Are you navigating the often complex process of securing a loan? Understanding the timeline for initial loan disbursement can make a significant difference in your planning and peace of mind. From application to fund distribution, each stage plays a crucial role in ensuring a smooth experience. Curious to learn more about how to effectively manage the loan process and what to expect? Keep reading!

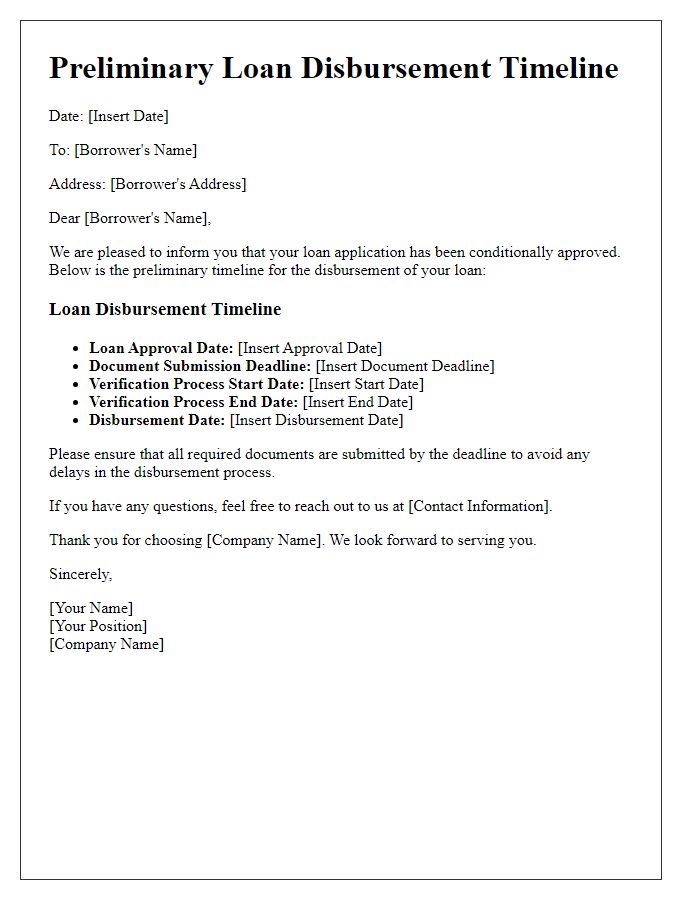

Loan Amount and Terms

The initial loan disbursement timeline is crucial for understanding the stages of financial support, typically involving significant amounts such as $250,000 for small business operations or personal projects. It often outlines terms lasting from 12 to 60 months, detailing interest rates ranging from 3% to 8%, influenced by credit scores. Key milestones in this timeline include the approval process, which may take 7 to 14 days, followed by document verification before funds are released. Upon completion of the prerequisite steps, disbursement usually occurs within 1 to 3 business days after final approval. Understanding these details ensures borrowers are well-informed about their financial obligations and repayment schedules.

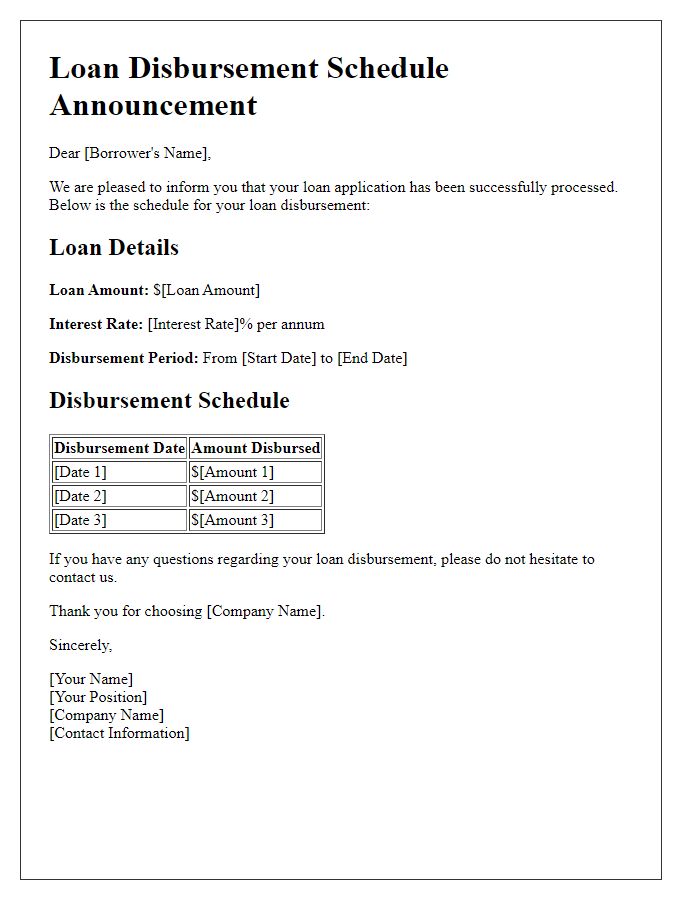

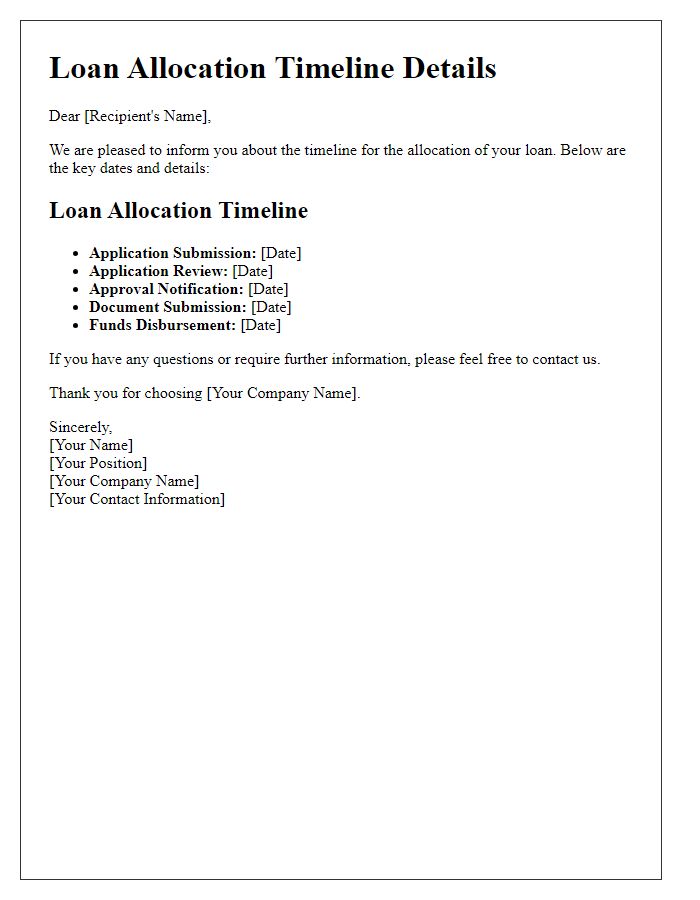

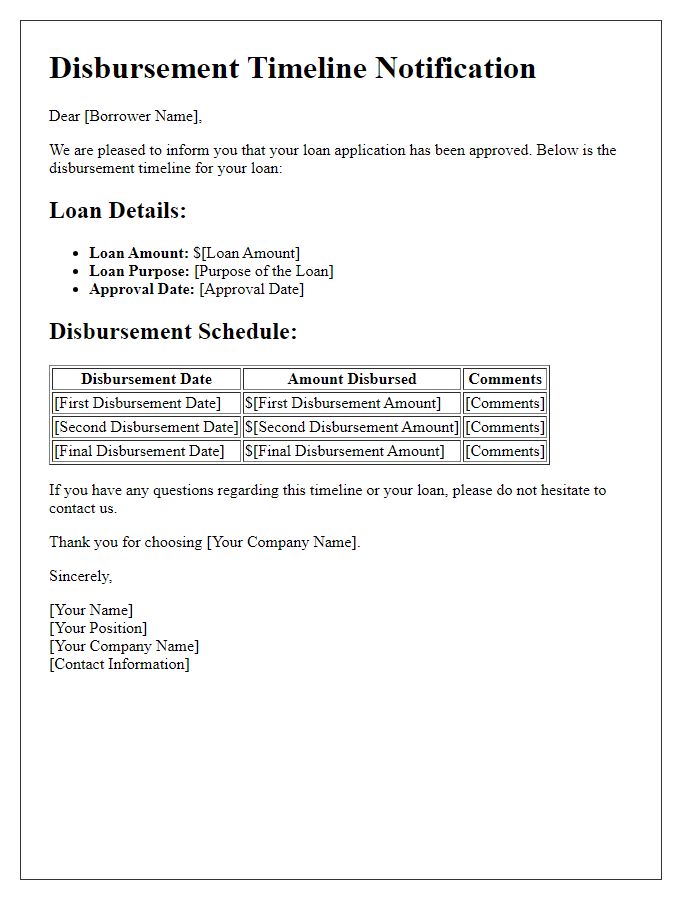

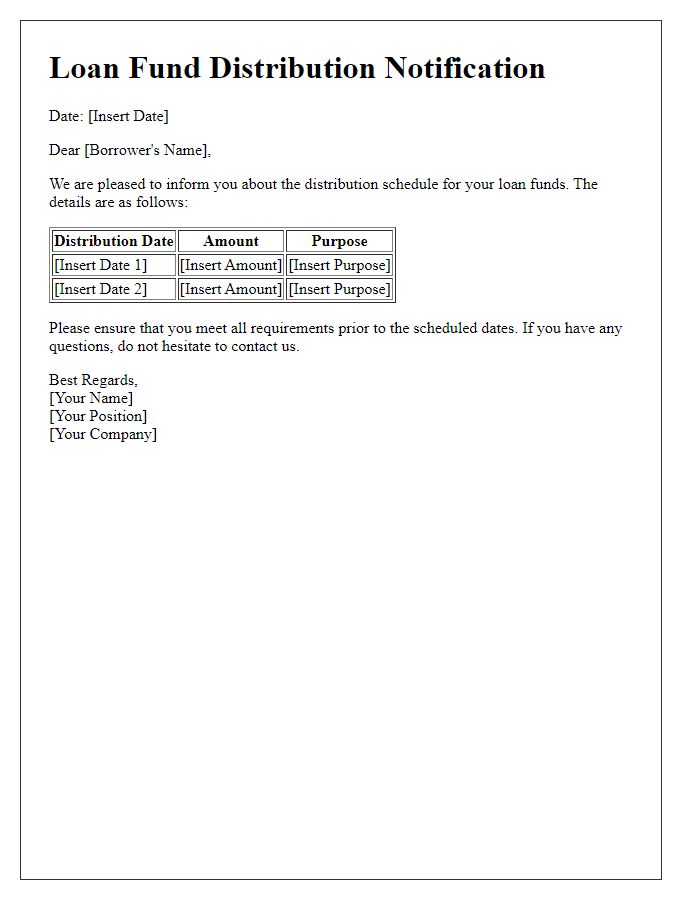

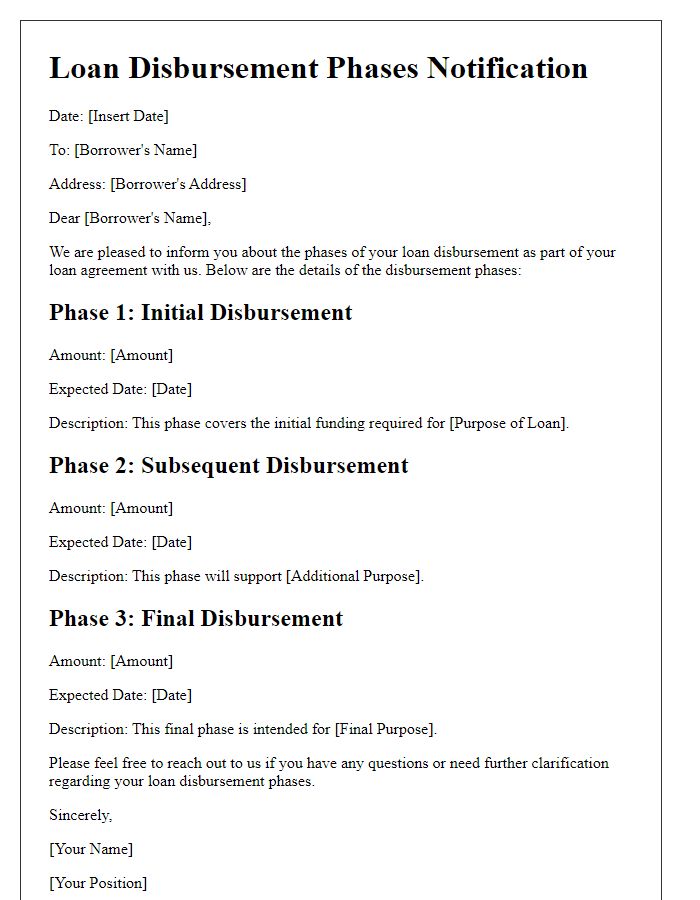

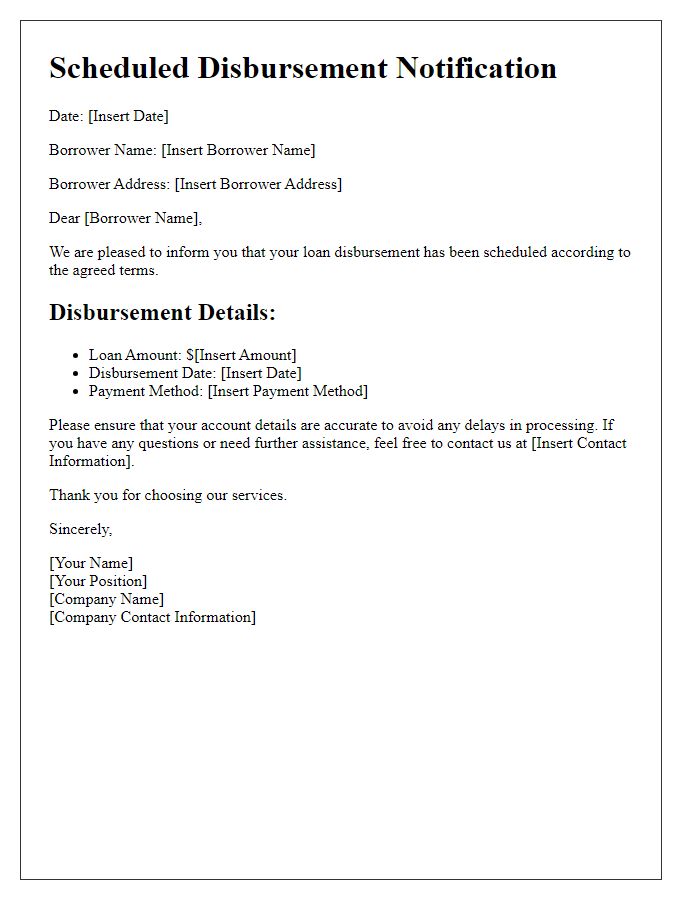

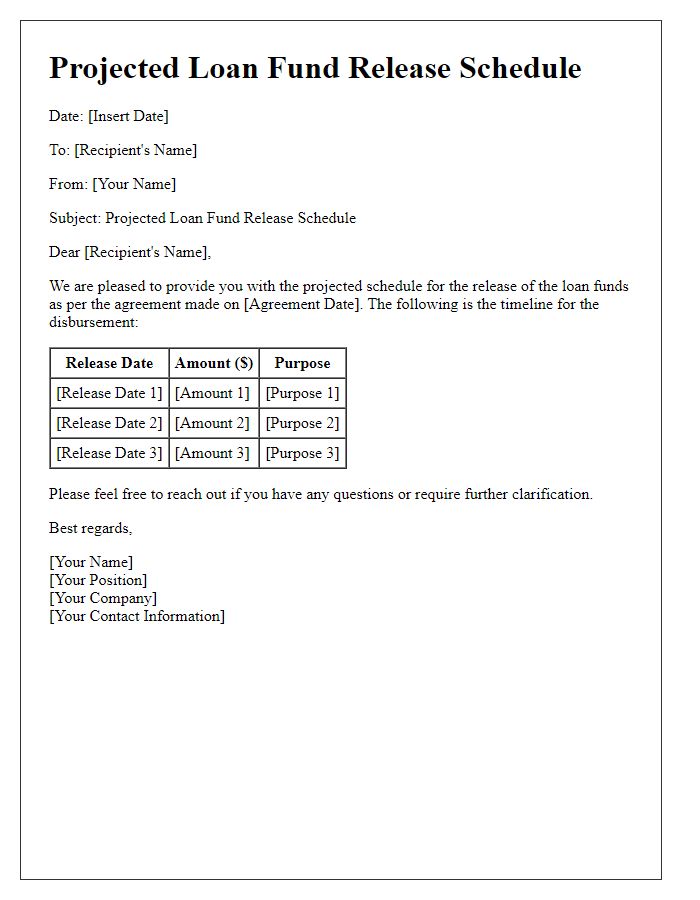

Disbursement Schedule

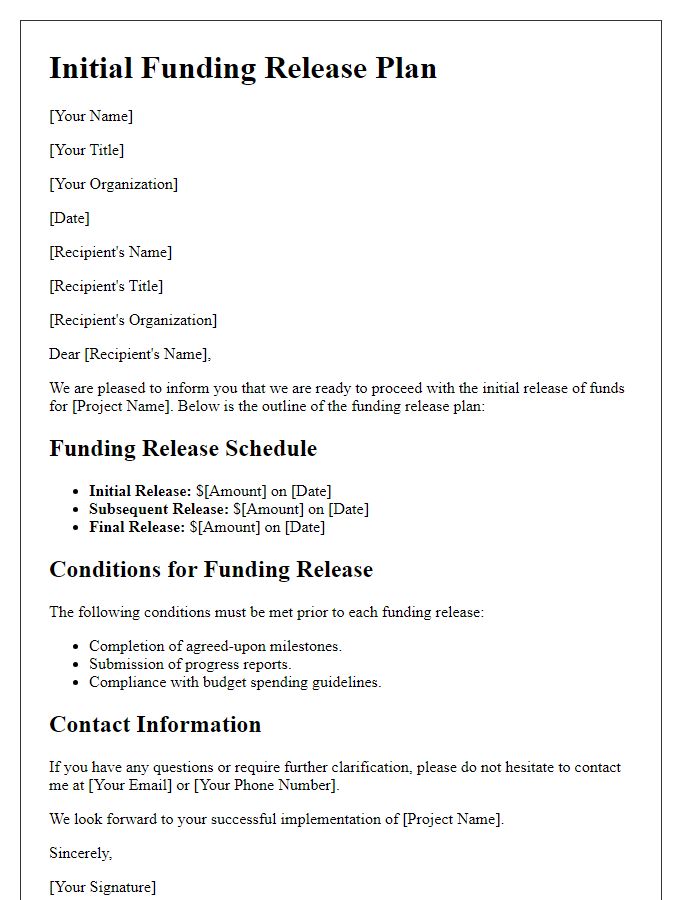

The initial loan disbursement timeline outlines the structured schedule for the distribution of funds, crucial for borrowers to effectively plan their financial commitments. Typically, the process begins with pre-disbursement verification steps, often taking 5 to 10 business days, during which the lending institution, such as a bank or credit union, confirms the borrower's eligibility based on credit history and income verification. Following this, the disbursement phase can commence, which commonly occurs in portions. For example, a university might disburse education loans in three installments throughout the academic year, specifically at the beginning of each semester. Each disbursement could involve an approximate amount based on tuition fees, living expenses, and the total loan agreement, with interest rates varying from 3% to 7% depending on the borrower's credit profile. Timely communication regarding these funds is essential, as most borrowers depend on this schedule to manage their financial obligations efficiently.

Required Documentation

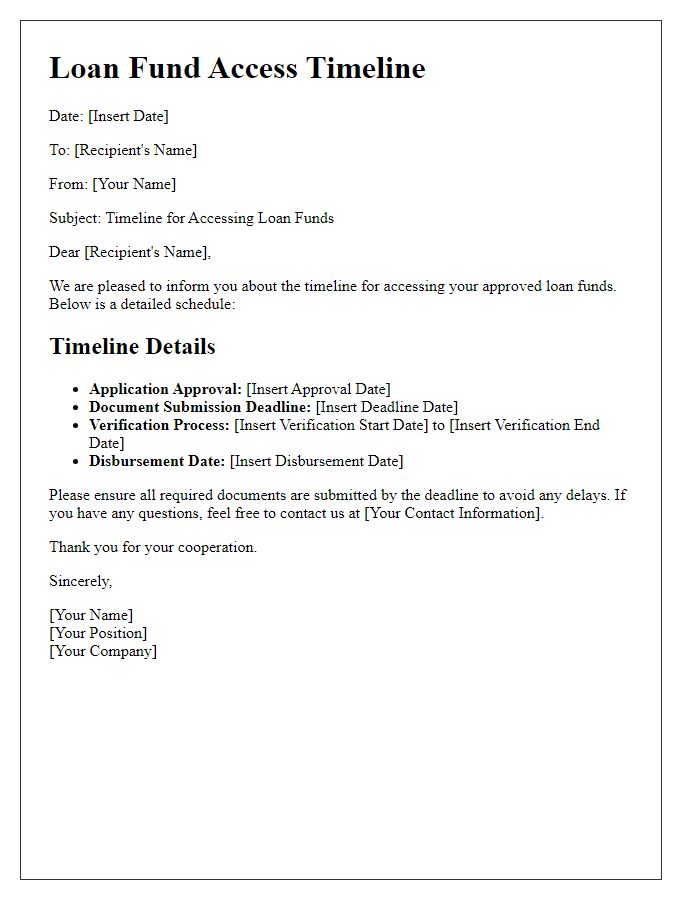

Initial loan disbursement timelines significantly depend on the completion of required documentation. Essential documents typically include a signed loan agreement, proof of income such as recent pay stubs (within the last 30 days), credit reports summarizing credit history from agencies like Experian or Equifax, and personal identification, such as a government-issued ID or passport. Additionally, property-related documents may be necessary for secured loans, which can include appraisals or title deeds. All documentation should be submitted electronically through secure portals or in-person at branches to ensure confidentiality. Once all documents are verified, disbursement timelines can range from a few days to several weeks, depending on the lender's policies and underwriting processes.

Interest Rate and Fees

The initial loan disbursement process can be significantly influenced by the interest rate, which is calculated as a percentage of the principal amount borrowed. For instance, a typical interest rate might range from 3% to 7% depending on the loan type and borrower creditworthiness. Additionally, fees associated with the loan, such as origination fees, typically amount to 1% to 3% of the loan value, may apply. Various lenders may implement different fee structures or timelines, which can make a notable difference in the overall cost of borrowing. Borrowers should carefully review these financial details prior to accepting the loan agreement to ensure they have a clear understanding of the total repayment amount over the loan's duration.

Contact Information and Support Channels

Initial loan disbursement timelines are critical for borrowers to understand. Typically, the disbursement process begins after submitting the loan application to a financial institution, such as banks or credit unions. Standard approval times range from 1 to 5 business days, depending on the complexity of the application and the borrower's credit history. Following approval, disbursement can take an additional 1 to 3 business days to process. Funds are primarily transferred via electronic means, such as ACH (Automated Clearing House) transfers, into a designated account specified by the borrower. Essential contact information, including customer service representatives and support channels, is often provided to address queries during the loan lifecycle, ensuring borrowers can access assistance as needed.

Comments