Are you planning to apply for a property loan and feeling a bit overwhelmed by the process? You're not alone; many individuals find themselves unsure of how to craft the perfect application letter. In this article, we'll break down the essential elements of a successful property loan application letter, making it easier for you to secure that funding. So, are you ready to take the first step towards owning your dream home? Let's dive in!

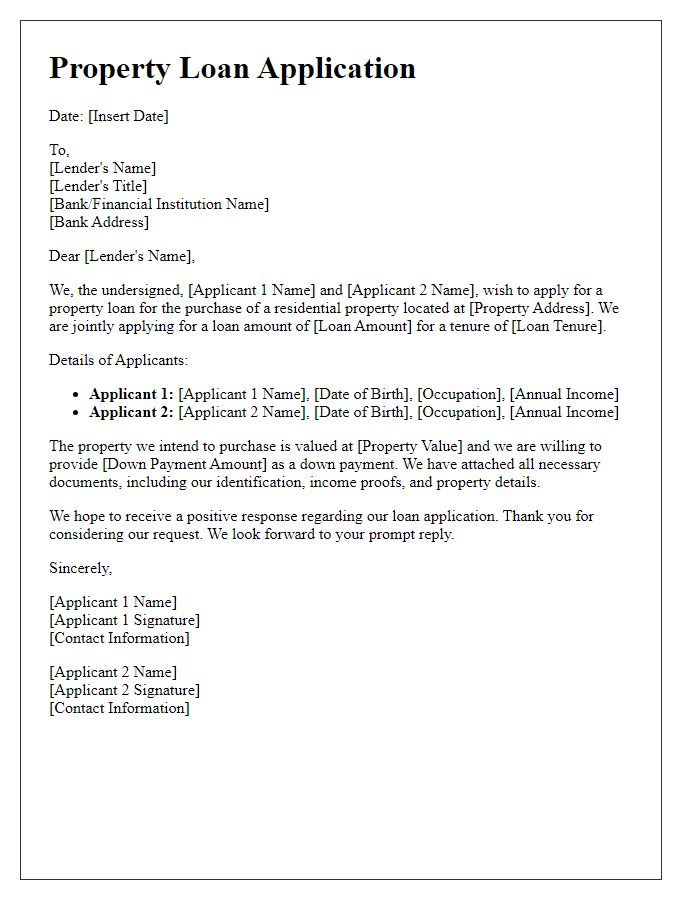

Applicant Information

When applying for a property loan, thorough applicant information is crucial for lenders. Key details include full name, address, contact number, and email address, which provide basic identification. Additionally, providing social security number and date of birth ensures a comprehensive background check. Employment information holds significance, including job title, employer's name, and years of service, which influence income stability. Previous addresses for the last five years may require documentation as well, asserting residency history. Financial details, such as annual income, existing debts, and credit score, support the evaluation of repayment capacity. Finally, details about the desired property, including location, purchase price, and type (e.g., single-family home or condominium), establish the context for the loan application.

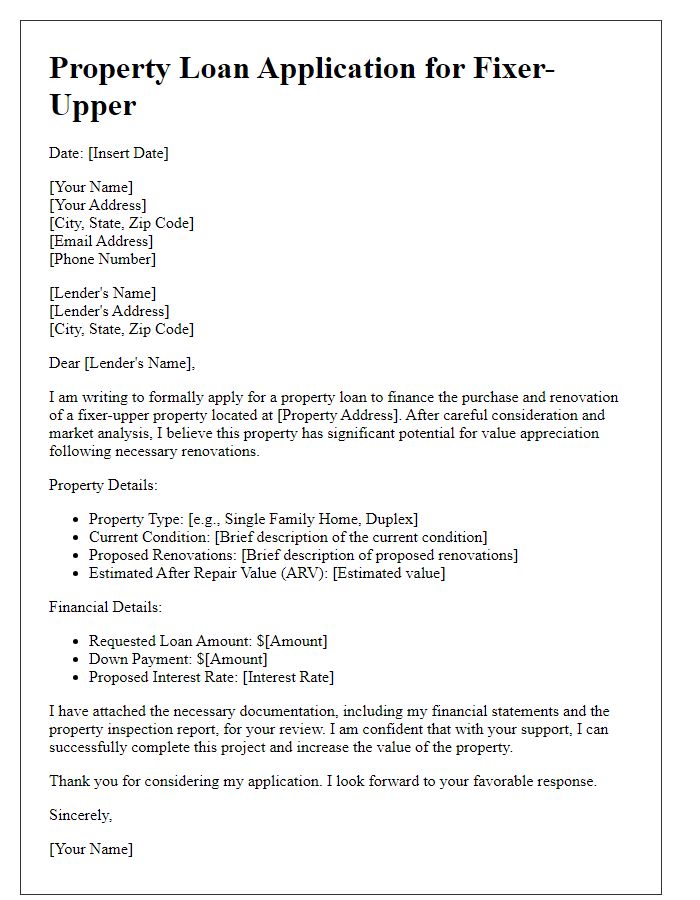

Property Details

The property located at 123 Maple Street, Springfield, is a three-bedroom, two-bathroom single-family home built in 2010. The total living area encompasses approximately 1,800 square feet, complemented by a well-manicured yard of 0.25 acres. The property features a modern kitchen equipped with stainless steel appliances, granite countertops, and an open-concept layout ideal for family gatherings. Additionally, the residence offers energy-efficient windows and solar panels installed in 2022, significantly reducing utility costs. The proximity to highly-rated schools, parks such as Lincoln Park, and local amenities enhances its appeal for potential buyers or investors. The estimated market value of the property is approximately $350,000, supported by recent sales of comparable homes in the neighborhood.

Loan Amount Requested

In a property loan application, the loan amount requested plays a crucial role in the financing process. Applicants typically seek a specific sum, often ranging from tens of thousands to several million dollars, depending on the property's value and location, such as residential areas in Los Angeles or commercial spaces in New York City. Documentation often includes a detailed breakdown of the intended use of funds, such as home purchase, refinancing, or investment in rental properties. The requested amount must align with the applicant's financial status, credit score--often above 700 for favorable terms--and debt-to-income ratio, which should ideally be below 36%. Providing a well-structured application demonstrates financial responsibility and helps expedite the approval process.

Income and Financial Details

A property loan application requires detailed income and financial information to assess eligibility and repayment capability. Monthly gross income, including salary, bonuses, and additional sources such as rental income or freelance work, should be clearly stated. Debt-to-income ratio (generally recommended to be below 30%) must be calculated by dividing total monthly debt payments (mortgage, car loans, credit card balances) by monthly gross income. Credit score (typically ranging from 300 to 850, with higher scores indicating better creditworthiness) plays a vital role in loan approval. Proof of assets (bank statements, retirement accounts, property values) allows lenders to evaluate the total financial picture and reserves. Employment history, showcasing stability (ideally within the same job or industry for at least two years), will enhance the application's credibility. Furthermore, detailed information about liabilities (existing loans, obligations) must be transparently provided to give a full view of the financial standing.

Contact Information

In property loan applications, contact information is crucial for communication. Essential details include the applicant's full name, a primary phone number (cell or landline for easy reach), email address (preferably a professional one), physical address (including city, state, and zip code, such as 123 Main St, Springfield, IL, 62701), and possibly a secondary contact number for alternative communication. For business loan applications, including company name and business address further clarifies the applicant's identity and enhances the application's credibility. Providing accurate and up-to-date contact information ensures timely updates throughout the loan approval process.

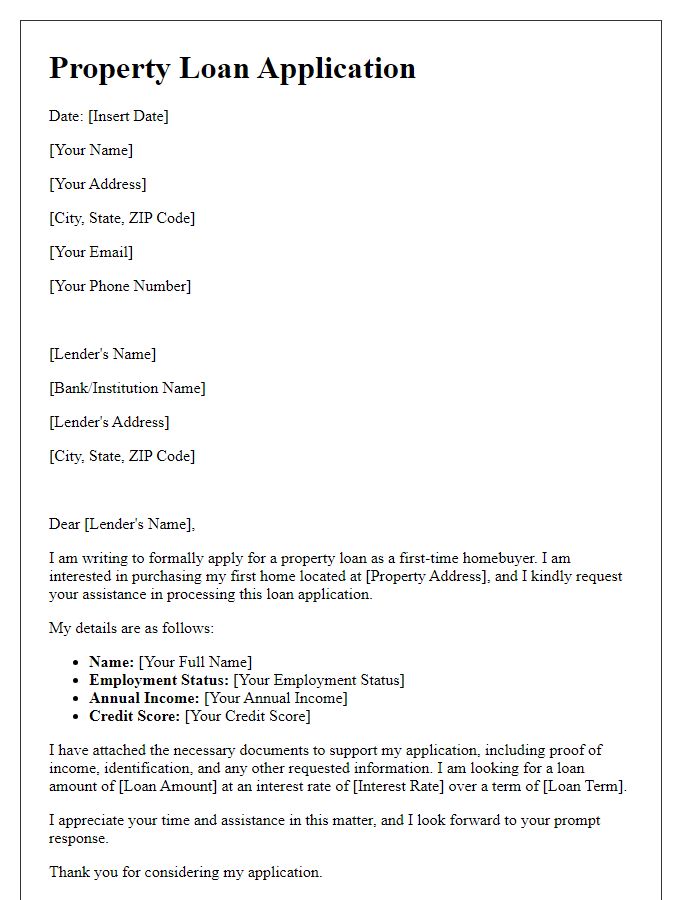

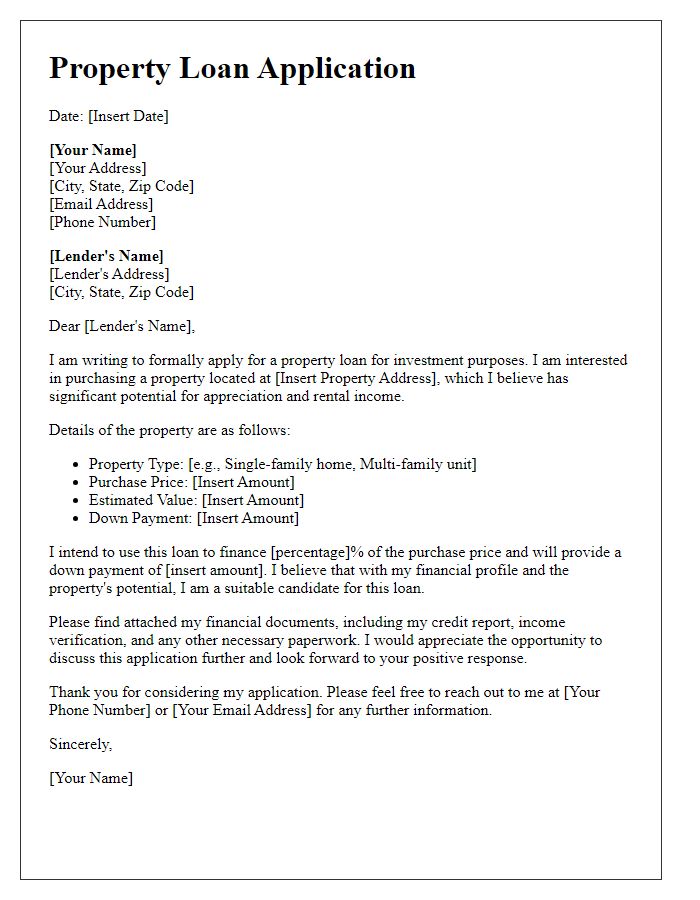

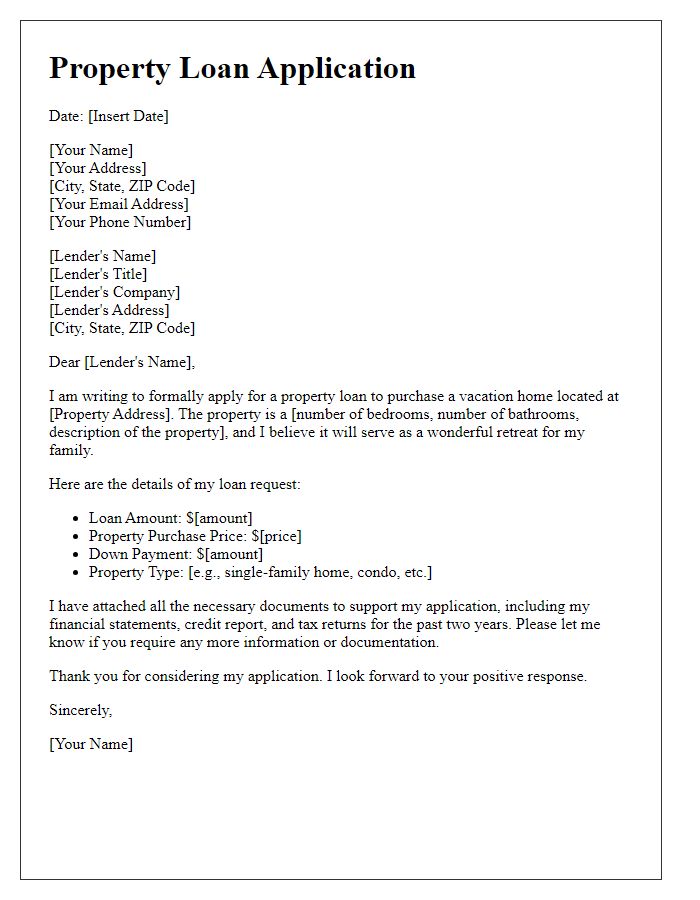

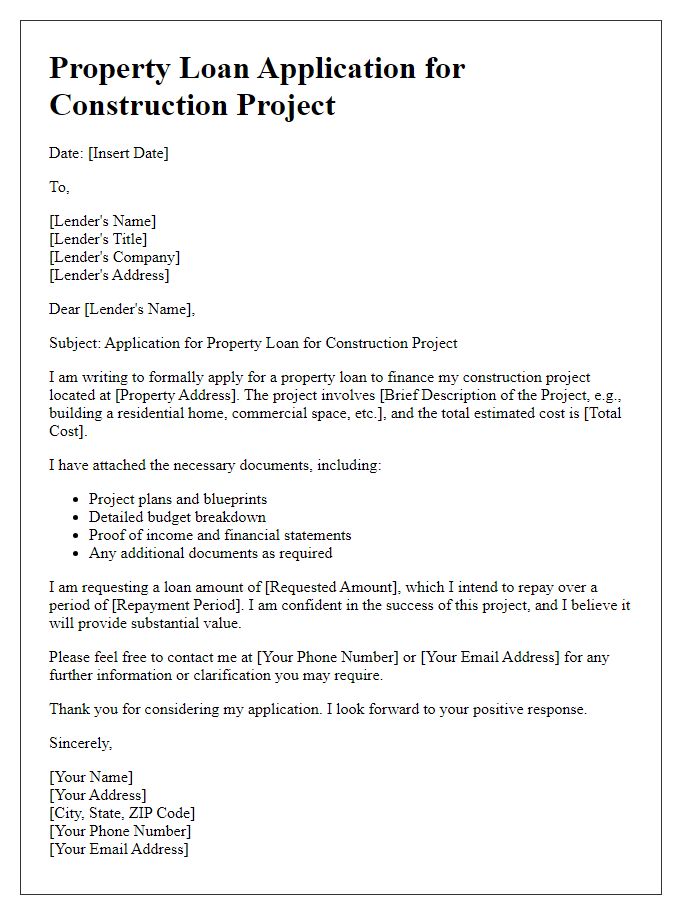

Letter Template For Property Loan Application Samples

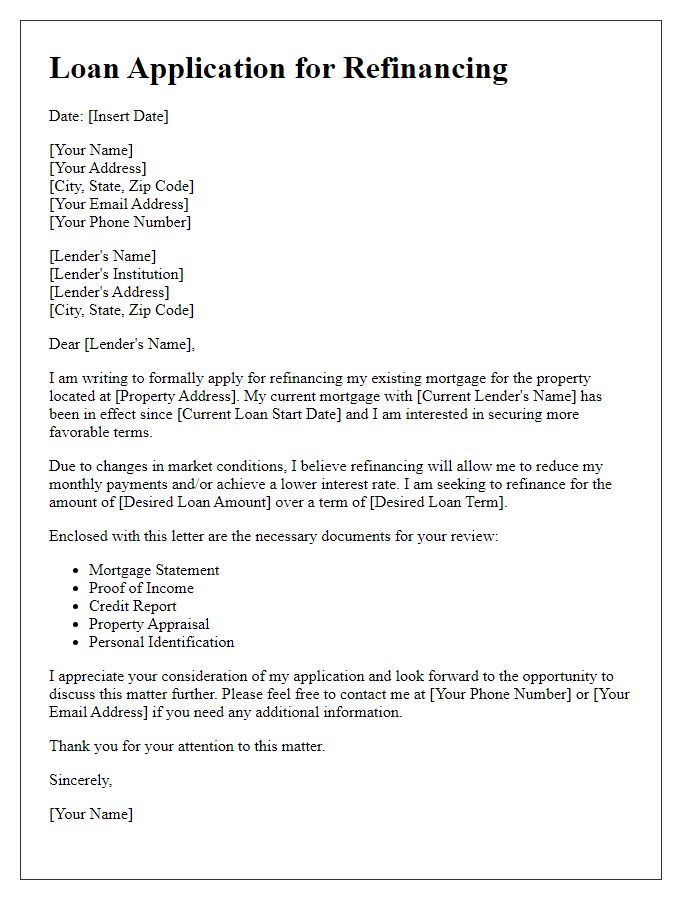

Letter template of property loan application for refinancing an existing mortgage

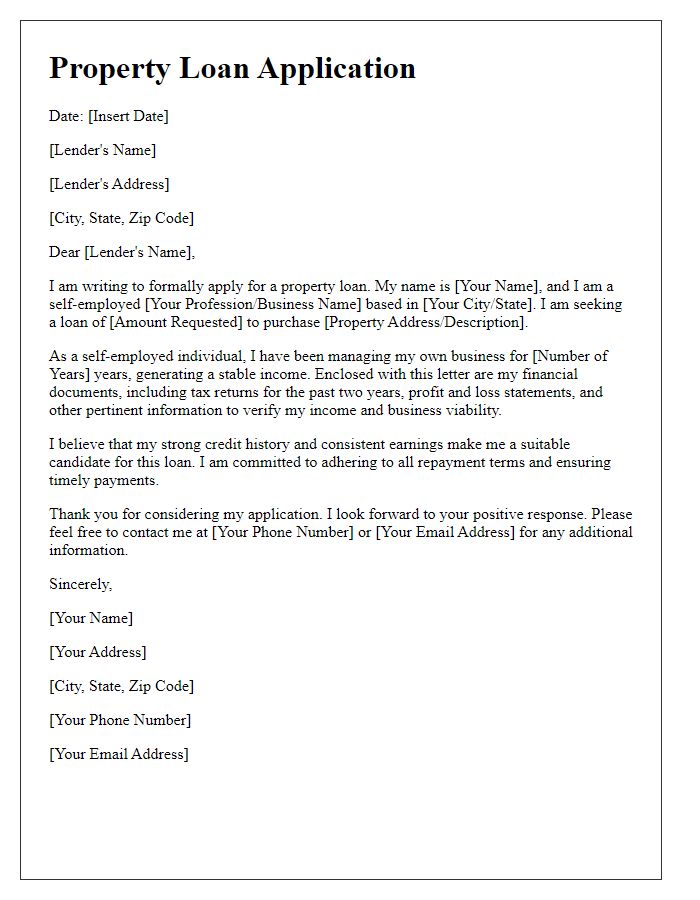

Letter template of property loan application for a self-employed applicant

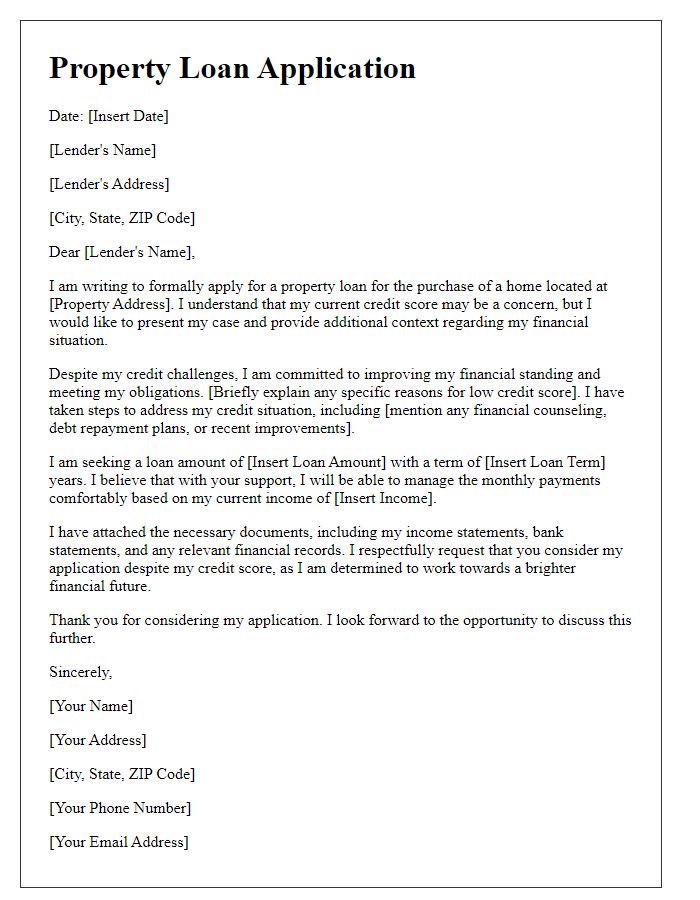

Letter template of property loan application for low credit score borrowers

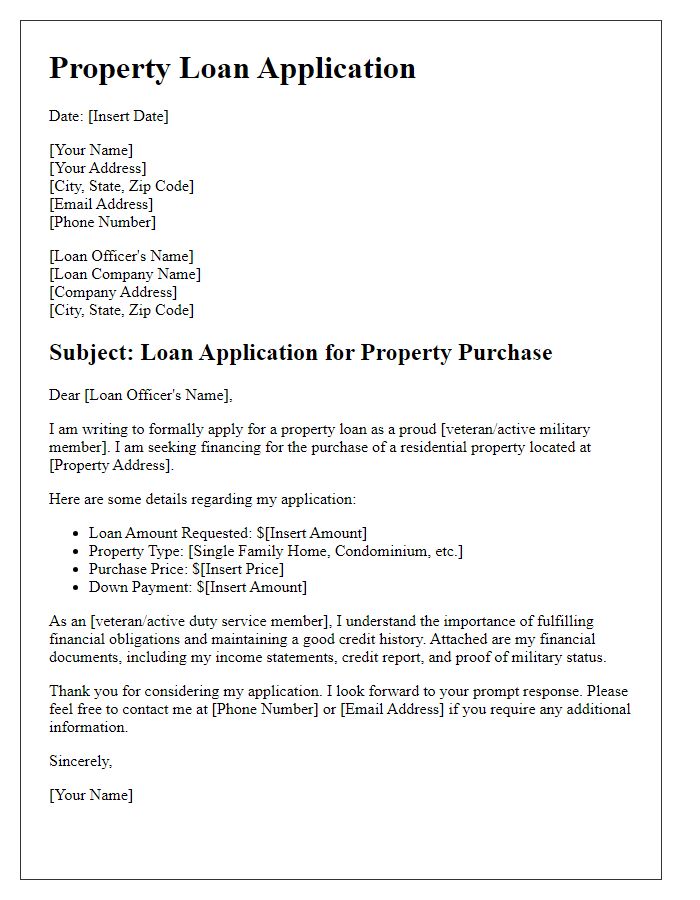

Letter template of property loan application for veterans and active military

Comments