Are you curious about how your credit score can impact your financial life? Understanding the factors that influence your credit score is essential for making informed decisions about loans, mortgages, and even rental applications. From payment history to credit utilization, each aspect plays a crucial role in shaping your financial future. Join us as we delve deeper into the intricacies of credit scores and explore tips for improving yours!

Personal Identification and Purpose Statement

A personal identification and purpose statement for understanding credit score influences involves several key components critical to effective financial management. An individual's credit score, a numerical representation (ranging from 300 to 850) of creditworthiness, is impacted by various factors including payment history (35%), credit utilization (30%), length of credit history (15%), new credit inquiries (10%), and types of credit accounts (10%). Understanding these factors can significantly enhance one's ability to achieve favorable loan terms and interest rates, which can save thousands over time. For instance, timely payments on credit cards and loans can improve a score by preventing late fees and negative reports to major credit bureaus like Experian, Equifax, and TransUnion. Additionally, demonstrating responsible credit usage, such as maintaining a credit utilization ratio below 30%, showcases reliability to lenders. Ultimately, individuals seeking to improve or maintain their credit score must be aware of these influences to navigate financial landscapes effectively and make informed decisions regarding loans, mortgages, and other credit-based products.

Credit Score Impact Explanation

A credit score significantly influences an individual's financial health and access to credit resources. Ranging from 300 to 850, this three-digit number determines interest rates, loan approval chances, and rental agreements. A higher score often results from consistent on-time payments, low credit utilization ratios (ideally below 30%), and a robust credit history. Major credit reporting agencies, such as Experian, TransUnion, and Equifax, track consumer behavior, reporting on factors like credit inquiries and account age. In the United States, nearly 30% of consumers have a credit score below 601, indicating potential challenges in securing favorable credit terms. Understanding the factors that impact credit scores can greatly enhance an individual's ability to achieve financial goals, such as homeownership or business funding.

Detailed Accounts and Payment History

Credit scores significantly reflect detailed accounts and payment history. Accounts, such as credit cards and loans, contribute to score calculations. Payment history comprises on-time payments and missed or late payments, influencing creditworthiness. FICO scores range from 300 to 850, with higher numbers indicating better credit. For example, missing a payment can decrease scores by 100 points or more, depending on the account's age and the payment's recency. Credit utilization, the ratio of current credit balances to available credit, also plays a crucial role, ideally remaining below 30%. Accurate reporting, including closed accounts and any derogatory marks, ensures a fair assessment of creditworthiness. Regularly reviewing credit reports from agencies like Experian, Equifax, and TransUnion can help identify discrepancies and maintain a healthy credit profile.

Credit Improvement Plan and Request

The impact of credit scores significantly shapes financial opportunities, particularly affecting loan eligibility, interest rates, and overall financial health. Factors influencing credit scores include payment history, credit utilization ratio, and length of credit history, with the FICO scoring model assigning weighted values to these aspects. For instance, a missed payment can reduce a credit score by 100 points or more, severely diminishing the chances of securing favorable loan terms. Additionally, maintaining a credit utilization ratio below 30% is crucial, as higher percentages can signal financial distress to lenders. Implementing a Credit Improvement Plan requires meticulous attention to these elements, alongside strategic actions such as timely bill payments and minimizing new credit inquiries, to boost credit ratings gradually. Engaging with a certified credit counselor can provide tailored advice and enhance understanding of credit management strategies, ultimately leading to improved financial prospects.

Contact Information and Follow-up Intentions

Credit scores significantly influence financial opportunities for individuals. A score below 600 can categorize a person as subprime, impacting mortgage approvals, interest rates, and even insurance premiums. Credit reporting agencies, such as Equifax, Experian, and TransUnion, maintain detailed records of borrowing and payment behaviors. Regular monitoring of one's credit report (accessible annually for free at AnnualCreditReport.com) is essential to identify errors that could adversely affect scores. Additionally, understanding factors like credit utilization rate, historical payment punctuality, and account age can help optimize credit scores, creating pathways for better financial products and lower rates.

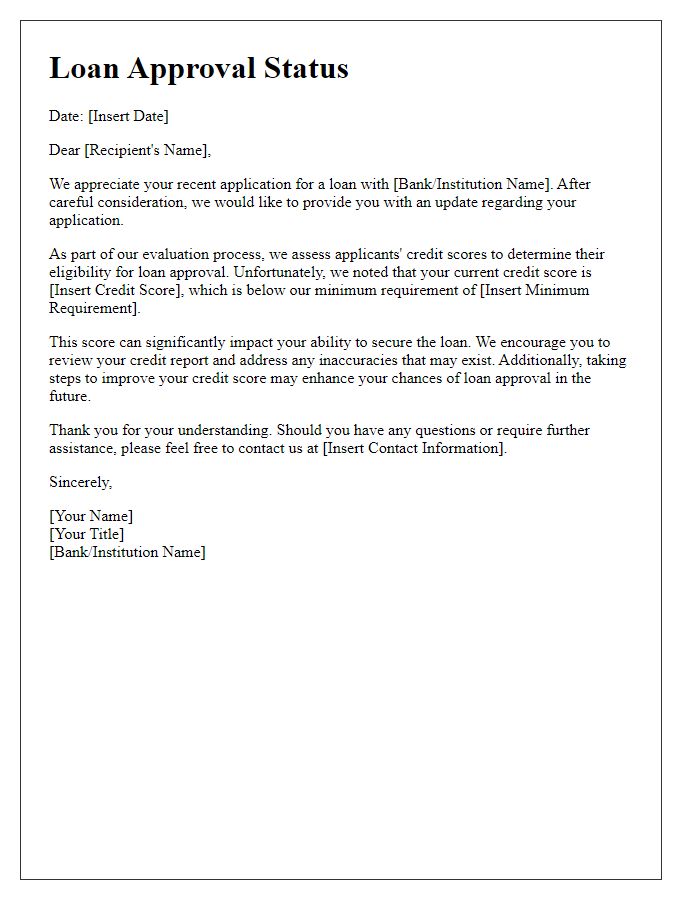

Letter Template For Credit Score Influence Samples

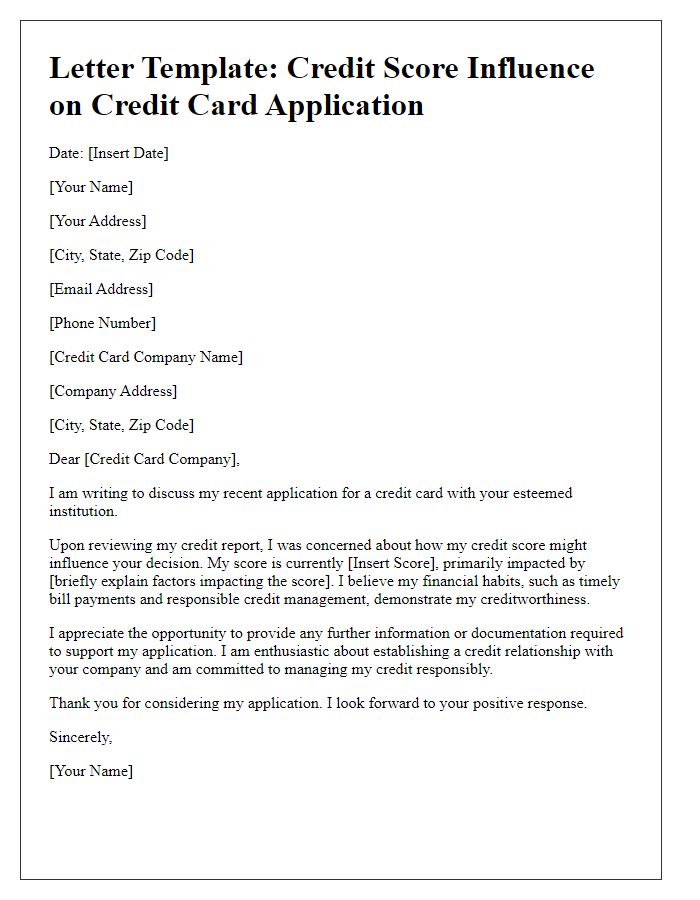

Letter template of credit score influence when applying for credit cards

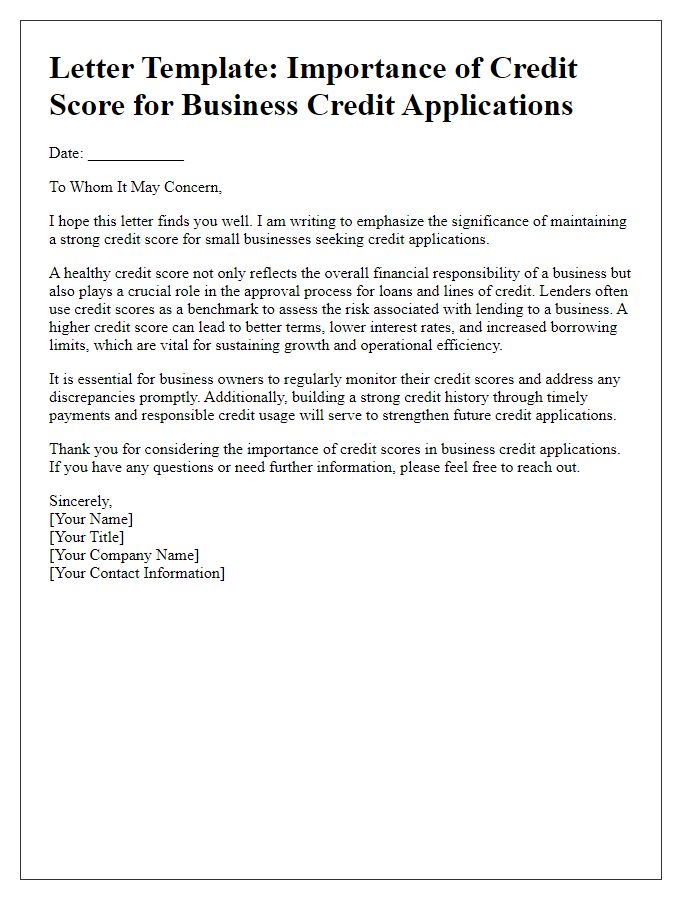

Letter template of credit score importance for business credit applications

Comments