Are you looking to navigate the complexities of a graduated payment loan proposal? Understanding the ins and outs of this financial option can be essential for making the best decision for your future. In this article, we'll break down everything you need to know, from how graduated payment loans work to their benefits and potential pitfalls. Join us as we explore this intriguing financial strategy and discover how it might be the right fit for your needs!

Loan Purpose and Overview

A graduated payment loan proposal typically outlines the purpose of the loan and provides an overview of its structure. This kind of loan is designed for borrowers expecting their income to increase over time. The proposal should detail the specific use of funds, such as home purchase or business expansion, highlighting how the graduated payment structure aligns with the borrower's anticipated financial growth. It often includes information on the initial lower payment amounts that gradually increase, providing a clear timeline--often over a period of 5 to 10 years--demonstrating how the borrower can manage initial financial constraints while planning for future income increases. Key components such as loan amount, interest rate, repayment schedule, and any collateral involved should be outlined to provide a comprehensive view of the loan's terms and implications.

Graduation Payment Schedule

A graduated payment loan proposal often includes a structured repayment plan designed for borrowers expecting income growth over time. The proposal outlines a repayment schedule where initial payments are lower and gradually increase at predetermined intervals, typically annual increments. Borrowers may target various loan amounts, such as $50,000 or $100,000, with interest rates varying between 4% and 6%, depending on the lender's terms. The first five years may consist of interest-only payments, easing caseload for recent graduates. Subsequent years, spanning 10 to 20 years, see increments of payments by 10% annually until the loan is fully amortized. This structure allows borrowers to manage their finances effectively, aligning with career advancement in fields such as engineering, education, or healthcare, where salary increases are common.

Borrower Financial Information

Graduated payment loans are designed for borrowers anticipating an increase in income over time. These loans feature lower initial payments that gradually increase over the term, often used for educational expenses. Borrower financial information is critical to the loan proposal, including annual income figures, employment status details, and debt-to-income ratios providing lenders with insight into repayment capability. Additional components like credit scores, housing expenses, and asset information, such as bank account balances and investment portfolios, help assess financial stability. Documented income sources may include pay stubs, tax returns, and proof of additional income streams, such as rental properties or investments. This comprehensive financial profile aids lenders in evaluating risk and determining loan eligibility for the desired amount.

Risk Assessment and Mitigation

A comprehensive risk assessment and mitigation strategy for a graduated payment loan proposal must focus on key financial metrics and potential borrower circumstances. Primary risks include borrower default, which can occur due to factors like employment instability or income fluctuations, particularly in fields sensitive to economic changes such as retail or hospitality. Key performance indicators such as the debt-to-income ratio (recommended below 36%) and credit score (ideally above 700) play crucial roles in determining borrower reliability. Mitigation strategies could involve designing a flexible repayment plan that accommodates income variability, offering financial counseling services to educate borrowers on budgeting and repayment, and setting up an emergency fund requirement that could cover at least three months of loan payments. Additionally, a reserve fund may be established to cover unexpected expenses for the lender, reducing the risk associated with defaults. Incorporating technology tools like automated payment reminders and assessments can enhance monitoring of borrower behavior, allowing for early intervention if signs of financial distress are detected, thus safeguarding the financial institution's interests.

Lender's Terms and Conditions

A graduated payment loan proposal usually outlines the terms and conditions set by the lender, providing borrowers with a structured repayment plan. Key elements include the initial lower payment amount that gradually increases over a specified period, typically five to ten years. Interest rates may be fixed or variable, affecting the overall repayment amount. The loan duration usually spans 15 to 30 years, depending on the lender's policies. Loan origination fees are often included, which might range from 1% to 3% of the loan amount. Prepayment penalties could apply if the borrower pays off the loan early, incentivizing adherence to the original schedule. Approval criteria generally include credit score requirements, income verification, and employment history, ensuring borrower stability and repayment capability. Documentation, such as proof of income and tax returns, is essential during the application process to analyze the borrower's financial health accurately.

Letter Template For Graduated Payment Loan Proposal Samples

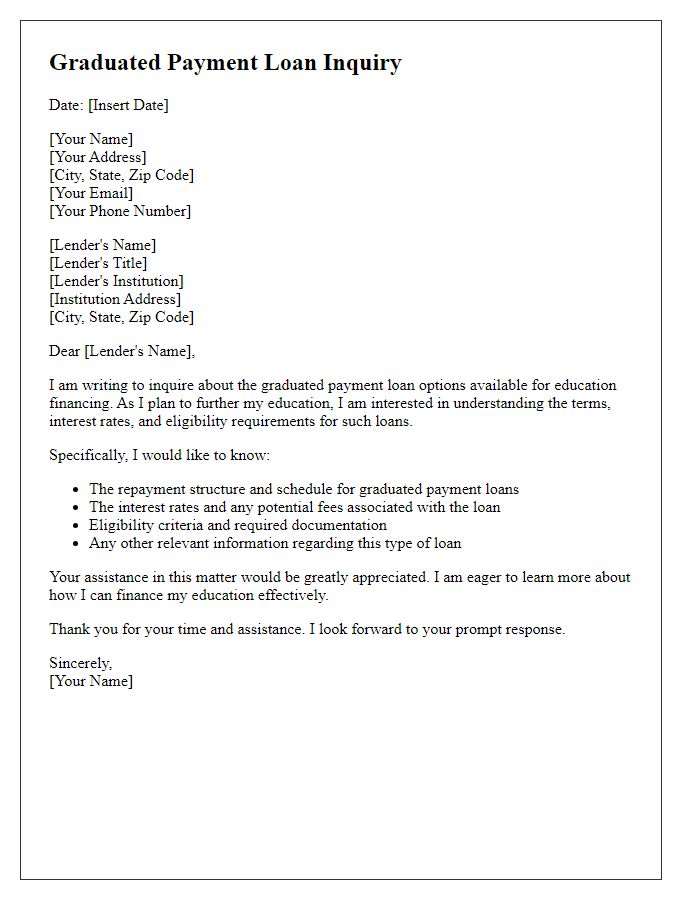

Letter template of graduated payment loan inquiry for education financing.

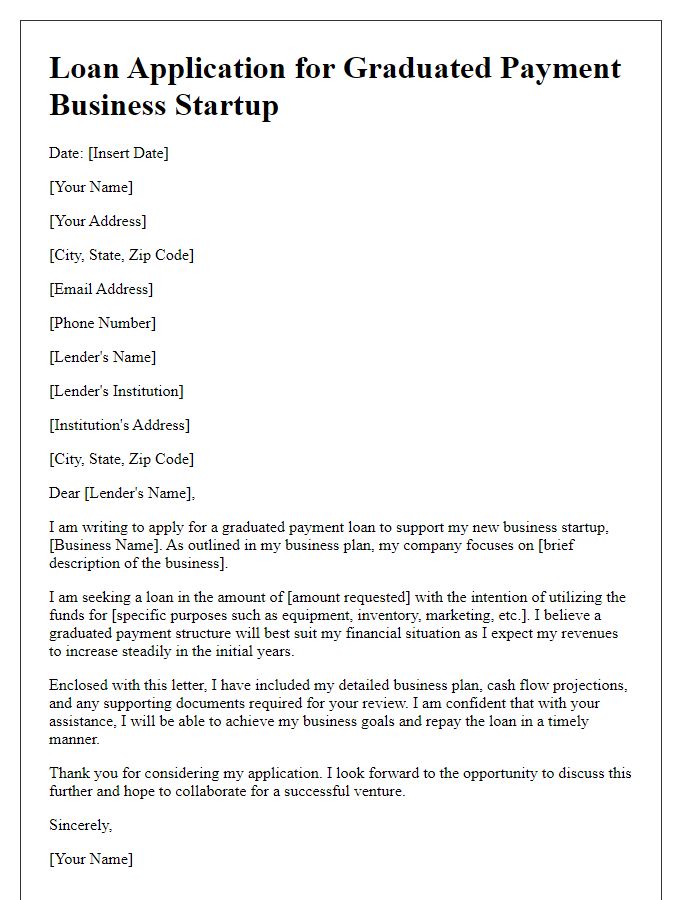

Letter template of graduated payment loan application for business startup.

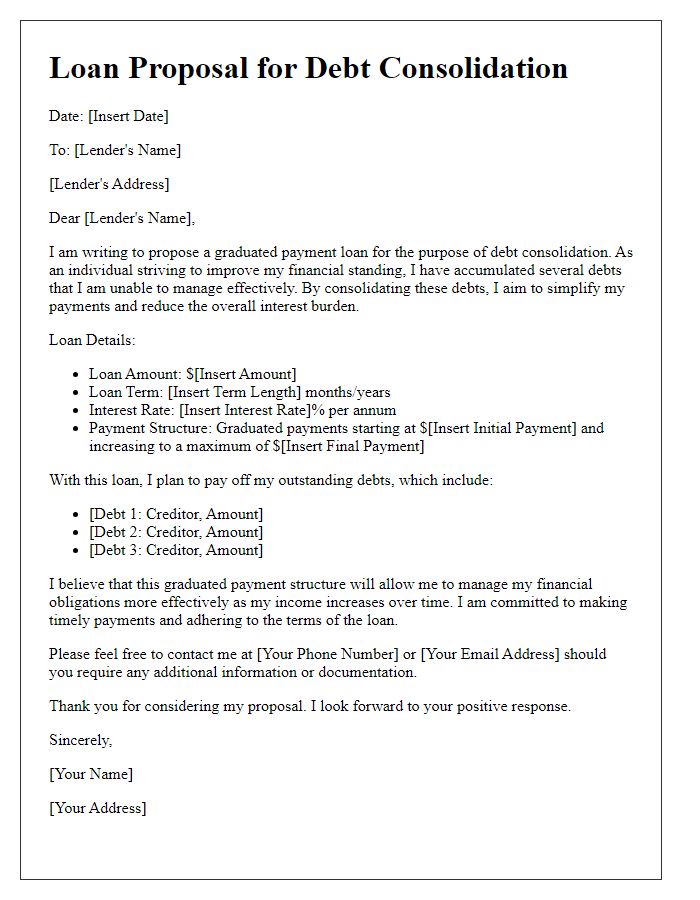

Letter template of graduated payment loan proposal for debt consolidation.

Letter template of graduated payment loan request for vehicle financing.

Letter template of graduated payment loan application for personal expenses.

Letter template of graduated payment loan inquiry for renovation projects.

Comments