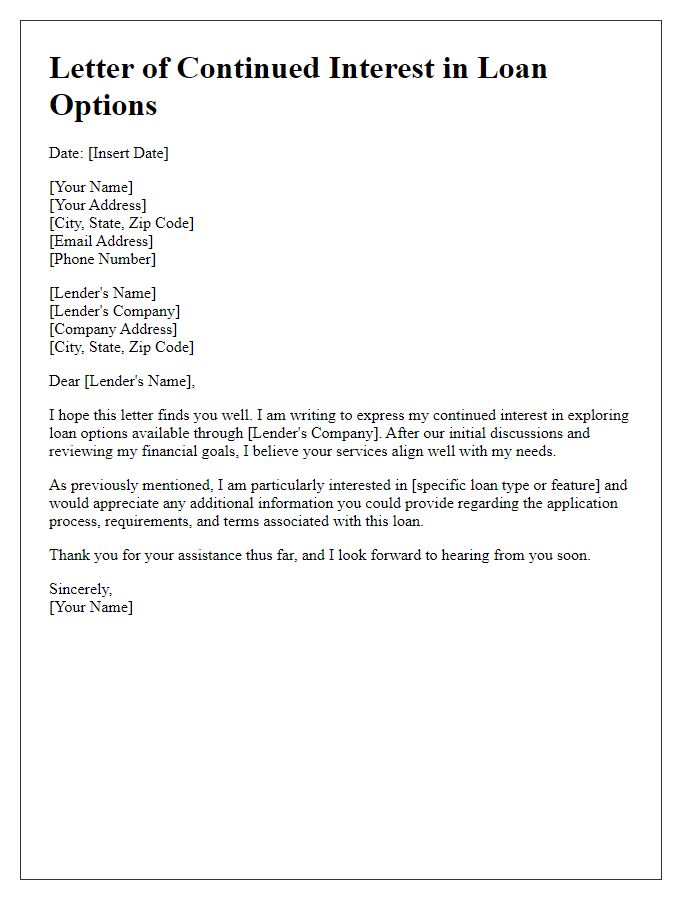

Are you looking to secure a loan or extend your financial support? It's crucial to clearly communicate your needs to potential lenders, ensuring they understand your situation and the specifics of what you're asking for. A well-crafted letter can make all the difference in your application process, showcasing your commitment and reliability. Read on to discover a helpful template that will guide you through articulating your loan needs effectively!

Clear purpose statement

In 2021, a local business seeking financial assistance submitted a request for a $50,000 loan to expand its operations. This loan's clear purpose statement outlined plans to renovate the storefront, increasing customer foot traffic in downtown Springfield. Funds were earmarked for purchasing new equipment, elevating service quality. Additionally, the statement projected job creation for three new employees over the next year, contributing to the community's economic growth. This focused approach emphasized the necessity of the loan and its positive impact on both the business and local economy.

Detailed loan amount and terms

A detailed loan request typically includes key components like the desired loan amount, which may range from $10,000 to $1,000,000, depending on individual financial circumstances. Specific terms are often outlined, such as a repayment period of 5 to 30 years, incorporating fixed or variable interest rates that generally fluctuate between 3% to 10% annually. Additionally, financial institutions may require collateral, such as property or vehicles, to secure the loan. A detailed explanation of the purpose of the loan, whether for home improvement, business expansion, or debt consolidation, provides context and urgency to the request. Supporting documents, including credit scores, income verification, and financial statements, are critical to strengthen the application's credibility and enhance the prospects of approval.

Justification for loan necessity

Financial stability often necessitates securing loans, especially in situations involving emergency home repairs. Homeowners facing unexpected events, such as severe weather damage, may require significant funding, often ranging from $5,000 to $50,000, depending on the extent of the repairs. In 2023, a report from the Federal Emergency Management Agency highlighted that approximately 40% of homeowners experienced unplanned expenses due to unexpected housing issues. Access to low-interest loans can relieve financial strain, allowing families to maintain their living conditions and property value. Favorable repayment terms, such as a five to ten-year duration, can facilitate manageable monthly payments, ensuring that these urgent repairs do not lead to long-term financial distress.

Summary of financial stability

In 2023, maintaining financial stability is crucial for individuals and businesses alike. A consistent source of income, such as a regular paycheck from employment, is essential for meeting monthly obligations, including rent or mortgage payments and utility bills. Key financial metrics, such as a debt-to-income ratio, typically lower than 36%, demonstrate an ability to manage existing debts while seeking additional funding. An established credit score, ideally above 700, signals reliability to lenders and can significantly impact interest rates for new loans. In summary, an assessment of financial health should include a detailed overview of income sources, liabilities, and credit history, which collectively support a strong case for loan needs while showcasing ongoing efforts to maintain or improve overall fiscal responsibility.

Express appreciation and urgency

When navigating the complexities of obtaining a personal loan, a clear and concise communication can greatly enhance the likelihood of securing necessary funds. Gratitude should be expressed towards the lender for their previous assistance, acknowledging their role in providing financial support during challenging times. Emphasizing the urgency of the loan request--perhaps due to a looming deadline for an important purchase or an unexpected medical expense--can convey the time-sensitive nature of the situation. Providing specific details, such as the desired loan amount and intended use, showcases responsibility and clarity. Highlighting the anticipated positive outcomes of securing the loan, like improved financial stability or timely home repairs, can further strengthen the appeal. Moreover, reiterating the readiness to discuss terms or meet requirements underscores commitment and seriousness in the loan process.

Comments