Are you looking to navigate the intricacies of subordinate financing acknowledgment in your correspondence? Understanding the importance of recognizing financial contributions from subordinates can help strengthen your professional relationships and foster transparency. In this article, we'll explore effective strategies for crafting a well-structured acknowledgment letter that communicates gratitude while ensuring legal clarity. Join us as we share valuable insights and templates that can enhance your financial communications!

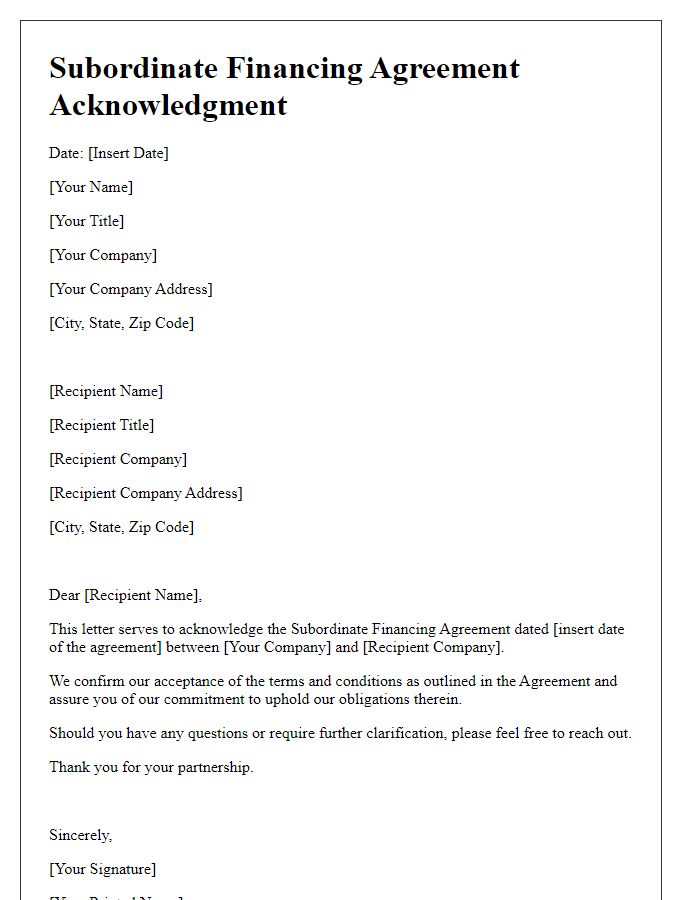

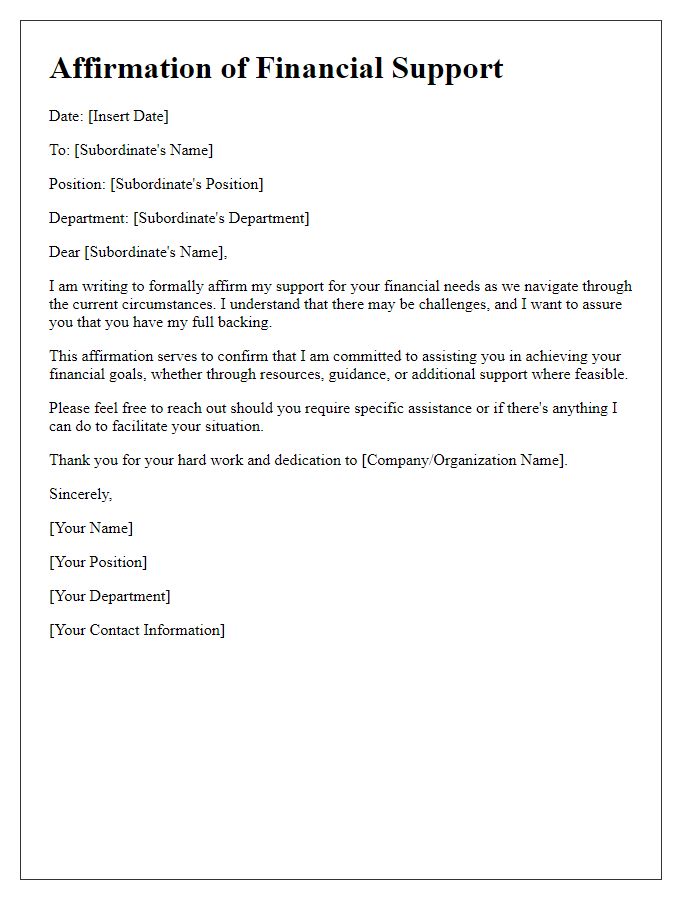

Proper Letterhead and Contact Information

Subordinate financing acknowledgment involves recognizing and formalizing a lower priority loan agreement in the context of a business or real estate transaction. This type of financing often includes clauses that outline payment hierarchies during potential insolvency or liquidation scenarios. It is crucial for establishing clear communication between lenders, especially in situations involving multiple loan agreements or financial commitments. Proper letterhead should include the company logo, name, address, and contact information, while also detailing the terms of the acknowledgment, including loan amount, interest rates, and repayment schedules. Recognizing the importance of these details solidifies the legal standing of the agreement.

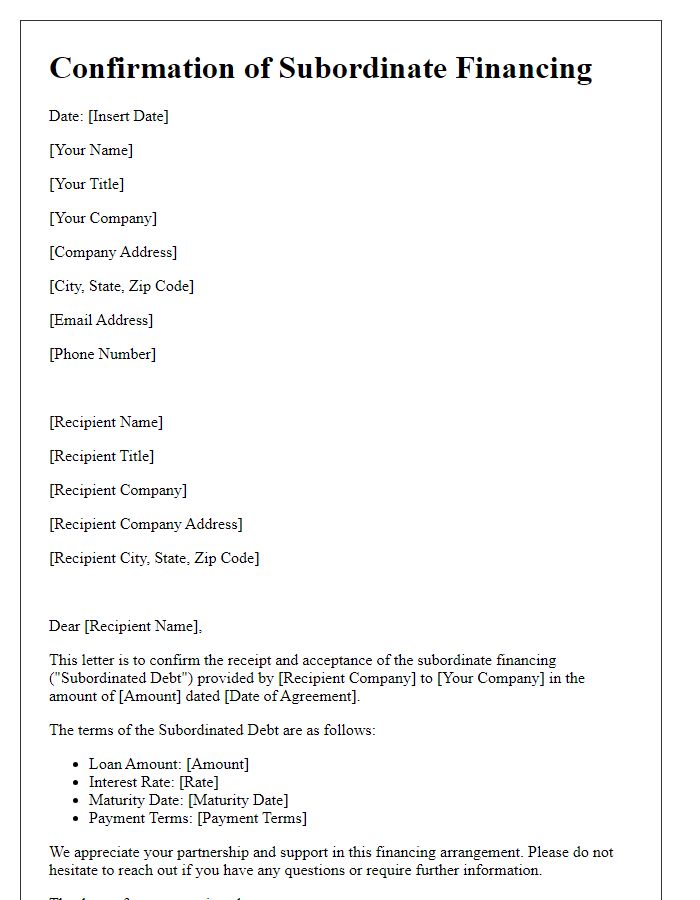

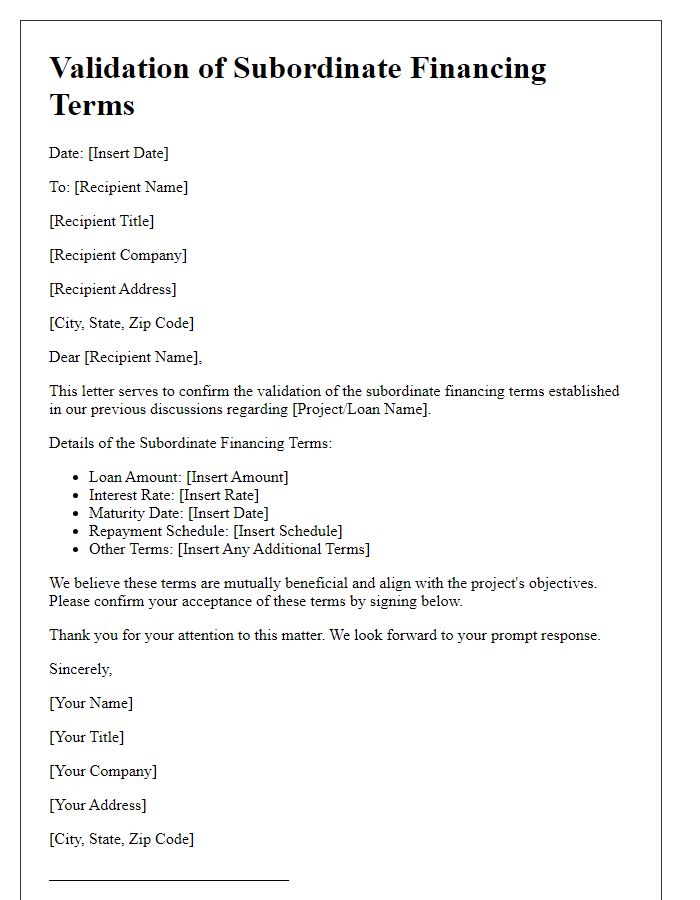

Clear Subject Line

Subordinate financing refers to a type of financing where a loan is riskier because it is lower in priority for repayment compared to other debts. This financial structure often appears in real estate deals or corporate finance scenarios. In the case of subordinate financing acknowledgment, clarity in documentation is crucial. A clear subject line helps the parties involved quickly identify the purpose of the correspondence. Examples of such subject lines may include "Acknowledgment of Subordinate Financing Agreement" or "Confirmation of Subordinate Loan Terms." Documenting this acknowledgment ensures that all parties understand their rights and responsibilities, reducing potential conflicts or misunderstandings in the future.

Detailed Terms and Conditions

In financial agreements involving subordinate financing, detailed terms and conditions play a critical role in establishing the expectations and responsibilities of the parties involved. Subordinate financing typically refers to loans or financial commitments ranked below senior debt, often seen in real estate investments or business acquisitions. These terms include the interest rate, which may vary but usually ranges from 5% to 12%, depending on the risk profile of the project. The repayment schedule outlines when payments are due, whether monthly or quarterly, often lasting between three to ten years. Default clauses define the conditions under which a borrower may be considered in default, potentially including missed payments or bankruptcy, leading to adverse actions such as foreclosure or the requirement to repay the loan in full. Conditions regarding prepayment may also be included, allowing borrowers to pay off the loan early, sometimes subject to penalties. Additionally, covenants may also exist, which are specific requirements and restrictions that borrowers must adhere to during the loan period, ensuring compliance for the protection of subordinate financiers. Overall, these terms emphasize the necessity of clarity in financial relationships, guiding actions, rights, and obligations of both lenders and borrowers in the subordinated structure.

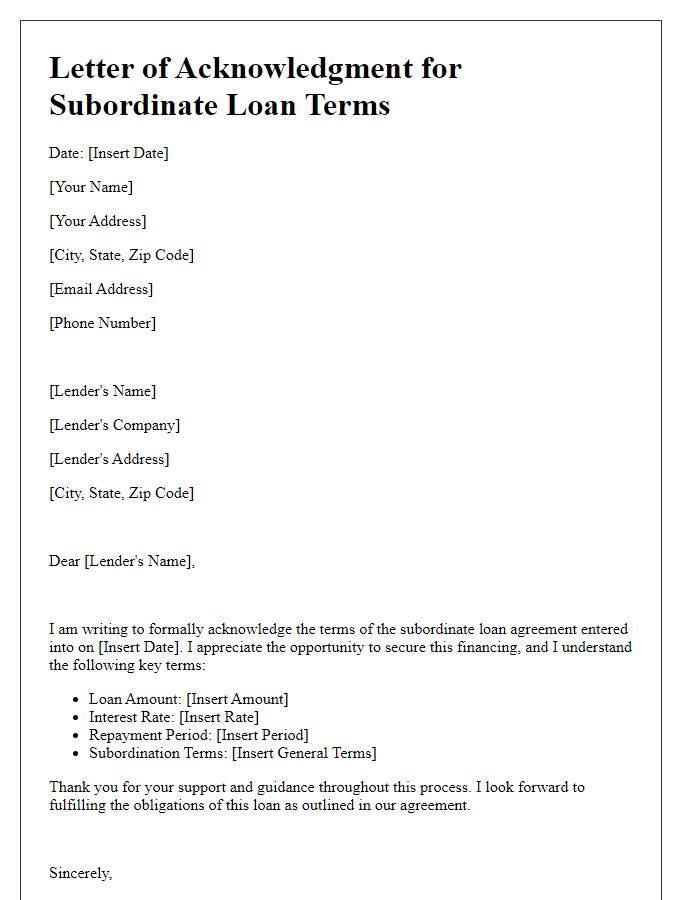

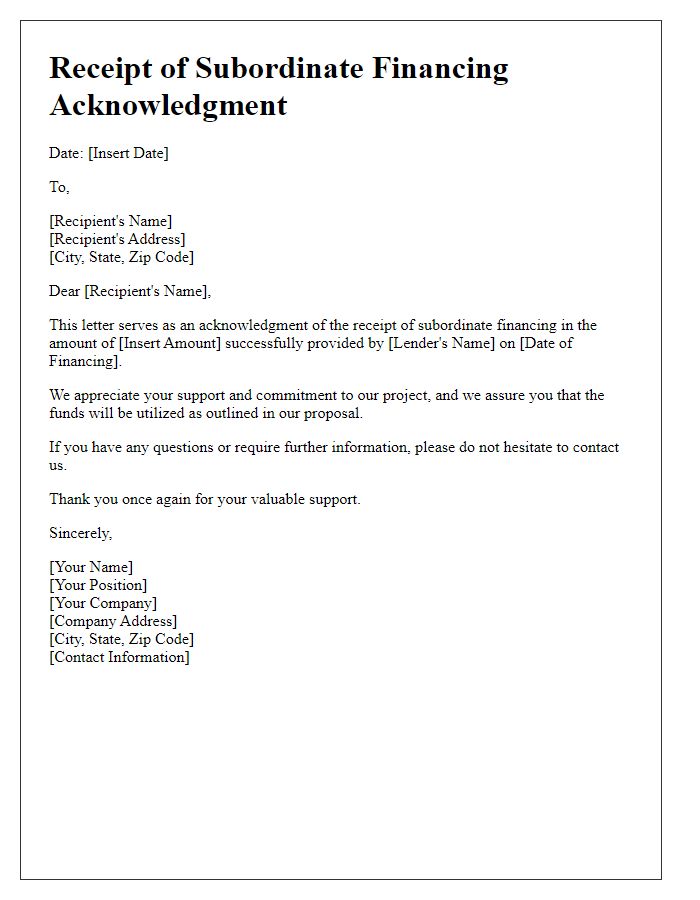

Acknowledgment of Parties Involved

Acknowledgment of subordinate financing often involves various parties, including lenders, borrowers, and sometimes regulatory bodies. This acknowledgment serves as an essential document in financial transactions, particularly in real estate or business acquisitions where a secondary loan (subordinate financing) is provided. Key players include primary lenders, such as commercial banks with a significant role in funding the primary mortgage or loan, and subordinate lenders who accept collateralized security behind the primary loan. The date of acknowledgment likely corresponds to a milestone event in the financing process, while the property address identifies the precise location connected to the financing agreements. It's imperative to document the terms of the subordinate financing, including interest rates, repayment schedules, and any collateral involved, ensuring all parties have a clear understanding of their obligations and rights throughout the lending process.

Signature and Date Section

The signature and date section of a subordinate financing acknowledgment document serves as a crucial point where all parties formally agree to the terms laid out in the document. This section typically includes lines for signatures of the borrower and the lender. The borrower is usually an individual or business entity seeking additional financing secured behind the primary loan. The lender, often a financial institution or private investor, provides the subordinate financing and is acknowledged for their role. Additionally, the date line records the exact date when the agreement is acknowledged, ensuring clear documentation and alignment of interests. Ensuring this section is correctly filled out is essential for legal enforceability and transparency in any financial agreement.

Comments