Are you facing the distressing prospect of foreclosure and unsure of what steps to take next? Foreclosure warning notices can be daunting, but understanding the process can empower you to take action. In this article, we'll break down what a foreclosure warning notice entails, how to properly respond, and the resources available to help you navigate this challenging situation. So, if you're looking for guidance on how to protect your home, keep reading!

Property Address and Details

Foreclosure warnings are critical communications that inform homeowners facing potential loss of property due to delinquent mortgage payments. The property address, typically formatted as Street Address, City, State, and Zip Code, serves as the primary identifier of the at-risk residence. Details such as loan number, outstanding balance (often thousands of dollars), and dates of missed payments can provide clarity on the urgency and potential consequences. This notice often includes the lender's name, the amount the homeowner is expected to pay to prevent foreclosure, and a specified timeframe (usually 30 days) for the homeowner to take action before further legal proceedings commence. Additionally, information on available resources, such as local housing counseling services or government assistance programs, can provide essential support to distressed homeowners navigating this challenging situation.

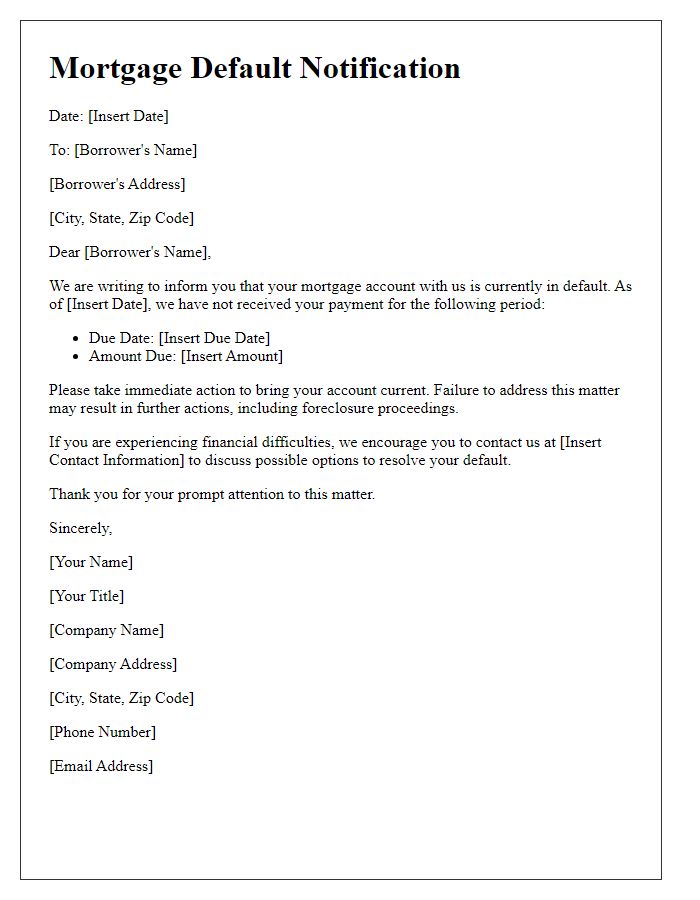

Loan Account Number

Foreclosure warning notices highlight the potential legal actions taken against homeowners who have defaulted on their mortgage payments. Specific loan account numbers identify the borrower and their financial obligations. Typically issued by lenders or banks, these notices serve as a critical alert before foreclosure proceedings commence. The communication details the outstanding amount, emphasizes the urgency of the situation, and provides options for resolution, such as payment plans or loan modifications. Notably, borrowers may have a limited timeframe, often ranging from 30 to 90 days, to remedy the default before the lender initiates legal action. Understanding local and state regulations regarding foreclosure processes is essential for homeowners facing this distressing situation.

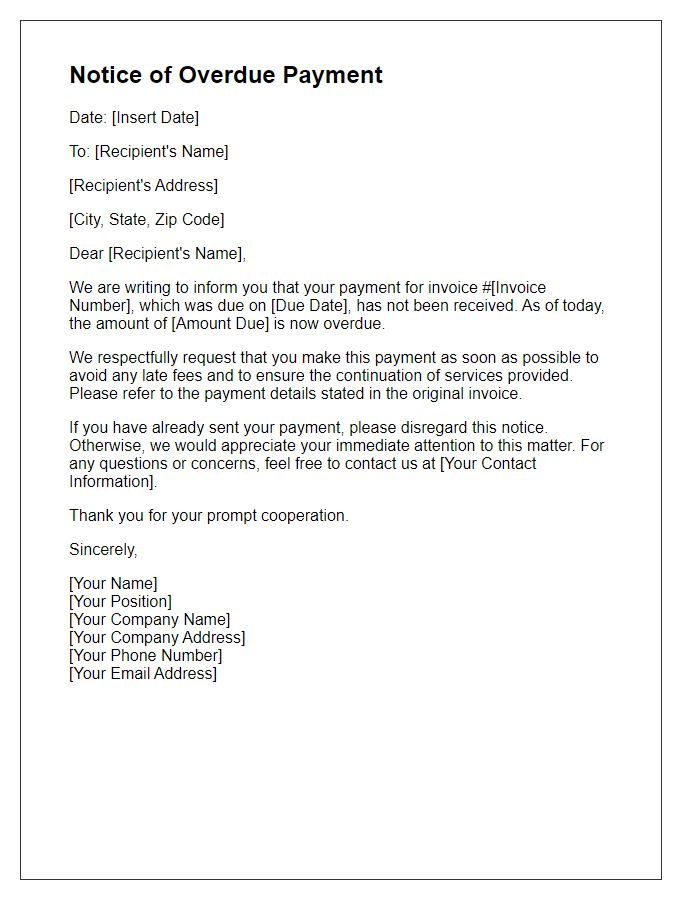

Outstanding Balance and Payment Due Dates

Homeowners facing foreclosure often receive warning notices detailing outstanding balances and payment due dates. These notices typically specify the total amount owed, including late fees and interest rates, which can accumulate rapidly. For example, a homeowner might have an outstanding balance of $15,000, due to missed payments over several months. Payment due dates are critical, as they may vary with a grace period of 15 days before further penalties apply. The notice often highlights the potential consequences like foreclosure proceedings initiated by lenders, particularly in states like Florida or California, where the process can be expedited in certain circumstances. This communication serves not only as a warning but also as a crucial call to action for homeowners to address their financial situation proactively to avoid losing their property.

Consequences of Non-Payment

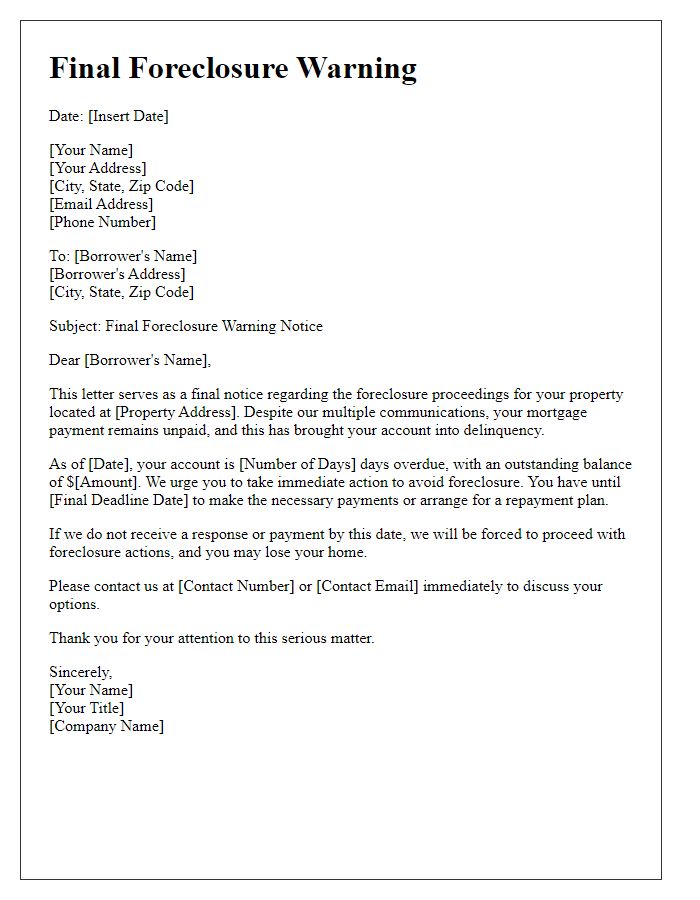

Foreclosure warning notices serve as critical alerts to homeowners who are struggling to keep up with mortgage payments. A foreclosure process can initiate after a borrower misses three consecutive payments (typically 90 days) on a mortgage loan, leading to serious implications such as loss of property ownership. The notice outlines potential consequences, including legal action taken by the lender, which could include filing a lawsuit or initiating a public auction of the property, commonly held at a local courthouse as per state laws. Borrowers may lose equity built in the home, and the negative impact on credit scores (potentially dropping by 100 points) can hinder future borrowing opportunities. In many cases, lenders provide options like loan modification or repayment plans, highlighting the importance of direct communication between borrowers and financial institutions to avoid dire outcomes.

Contact Information for Assistance

Foreclosure warning notices serve as crucial alerts for homeowners facing potential loss of property. These documents typically include key information such as the homeowner's address, legal description of the property, and the specific date by which action must be taken to avoid foreclosure proceedings. It is essential to provide contact information for assistance, often directing homeowners to local housing counseling agencies or legal aid services. These organizations can offer guidance on options like loan modification programs or mediation processes, aiming to help homeowners navigate this challenging situation. Additionally, including the name of the loan servicer or bank, along with corresponding phone numbers, websites, and emails, ensures that homeowners have immediate access to resources and assistance tailored to their circumstances.

Comments