Are you feeling overwhelmed by missed payments and seeking a solution? In today's fast-paced world, it's easy to lose track of bills, but you don't have to face the repercussions alone. Crafting a skipped payment agreement can help ease financial stress and pave the way for a more manageable repayment plan. Ready to learn how to create this vital document? Keep reading for tips and templates to get you started!

Payment Restructure Terms

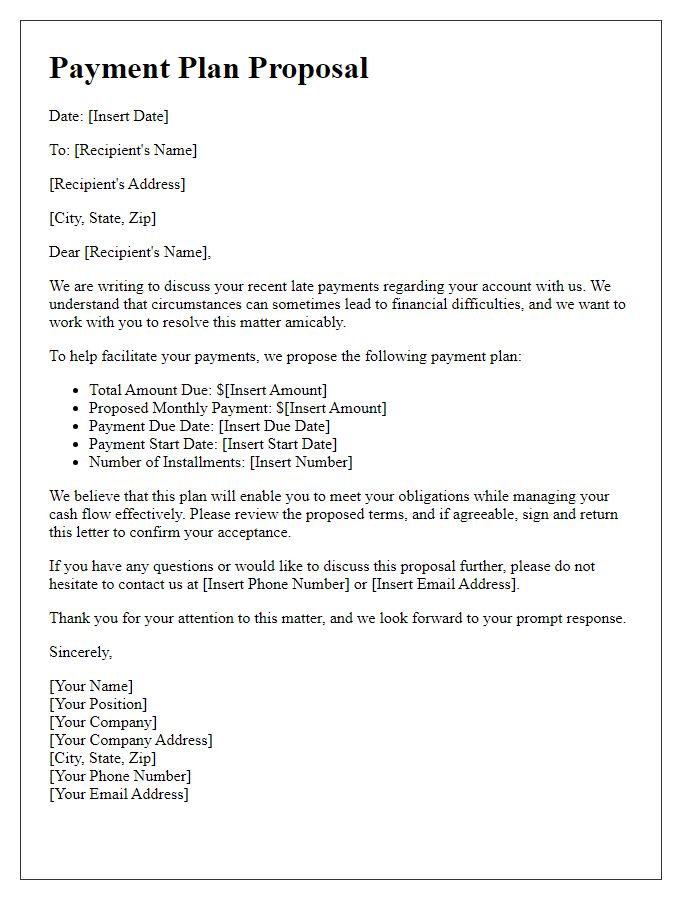

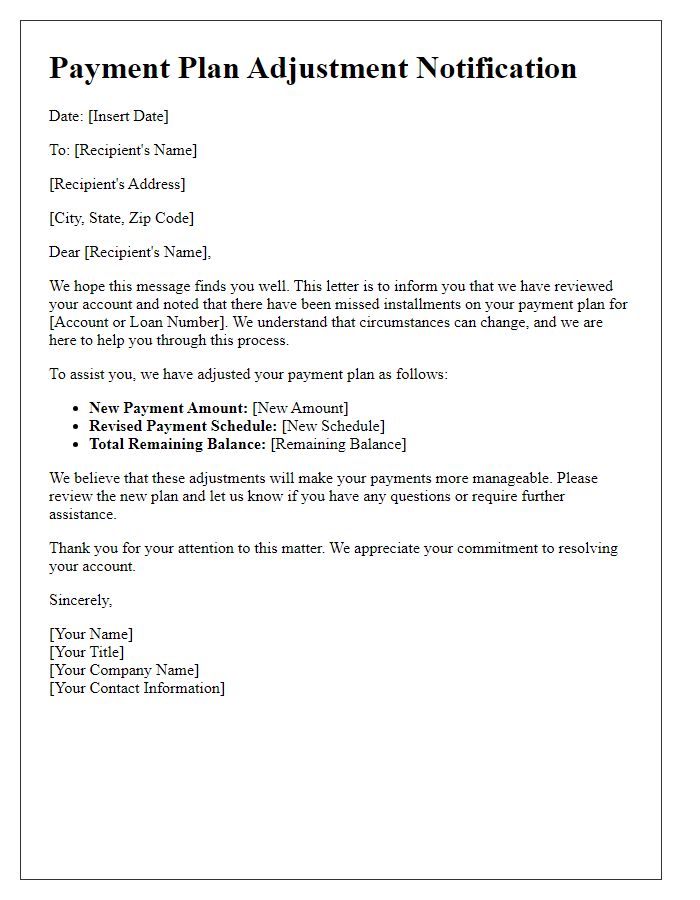

A payment restructure agreement can provide an essential framework for individuals facing financial difficulties, allowing them to resume timely payments while avoiding potential penalties or legal actions. This agreement typically outlines key details such as the total outstanding balance, which could range into thousands of dollars, the proposed new payment schedule detailing specific amounts and due dates, and any additional fees involved, which may include late charges up to a specified percentage. Furthermore, it may include provisions for missed payments, ensuring clarity regarding the consequences of defaulting on the restructured plan. This agreement often emphasizes communication between the involved parties, typically borrower and lender, to facilitate understanding and uphold mutual responsibilities throughout the payment restructuring process.

Parties Involved in Agreement

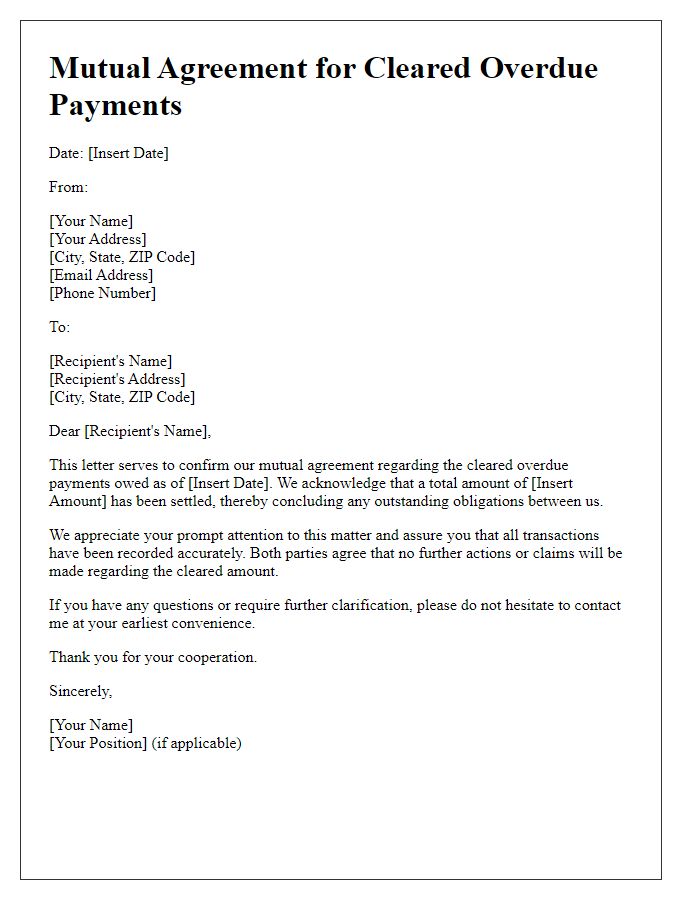

Parties involved in a skipped payment agreement typically include two primary entities: the Debtor, who is the individual or business responsible for making payments, and the Creditor, who is the entity that has extended credit or provided a loan. The Debtor may include individuals facing personal financial challenges or businesses experiencing cash flow issues. The Creditor could be a financial institution, a private lender, or a service provider. The agreement may specify additional parties, such as guarantors or co-signers, ensuring that obligations are met. Clarity on roles and responsibilities of each party is essential for effective communication and resolution of payment schedules.

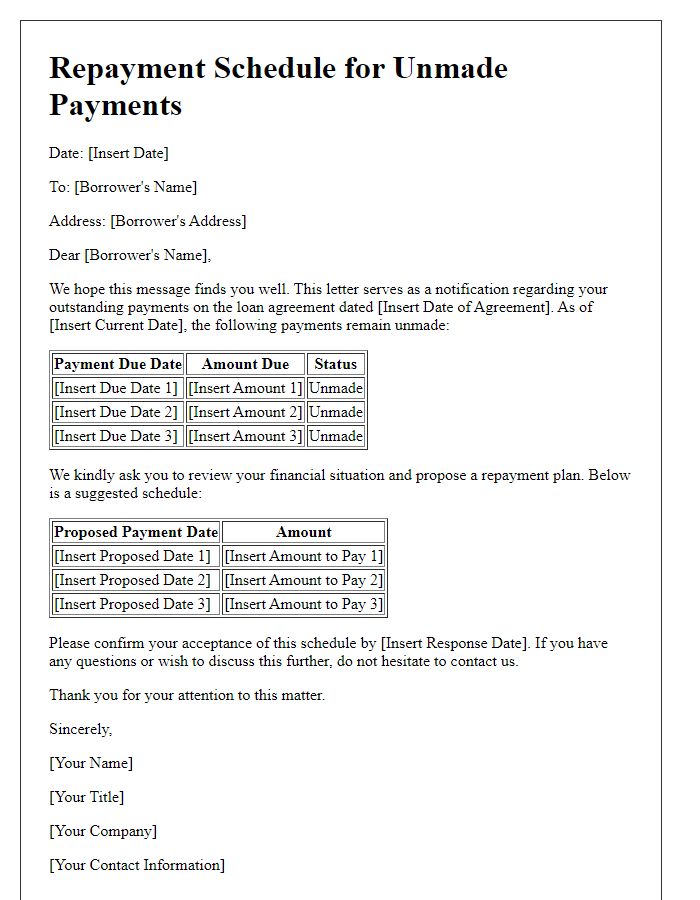

New Payment Schedule

The new payment schedule for the outstanding balance of $1,500 owed will commence on November 15, 2023. Payments will be structured into three equal installments of $500, due on the 15th of each month until the balance is fully settled by January 15, 2024. This agreement aims to accommodate the financial circumstances affecting timely payments, allowing for improved cash flow management during this period. Delays or missed payments beyond the agreed schedule may incur additional fees and impact credit ratings. Please ensure all future payments are processed through bank transfer to the designated account for ease of tracking and management.

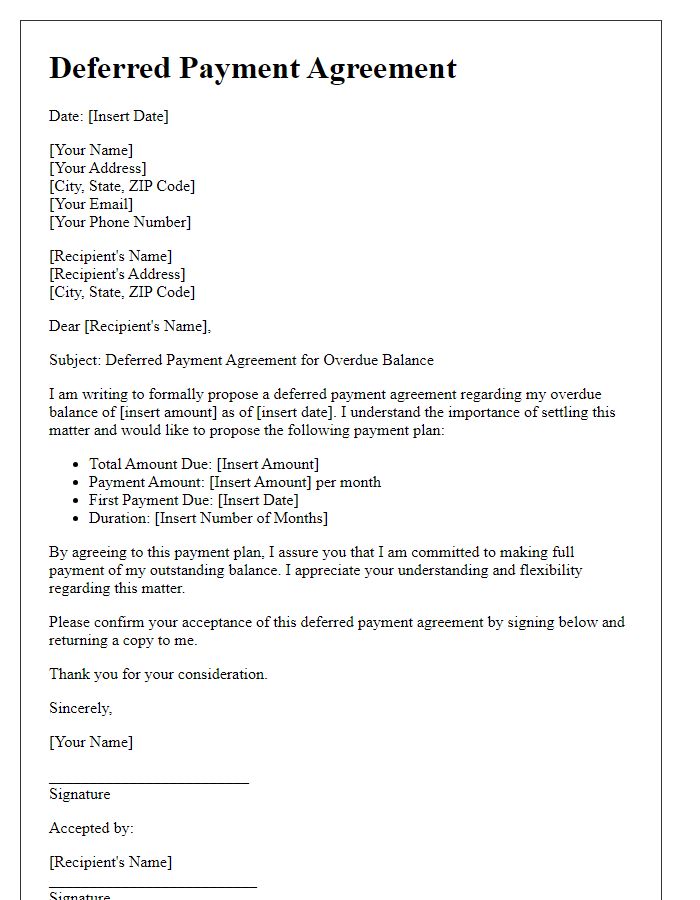

Signatures and Consent

A skipped payment agreement outlines the terms of missed payments within a financial context, typically regarding loans or agreements involving significant amounts of money. This document requires the signatures of both parties involved to denote mutual consent and understanding. The signatures affirm the acknowledgment of the agreement's conditions, including any penalties or changes in payment schedule. Essential details include the names of the parties involved, date of consent, and specific terms outlining the repercussions for continued missed payments. Proper identification, such as social security numbers or account numbers, further clarifies the agreement's scope, enhancing legal enforceability in case of disputes.

Contact Information and Communication Plan

A comprehensive communication plan is essential for managing skipped payment agreements effectively. Initial contact should occur within 7 days of the missed payment date, detailing the outstanding amount due, which might include late fees of up to 5% per month according to company policy. Communication can take place through multiple channels, such as email (using verified addresses in the database), phone calls during business hours (9 AM to 5 PM local time), and text reminders (sent from a designated number). The follow-up schedule should include reminders at 14 days and 30 days post missed payment, allowing the debtor ample opportunities to respond. Documentation of all communications should be maintained for future reference, ensuring compliance with regulations such as the Fair Debt Collection Practices Act. Provide alternative payment plans to facilitate recovery of the owed amount, highlighting options such as installment payments over 3 to 6 months. Regularly review the communication plan every quarter to adapt to changing circumstances or feedback from clients.

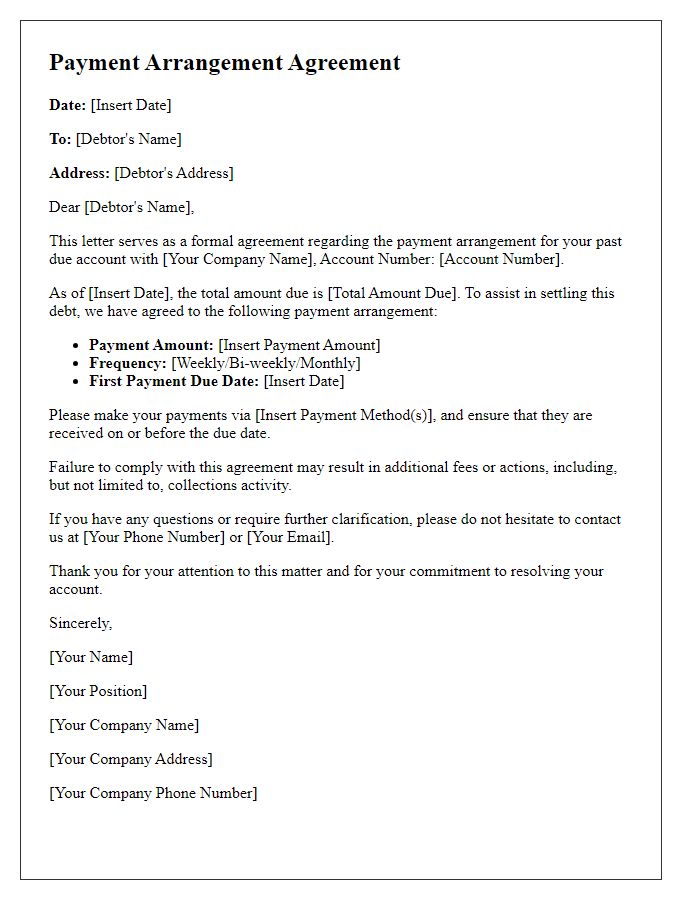

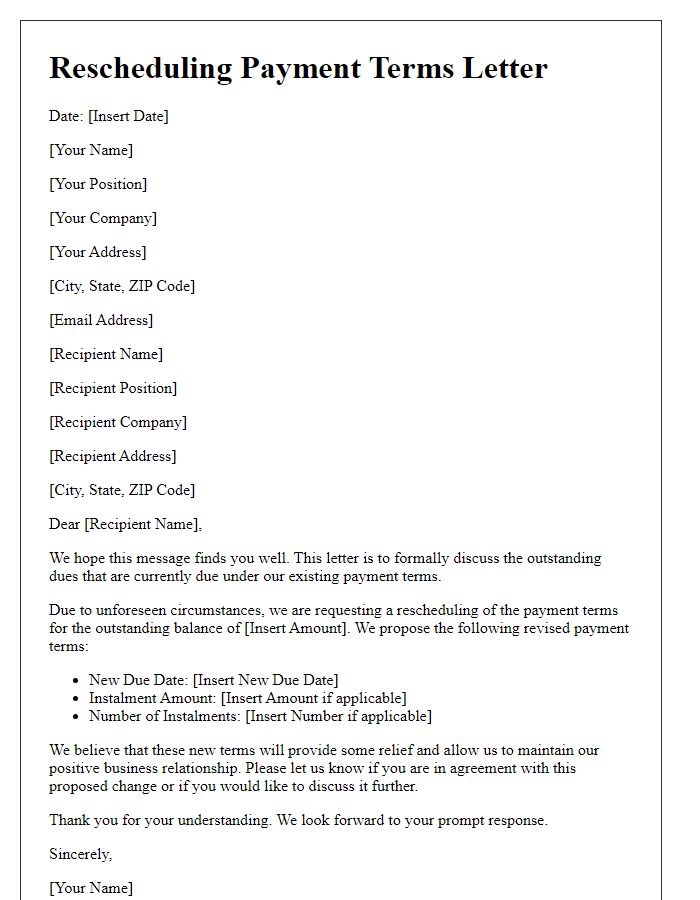

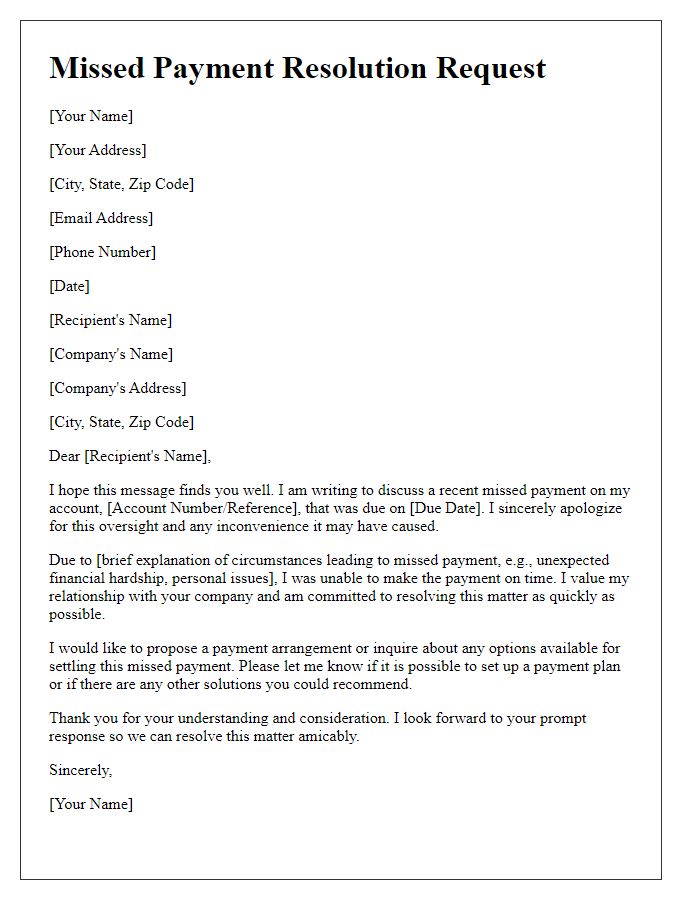

Letter Template For Skipped Payment Agreement Samples

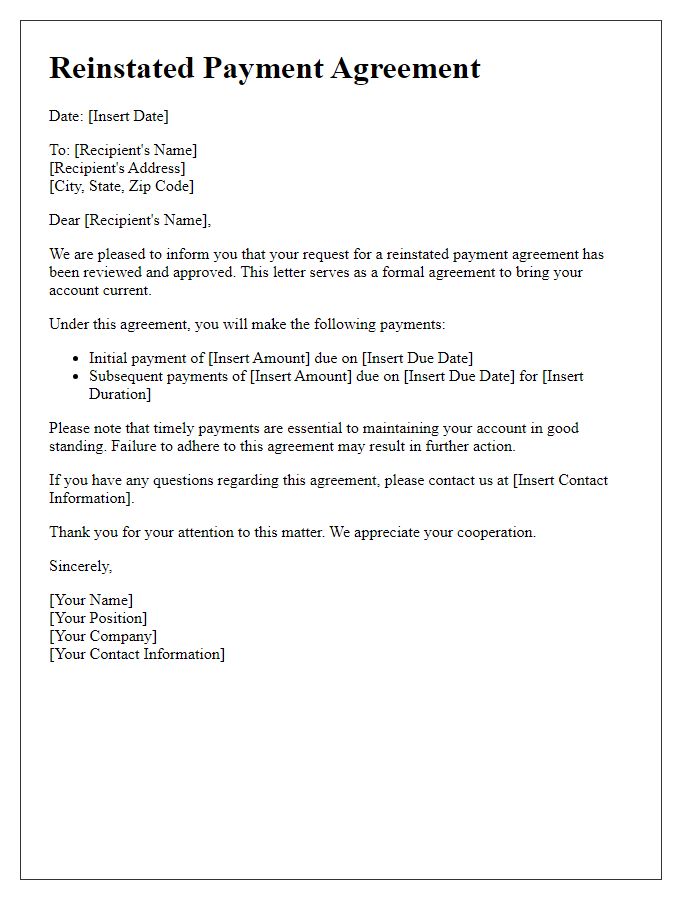

Letter template of reinstated payment agreement for bring accounts current

Comments