Are you feeling overwhelmed by your current loan payments and considering a temporary relief? You're not alone; many people find themselves in a similar situation and are seeking options to alleviate their financial burdens. One effective route is to request a loan deferral, which can provide you with the breathing room you need to regain stability. Curious about how to draft the perfect letter for your request? Read on for expert tips and a handy template!

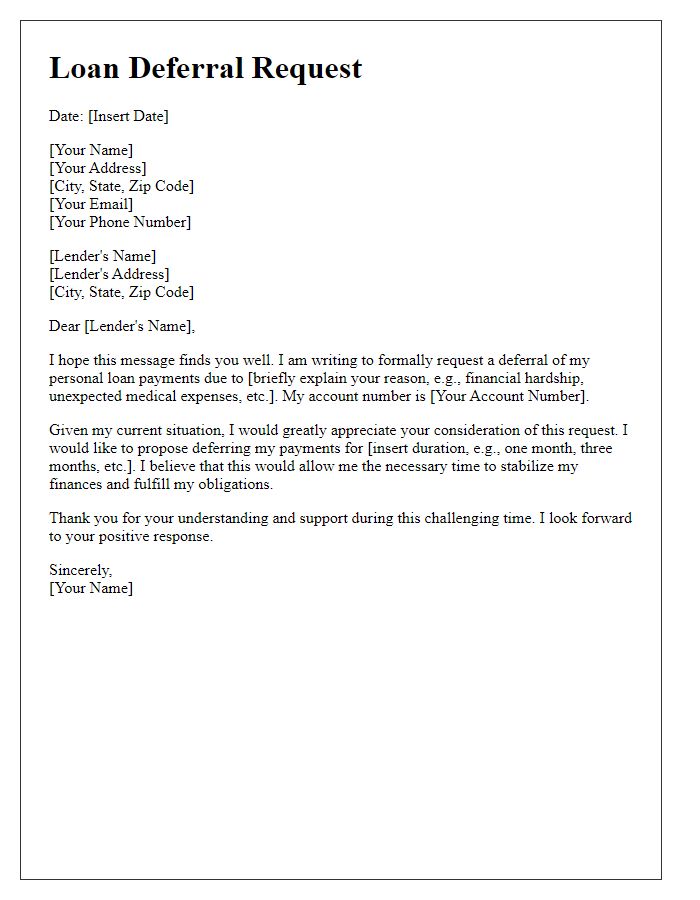

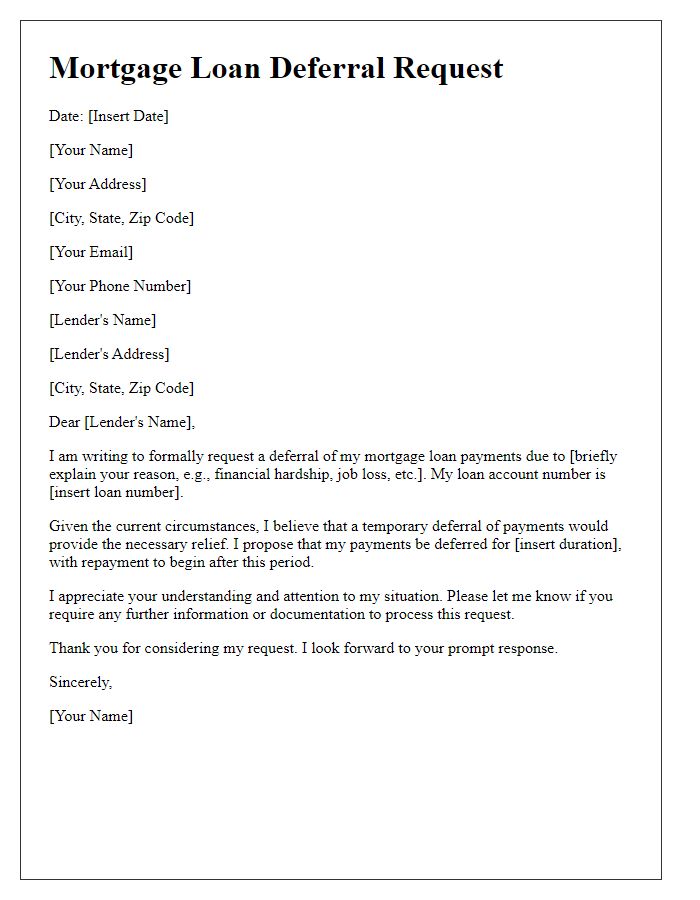

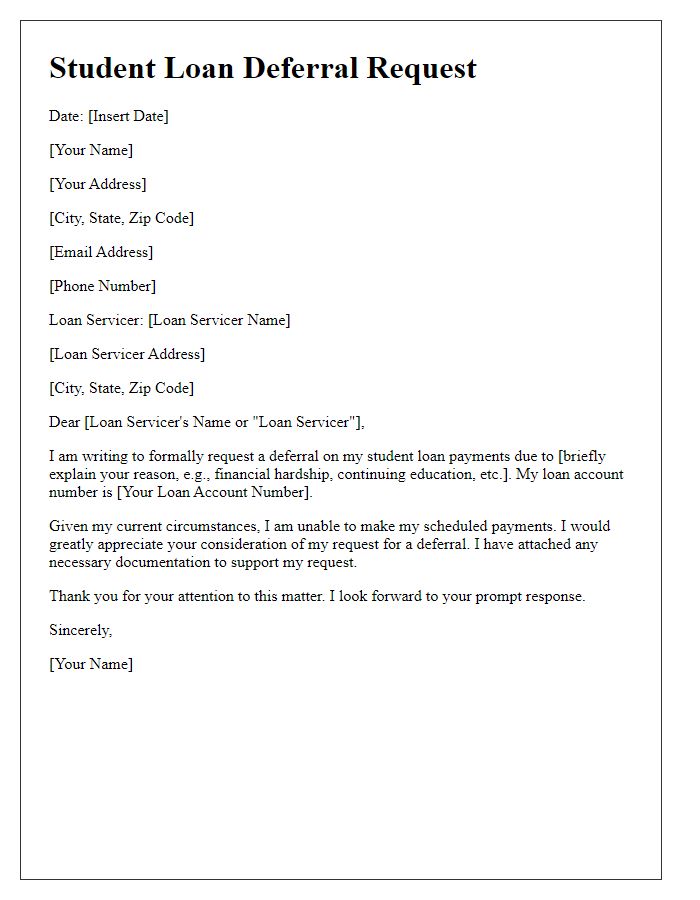

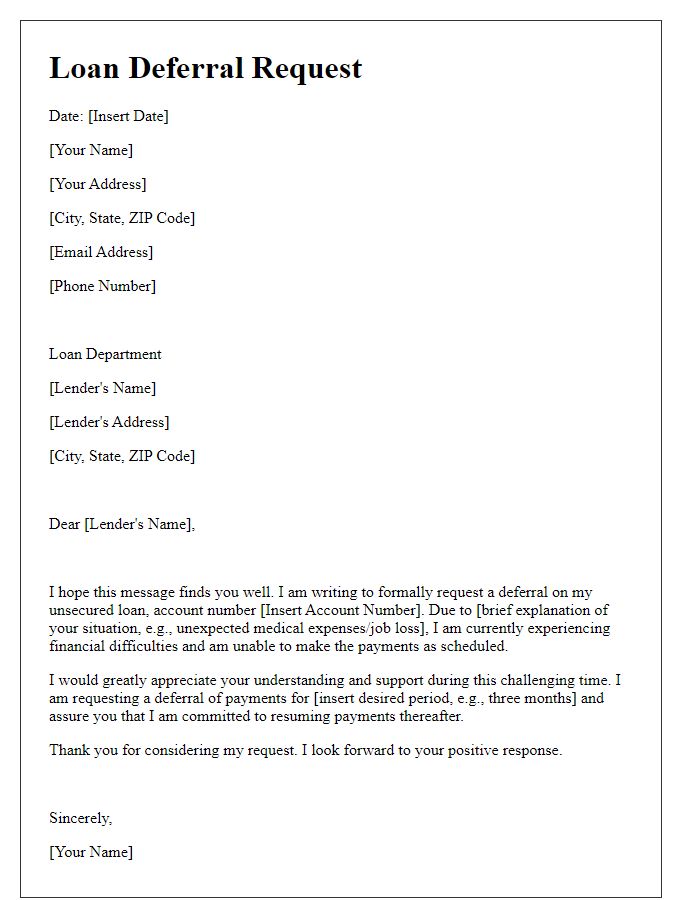

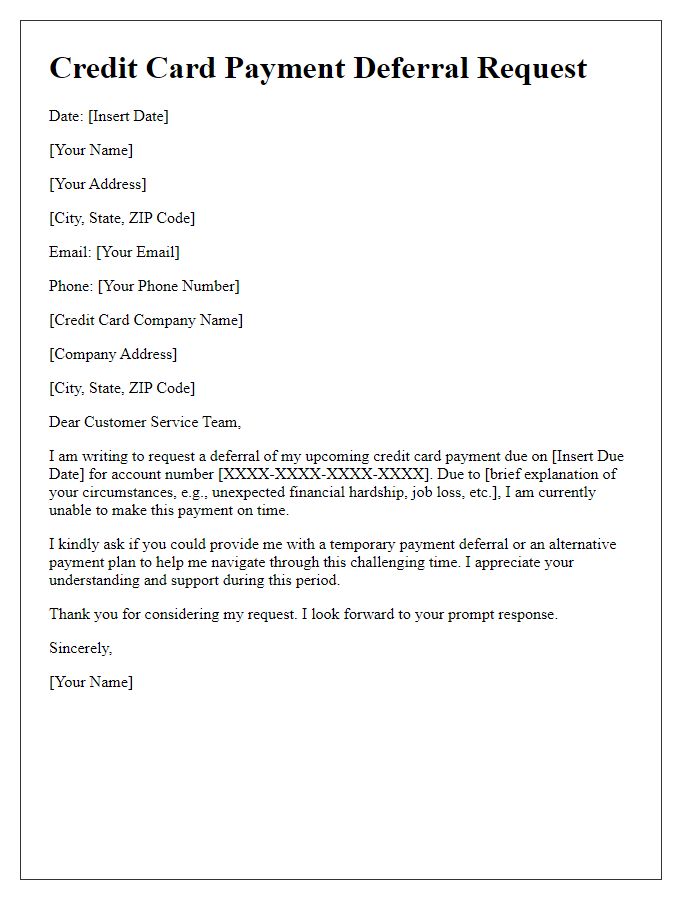

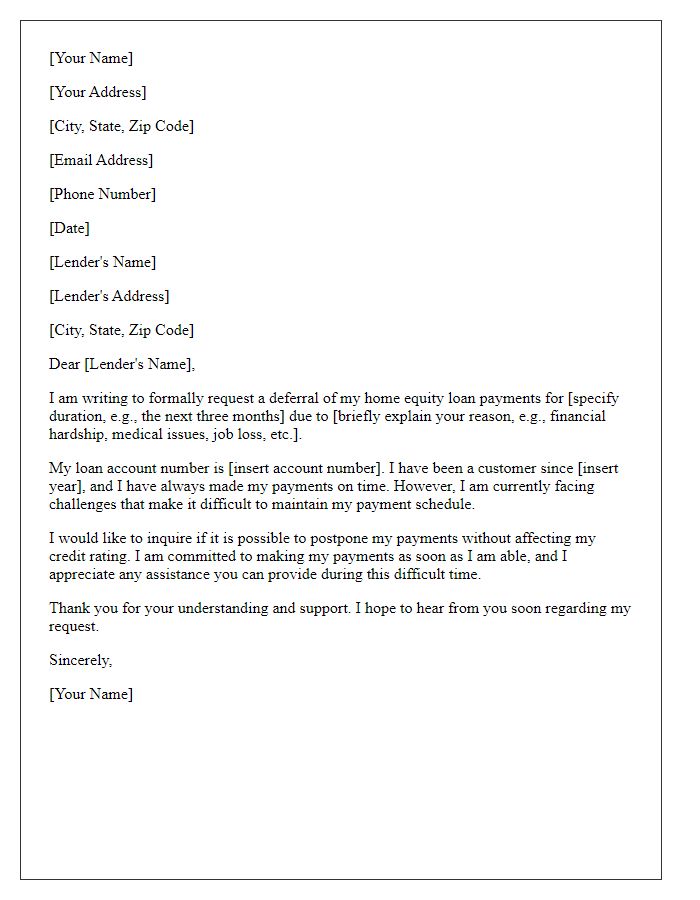

Personal and Loan Information

Loan deferral requests can benefit from clear and detailed personal and loan information. Relevant names should include the borrower's full name, loan account number, and necessary contact details. Additional essential details involve the lender's name and the type of loan, such as a mortgage, personal loan, or student loan, along with the specific loan amount and interest rate. It is also critical to include the loan's start date, payment history, and current balance. Providing a brief explanation of the reason for the deferral request, such as financial hardship due to job loss or medical expenses, adds context, enhancing the lender's understanding of the situation. Clear communication of the desired deferral period (for example, three months or six months) helps set expectations.

Reason for Deferral Request

Financial hardships arising from unexpected events, such as job loss or medical emergencies, can significantly impact an individual's ability to meet loan obligations. For instance, the economic downturn caused by the COVID-19 pandemic has left many individuals unemployed, struggling to cover essential expenses. During such challenging times, requesting a loan deferral may provide temporary relief, allowing borrowers to stabilize their financial situation before resuming regular payments. This option is particularly relevant for loans, such as personal loans or mortgages, where accumulated arrears can lead to severe consequences like foreclosures or damaged credit scores. Addressing loan deferrals with lenders often involves submitting documentation that verifies hardship, including termination letters or medical bills, to support the request and demonstrate the genuine need for temporary financial reprieve.

Proposed Deferral Terms

A loan deferral request can be crucial for individuals facing temporary financial challenges, particularly during emergencies such as job loss or medical issues affecting income. Lenders may typically allow a deferral period of 3 to 6 months, during which borrowers can pause payments without incurring penalties or late fees, depending on individual circumstances. Borrowers often must provide documentation of financial hardship, such as recent pay stubs, bank statements, or medical bills. It's vital that borrowers specify the desired deferral terms in their request, clearly indicating the repayment schedule post-deferral, including any interest accrued during this period. Engaging in this process can offer significant relief and aid in regaining financial stability during challenging times.

Supporting Documentation

A loan deferral request can often require supporting documentation to validate the circumstances causing the financial hardship. Essential documentation includes recent pay stubs or salary slips from the borrower's employer, which reflect current income levels. Bank statements from the last three to six months provide insight into the borrower's financial activity and current account balances. Additionally, a formal letter outlining the reasons for the deferral request aids in contextualizing the request, detailing circumstances such as unexpected medical expenses or job loss. If applicable, evidence of job search efforts, like application confirmations or rejection letters, may further support the case for a deferral. It's crucial for borrowers to compile this information meticulously to ensure lenders understand their situation before making a decision.

Contact Information and Follow-up

A loan deferral request involves communicating with lenders regarding temporary relief from loan payments, particularly during financial difficulties. To ensure effective communication, include your full name alongside contact information such as a current address, email, and phone number. Specify the loan type, like a mortgage with a principal of $250,000, initiated in 2020, highlighting the lender's name and relevant account number for clarity. A follow-up section should outline your intentions, such as setting a timeline of two weeks for further correspondence or clarification regarding the deferral request. Being diligent with your contact approach ensures your lender can quickly assess your situation and respond accordingly.

Comments