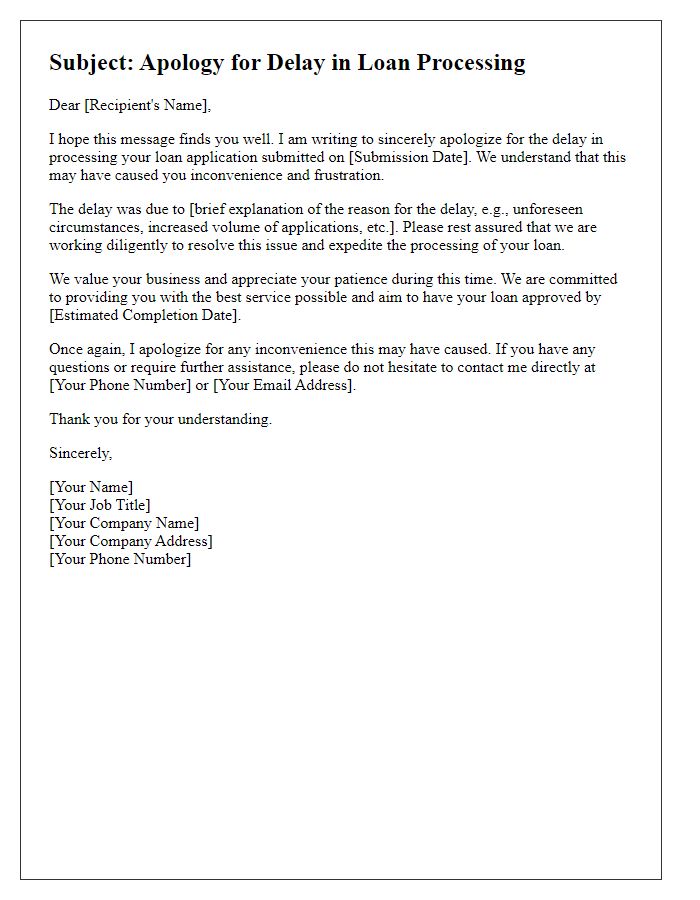

Polite Apology

Loan processing delays can significantly impact borrowers, especially individuals and families relying on timely access to funds for essential needs such as home purchases, education expenses, or medical bills. Factors such as high application volume at financial institutions, regulatory compliance lapses, or missing documentation may contribute to extended processing times, frustrating applicants awaiting responses. Loan officers often extend polite apologies to clients, acknowledging the inconvenience caused by these delays and assuring them that efforts are in place to expedite the process. Maintaining open communication throughout this period remains crucial, as it helps alleviate borrower anxiety and fosters trust between the financial institution and its clients.

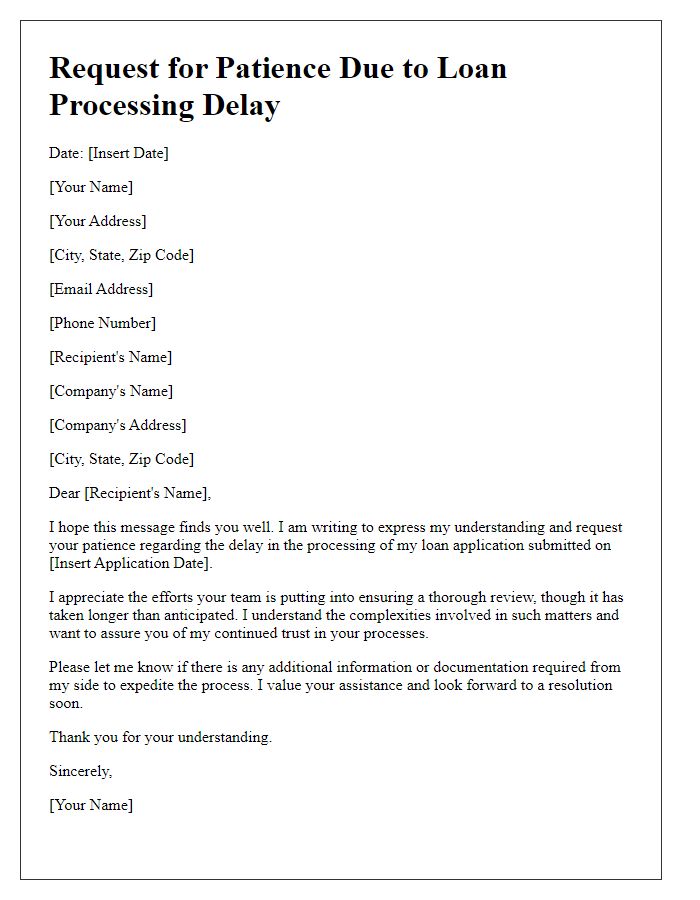

Reason for Delay

Loan processing delays can often occur due to various factors such as incomplete documentation or additional verification requirements. For instance, missing financial statements or proof of income can lead to extended processing times, typically adding several days to weeks. Additionally, fluctuations in demand at lending institutions, particularly after significant events like economic downturns or high mortgage application seasons, may result in bottlenecks. External factors like interest rate changes or regulatory updates can also contribute to delays. Hence, clients may experience a lag before receiving final approval or funding.

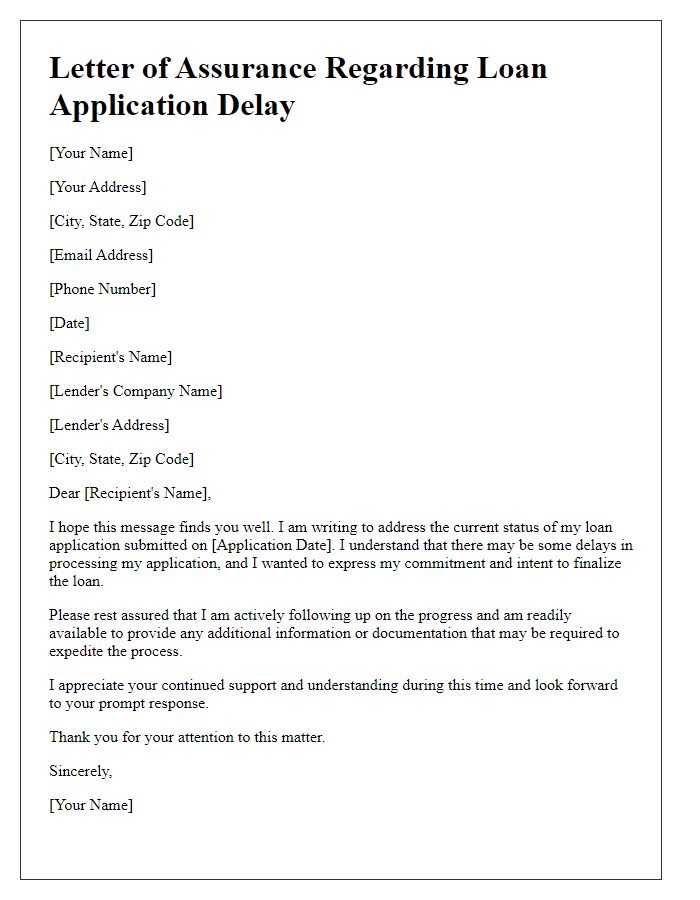

Assurance of Resolution

Loan processing delays can significantly impact borrowers' financial plans, especially when purchasing homes or vehicles. Such delays often arise from various factors, including incomplete documentation, credit checks, or high demand during peak lending seasons, where institutions see applications surge (like Spring 2023). For example, a mortgage application may require verification of income statements and employment history, which can take several days. Additionally, regulatory compliance checks related to the Truth in Lending Act must ensure transparency in loan terms. Financial institutions, including major banks like JPMorgan Chase, usually aim to process loans within a standard timeframe of 30 to 45 days. However, when borrowers are informed about potential delays, they should receive assurance that all efforts are being made to expedite the process and that communication will be prioritized, ultimately ensuring a resolution to their financial needs in a timely manner.

Contact Information

Loan processing delays can significantly impact borrowers, often causing financial stress and uncertainty. Specific issues, such as incomplete documentation, underwriting reviews, or system errors, can prolong the approval timeline. Typical delays may extend from a few days to several weeks, depending on the lender's workload and efficiency. This can affect loan types, including mortgages, personal loans, and auto loans. For instance, a mortgage application could take up to 60 days; meanwhile, auto loans may process within a week if all documentation is submitted correctly. Staying informed through regular communication with lender representatives is crucial. Correct contact information, including phone numbers and email addresses, helps facilitate prompt resolution of issues during the processing phase.

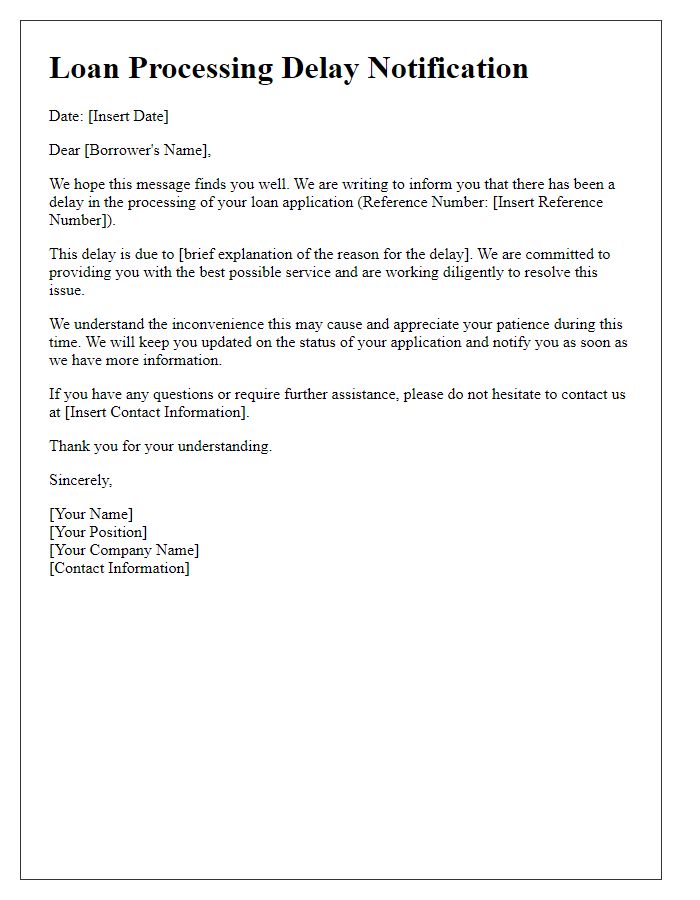

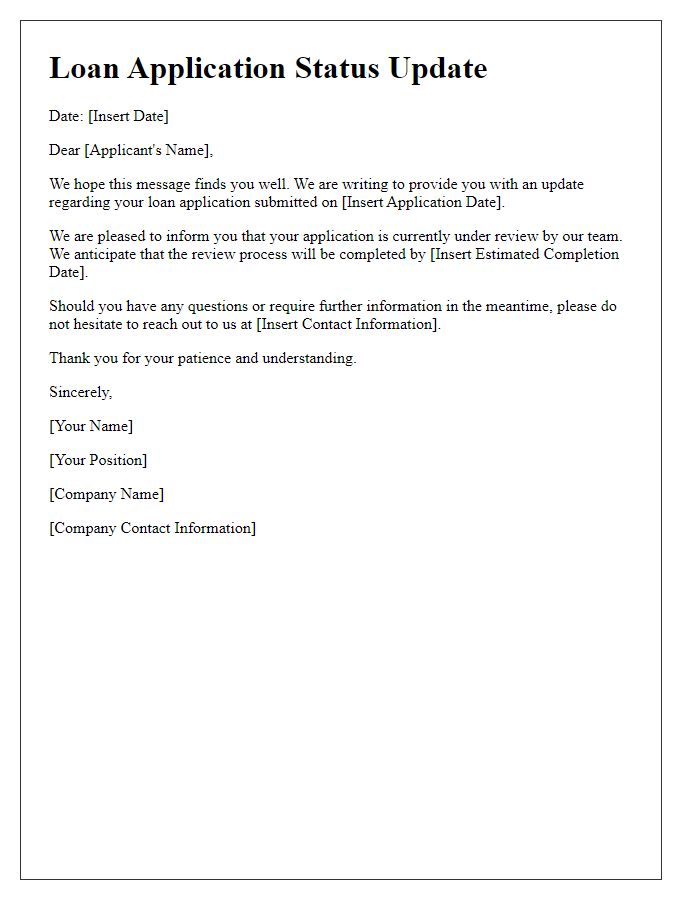

Letter Template For Loan Processing Delay Samples

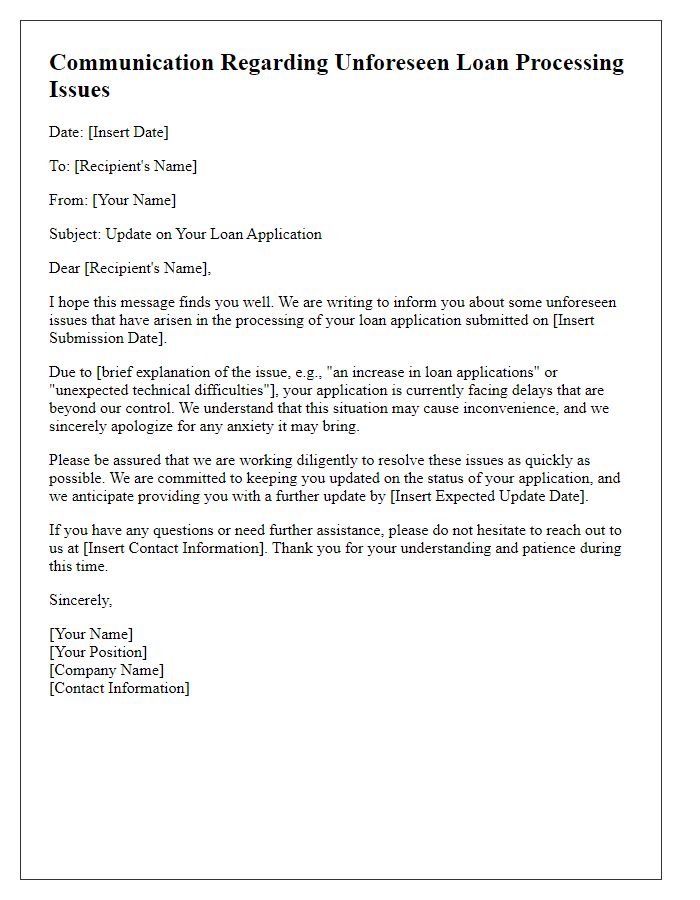

Letter template of communication about unforeseen loan processing issues

Comments