When it comes to navigating the world of audited financial statements, understanding the importance of a well-crafted letter template can make all the difference. These documents serve not only as formal communication but also as a bridge to transparency and trust in financial reporting. Whether you're a seasoned professional or new to the process, knowing how to structure your letter can enhance clarity and professionalism. Curious to learn more about creating an effective letter template for your audited financial statements? Let's dive in!

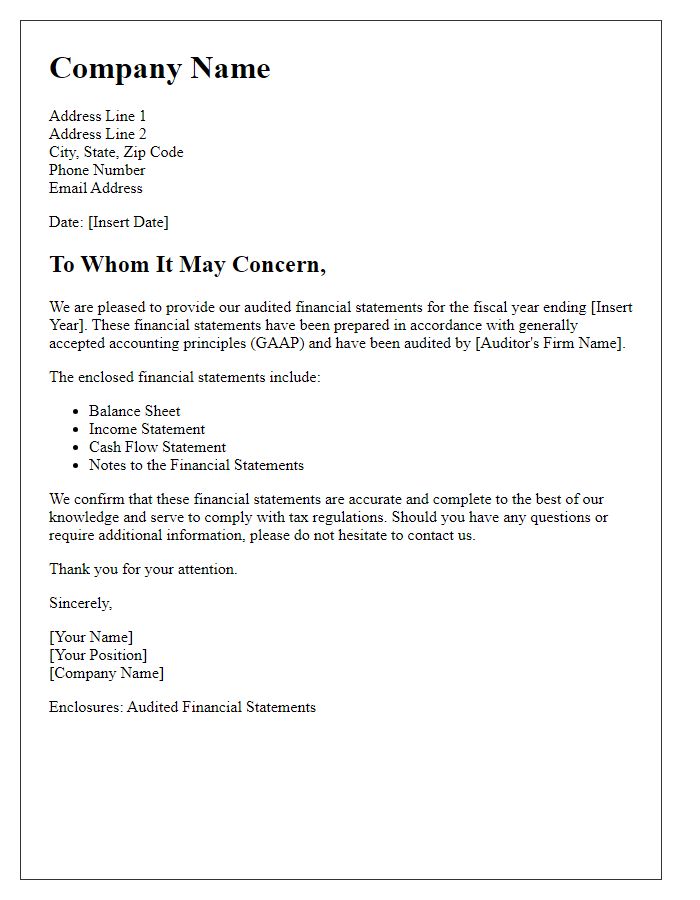

Addressee's information

Audited financial statements provide an essential overview of a company's financial health. Addressing these documents requires precise details including the addressee's name, title, and organization, which should be clearly outlined. This information ensures that the report reaches the intended recipient, such as a financial officer or board member, facilitating effective communication. Additional contextual details might include the addressee's address, city, state, and zip code, allowing for proper routing and personalization. Dates, such as when the statement is issued, should also be specified, ensuring timely review and consideration by stakeholders.

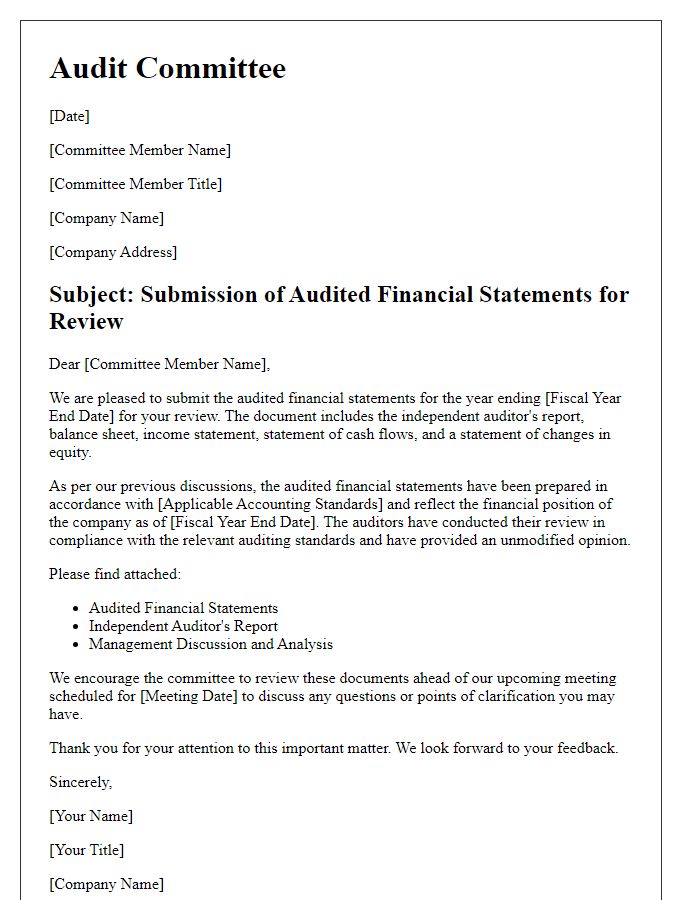

Auditor's responsibility statement

The auditor's responsibility statement outlines essential duties and obligations of auditors during the examination of financial statements, ensuring compliance with accounting standards such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Auditors assess the risk of material misstatement, evaluating internal controls and testing transactions within the entity's financial systems, often spanning across multiple financial periods. They provide reasonable assurance that financial statements are free from significant errors, fraud, or omissions, enabling stakeholders to make informed decisions based on accurate financial information. This process involves thorough documentation and the application of professional skepticism, ensuring an unbiased overview of the company's financial health for entities such as public corporations, non-profits, or government agencies.

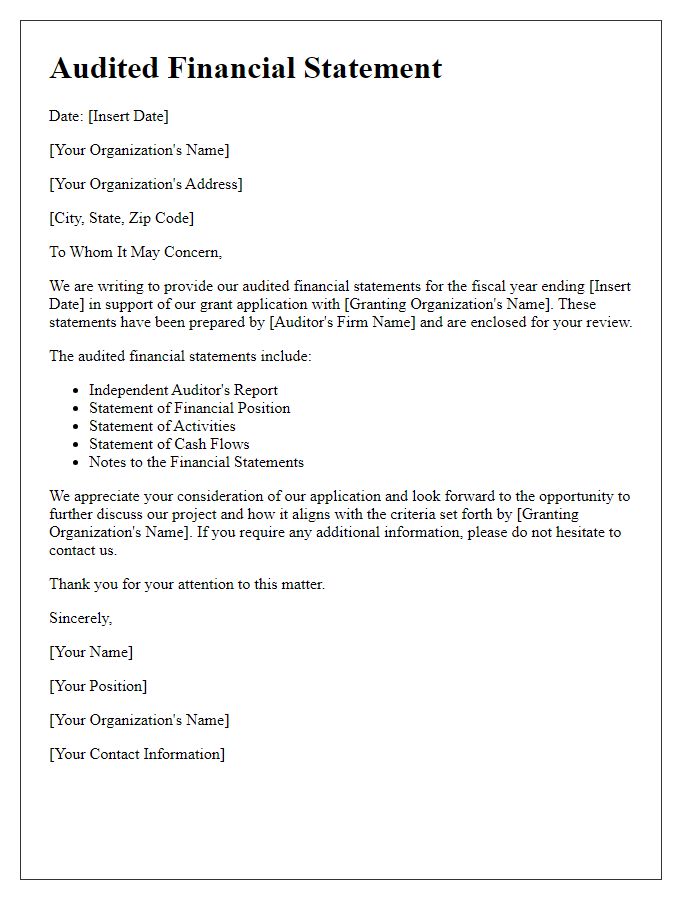

Financial statement overview

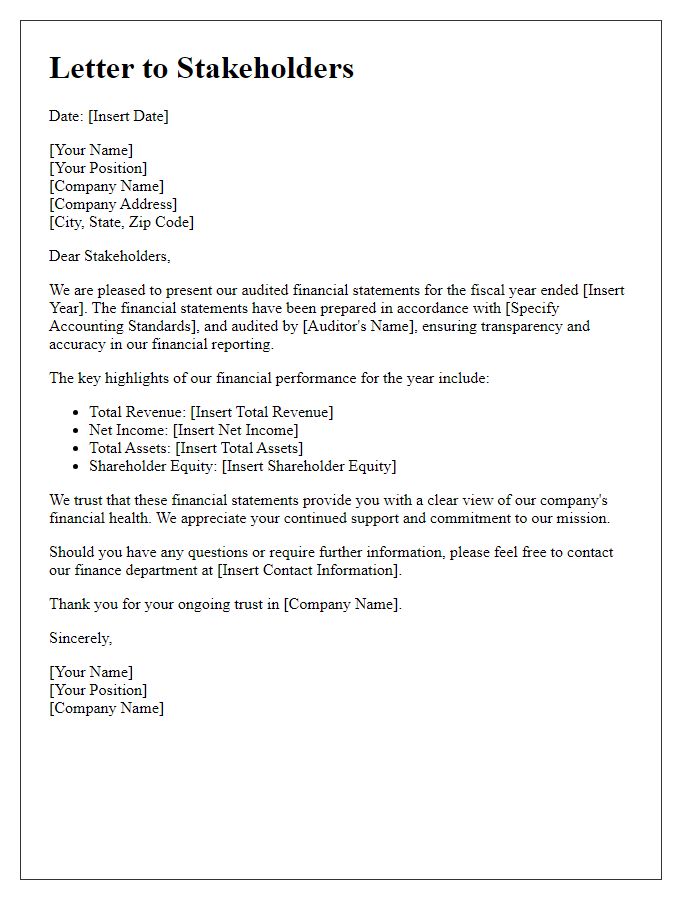

Audited financial statements provide a comprehensive overview of a company's financial performance and position over a specific accounting period, typically one year. They include key financial documents such as the balance sheet, income statement, and cash flow statement, which are prepared in accordance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Independent auditors, certified professionals with expertise in financial processes, examine these statements to ensure accuracy, compliance, and fairness. The audit process involves thorough scrutiny of financial records, internal controls, and accounting practices, often resulting in an auditor's report summarizing findings and opinions on the authenticity of the statements. This transparency fosters trust among stakeholders, including investors (individuals or entities purchasing company stocks), creditors (those providing financial loans), and regulatory bodies (government agencies enforcing financial compliance), highlighting the importance of audited financial statements in corporate governance and decision-making.

Opinion on the financial statements

An auditor's opinion on financial statements serves as a critical assessment of an organization's financial reporting accuracy and compliance with applicable accounting standards. This opinion categorizes into four types: unmodified, modified, adverse, and disclaimer, directly influencing stakeholder trust. For instance, an unmodified opinion indicates that the financial statements, prepared in accordance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), present a true and fair view of the financial position as of December 31, 2022. Conversely, a modified opinion suggests potential issues, leading to a lack of confidence among investors or creditors. Accurate audits contribute significantly to the transparency and reliability of financial information, fostering informed decision-making in markets across the United States and beyond.

Signature of the authorized person

The audited financial statement requires the signature of an authorized person, such as the Chief Financial Officer (CFO) of the corporation, often alongside other key stakeholders, like the Board of Directors. This signature verifies the accuracy and completeness of the financial reports, which adhere to the generally accepted accounting principles (GAAP). The document typically includes audited data covering a fiscal year, detailing assets, liabilities, and shareholders' equity, with the audit conducted by external auditors from recognized firms, ensuring credibility and transparency for investors and regulatory bodies alike. Each signature signifies a commitment to uphold financial integrity, often seen in corporate settings across major financial hubs, such as New York City and London.

Letter Template For Audited Financial Statement Use Samples

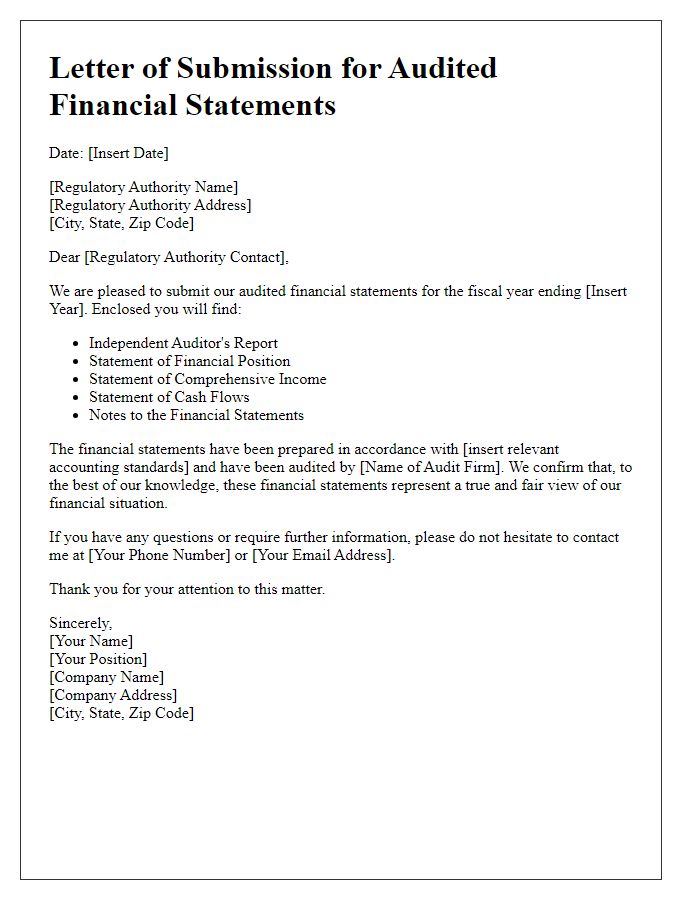

Letter template of audited financial statement for regulatory submission

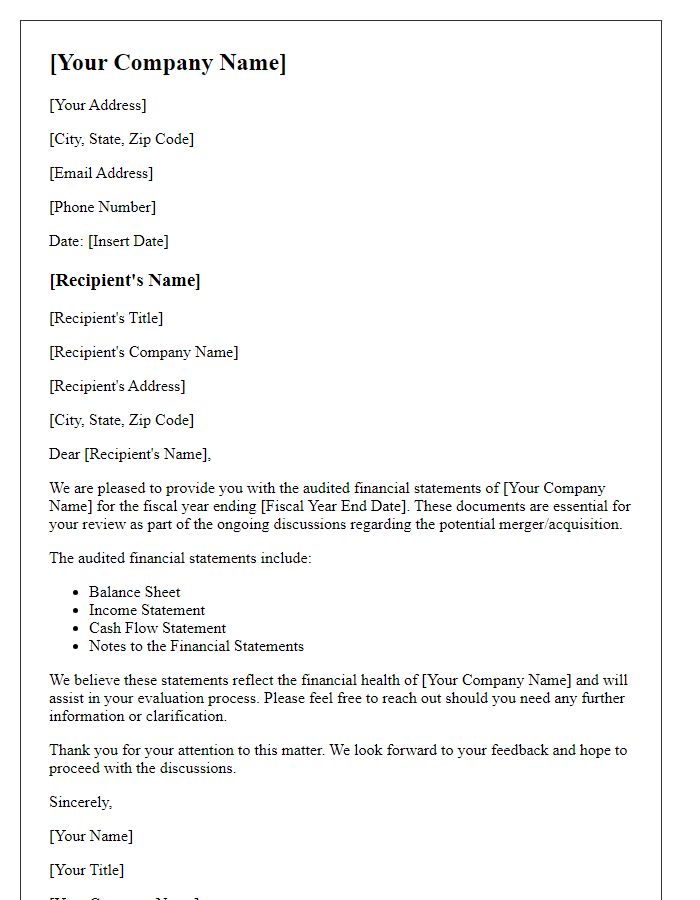

Letter template of audited financial statement for mergers and acquisitions

Comments