Welcome to our comprehensive guide on debt management counseling letters! If you're feeling overwhelmed by debt and unsure how to approach a creditor or counselor, you're not alone. Crafting a well-structured letter can make a world of difference in your journey toward financial stability. Ready to learn how to effectively communicate your needs and take control of your financial future? Read on to explore our detailed letter template and helpful tips!

Personalization and recipient details

Effective debt management counseling involves careful assessment of an individual's financial situation. Clients often undergo a thorough evaluation, which includes analyzing income sources, such as salaries from employment or other income streams, alongside monthly expenses (housing costs, utilities, groceries). This assessment provides a holistic view enabling tailored strategies to address specific debts, which may include credit card balances, personal loans, or student loans. Additionally, establishing communication with creditors can assist in negotiating lower interest rates or payment plans, alleviating financial stress. Regular follow-up sessions are key to monitoring progress, adjusting plans as necessary, and ensuring clients maintain financial stability. Understanding personal financial goals is crucial for long-term success.

Clear subject and purpose statement

Debt management counseling assists individuals in developing effective strategies to manage and reduce their financial obligations. Such counseling services typically involve comprehensive assessments of personal debt levels, income, and expenses. Professionals in this field, often certified through organizations recognized by the National Foundation for Credit Counseling (NFCC), guide clients in creating personalized budgets and repayment plans. Educational resources on credit scores, interest rates, and negotiation techniques with creditors may also be provided. The objective of debt management counseling is to empower individuals to regain financial stability and avoid potential bankruptcy (a legal status of a person or entity that cannot repay the debts owed to creditors). By adopting these strategies, clients can work towards achieving financial resilience and improving their overall credit health.

Explanation of services offered

Debt management counseling services provide individuals with personalized financial guidance aimed at alleviating debt burdens. These services typically include comprehensive budget assessments that analyze income and expenses, identifying areas for improvement to facilitate debt repayment. Counselors work with clients to develop tailored debt repayment plans, often negotiating favorable terms with creditors to lower interest rates or consolidate payments. The National Foundation for Credit Counseling (NFCC) endorses certified agencies ensuring high-quality support. Additionally, educational resources on personal finance management help clients build sustainable financial habits for the future. Regular follow-up sessions track progress, offering ongoing support to help individuals achieve financial stability and independence.

Confidentiality and trust assurance

Confidentiality and trust assurance are fundamental principles in debt management counseling practices. Financial counseling organizations, such as the National Foundation for Credit Counseling (NFCC), adhere to strict confidentiality protocols to protect the sensitive financial information of clients. These protocols ensure that personal and financial data, including income details, debt amounts, and credit histories, are kept secure and shared only with authorized personnel. Trust between clients and counselors is crucial for effective debt management, as it encourages open communication regarding financial challenges and goals. In reputable agencies, clients are provided with clear privacy policies outlining how their information will be managed and safeguarded throughout the counseling process. Regular training on ethics and confidentiality for counselors enhances this trust, ensuring that clients feel safe disclosing their financial situations and seeking guidance towards debt resolution.

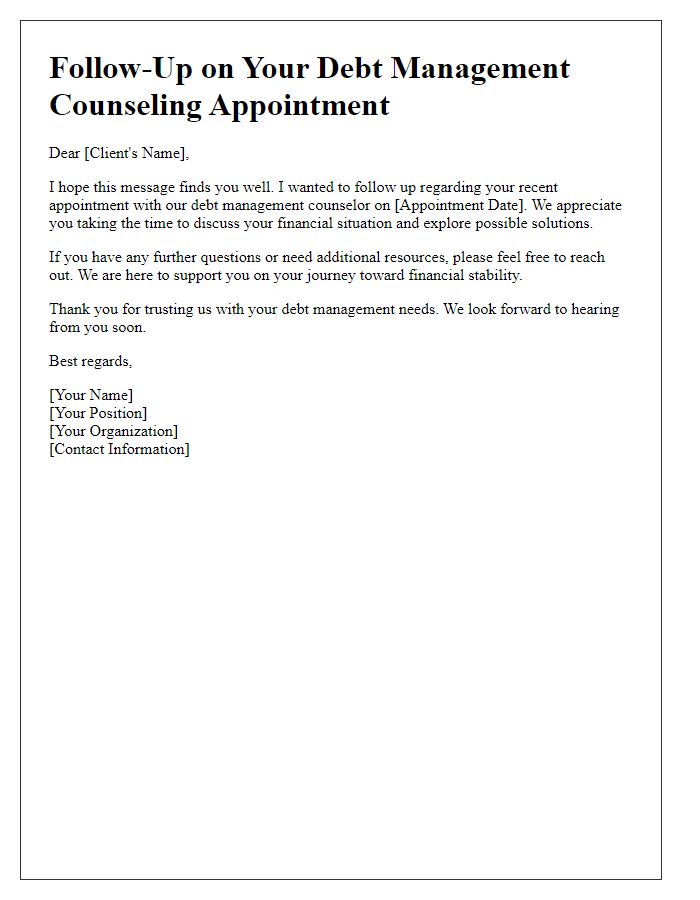

Contact information and next steps

Debt management counseling is an essential resource for individuals facing financial challenges. Counseling sessions typically provide personalized strategies to address outstanding debts, including credit card balances and medical bills, while also considering factors such as income, expenses, and overall financial health. A certified credit counselor, often part of reputable organizations such as the National Foundation for Credit Counseling (NFCC), will assess individual situations, offering practical advice on budgeting and debt repayment options. Next steps typically involve scheduling a consultation, providing necessary financial documentation, and setting achievable financial goals to create a sustainable debt repayment plan. Contact information, such as phone numbers (often toll-free) or email addresses, allows clients to reach out for support and guidance in navigating their debt relief journey.

Letter Template For Debt Management Counseling Samples

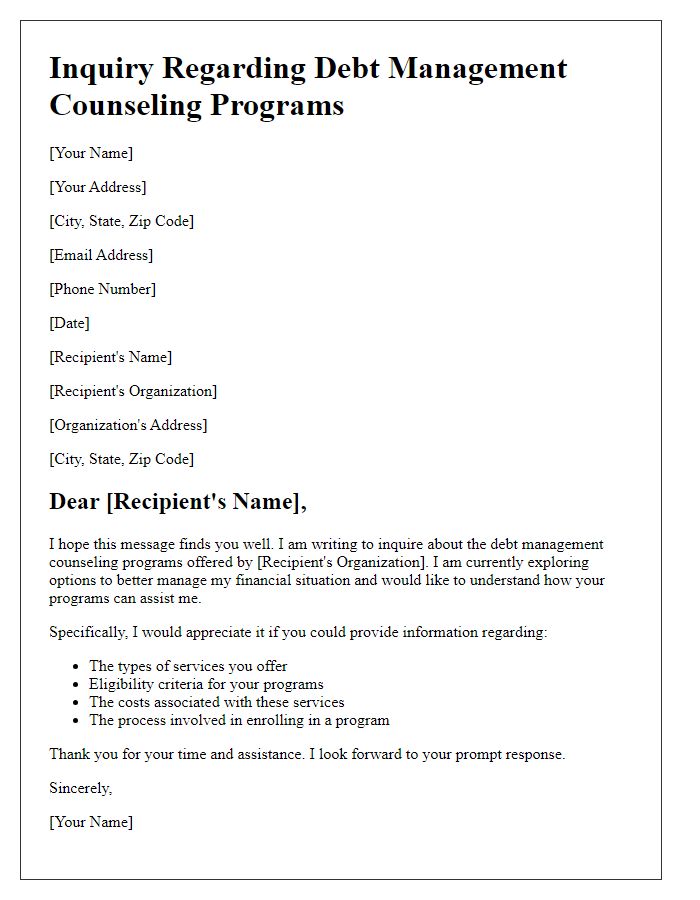

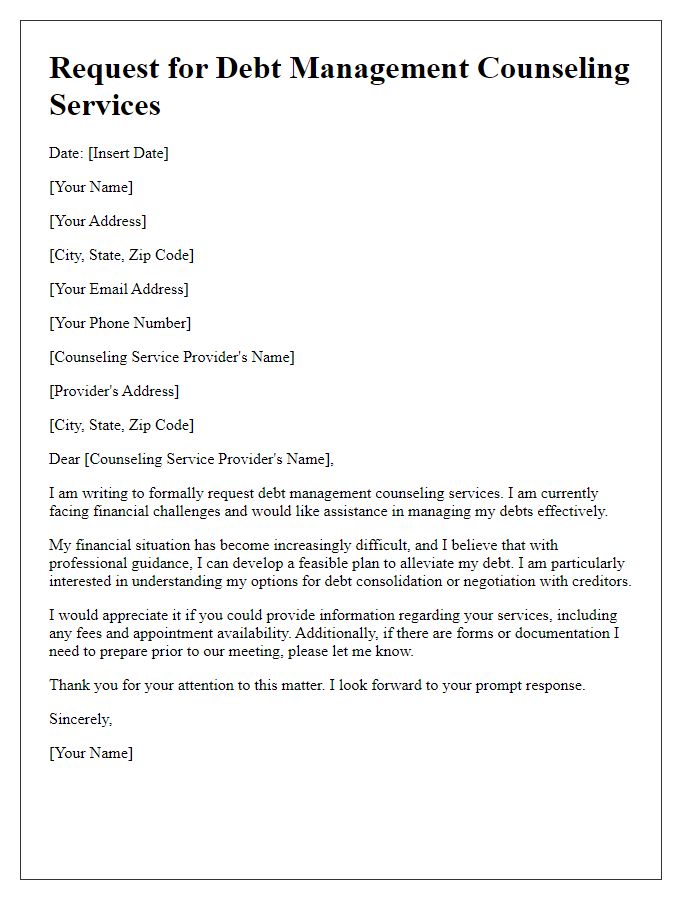

Letter template of inquiry regarding debt management counseling programs.

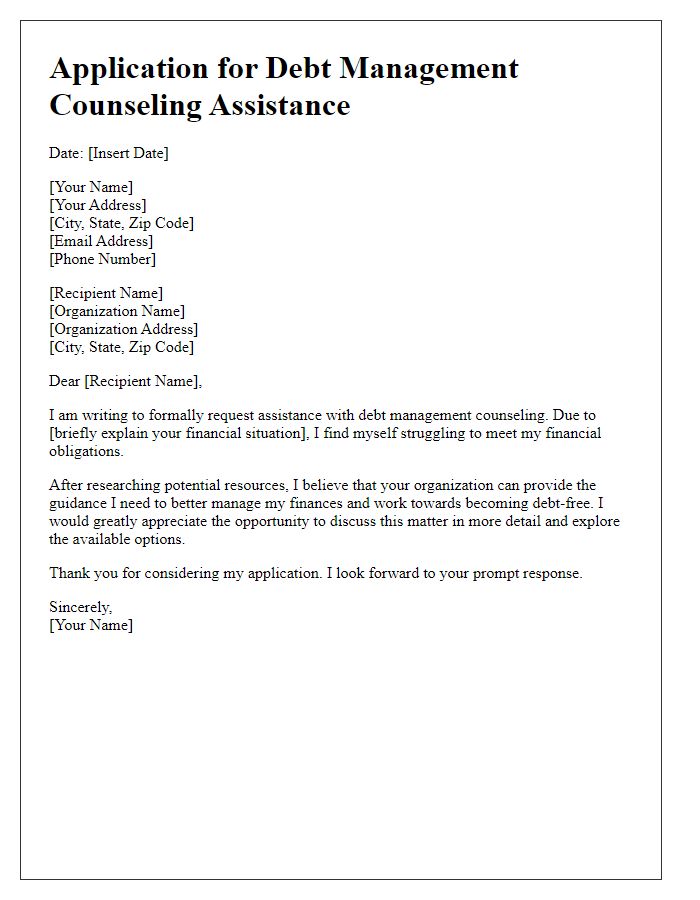

Letter template of application for debt management counseling assistance.

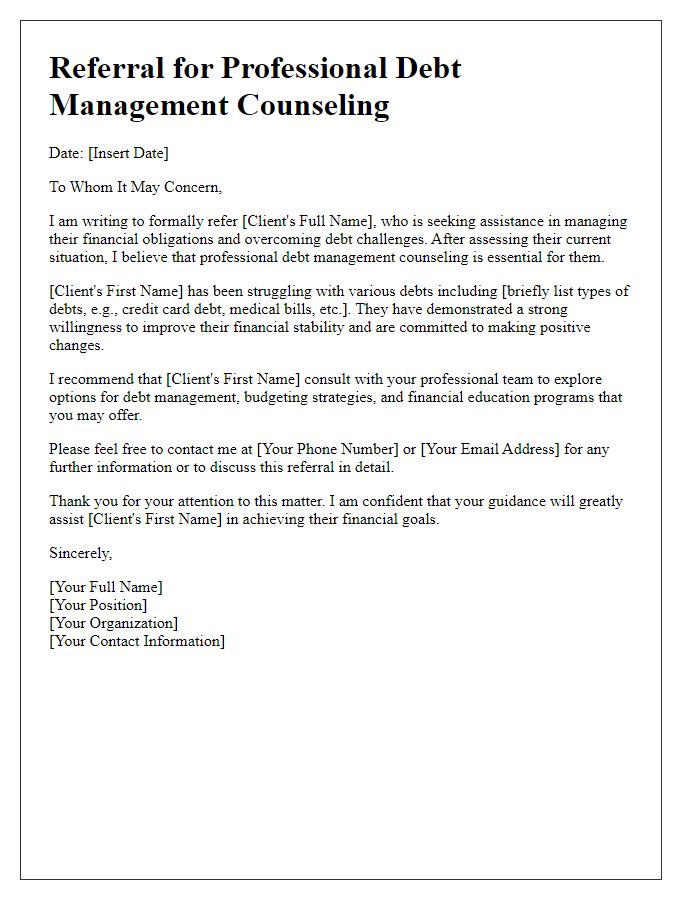

Letter template of referral for professional debt management counseling.

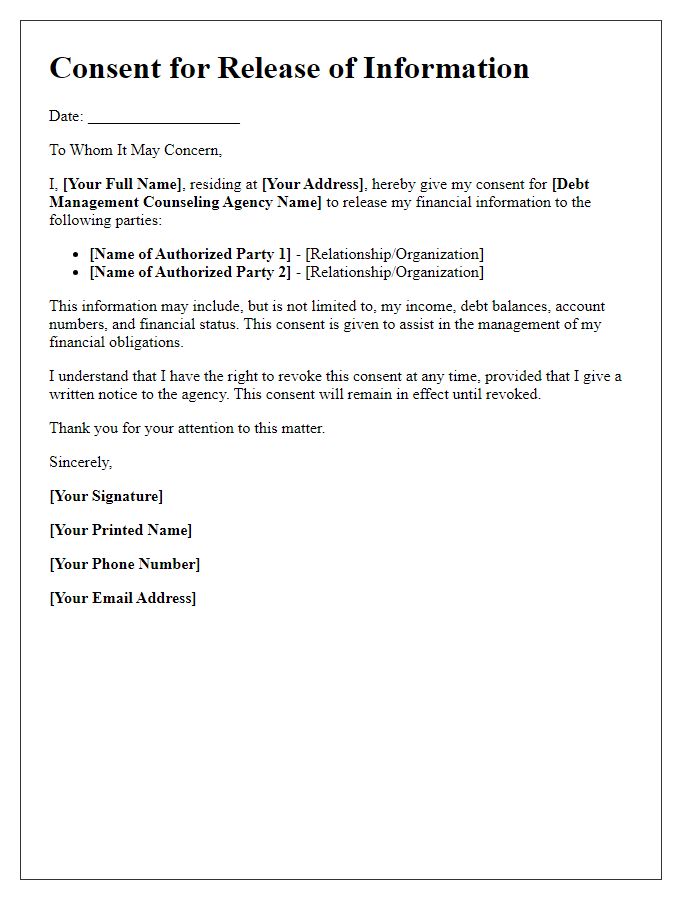

Letter template of consent for debt management counseling release of information.

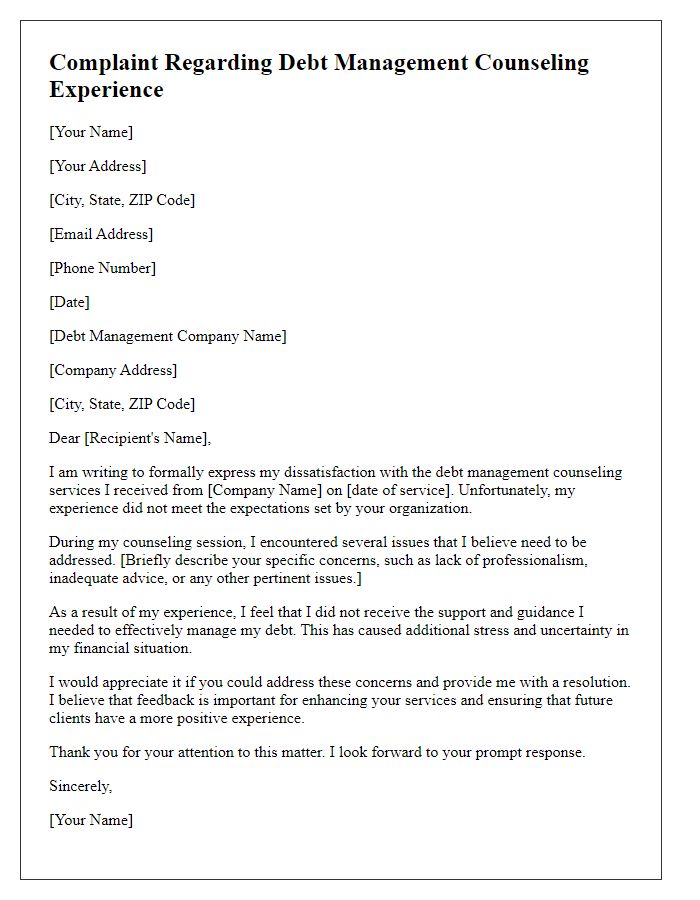

Letter template of complaint regarding debt management counseling experience.

Comments