Are you feeling overwhelmed by your mortgage payments? You're not alone, as many homeowners are navigating these challenging financial waters. In this article, we'll discuss mortgage payment amnesty options that could provide some much-needed relief and give you the peace of mind you deserve. So, if you're curious about how to ease your financial burden, keep reading to discover your potential pathways to financial freedom!

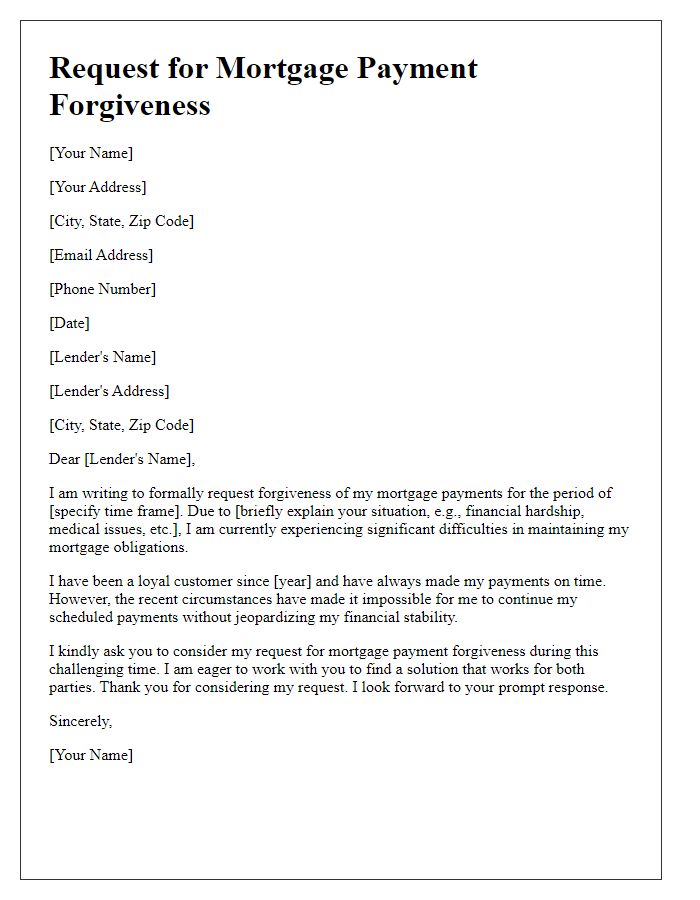

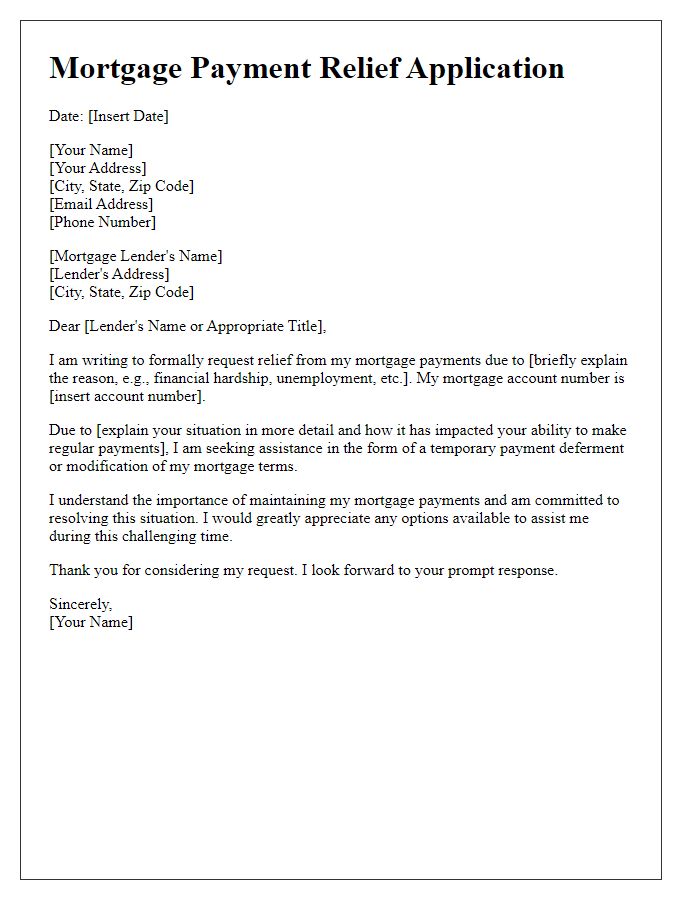

Borrower's personal and contact information.

A mortgage payment amnesty program can provide financial relief for homeowners struggling with payments due to unforeseen circumstances such as job loss, medical emergencies, or economic downturns. The borrower, typically a property owner facing difficulties, must provide personal information (full name, social security number, and date of birth) alongside contact information (phone number, email address, and residential address) to initiate the process. This documentation is essential to verify eligibility and ensure secure communication between the borrower and the lending institution. Successful processing often leads to temporary suspension or reduction of monthly payments, offering a vital lifeline during challenging times.

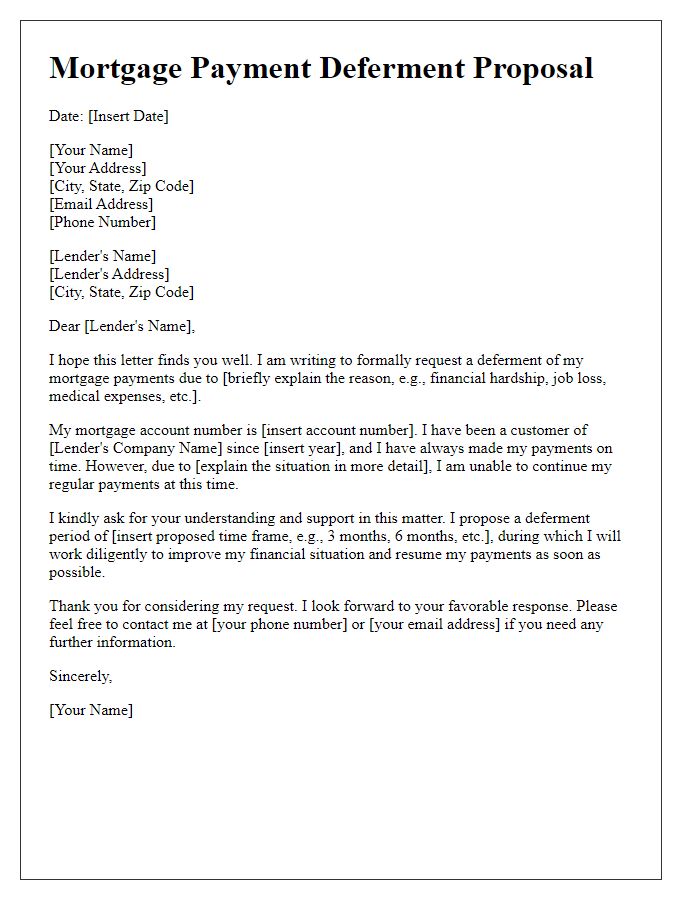

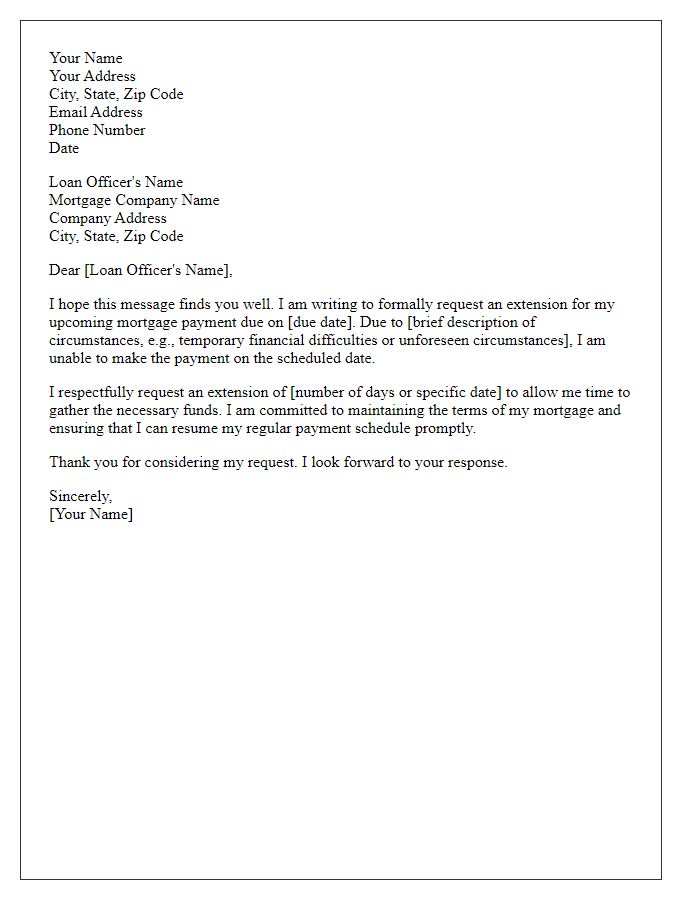

Loan account details.

Mortgage payment amnesty provides relief to borrowers facing financial hardships, often allowing a temporary postponement of payments. Loan account details, such as the mortgage identification number (e.g., 123456789), specific property address (e.g., 456 Oak Street, Springfield), outstanding balance (e.g., $250,000), and payment history (covering the last 12 months), are crucial elements. Borrowers must submit documentation proving their financial situation, typically including income statements and proof of unemployment if applicable, to qualify for this program. Each lender may have unique requirements and application processes, making it essential to directly consult with the mortgage servicer to navigate the amnesty successfully.

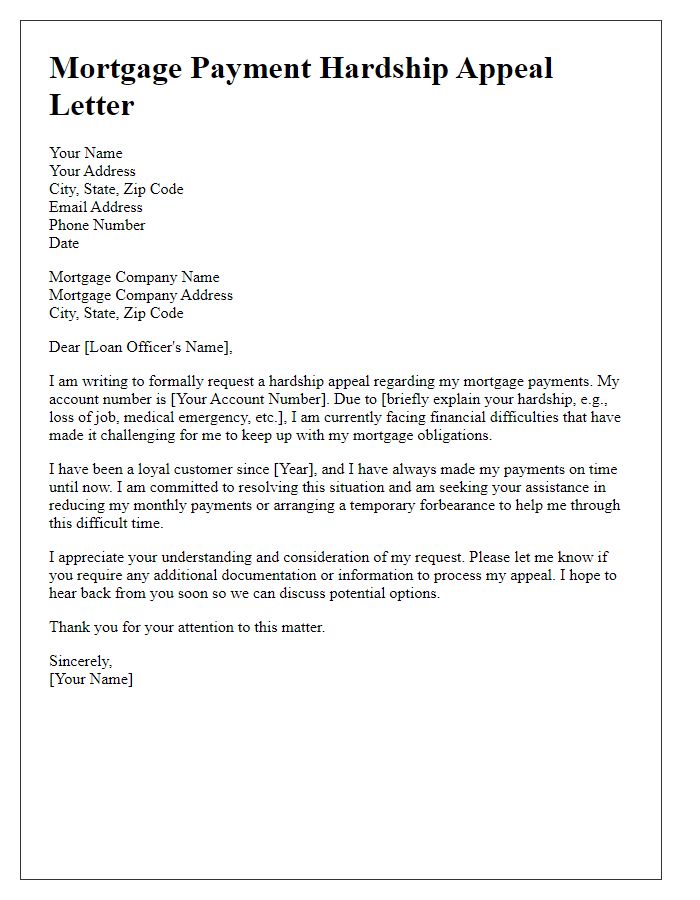

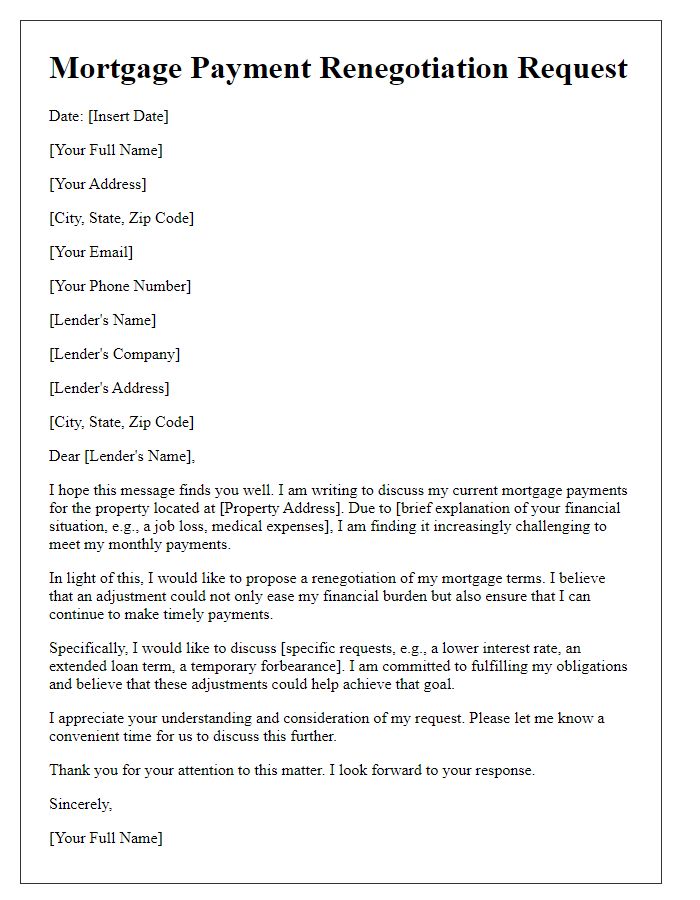

Reason for requesting amnesty.

Financial difficulties resulting from unexpected events, such as job loss or medical emergencies, have significantly impacted the ability to make mortgage payments on time. Current circumstances have led to a temporary inability to generate sufficient income, resulting in delinquency. Requesting a mortgage payment amnesty could provide the necessary relief to navigate through this challenging period. This amnesty could allow for a reprieve from payment obligations for a defined period, facilitating financial stability and ensuring the long-term maintenance of property ownership in [City or Region], thereby protecting both financial investment and future housing security.

Proposed payment plan or resolution.

A mortgage payment amnesty can provide relief for homeowners facing financial difficulties. A structured payment plan may include a temporary reduction in monthly payments for a specific period, such as three to six months, allowing homeowners to regain financial stability. For instance, the plan might propose a 50% reduction in payments during the hardship period, which could be beneficial for residents in cities with high living costs like San Francisco or New York. Additionally, a resolution could involve extending the loan term by five years to lower monthly obligations. Homeowners should be aware that this amnesty could require a formal agreement detailing the adjusted terms and any potential interest implications. Engaging with local lenders to discuss these options is crucial, ensuring that borrowers receive the necessary support during challenging times.

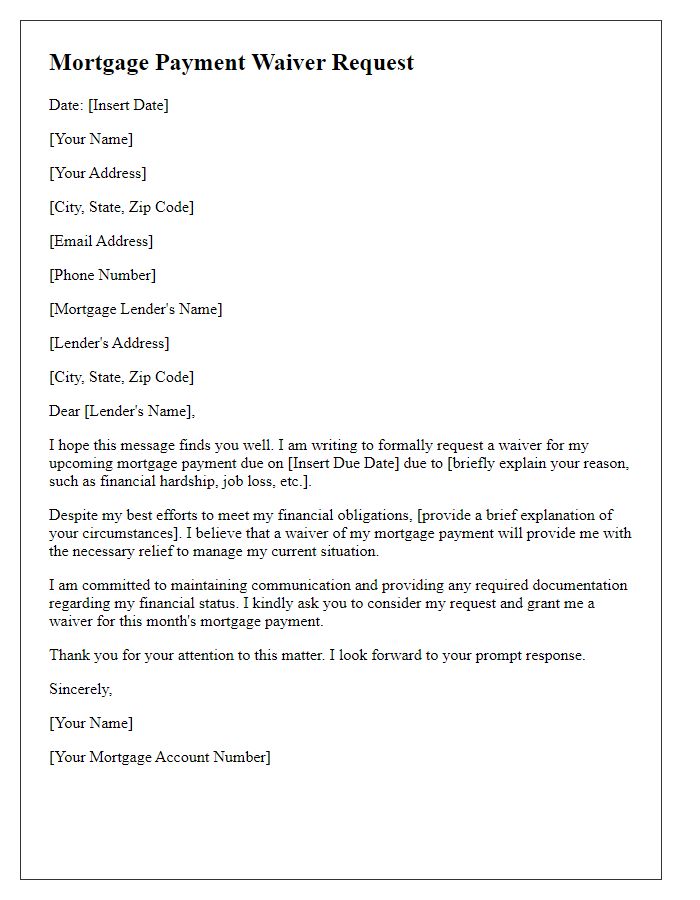

Appreciation and formal closing statement.

A mortgage payment amnesty may provide a temporary relief option for homeowners struggling to meet their financial obligations due to unforeseen circumstances. These programs, often initiated by banks or government agencies during economic downturns, allow borrowers to defer payments without penalty for specific periods. Homeowners may express appreciation for this opportunity, recognizing how it alleviates immediate financial stress and allows time for recovery. Additionally, a formal closing statement may include gratitude towards mortgage lenders for their understanding and support, reinforcing the collaborative effort to navigate challenging financial landscapes, particularly in the wake of events like natural disasters or economic crises.

Comments